Investors Still Aren't Entirely Convinced By Parkson Retail Asia Limited's (SGX:O9E) Revenues Despite 39% Price Jump

Investors Still Aren't Entirely Convinced By Parkson Retail Asia Limited's (SGX:O9E) Revenues Despite 39% Price Jump

Despite an already strong run, Parkson Retail Asia Limited (SGX:O9E) shares have been powering on, with a gain of 39% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 10% in the last twelve months.

新加坡交易所的Parkson Retail Asia Limited (SGX:O9E)股票已经持续表现强劲,最近30天上涨了39%。但自去年以来,股价仍然下跌了10%,使得不是所有的股东都感到高兴。

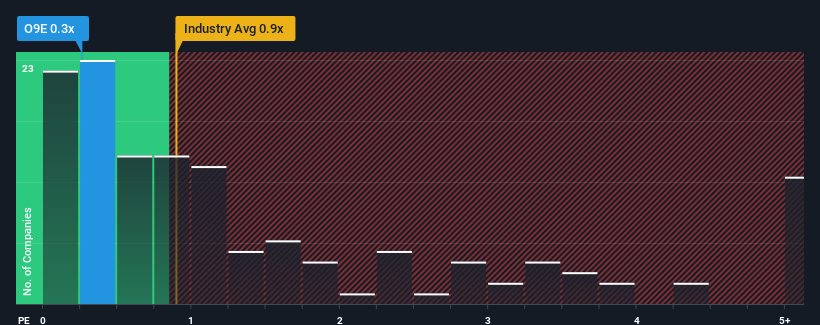

Even after such a large jump in price, Parkson Retail Asia's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a buy right now compared to the Multiline Retail industry in Singapore, where around half of the companies have P/S ratios above 0.8x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

即使是在股价大幅上涨后,与新加坡多元零售行业中P/S比率超过0.8倍,P/S比率甚至超过4倍的公司相比,Parkson Retail Asia现阶段的市销率(简称"P/S")0.3倍仍然可能使其看起来像是一个不错的买入机会。然而,P/S的低水平可能有其原因,需要进一步调查才能判断这是否合理。

SGX:O9E Price to Sales Ratio vs Industry June 3rd 2024

新加坡交易所(SGX:O9E)市销率与行业板块比较,2024年6月3日

What Does Parkson Retail Asia's Recent Performance Look Like?

Parkson Retail Asia的近期表现如何?

For example, consider that Parkson Retail Asia's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Parkson Retail Asia will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

例如,Parkson Retail Asia的财务表现近来一直较为疲软,其营业收入在下降。有可能是因为投资者认为该公司在不久的将来无法避免表现不如整个行业。看好Parkson Retail Asia的人会希望情况不是这样的,以便以更低的估值买入该股票。尽管目前没有针对Parkson Retail Asia的分析师预测数据,但可以查看这个免费的数据可视化图表,了解如何比较其收益、营业收入和现金流水平。

Although there are no analyst estimates available for Parkson Retail Asia, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

Parkson Retail Asia尚未提供分析师的预测数据。请参考免费的数据可视化图表,了解公司的收益、营业收入和现金流水平。

How Is Parkson Retail Asia's Revenue Growth Trending?

Parkson Retail Asia的营收增长如何?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Parkson Retail Asia's to be considered reasonable.

通常情况下,公司要想达到类似于Parkson Retail Asia这样的市销率比率,就必须达到或低于行业平均水平。

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.3%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 29% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

回顾过去一年的财务状况,我们很失望地发现,Parkson Retail Asia的营收下滑了6.3%,这让其长期表现良好的势头受到了打压,尽管其3年营业收入增长仍然达到了29%。因此,尽管他们本来希望公司的表现会一直保持良好,股东们对中期的营业收入增长水平应该还算满意。

Comparing that to the industry, which is predicted to deliver 9.5% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

与行业相比,在接下来的12个月中预计增长9.5%的情况下,公司的动力在基于最近中期的营收增长结果。

In light of this, it's peculiar that Parkson Retail Asia's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

鉴于这一点,如此多的公司的P/S都大于Parkson Retail Asia,这是比较奇怪的。这可能意味着,大多数投资者不相信该公司能够维持近期的增长率。

What We Can Learn From Parkson Retail Asia's P/S?

我们可以从Parkson Retail Asia的市销率中学到什么?

Despite Parkson Retail Asia's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

尽管Parkson Retail Asia的股价最近有所上涨,但其P/S仍然落后于大多数其他公司。因此,我们认为市销率比率的真正用途并不在于估值,而是以此来衡量当前投资者的情绪和未来的预期。

The fact that Parkson Retail Asia currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

Parkson Retail Asia当前的市销率比行业水平低是出乎意料的,因为它最近3年的增长与整个行业的预测相符。当我们看到类似于行业水平的营收增长率但低于预期的市销率时,我们假设潜在的风险是对股价施加下行压力的因素。营收趋势表明,价格下跌的风险很低,但投资者似乎认为未来有收入波动的可能性。

You should always think about risks. Case in point, we've spotted 2 warning signs for Parkson Retail Asia you should be aware of.

投资者一定要考虑到风险。例如,我们已经发现Parkson Retail Asia存在两个值得注意的警示信号。

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果过去稳定的盈利增长公司符合您的口味,您可能希望查看这些具有强劲盈利增长和低市盈率的其他公司的免费集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?关注内容?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

For example, consider that Parkson Retail Asia's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Parkson Retail Asia will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

For example, consider that Parkson Retail Asia's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Parkson Retail Asia will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.