Increases to CEO Compensation Might Be Put On Hold For Now at Antero Midstream Corporation (NYSE:AM)

Increases to CEO Compensation Might Be Put On Hold For Now at Antero Midstream Corporation (NYSE:AM)

Key Insights

主要见解

- Antero Midstream's Annual General Meeting to take place on 5th of June

- Salary of US$364.7k is part of CEO Paul Rady's total remuneration

- The total compensation is 42% higher than the average for the industry

- Antero Midstream's total shareholder return over the past three years was 83% while its EPS grew by 2.9% over the past three years

- Antero Midstream的股东大会将于6月5日举行。

- 美元36.47万薪酬属于CEO保罗·雷迪总报酬的一部分。

- 总报酬比行业平均水平高42%。

- 过去三年,Antero Midstream的股东总回报率为83%,而过去三年的EPS增长了2.9%。

CEO Paul Rady has done a decent job of delivering relatively good performance at Antero Midstream Corporation (NYSE:AM) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 5th of June. However, some shareholders may still want to keep CEO compensation within reason.

近期Antero Midstream Corporation(纽交所:AM)CEO保罗·雷迪不断取得相对良好的业绩。 因此,随着股东们参加6月5日的股东大会,CEO薪酬可能不会成为股东的主要关注点。 然而,仍有一些股东可能希望将CEO的薪酬控制在一个合理的范围内。

Comparing Antero Midstream Corporation's CEO Compensation With The Industry

将Antero Midstream Corporation的CEO薪酬与行业进行比较。

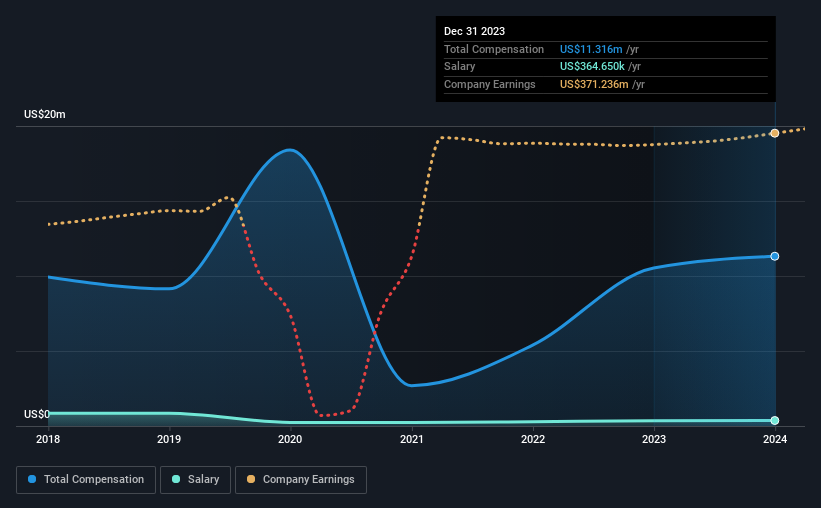

At the time of writing, our data shows that Antero Midstream Corporation has a market capitalization of US$7.0b, and reported total annual CEO compensation of US$11m for the year to December 2023. That's just a smallish increase of 7.4% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$365k.

截至撰写本文时,我们的数据显示Antero Midstream Corporation的市值为70亿美元,截至2023年12月的年报总CEO薪酬为1100万美元。这仅比去年增加了7.4%。我们认为总报酬更重要,但我们的数据显示CEO的薪酬较低,为365,000美元。

On examining similar-sized companies in the American Oil and Gas industry with market capitalizations between US$4.0b and US$12b, we discovered that the median CEO total compensation of that group was US$8.0m. Hence, we can conclude that Paul Rady is remunerated higher than the industry median. Furthermore, Paul Rady directly owns US$19m worth of shares in the company, implying that they are deeply invested in the company's success.

通过检查美国石油和天然气行业市值在40亿美元至120亿美元之间的类似规模的公司,我们发现该组别的CEO总报酬的中位数为800万美元。因此,我们可以得出结论,保罗·雷迪的报酬高于行业中位数。此外,保罗·雷迪直接持有公司价值1900万美元的股票,表明他们对公司的成功投入了巨大的精力。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$365k | US$358k | 3% |

| Other | US$11m | US$10m | 97% |

| Total Compensation | US$11m | US$11m | 100% |

| 组成部分 | 2023 | 2022 | 比例(2023) |

| 薪资 | 美元365,000 | 美元358,000 | 3% |

| 其他 | 1100万美元 | 1000万美元 | 97% |

| 总补偿 | 1.1亿美元 | 1100万美元 | 100% |

On an industry level, roughly 14% of total compensation represents salary and 86% is other remuneration. A high-salary is usually a no-brainer when it comes to attracting the best executives, but Antero Midstream paid Paul Rady a nominal salary to the CEO over the past 12 months, instead focusing on non-salary compensation. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

在行业水平上,大约14%的总报酬代表薪资,86%是其他报酬。吸引最优秀的高管通常是普遍认可的方式,但Antero Midstream在过去的12个月中向CEO支付了名义上的薪酬,而重点放在非薪资报酬上。如果总报酬偏向非薪资福利,这表明CEO薪酬与公司绩效挂钩。

A Look at Antero Midstream Corporation's Growth Numbers

Antero Midstream Corporation的增长数字。

Over the past three years, Antero Midstream Corporation has seen its earnings per share (EPS) grow by 2.9% per year. It achieved revenue growth of 9.7% over the last year.

在过去的三年中,Antero Midstream Corporation的每股收益(EPS)每年增长2.9%。它在过去一年内实现了9.7%的营收增长。

We would argue that the improvement in revenue is good, but isn't particularly impressive, but the modest improvement in EPS is good. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

我们认为营收的提高是好的,但不是特别令人印象深刻,但每股收益的适度提高是好的。 显然,表现相当不错,但根据这些信息来看,还没有达到卓越的水平。 历史业绩有时可以很好地预示未来发展,但如果您想了解公司的未来,可能会对分析师预测的这种免费可视化非常感兴趣。

Has Antero Midstream Corporation Been A Good Investment?

Antero Midstream Corporation是一项不错的投资吗?在过去三年中,大多数股东可能会对Antero Midstream Corporation提供了83%的总回报感到满意。 因此,有人可能认为该公司的CEO应该获得比同等规模企业更高的薪酬。

Most shareholders would probably be pleased with Antero Midstream Corporation for providing a total return of 83% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

Antero Midstream主要使用非薪资福利奖励其CEO。 鉴于公司的总体表现还可以,CEO的薪酬政策可能不是股东即将到来的股东大会的中心关注点。 不过,由于他们已经高于行业水平,因此并不是所有股东都可能支持CEO获得加薪。

In Summary...

总之……

Antero Midstream primarily uses non-salary benefits to reward its CEO. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

通过研究公司的CEO薪酬趋势以及公司其他方面,我们可以了解到该公司的许多信息。在此之前,我们发现了Antero Midstream的2个警示信号(其中1个让我们有点不安!),您应该在此投资之前知道。

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 2 warning signs for Antero Midstream (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

通过研究公司CEO薪酬趋势以及其他业务方面,我们可以了解到有关公司的很多信息。在投资前,我们发现Antero Midstream存在2个警示信号(其中一个让我们有些不安!),你应该了解这些信息。

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

可以说,业务质量比CEO薪酬水平更为重要。因此,请查看这个免费的有趣公司列表,这些公司具有高的净资产收益率和较低的债务。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?关于内容有所顾虑?直接和我们联系。或电邮 editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。