Smart Money Is Betting Big In SMTC Options

Smart Money Is Betting Big In SMTC Options

Financial giants have made a conspicuous bullish move on Semtech. Our analysis of options history for Semtech (NASDAQ:SMTC) revealed 8 unusual trades.

金融巨头对爱文思控股做出了明显的乐观举动。我们对爱文思控股(纳斯达克:SMTC)期权历史的分析显示,有8次异常交易。

Delving into the details, we found 37% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $78,580, and 6 were calls, valued at $193,326.

深入挖掘细节,我们发现37%的交易者看涨,而37%的交易者持看淡态度。在我们发现的所有交易中,有2次看跌交易,价值78,580美元,有6次看涨交易,价值193,326美元。

Expected Price Movements

预期价格波动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $15.0 to $39.0 for Semtech over the last 3 months.

结合这些合约的成交量和未平仓合约量,似乎过去3个月里,大鳄们一直把爱文思控股的目标价区间定在15.0美元到39.0美元之间。

Insights into Volume & Open Interest

成交量和持仓量分析

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Semtech's options for a given strike price.

这些数据可以帮助您跟踪爱文思控股期权在特定行权价的流动性和兴趣。

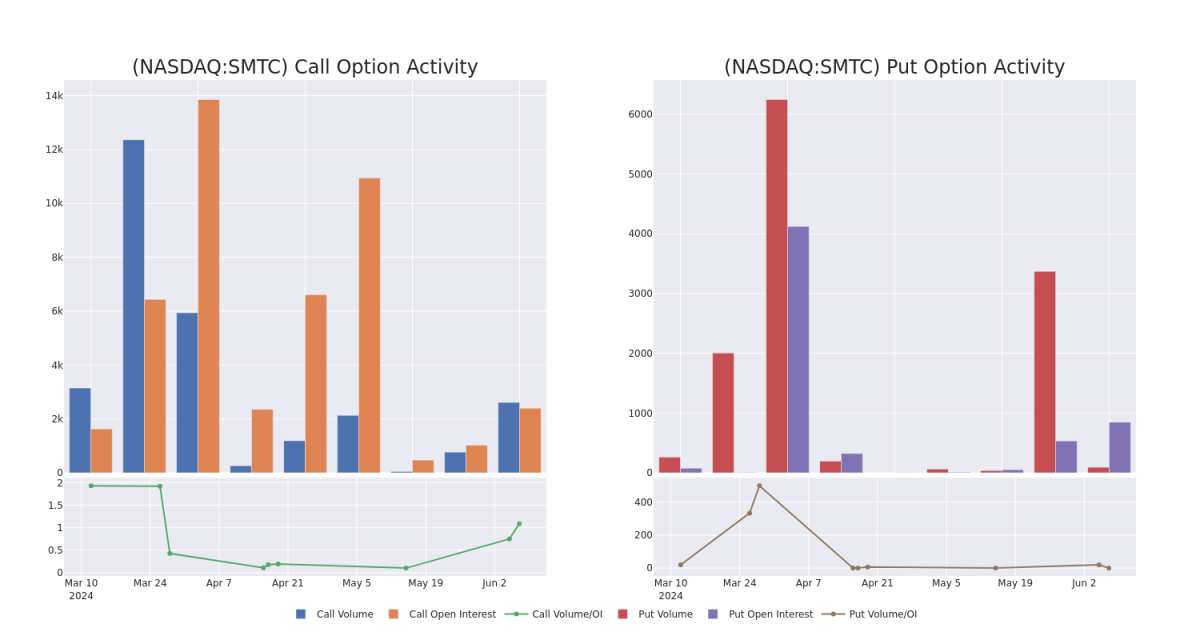

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Semtech's whale activity within a strike price range from $15.0 to $39.0 in the last 30 days.

下面,我们可以观察到过去30天内,所有来自于15.0美元到39.0美元行权价范围内的交易者的看涨和看跌期权的成交量和未平仓合约的演变情况。

Semtech Call and Put Volume: 30-Day Overview

爱文思控股看涨期权和看跌期权的成交量:30天概览

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMTC | PUT | SWEEP | BULLISH | 06/21/24 | $11.8 | $10.2 | $10.37 | $39.00 | $51.9K | 298 | 54 |

| SMTC | CALL | SWEEP | NEUTRAL | 01/16/26 | $22.4 | $16.4 | $19.4 | $15.00 | $38.8K | 20 | 0 |

| SMTC | CALL | SWEEP | BULLISH | 12/20/24 | $5.8 | $4.5 | $5.48 | $32.00 | $32.5K | 517 | 158 |

| SMTC | CALL | TRADE | NEUTRAL | 06/21/24 | $2.8 | $1.65 | $2.3 | $30.00 | $31.9K | 1.8K | 2.1K |

| SMTC | CALL | SWEEP | BEARISH | 12/20/24 | $6.2 | $4.5 | $5.03 | $32.00 | $30.4K | 517 | 99 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 行权价 | 总交易价 | 未平仓量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMTC | 看跌 | Sweep | 看好 | 06/21/24 | $11.8 | $10.2 | $10.37 | $39.00 | $51.9K | 298 | 54 |

| SMTC | 看涨 | Sweep | 中立 | 01/16/26 | $22.4 | $16.4 | $19.4 | 15.00美元 | $38.8K | 20 | 0 |

| SMTC | 看涨 | Sweep | 看好 | 12/20/24 | $5.8 | $4.5 | $5.48 | $32.00 | $32.5K | 517 | 158 |

| SMTC | 看涨 | 交易 | 中立 | 06/21/24 | $2.8 | $1.65 | $2.3 | $30.00 | $31.9K | 1.8K | 2.1K |

| SMTC | 看涨 | Sweep | 看淡 | 12/20/24 | $6.2 | $4.5 | $5.03 | $32.00 | $30.4K | 517 | 99 |

About Semtech

关于爱文思控股

Semtech Corp is engaged in designing, developing, manufacturing and marketing analog and mixed-signal semiconductors, algorithms and wireless semiconductors, connectivity modules, gateways, routers and connected services for IoT. The company operates in four reportable segments' 1) Signal Integrity, 2) Advanced Protection and Sensing, 3) IoT System and 4) IoT Connected Services. The majority of the company's revenue is earned through Advanced Protection and Sensing Products segment. Geographically majority of the company's revenue is earned from Asia Pacific region.

爱文思控股从事设计、开发、制造和销售模拟与混合信号半导体、算法和无线半导体、连接模块、网关、路由器和物联网连接服务。公司的业务分为四个可报告部门:1)信号完整性,2)高级保护和感应,3)物联网系统和4) 物联网连接服务。公司的大部分营业收入来自于高级保护和感应产品部门。从地域板块来看,公司的大部分营业收入来自亚太地区。

After a thorough review of the options trading surrounding Semtech, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在全面审查围绕爱文思控股展开的期权交易后,我们转而更详细地研究公司的情况,这包括评估其当前的市场状况和表现。

Semtech's Current Market Status

爱文思控股的当前市场状况

- With a volume of 4,779,316, the price of SMTC is down -19.37% at $30.62.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 90 days.

- 爱文思控股的成交量为4,779,316股,目前股价为30.62美元,下跌了19.37%。下一个季度财报预计将在90天内公布。

- RSI因子暗示该基础股票可能被卖过头了。

- 5位行业分析师在过去一个月内分享了他们对这只股票的看法,提出了平均目标价为51.6美元。

Expert Opinions on Semtech

关于先科电子的专家意见

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $51.6.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for Semtech, targeting a price of $50.

- An analyst from Craig-Hallum has decided to maintain their Buy rating on Semtech, which currently sits at a price target of $48.

- In a cautious move, an analyst from Piper Sandler downgraded its rating to Overweight, setting a price target of $60.

- Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Semtech with a target price of $50.

- An analyst from B. Riley Securities persists with their Buy rating on Semtech, maintaining a target price of $50.

- 斯蒂夫尔的一位分析师保持持有先科电子买入评级,目标价为50美元。

- Craig-Hallum的一位分析师决定保持先科电子买入评级,目前目标价为48美元。

- 派杰投资的一位分析师谨慎操作,将其评级下调至超配,目标价为60美元。

- Needham的一位分析师持续对先科电子保持买入评级,目标价为50美元。

- B. Riley Securities的一位分析师坚持对先科电子进行买入评级,目标价维持在50美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Semtech with Benzinga Pro for real-time alerts.

交易期权的风险更高,但也有可能获得更高收益。精明的交易者通过持续的教育、策略性的交易调整、使用各种因子、保持对市场动态的关注来减少这些风险。通过Benzinga Pro实时提醒了解先科电子的最新期权交易。