Markets Weekly Update (June 14) : Fed Diverges From Global Peers in New Era of Higher for Longer

Markets Weekly Update (June 14) : Fed Diverges From Global Peers in New Era of Higher for Longer

Macro Matters

宏观很重要

Fed Diverges From Global Peers in New Era of Higher for Longer

在长期走高的新时代,美联储与全球同行存在分歧

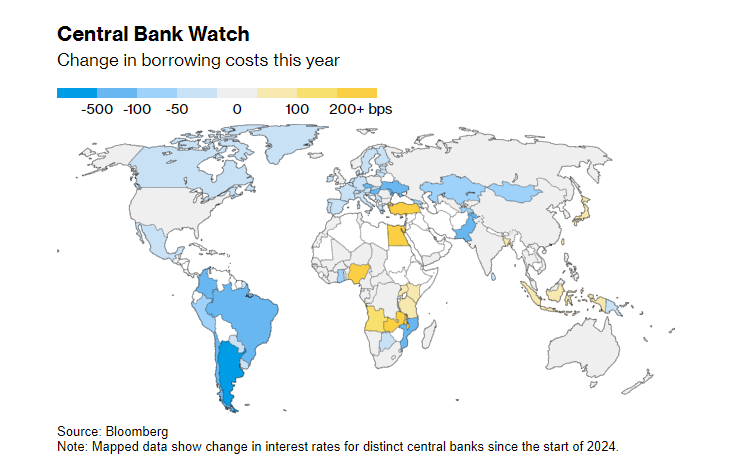

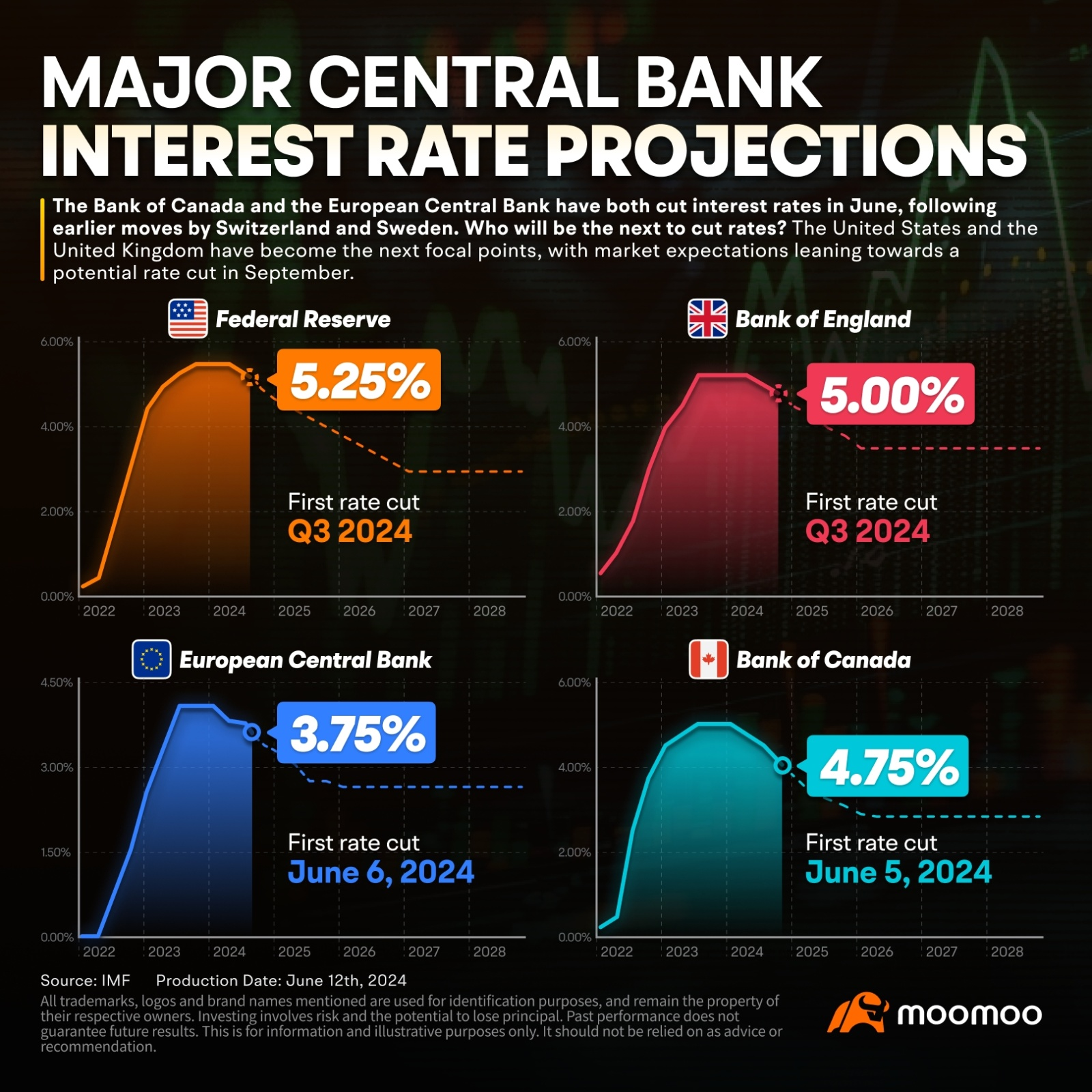

The Federal Reserve is bucking the global trend by signaling a more conservative approach to interest rate cuts, with officials now expecting just one reduction this year—a downshift from the three cuts forecasted in March—and projecting that rates won't fall as low as previously thought, suggesting that higher interest rates are here to stay. This stance stands in stark contrast to actions taken by other major central banks like the Bank of Canada and the European Central Bank, both of which have recently lowered their rates by 25 basis points, and the Swiss National Bank, which initiated its own cut earlier in March.

美联储表示将采取更为保守的降息方针,从而逆转全球趋势,官员们现在预计今年仅降息一次,与3月份预测的三次降息相比有所下降,并预计降息不会像先前想象的那么低,这表明更高的利率将继续下去。这一立场与其他主要中央银行采取的行动形成鲜明对比,例如加拿大银行和欧洲央行,这两家银行最近都将利率下调了25个基点,以及瑞士国家银行,后者在3月初开始了自己的降息。

US Producer Prices Surprise With Biggest Decline Since October

美国生产者价格出人意料地创下10月以来最大跌幅

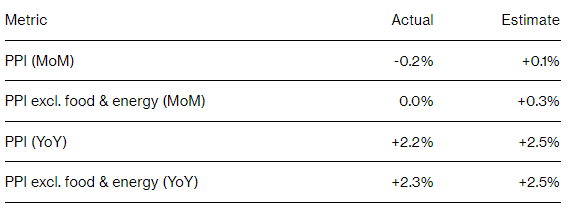

US producer prices unexpectedly declined in May by the most in seven months, another welcome development that will strengthen the Federal Reserve’s confidence in moderating inflation.

美国5月份生产者价格出人意料地跌幅为七个月来最大,这是另一项可喜的进展,它将增强美联储对缓和通货膨胀的信心。

The producer price index for final demand decreased 0.2% from a month earlier, lower than all estimates in a Bloomberg survey of economists. Compared with a year ago, the PPI rose 2.2%, Bureau of Labor Statistics data showed Thursday.

最终需求的生产者价格指数比一个月前下降了0.2%,低于彭博社对经济学家的调查中的所有预期。美国劳工统计局周四的数据显示,与去年同期相比,PPI上涨了2.2%。

BOJ Triggers Yen Slump With Lack of Detail on Bond Buying Cuts

日本央行因缺乏削减债券购买细节而引发日元暴跌

Investors were caught off guard when the Bank of Japan (BOJ) held off on providing specifics about reducing its bond-buying program until its July meeting, a move that contributed to a further drop in the yen and prompted traders to scale back expectations for an interest rate hike in the near future. Despite predictions from economists that the BOJ would start tapering its purchases, the central bank's decision to delay details signaled a slower return to normal monetary policy. Meanwhile, the BOJ's move to keep the benchmark rate steady was anticipated, but the yen still fell to its lowest against the dollar since April, yields on 10-year government bonds decreased, and Japanese stocks managed to climb, bucking the downtrend in other Asian markets.

当日本银行(BOJ)推迟到7月的会议才提供有关缩减债券购买计划的具体信息时,投资者措手不及,此举导致日元进一步下跌,并促使交易者缩减了对不久的将来加息的预期。尽管经济学家预测日本央行将开始缩减购买规模,但央行推迟细节的决定表明恢复正常货币政策的速度放缓。同时,日本央行保持基准利率稳定的举措是预料之中的,但日元兑美元汇率仍跌至4月以来的最低水平,10年期国债收益率下降,日本股市成功攀升,逆转了其他亚洲市场的下跌趋势。

Smart Money Flow

智能资金流

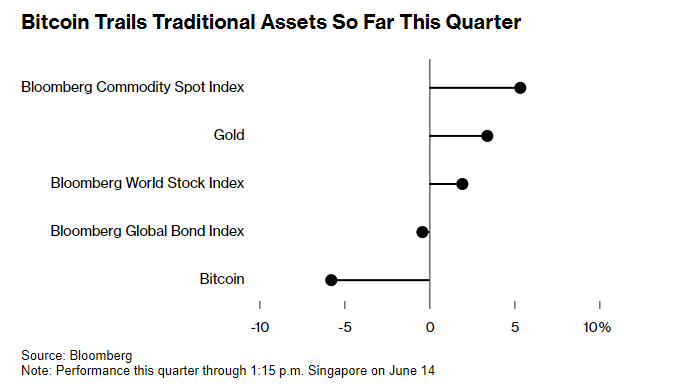

Bonds Are Beating Bitcoin as Doubts Gather Over Crypto Rebound

随着人们对加密货币反弹的疑虑越来越多,债券正在击败比特币

This quarter has seen traditional investments like stocks and bonds outperform Bitcoin, suggesting that the cryptocurrency's surge may be losing momentum. Bitcoin has dipped around 5% since April began, trailing behind global equity, bond, and commodity indices, and even gold has outpaced the digital currency. Despite reaching an all-time high of $73,798 in March, Bitcoin's attempts to rally back to that level have fallen short. Enthusiasm for factors that once boosted Bitcoin, such as US Bitcoin ETF inflows and hopes for Fed rate cuts, now seems to wane, failing to reignite the strong market sentiment previously observed.

本季度,股票和债券等传统投资的表现优于比特币,这表明加密货币的飙升可能正在失去动力。自4月初以来,比特币已经下跌了约5%,落后于全球股票、债券和大宗商品指数,甚至黄金的速度也超过了数字货币。尽管在3月份达到了73,798美元的历史新高,但比特币反弹至该水平的尝试仍未成功。对曾经提振比特币的因素的热情,例如美国比特币ETF的流入和美联储降息的希望,现在似乎有所减弱,未能重燃先前观察到的强劲市场情绪。

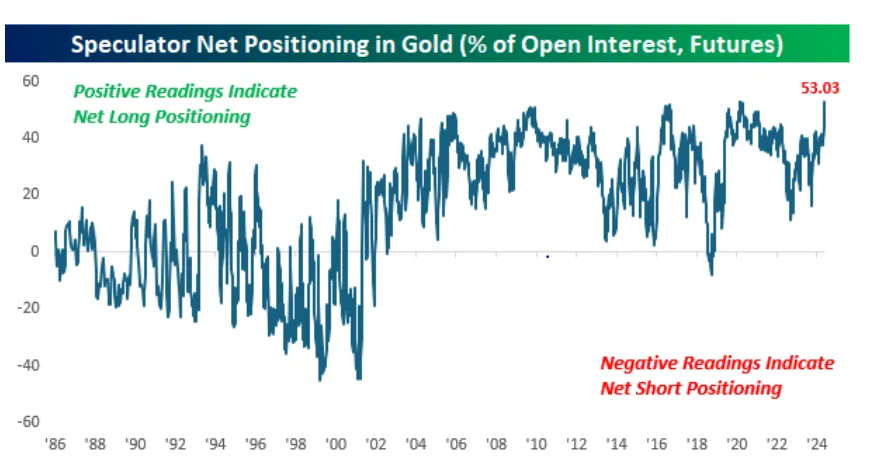

Net long positions in gold futures are hovering at the highest levels since 1986.

黄金期货的净多头头寸徘徊在1986年以来的最高水平。

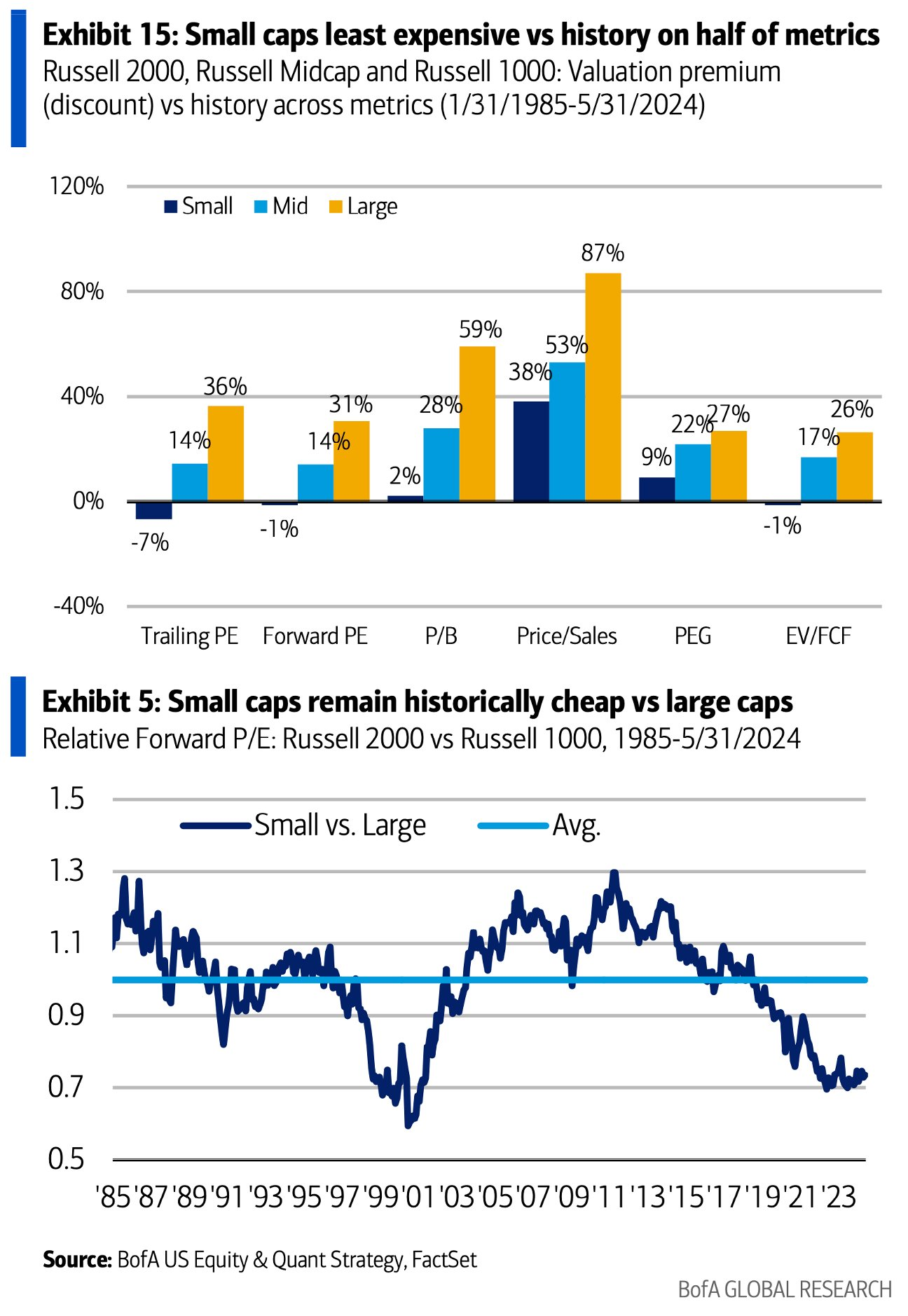

Small caps are historically cheap on various metrics.

从历史上看,从各种指标来看,小盘股都很便宜。

Top Corporate News

热门企业新闻

Apple Tops Microsoft in Value After Best 3-Day Run Since 2020

苹果继2020年以来最佳3天表现之后,其市值超过微软

Apple has reclaimed its crown as the world's most valuable company, surpassing Microsoft with a market cap of $3.285 trillion after a strong rally fueled by investor optimism about its growth prospects and positioning in artificial intelligence. The tech giant's market value edged past Microsoft's $3.282 trillion, marking the first time Apple has come out on top since January. With its biggest three-day jump since August 2020, Apple has bounced back from recently ranking third behind Nvidia, reflecting Wall Street's dynamic leaderboard. According to Rhys Williams of Wayve Capital Management, the market is favoring companies that are expected to lead in AI, suggesting that Apple and Microsoft, along with Nvidia, may continue to vie closely for the top spot.

在投资者对其增长前景和人工智能定位的乐观情绪推动下,苹果以3.285万亿美元的市值超过了微软,夺回了其作为全球最有价值公司的桂冠。这家科技巨头的市值小幅超过微软的3.282万亿美元,这标志着苹果自1月份以来首次名列前茅。苹果创下了自2020年8月以来最大的三日涨幅,已从最近仅次于英伟达的第三名反弹,这反映了华尔街的动态排行榜。Wayve Capital Management的里斯·威廉姆斯表示,市场青睐有望在人工智能领域处于领先地位的公司,这表明苹果和微软以及英伟达可能会继续激烈争夺头把交椅。

Broadcom Beats Earnings Estimates, Announces 10-for-1 Stock Split

博通超出盈利预期,宣布以10比1的比例进行股票分割

Broadcom delivered a strong performance in its second fiscal quarter, surpassing Wall Street's expectations with an adjusted earnings per share of $10.96, beating the forecast of $10.84, and a revenue of $12.49 billion, compared to the anticipated $12.03 billion. The company's announcement of a 10-for-1 stock split, effective from July 15, has been well-received, with the stock jumping approximately 10% after hours. Looking ahead, Broadcom has raised its sales outlook for fiscal year 2024 to around $51 billion, nudging past the consensus estimate of $50.42 billion. Despite a drop in net income from last year's $3.48 billion to $2.12 billion this quarter, the company's overall financial health appears robust, indicating confidence in its future growth trajectory.

博通在第二财季表现强劲,超出了华尔街的预期,调整后的每股收益为10.96美元,超过了预期的10.84美元,收入为124.9亿美元,而预期的为120.3亿美元。该公司宣布从7月15日起实行10比1的股票拆分,受到了好评,该股盘后上涨了约10%。展望未来,博通已将其2024财年的销售前景上调至约510亿美元,超过了共识估计的504.2亿美元。尽管净收入从去年的34.8亿美元下降至本季度的21.2亿美元,但该公司的整体财务状况似乎强劲,这表明了对其未来增长轨迹的信心。

Oracle Shares Hit Record High on AI-Fueled Cloud Growth

由于人工智能推动的云增长,甲骨文股价创历史新高

Oracle Corp. has exceeded expectations with significant bookings and struck partnership deals with its tech rivals, propelling the company's shares to an all-time high and advancing Chairman Larry Ellison's vision of establishing Oracle as a formidable force in the cloud computing arena. CEO Safra Catz highlighted the company's momentum, citing record-breaking sales contracts over the past two quarters, largely driven by the surging demand for training AI large language models on Oracle's cloud platform. Looking ahead, Catz forecasts a bright fiscal year with double-digit revenue growth through May 2025, anticipating an uptick in the pace as Oracle's cloud infrastructure scales up to meet the robust demand for AI capabilities.

甲骨文公司的大量预订量超出了预期,并与科技竞争对手达成了合作协议,推动该公司的股价创下历史新高,并推进了董事长拉里·埃里森将甲骨文打造成云计算领域强大力量的愿景。首席执行官萨夫拉·卡茨强调了该公司的势头,理由是过去两个季度创纪录的销售合同,这主要是由在甲骨文云平台上训练人工智能大型语言模型的需求激增所推动的。展望未来,Catz预测,到2025年5月,财年将实现两位数的收入增长。他预计,随着甲骨文云基础设施的扩大以满足对人工智能功能的强劲需求,这一步伐将加快。

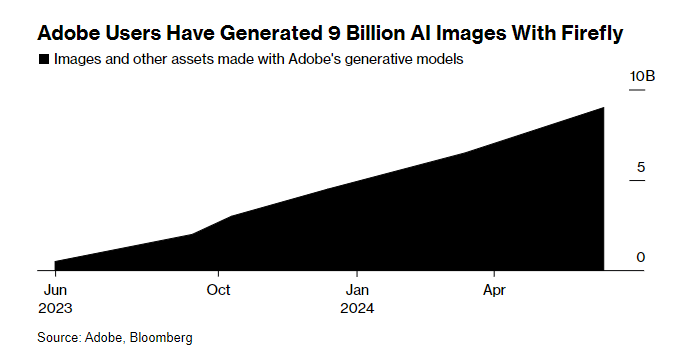

Adobe Jumps After Results Signal It’s Part of AI Boom

在业绩表明它是人工智能繁荣的一部分之后,Adobe大获成功

Adobe Inc. saw its shares climb in after-hours trading as the company's outlook on sales outshined expectations, indicating that its suite of creative products, now enhanced with artificial intelligence tools, is gaining traction with customers. The company is forecasting $460 million in new annual recurring revenue from its digital media segment for the current quarter, surpassing analysts' predictions of $435.2 million. Despite the growing investor unease over the impact of generative AI on Adobe's stronghold in the graphic arts software sector—a concern shared by peers like Salesforce, Workday, and ServiceNow who have seen a slowdown in demand—Adobe's success in integrating AI into its offerings appears to be resonating with its user base, helping it to stay competitive against both established rivals and emerging AI-focused startups.

Adobe Inc.的股价在盘后交易中攀升,原因是该公司的销售前景超出预期,这表明其创意产品套件越来越受到客户的关注,这些产品现在已通过人工智能工具进行了增强。该公司预计,本季度其数字媒体板块的新年经常性收入为4.6亿美元,超过分析师预测的4.352亿美元。尽管投资者对生成式人工智能对Adobe在平面艺术软件领域的据点的影响越来越不安,Salesforce、Workday和ServiceNow等同行也对此感到担忧,但Adobe成功将人工智能整合到其产品中似乎引起了用户群的共鸣,有助于其与知名竞争对手和以人工智能为重点的新兴初创公司保持竞争力。

Upcoming Economic Data

即将公布的经济数据

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

免责声明:本演示文稿仅用于信息和教育用途,不是对任何特定投资或投资策略的推荐或认可。本内容中提供的投资信息属于一般性质,仅用于说明目的,可能并不适合所有投资者。它是在不考虑个人投资者的财务复杂程度、财务状况、投资目标、投资时间范围或风险承受能力的情况下提供的。在做出任何投资决定之前,您应根据您的相关个人情况考虑这些信息的适当性。过去的投资表现并不能预示或保证未来的成功。回报会有所不同,所有投资都有风险,包括本金损失。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo是由Moomoo Technologies Inc.提供的财务信息和交易应用程序。在美国,Moomoo上的投资产品和服务由FINRA/SIPC成员Moomoo Financial Inc. 提供。