Smart Money Is Betting Big In ORCL Options

Smart Money Is Betting Big In ORCL Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Oracle.

有大量资金可以花的鲸鱼对甲骨文采取了明显的看涨立场。

Looking at options history for Oracle (NYSE:ORCL) we detected 51 trades.

查看甲骨文(纽约证券交易所代码:ORCL)的期权历史记录,我们发现了51笔交易。

If we consider the specifics of each trade, it is accurate to state that 49% of the investors opened trades with bullish expectations and 37% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,49%的投资者以看涨的预期开启交易,37%的投资者持看跌预期。

From the overall spotted trades, 32 are puts, for a total amount of $3,260,682 and 19, calls, for a total amount of $686,501.

在已发现的全部交易中,32笔是看跌期权,总额为3,260,682美元,19笔看涨期权,总额为686,501美元。

Predicted Price Range

预测的价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $97.5 and $140.0 for Oracle, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要的市场走势者正在关注甲骨文在过去三个月中介于97.5美元至140.0美元之间的价格区间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

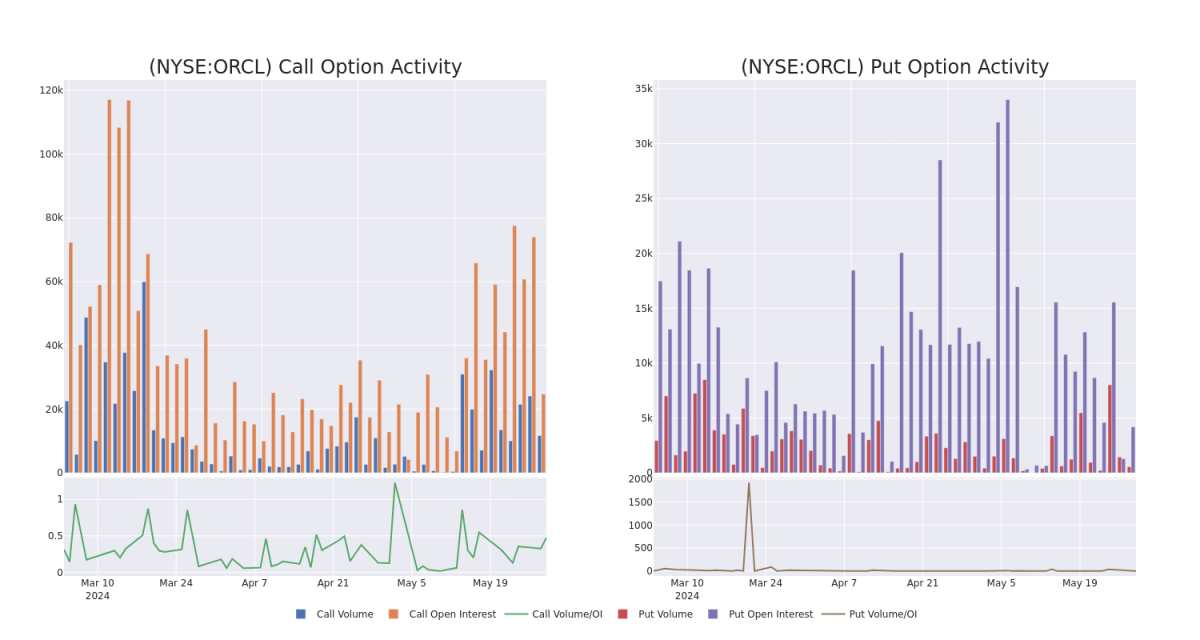

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for Oracle's options for a given strike price.

这些数据可以帮助您跟踪给定行使价下甲骨文期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Oracle's whale activity within a strike price range from $97.5 to $140.0 in the last 30 days.

下面,我们可以分别观察过去30天在行使价从97.5美元到140.0美元行使价范围内甲骨文所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的变化。

Oracle 30-Day Option Volume & Interest Snapshot

甲骨文30天期权交易量和利息快照

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | PUT | TRADE | NEUTRAL | 01/17/25 | $2.92 | $2.78 | $2.84 | $97.50 | $704.0K | 3.4K | 3.0K |

| ORCL | PUT | SWEEP | BEARISH | 09/20/24 | $6.1 | $6.0 | $6.0 | $115.00 | $600.1K | 3.7K | 1.0K |

| ORCL | PUT | TRADE | BULLISH | 06/28/24 | $1.38 | $0.67 | $0.78 | $105.00 | $206.7K | 74 | 2.6K |

| ORCL | PUT | SWEEP | BULLISH | 06/21/24 | $4.2 | $4.15 | $4.15 | $116.00 | $147.7K | 322 | 539 |

| ORCL | PUT | SWEEP | BULLISH | 01/17/25 | $2.85 | $2.83 | $2.84 | $97.50 | $145.1K | 3.4K | 511 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | 放 | 贸易 | 中立 | 01/17/25 | 2.92 美元 | 2.78 美元 | 2.84 美元 | 97.50 美元 | 704.0 万美元 | 3.4K | 3.0K |

| ORCL | 放 | 扫 | 粗鲁的 | 09/20/24 | 6.1 美元 | 6.0 美元 | 6.0 美元 | 115.00 美元 | 600.1 万美元 | 3.7K | 1.0K |

| ORCL | 放 | 贸易 | 看涨 | 06/28/24 | 1.38 | 0.67 美元 | 0.78 美元 | 105.00 美元 | 206.7 万美元 | 74 | 2.6K |

| ORCL | 放 | 扫 | 看涨 | 06/21/24 | 4.2 美元 | 4.15 美元 | 4.15 美元 | 116.00 美元 | 14.77 万美元 | 322 | 539 |

| ORCL | 放 | 扫 | 看涨 | 01/17/25 | 2.85 美元 | 2.83 美元 | 2.84 美元 | 97.50 美元 | 145.1 万美元 | 3.4K | 511 |

About Oracle

关于甲骨文

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

Oracle 为世界各地的企业提供数据库技术和企业资源规划(ERP)软件。甲骨文成立于 1977 年,率先推出了第一个基于 SQL 的商用关系数据库管理系统。如今,甲骨文在175个国家拥有43万名客户,由其13.6万名员工提供支持。

Where Is Oracle Standing Right Now?

甲骨文现在在哪里?

- With a volume of 10,808,885, the price of ORCL is down -5.37% at $117.09.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 11 days.

- ORCL的交易量为10,808,885美元,下跌了-5.37%,至117.09美元。

- RSI 指标暗示,标的股票目前在超买和超卖之间保持中立。

- 下一份财报预计将在11天后公布。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Oracle with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了获得更高利润的可能性。精明的交易者通过持续的教育、战略交易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用 Benzinga Pro 了解甲骨文的最新期权交易情况,获取实时提醒。