Real Estate Directors Building up Their Company Stakes

Real Estate Directors Building up Their Company Stakes

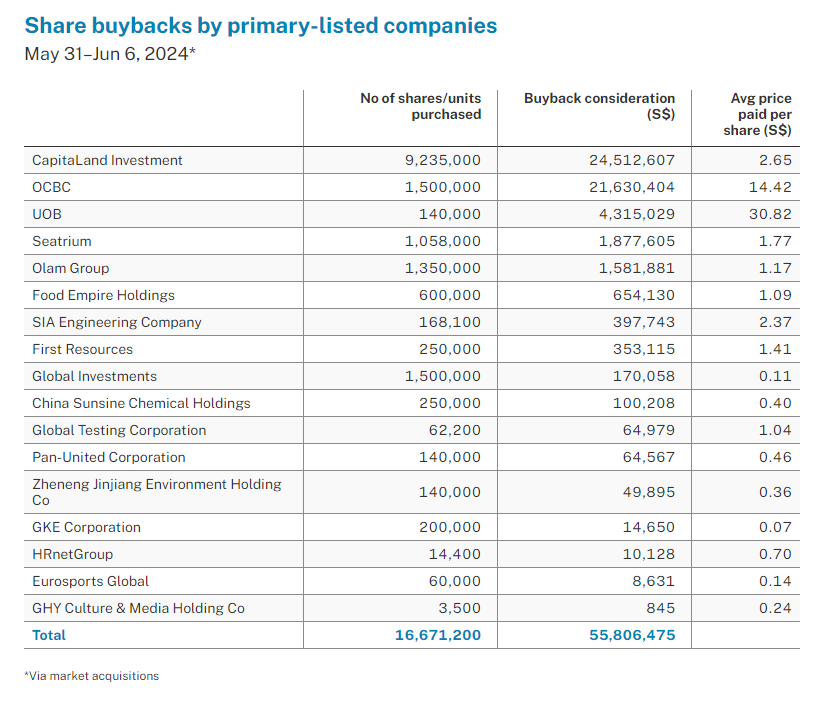

Institutions were net sellers of Singapore stocks over the five trading sessions through to Jun 6, with S$106.8 million of net institutional outflow, as 17 primary-listed companies conducted buybacks with a total consideration of S$55.8 million.

机构在五个交易日内抛售新加坡股票,净机构流出达1.068亿新元。其中17家主板上市公司进行股票回购,代价总计5,580万新元。

Most of the net institutional outflow was on the back of MSCI Singapore rebalancing on May 31, with five deletions to the index. The remaining four trading sessions saw S$42.8 million of net institutional inflow.

绝大部分的净机构流出是由MSCI新加坡五月三十一日调整指数引起的,该指数剔除了300多只股票。其余的四个交易日中,净机构流入达到4280万新元。

Leading the net institutional outflow over the five sessions were City Developments Ltd, Seatrium, Mapletree Logistics Trust, Mapletree Pan Asia Commercial Trust, Genting Singapore , Jardine Cycle & Carriage, NetLink NBN Trust, Golden Agri-Resources, Venture Corporation and Raffles Medical Group.

在这五个交易日内,City Developments Ltd、Seatrium、Mapletree Logistics Trust、Mapletree Pan Asia Commercial Trust、Genting Singapore、Jardine Cycle&Carriage、NetLink NBN Trust、Golden Agri-Resources、Venture Corporation和Raffles Medical Group是净机构流出的领头羊。

Meanwhile UOB, Singtel, Sats, DBS, Singapore Exchange, CapitaLand Investment, Capitaland Ascendas Reit, Hongkong Land, Keppel, and OCBC led the net institutional inflow over the five sessions.

而大华银行、新电信、新翔集团、星展银行、新交所、凯德投资、凯德商业地产信托基金、香港置地、吉宝、华侨银行是这五个交易日中最大的净机构流入公司。

The five trading sessions saw close to 100 director interests and substantial shareholdings filed for 50 primary-listed stocks. Directors or chief executives filed 28 acquisitions, and one disposal, while substantial shareholders filed 11 acquisitions and seven disposals.

在这五个交易日内,有50家主板上市公司申报了近100次董事利益和实质性股份持有。其中,公司董事或首席执行官申报了28次收购和1次减持;实质性股东申报了11次收购和7次减持。

Raffles Medical Group

莱佛士医疗集团

Between May 31 and Jun 5, Raffles Medical Group executive chairman Loo Choon Yong acquired 2.3 million shares at an average price of S$1.02 per share. This increased his total interest from 54.29 per cent to 54.41 per cent. Since, late February, Loo has been gradually increasing his total interest in the stock from 53.02 per cent.

在5月31日至6月5日期间,莱佛士医疗集团执行主席Loo Choon Yong以每股1.02新元的平均价位购买了230万股,将他的总持股份额从54.29%提高至54.41%。自2月底以来,Loo逐步增加了他在该股票中的总持股比例,从53.02%开始。

City Developments Ltd (CDL)

新加坡城市发展有限公司(CDL)

On Jun 3, CDL Independent non-executive director Chong Yoon Chou purchased 40,000 shares at S$5.62 per share.

6月3日,新加坡城市发展有限公司独立非执行董事Chong Yoon Chou以每股5.62新元的价格购买了4万股。

Chong began his career in the finance industry, as an analyst and fund manager at Aberdeen Standard Investments in 1994. He later transferred to Sydney in 2001 as head of Australian equities. He further expanded his role across various global markets, including Europe and the Americas, before returning to Singapore as investment director.

Chong Yoon Chou在1994年开始了他的金融业职业生涯,担任斯坦德投资管理有限公司的分析师和基金经理。他于2001年被调往悉尼担任澳大利亚股票主管,之后在欧洲和美洲等多个全球市场拓展了他的业务范围。他还曾担任斯坦德海投资管理有限公司的董事总经理。在斯坦德的整个任期中,他为重大重组和并购项目做出了贡献。

He also served as managing director of Aberdeen Asset Management Malaysia. Throughout his tenure with Aberdeen, he contributed to significant restructuring and M&A projects.

Chong在5月31日时,曾以每股5.8新元的价格购买了10万股CDL股票。他是Advisors' Clique的创始人,也是大东方金融顾问公司的执行高级董事。

On May 31, CDL independent non-executive director Colin Ong Lian Jin acquired 100,000 shares at S$5.80 per share. Ong is the founder of Advisors' Clique and executive senior director of Great Eastern Financial Advisers, a position he has held since 2011.

CDL独立非执行董事盾梁进(Colin Ong Lian Jin)在5月31日以每股5.8新元的价格购买了10万股CDL股票。盾梁进是Advisors'Clique的创始人,也是大东方金融顾问公司的执行高级董事。

On May 21, CDL provided a first-quarter 2024 business update. The group highlighted that it achieved resilient performance across all its business segments, focusing on sales growth, asset enhancements, operational refinements, as well as acquisition and divestment initiatives.

CDL在5月21日提供了2024财季的业务更新。该集团强调,它在所有的业务领域都取得了稳健的业绩,注重销售增长、资产提升、运营改进以及收购和剥离行动。它也强调了其关注资本管理,通过加速出售长期持有的分层资产来提取潜在价值并回收资金。此外,该集团致力于实现成长、增强和转型策略,旨在以韧性和适应性应对目前的经济局势,提高运营效率并追求增长机会。

The group also relayed its focus on capital management by accelerating the sale of long-held strata assets to extract latent value and recycle capital. This included the recent sales launch of strata units at various properties, with the aim of optimising the asset base and enhancing shareholder value. It remains committed to its growth-enhancement-transformation strategy, aiming to navigate the current economic landscape with resilience and adaptability, improving operational efficiencies, and pursuing growth opportunities.

史丹福置地公司

Stamford Land Corporation

史丹福置地公司执行主席欧昭杰在5月27日至6月4日期间,以每股0.39新元的平均价格购买了1,257,300股,将他在该公司的总持股份额从45.78%提高至45.86%。

Stamford Land Corporation executive chairman Ow Chio Kiat increased his total interest in the company from 45.78 to 45.86 per cent, acquiring 1,257,300 shares at an average price of S$0.39 per share between May 27 and Jun 4.

欧昭杰还增加了他在新加坡船务的总持股份额,他也担任该公司的执行主席。他在5月27日的持股比例为42.97%,在6月5日增至43.04%。

Ow also increased his total interest in Singapore Shipping Corporation, where he also serves as executive chairman. He increased his interest in the shipping group from 42.97 per cent on May 27 to 43.04 per cent on Jun 5.

协和

Hiap Hoe

协和执行主席张和平于6月4日以0.63新元购买500,000股,使他在该区域高端房产集团中的持股比例从74.86%提高至74.97%。

On Jun 4, Hiap Hoe executive chairman Teo Ho Beng acquired 500,000 shares at S$0.63 per share. With a consideration of S$315,000, this increased his total interest in the regional premium real estate group from 74.86 to 74.97 per cent.

张和平于1983年加入协和集团,担任董事一职。他于2024年1月从协和集团的首席执行官职务中免职,更名为执行主席。他自2006年以来一直担任首席执行官职务,并曾担任董事会执行主席,持有该集团的丰富经验。

Teo was appointed director of Hiap Hoe Group in 1983. He was redesignated executive chairman and relinquished his role as CEO in Hiap Hoe Group in January 2024. He held the CEO position from 2006 and was previously the executive chairman of the board from May 2012 to May 2017.

在5月27日至6月4日期间,欧昭杰以每股0.39新元的平均价格购买了1,257,300股,将他在该公司的总持股份额从45.78%提高至45.86%。

He has more than 42 years of experience in the construction and property industries, and over 27 years of experience in the leisure industry.

他在建造业和房地产行业拥有超过42年的经验,休闲业拥有超过27年的经验。

He is responsible for the formulation of corporate strategies and policies for Hiap Hoe, and the implementation of these strategies by senior management at the operations level.

他负责协和制定企业战略和政策,以及通过高层管理层在运营层面实施这些战略。

Teo also chairs the financial investment committee for the group's investment portfolios and senior management meetings to monitor Hiap Hoe's performances, including oversees management, budgeting, and forecasting processes to ensure there is prudent financial management.

张志君还主持集团投资组合的金融投资委员会和高级管理会议,以监控协和的表现,包括管理海外、预算和预测过程,确保谨慎的财务管理。

In addition, he sits on the board of Ley Choon Group Holdings as non-executive director.

此外,他还担任立堾集团控股有限公司非执行董事会成员。

On Feb 29, Hiap Hoe reported a profit after tax of S$5.5 million in FY2023 (ended Dec 31) versus a loss after tax of S$22.1 million in FY2022.

2023财年结束于12月31日,协和报告净利润为550万新元,而2022财年净亏损为2210万新元。

The FY2023 revenue of S$111.9 million decreased S$7.5 million from S$119.4 million in FY2022, mainly due to the loss of revenue from its two Singapore hotels, which were closed for three months for refurbishment works for their rebranding as the new Aloft Singapore Novena.

2023财年营业收入为1.119亿新元,比2022财年的1.194亿新元减少750万新元,主要是因为其两家新加坡酒店的收入损失,这两家酒店关闭了三个月,进行重新品牌定位和翻新工程,成为新的新加坡诺维娜酒店。

The group recorded an increase in rental revenue from S$27.0 million in FY2022 to S$28.9 million in FY2023, mainly due to the higher occupancies in its properties. Its leisure business also fared well in FY2023, with revenue 11 per cent higher than that in FY2022, at S$11.2 million.

集团在财年2023的租赁收入从2022年的2700万新元增至2890万新元,主要是由于其物业的更高入住率,其休闲业务在2023财年也表现良好,营业收入比2022年增长了11%,达到1120万新元。

Centurion Corporation

胜捷企业

Between Jun 3 and 4, Centurion Corporation executive director and joint chairman David Loh Kim Kang bought 538,600 shares at an average price of S$0.532 per share, which increased his direct stake from 5.43 to 5.49 per cent. His preceding acquisition was on Feb 29, when he bought 1.25 million shares at S$0.425 per share.

2022年6月3日至4日,胜捷企业执行董事兼主席卢金康以平均每股0.532新元的价格购买了538,600股股票,直接持股由5.43%增至5.49%。他此前的收购是在2月29日,当时他以每股0.425新元的价格购买了125万股股票。

His total interest in the specialised accommodation developer and manager is now 56.15 per cent, with deemed interests mostly through his 50 per cent shareholding interest in Centurion Global.

他在这家专业住宿开发商和管理公司中的总利益现在为56.15%,其中大部分通过其在胜捷全球的50%持股权算入。

Loh is responsible for the formulation of corporate and business strategies and leads the execution of strategic growth plans of the group. He has over 20 years of experience in the investment and brokerage industry.

卢先生负责制定集团的公司和业务战略,并领导了集团战略增长计划的执行。他在投资和券商业界拥有超过20年的经验。

Centurion owns and manages a strong portfolio of 34 operational accommodation assets totalling about 67,347 beds as at Mar 31.

胜捷企业拥有并管理着一个强大的34家住宿资产组合,总床位达67,347张,截至3月31日。

On May 9, it reported a 30 per cent increase in revenue for Q1 2024, reaching S$61.1 million, compared to S$47.1 million in Q1 2023. This growth was attributed to positive rental rate revisions and higher occupancy rates in its global purpose-built workers accommodation and purpose-built student accommodation portfolios.

2024年第一季度,胜捷企业的营收增长了30%,达到6110万新元,而2023年第一季度的营收为4710万新元。这种增长归因于全球专业建造工人住宿和专业建造学生住宿组合中的积极租金调整和更高的入住率。

The group's portfolio in Singapore saw an increase in financial occupancy from 98 per cent in Q1 2023, to 99 per cent in Q1 2024, indicating a strong and sustained demand.

该集团在新加坡的组合看到了金融入住率从2023年第一季度的98%增加到2024年第一季度的99%,说明需求强劲和稳定。

This rise in occupancy, coupled with tenancies being renewed at higher rental rates in the last quarter of 2023, resulted in a significant increase in revenue from S$30.5 million in the first quarter of 2023 to S$41.6 million in the same period in 2024.

这种入住率的提高,加上在2023年最后一个季度提高的租金率,导致2023年第一季度的营收从3050万新元增至同期的2024年第一季度的4160万新元。

Malaysia saw an expansion in capacity and maintained strong occupancy, with 5 per cent growth in local currency revenue, which was reduced to a 2 per cent decline when reported in Singapore dollars.

马来西亚的容量有所扩大,并保持着强劲的入住率,在当地货币的营收增长了5%,但以新加坡元报告时下降了2%。

The UK experienced robust growth in revenue, driven by a supply-demand imbalance in student accommodation and successful rental revisions. The financial occupancy rates for properties in Adelaide and Melbourne, Australia, saw a notable increase from 80 per cent in Q1 2023 to 90 per cent in Q1 2024.

英国的营收增长强劲,受学生宿舍供需失衡和成功的租金修订的推动。阿德莱德和墨尔本等地的产业的金融入住率从2023年第一季度的80%显著增加至2024年第一季度的90%。

On May 16, Centurion announced that Centurion-Lionrock (HK), a subsidiary of Centurion Overseas Investments, secured a lease for 15 floors in a Hong Kong building to create a student accommodation facility with 89 beds.

2024年5月16日,胜捷企业宣布,胜捷海外投资子公司胜捷狮岩(HK)已获得在一栋香港大厦内租用15层楼以创建一家有89张床位的学生住宿设施的租约。

This project, near two universities, is a joint venture with LionRock Property owning 40 per cent. The facility is scheduled for operation in September 2024, under the "dwell" student accommodation brand.

这个项目靠近两所大学,是与LionRock Property的合资企业,LionRock Property持有40%。该设施计划在2024年9月开始运营,属于“住”学生住宿品牌。

Hong Lai Huat

hong lai huat

On May 30, Hong Lai Huat Group deputy chairman and CEO Ong Bee Huat acquired five million shares at an average price of S$0.04 per share. With a consideration of S$200,000 the married deal increased his total interest in the real estate and property developer from 42.33 to 43.30 per cent.

5月30日,Hong Lai Huat Group的副主席兼首席执行官王美发以每股0.04新元的平均价格收购了500万股。 这宗未披露夫妇交易使他对房地产和物业开发商的总持股比例从42.33%增至43.30%。

Ong is the founder of the group and responsible for overall strategic direction and planning as well as business development.

王美发是该集团的创始人,负责整体战略方向和规划以及业务拓展。

Inside Insights is a weekly column on The Business Times, read the original version.

Inside Insights是《商业时报》的每周专栏。 原文版本。

Enjoying this read?

阅读愉快?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 现在订阅SGX My Gateway通讯,获取关于新加坡交易所上市公司的最新市场新闻、板块表现、新产品发布更新以及研报汇编。

- 通过SGX Invest Telegram频道随时获取最新信息。