Soft Inflation Data Boosts Small Caps, Real Estate, Regional Banks; Traders Anticipate Fed Rate Cuts As Stocks React

Soft Inflation Data Boosts Small Caps, Real Estate, Regional Banks; Traders Anticipate Fed Rate Cuts As Stocks React

A cooler-than-expected U.S. inflation report fueled a rally on Wall Street, ahead of the highly anticipated Federal Open Market Committee (FOMC) meeting at 2:00 p.m. Wednesday.

在周三下午2点高度关注的联邦公开市场委员会(FOMC)会议之前,美国一份低于预期的通胀报告刺激了华尔街的涨势。

What happened: Inflation slowed to 3.3% annually in May, below both the expected and previous rate of 3.4%. On a monthly basis, the Consumer Price Index (CPI) remained flat, below the anticipated 0.1% increase and a significant drop from April's 0.3% rise.

发生了什么:5月份通货膨胀率为3.3%,低于预期和先前的3.4%水平。从月度来看,消费者价格指数(CPI)保持不变,低于预期的0.1%增长,并显著低于4月的0.3%上涨。

Additionally, the core measure of inflation, which excludes energy and food, weakened more than predicted. Annually, core inflation slowed from 3.6% to 3.4%, falling short of the 3.5% expectation.

此外,排除能源和食品的核心通胀率的增长低于预期。年度核心通胀从3.6%下降至3.4%,未达到3.5%的预期。

Why it matters: Lower-than-expected inflation data is bolstering hopes for a steady return to the Federal Reserve's 2% target and raising expectations for interest rate cuts later this year.

为什么要关注:低于预期的通胀数据增加了人们对恢复到联邦储备委员会2%的目标并增加对今年晚些时候降息的预期的希望。

Markets are now assigning a probability of over 70% for a September rate cut, up from 54% before the inflation report. Notably, Fed futures now indicate 55 basis points of rate cuts priced in by the end of the year, implying two rate cuts.

市场现在给9月降息的概率分配了超过70%,比通胀报告之前54%的概率高。值得注意的是,联邦期货现在表明到今年年底已定价降息55个基点,意味着两次降息。

Prospects of a declining cost of borrowing are aiding interest-rate sensitive sectors and stocks, which had lagged in recent weeks due to fears of prolonged higher rates.

借贷成本下降的前景正在提振基于利率敏感性的板块和股票,这些板块和股票由于担心利率持续上涨而落后于最近几周。

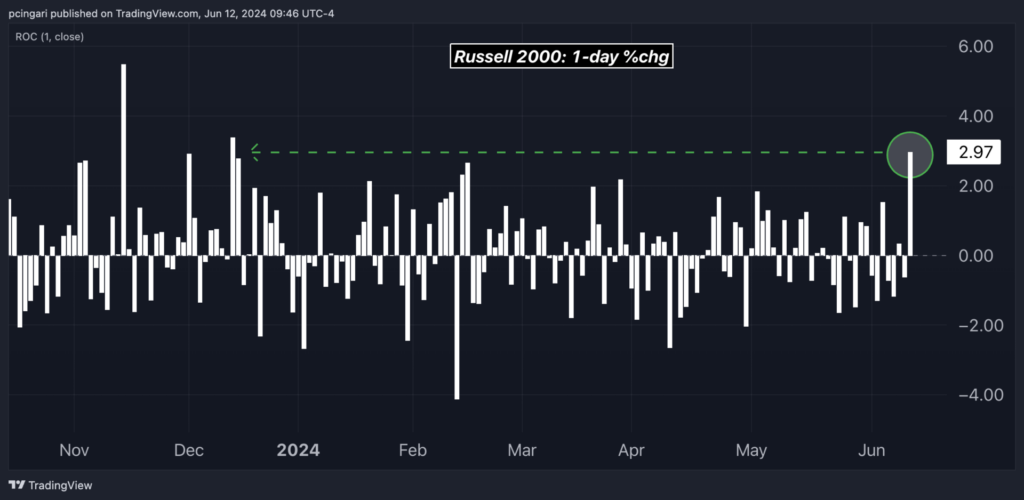

Market reactions: Small caps, as tracked by the iShares Russell 2000 ETF (NYSE:IWM), were the brightest spot in the market, opening 2.9% higher and on track for the best-performing day year to date.

小盘股,由iShares罗素2000指数ETF(纽约证券交易所:IWM)跟踪,是市场上最亮眼的板块,开盘涨2.9%,有望成为年度表现最佳的一天。

Chart: Small Caps Eye Best Day Since Mid-December 2023

图表:小盘股着眼于自2023年12月以来的最佳一天

In comparison, large-cap indices such as the S&P 500, the Nasdaq 100, and the Dow Jones Industrial Average were all about 0.9% higher.

相比之下,大盘指数,如标普500指数、纳斯达克100指数和道琼斯工业平均指数均上涨约0.9%。

Sector-wise, real estate and materials were the best performers, with the Vanguard Real Estate ETF (NYSE:VNQ) and the Materials Select Sector SPDR Fund (NYSE:XLB) up 2.2% and 1.6%, respectively.

在板块方面,房地产和材料板块表现最好,其中万得不动产信托指数ETF(纽约证交所:VNQ)和材料选择部门SPDR基金(纽约证交所:XLB)分别上涨2.2%和1.6%。

Industry-wise, homebuilders, regional banks, solar, and biotech stocks were the top performers, showing notable increases.

在行业板块上,建筑商、区域银行、太阳能和生物科技股表现最好,明显上涨。

- SPDR S&P Homebuilders ETF (NYSE:XHB) up 4%

- Invesco Solar ETF (NYSE:TAN) 3.9%

- SPDR S&P Regional Banking ETF (NYSE:KRE) up 3.3%

- SPDR S&P Biotech ETF (NYSE:XBI) up 2.3%

- 标普房屋建设ETF(纽约证交所:XHB)上涨4%。

- 英威腾太阳能ETF(纽约证交所:TAN)上涨3.9%。

- 标普区域银行ETF(纽约证交所:KRE)上涨3.3%。

- 标普生物科技ETF(纽约证交所:XBI)上涨2.3%。

According to Benzinga pro data the top-performing stocks (with at least $1 billion of market cap) in the hour following the U.S. inflation report were:

根据Benzinga pro的数据,美国通胀数据公布后的一个小时,市值至少10亿美元的股票中表现最好的股票是:

- Sunrun Inc. (NASDAQ:RUN): 7.87%

- Array Technologies Inc. (NASDAQ:ARRY): 7.65%

- Opendoor Technologies Inc. (NASDAQ:OPEN): 7.44%

- Element Solutions Inc. (NYSE:ESI): 6.78%

- TeraWulf Inc. (NASDAQ:WULF): 6.68%

- Iamgold Corporation (NYSE:IAG): 6.55%

- Globus Medical Inc. (NYSE:GMED): 6.04%

- Dyne Therapeutics Inc. (NASDAQ:DYN): 5.99%

- Enphase Energy Inc. (NASDAQ:ENPH): 5.93%

- Upstart Holdings Inc. (NASDAQ:UPST): 5.75%

- 运行公司股票(纳斯达克证券交易所:RUN):上涨7.87%。

- Array Technologies股票(纳斯达克证券交易所:ARRY):上涨7.65%。

- Opendoor Technologies股票(纳斯达克证券交易所:OPEN):上涨7.44%。

- Element Solutions股票(纽约证交所:ESI):上涨6.78%。

- TeraWulf公司(纳斯达克股票代码:WULF):6.68%

- iamgold公司(纽交所股票代码:IAG):6.55%

- Globus Medical公司(纽交所股票代码:GMED):6.04%

- Dyne Therapeutics公司(纳斯达克股票代码:DYN):5.99%

- Enphase Energy公司(纳斯达克股票代码:ENPH):5.93%

- Upstart Holdings公司(纳斯达克股票代码:UPST):5.75%

Looking ahead, traders are now eagerly anticipating the Federal Open Market Committee (FOMC) meeting. The statement and new macroeconomic projections will be released at 2:00 p.m. ET, followed by Fed Chair Powell's press conference at 2:30 p.m. ET.

展望未来,交易员们现在正在急切地期待联邦公开市场委员会(FOMC)会议。 陈述和新的宏观经济预测将于美国东部时间下午2:00发布,接着是联邦储备委员会主席鲍威尔的新闻发布会,将于美国东部时间下午2:30举行。

Read now: Fed Meeting Preview: Economists Predict Steady Rates In June, Fewer Cuts Ahead

立即阅读:联邦会议预览: 经济学家预计六月利率稳定,之后降息率减少。

Photo: Shutterstock

Photo: shutterstock