There's A Lot To Like About Turning Point Brands' (NYSE:TPB) Upcoming US$0.07 Dividend

There's A Lot To Like About Turning Point Brands' (NYSE:TPB) Upcoming US$0.07 Dividend

It looks like Turning Point Brands, Inc. (NYSE:TPB) is about to go ex-dividend in the next 4 days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. In other words, investors can purchase Turning Point Brands' shares before the 14th of June in order to be eligible for the dividend, which will be paid on the 5th of July.

据悉,Turning Point Brands, Inc.(纽交所:TPB)将于未来4天内进行分红派息。通常,分红日是记录日的前一个工作日,记录日是公司确定股东有资格获得分红的日期。分红日是一个重要的日期,因为在这个日期之后再购买该股可能意味着迟到的结算,不会显示在记录日上。换句话说,投资者可在6月14日之前购买Turning Point Brands的股票以获得该股的分红,而该股的分红将于7月5日支付。

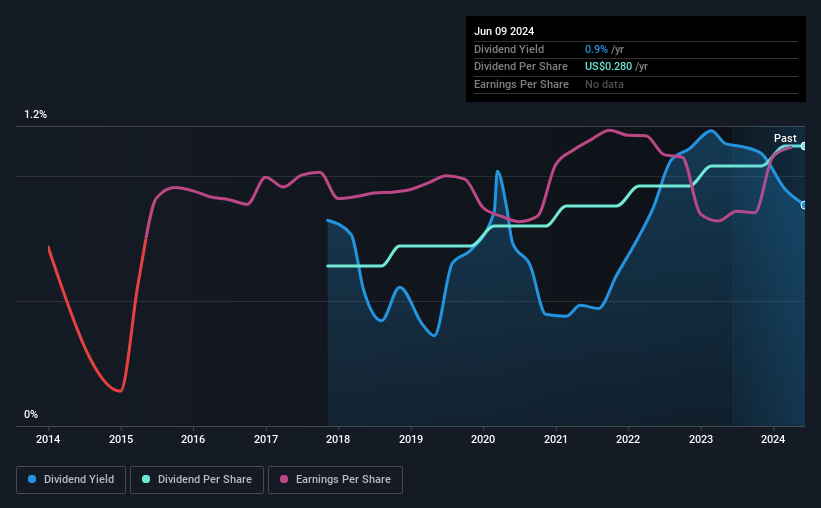

The company's next dividend payment will be US$0.07 per share, on the back of last year when the company paid a total of US$0.28 to shareholders. Looking at the last 12 months of distributions, Turning Point Brands has a trailing yield of approximately 0.9% on its current stock price of US$31.68. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

公司的下一笔股息将为每股0.07美元,去年,该公司向股东支付了总计0.28美元。回顾过去12个月的分红,Turning Point Brands的股价为31.68美元,回报率约为0.9%。对于长期持有者来说,分红是投资回报的一个重要贡献者,但前提是该公司能够持续支付分红。这就是为什么我们应该始终检查股息支付是否可持续以及公司是否在增长。

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Turning Point Brands has a low and conservative payout ratio of just 11% of its income after tax. A useful secondary check can be to evaluate whether Turning Point Brands generated enough free cash flow to afford its dividend. The good news is it paid out just 6.5% of its free cash flow in the last year.

通常,分红通常来自公司利润,因此,如果公司支付的金额超过其所赚取的金额,则其股息通常面临更大的风险。Turning Point Brands的股息支付比率低且保守,仅占其纳税后收入的11%。有用的第二个检查可以评估Turning Point Brands是否产生足够的自由现金流来支付其股息。好消息是,在过去的一年中,其自由现金流仅支付了6.5%的股息。

It's positive to see that Turning Point Brands's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

令人欣慰的是,Turning Point Brands的股息既有盈利支持又有现金流支持,这通常是股息可持续的标志,而较低的支付比率通常表明在削减股息之前有更大的安全边际。

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

点击此处查看公司的支付比率以及未来分红的分析师预期。

Have Earnings And Dividends Been Growing?

收益和股息一直在增长吗?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. For this reason, we're glad to see Turning Point Brands's earnings per share have risen 13% per annum over the last five years. Earnings per share have been growing rapidly and the company is retaining a majority of its earnings within the business. This will make it easier to fund future growth efforts and we think this is an attractive combination - plus the dividend can always be increased later.

一般来说,经常增长每股收益的公司通常会成为最佳的股息股票,因为它们通常更容易增加每股股息。如果收益下降,公司被迫削减股息,投资者的投资可能面临风险。因此,我们很高兴看到,在过去的五年中,Turning Point Brands的每股收益年增长率为13%。每股收益一直在快速增长,并且公司将大部分收益留在企业中,使其更容易为未来的增长努力提供资金,这具有吸引力的组合-此外股息始终可以在以后增加。

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Turning Point Brands has delivered 8.3% dividend growth per year on average over the past seven years. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

另一种衡量公司股息前景的关键方法是衡量其历史股息增长率。过去7年,Turning Point Brands的股息年平均增长率为8.3%。我们很高兴看到在多年内,股息随收益上升,这可能表明该公司打算与股东分享增长。

The Bottom Line

还有一件事需要注意的是,我们已经确定了上海医药的2个警告信号,了解这些信号应该成为你的投资过程的一部分。

Should investors buy Turning Point Brands for the upcoming dividend? We love that Turning Point Brands is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. These characteristics suggest the company is reinvesting in growing its business, while the conservative payout ratio also implies a reduced risk of the dividend being cut in the future. There's a lot to like about Turning Point Brands, and we would prioritise taking a closer look at it.

投资者应该购买Turning Point Brands以获得即将付息的分红吗?我们很高兴看到,Turning Point Brands的每股收益在增加,同时仅占其收益和现金流的低百分比。这些特征表明公司正在重新投资以发展业务,而保守的股息支付比率也表明股息未来被削减的风险降低。Turning Point Brands是一个非常有吸引力的公司,我们应该优先更加关注它。

On that note, you'll want to research what risks Turning Point Brands is facing. For example, we've found 1 warning sign for Turning Point Brands that we recommend you consider before investing in the business.

对此,您需要调查Turning Point Brands面临的风险。例如,我们已经发现1个有关Turning Point Brands的警告信号,建议您在投资该公司之前对其进行考虑。

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

一般来说,我们不建议仅仅购买第一个股息股票。下面是一个经过策划的有趣的、股息表现良好的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者,发送电子邮件至editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

It's positive to see that Turning Point Brands's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater

It's positive to see that Turning Point Brands's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater