We Discuss Why GoPro, Inc.'s (NASDAQ:GPRO) CEO Compensation May Be Closely Reviewed

We Discuss Why GoPro, Inc.'s (NASDAQ:GPRO) CEO Compensation May Be Closely Reviewed

Key Insights

关键见解

- GoPro will host its Annual General Meeting on 4th of June

- Salary of US$850.0k is part of CEO Nick Woodman's total remuneration

- The total compensation is 113% higher than the average for the industry

- GoPro's EPS declined by 88% over the past three years while total shareholder loss over the past three years was 86%

- GoPro将于6月4日举办年度股东大会

- 850.0万美元的薪水是首席执行官尼克·伍德曼总薪酬的一部分

- 总薪酬比该行业的平均水平高113%

- 在过去三年中,GoPro的每股收益下降了88%,而过去三年的股东总亏损为86%

Shareholders will probably not be too impressed with the underwhelming results at GoPro, Inc. (NASDAQ:GPRO) recently. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 4th of June. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

GoPro公司(纳斯达克股票代码:GPRO)最近表现不佳的业绩可能不会给股东留下太深刻的印象。股东们可以借此机会在6月4日的下一次股东周年大会上追究董事会和管理层对表现不佳的责任。这也将是他们就公司方向向董事会提出质疑并对高管薪酬等决议进行表决的机会。我们说明了为什么我们认为首席执行官薪酬与公司业绩不同步。

Comparing GoPro, Inc.'s CEO Compensation With The Industry

比较 GoPro, Inc.”s 首席执行官向业界提供的薪酬

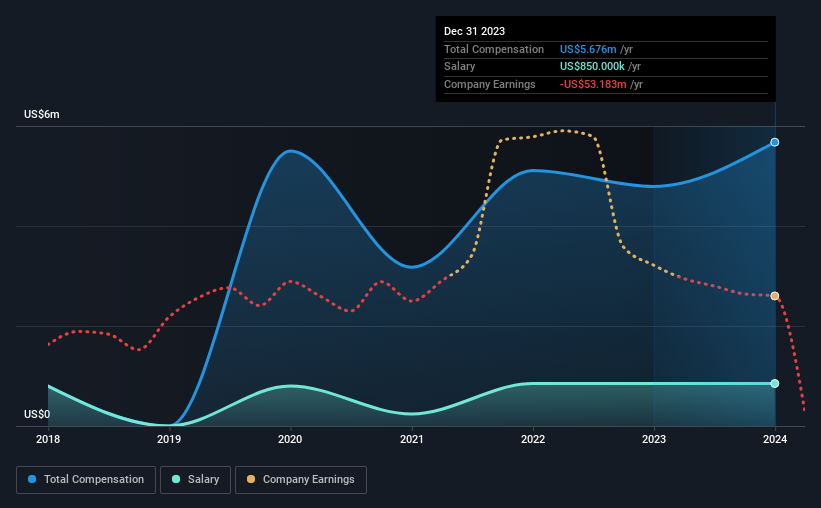

At the time of writing, our data shows that GoPro, Inc. has a market capitalization of US$235m, and reported total annual CEO compensation of US$5.7m for the year to December 2023. That's a notable increase of 18% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$850k.

在撰写本文时,我们的数据显示,GoPro公司的市值为2.35亿美元,并报告称,截至2023年12月的一年中,首席执行官的年薪酬总额为570万美元。这比去年显著增长了18%。虽然我们总是首先考虑总薪酬,但我们的分析表明,薪资部分较低,为85万美元。

For comparison, other companies in the American Consumer Durables industry with market capitalizations ranging between US$100m and US$400m had a median total CEO compensation of US$2.7m. Hence, we can conclude that Nick Woodman is remunerated higher than the industry median. Moreover, Nick Woodman also holds US$40m worth of GoPro stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

相比之下,美国耐用消费品行业中市值在1亿美元至4亿美元之间的其他公司的首席执行官总薪酬中位数为270万美元。因此,我们可以得出结论,尼克·伍德曼的薪酬高于行业中位数。此外,尼克·伍德曼还直接以自己的名义持有价值4000万美元的GoPro股票,这向我们表明他们在该公司拥有大量个人股份。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$850k | US$850k | 15% |

| Other | US$4.8m | US$3.9m | 85% |

| Total Compensation | US$5.7m | US$4.8m | 100% |

| 组件 | 2023 | 2022 | 比例 (2023) |

| 工资 | 850 万美元 | 850 万美元 | 15% |

| 其他 | 480 万美元 | 390 万美元 | 85% |

| 总薪酬 | 5.7 万美元 | 480 万美元 | 100% |

Talking in terms of the industry, salary represented approximately 17% of total compensation out of all the companies we analyzed, while other remuneration made up 83% of the pie. In GoPro's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

就行业而言,在我们分析的所有公司中,工资约占总薪酬的17%,而其他薪酬占总薪酬的83%。就GoPro而言,与整个行业相比,非工资薪酬在总薪酬中所占的比例更大。如果将总薪酬倾向于非工资福利,则表明首席执行官的薪酬与公司业绩挂钩。

GoPro, Inc.'s Growth

GoPro, Inc. 's 增长

GoPro, Inc. has reduced its earnings per share by 88% a year over the last three years. It saw its revenue drop 6.2% over the last year.

在过去三年中,GoPro公司的每股收益每年减少88%。它的收入比去年下降了6.2%。

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

每股收益的下降有点令人担忧。收入实际上比去年下降的事实使情况雪上加霜。这些因素表明,业务表现并不能真正证明首席执行官的高薪是合理的。展望未来,您可能需要查看这份关于分析师对公司未来收益预测的免费可视化报告。

Has GoPro, Inc. Been A Good Investment?

GoPro, Inc. 是一项不错的投资吗?

Few GoPro, Inc. shareholders would feel satisfied with the return of -86% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

很少有GoPro公司的股东会对三年内-86%的回报率感到满意。因此,股东们可能希望公司在首席执行官薪酬方面不那么慷慨。

To Conclude...

总而言之...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

股东不仅没有看到可观的投资回报,而且业务也表现不佳。很少有股东愿意给首席执行官加薪。在即将举行的股东周年大会上,董事会将有机会解释为改善业务绩效而计划采取的措施。

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for GoPro that you should be aware of before investing.

首席执行官薪酬是你关注的关键方面,但投资者也需要睁大眼睛关注与业务绩效相关的其他问题。这就是为什么我们进行了一些挖掘并确定了GoPro的1个警告信号,您在投资之前应注意这一点。

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

可以说,业务质量比首席执行官的薪酬水平重要得多。因此,请查看这份免费清单,列出了股本回报率高、负债率低的有趣公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。