The Japanese Yen Fell To A Six-Week Low After The Bank Of Japan Ended Its Meeting

The Japanese Yen Fell To A Six-Week Low After The Bank Of Japan Ended Its Meeting

By RoboForex Analytical Department

由RoboForex分析部门提供

The Japanese yen exchange rate paired with the US dollar looks unimpressive by the end of this week. The USD/JPY pair rose to almost 158.00 immediately after the end of the June meeting of the Bank of Japan, which left the interest rate unchanged. Everything went according to expectations.

本周日元兑美元汇率并不理想。在日本银行6月会议结束后,美元/日元汇率曾一度升至接近158.00。此次会议未改变利率,符合市场预期。

In March, the BoJ raised the rate for the first time in seven years, moving it from negative territory to zero.

三月,日本银行首次在七年内升息,将利率从负值提高至零。

In its comments, the regulator noted that it will continue to buy Japanese government bonds at the same pace as agreed in March until its July meeting. Thus, market expectations were ignored, which worked against the JPY. Investors hoped that the BoJ would at least carefully consider gradually reducing its balance sheet through government bonds as part of a smooth monetary policy transition from quantitative easing to tightening.

监管机构在评论中指出,将继续以三月份同意的速度购买日本政府债券,直至七月份会议。因此,市场预期被忽视,对日元不利。投资者希望日本银行考虑通过政府债券进行平缓货币政策过渡,逐步减少其负债表。

Previously, Bank of Japan Governor Kazuo Ueda confirmed the regulator's intention to gradually reduce its substantial balance sheet in the future. However, the timing of this action remains uncertain.

在此之前,日本银行行长上田和夫确认监管机构在未来逐渐减少其大幅负债表的意图。但此行动的时间仍不确定。

USD/JPY Technical Analysis

美元/日元技术面分析

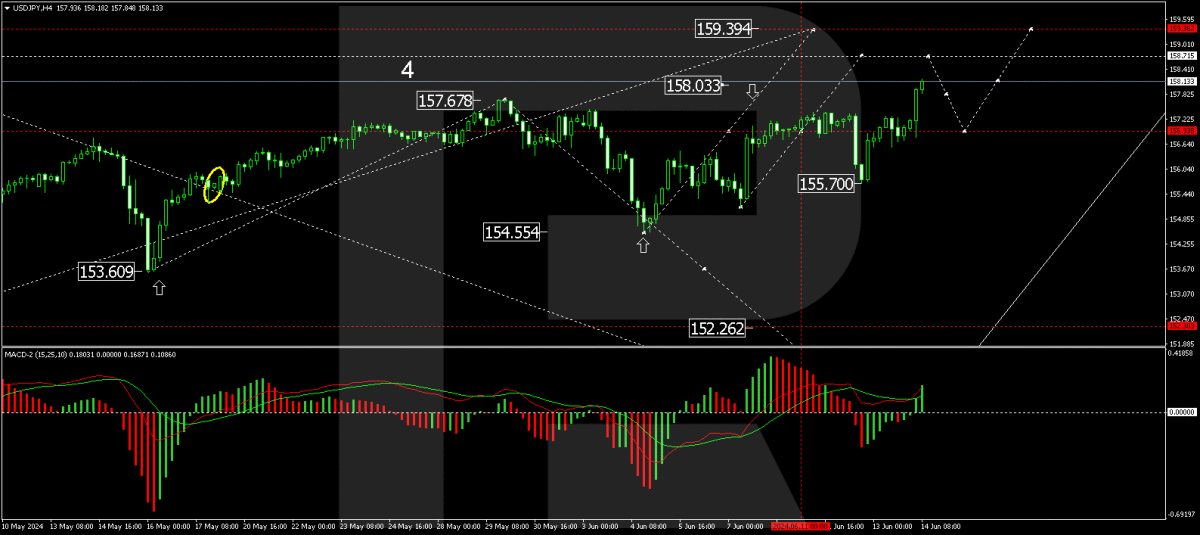

On the H4 USD/JPY chart, the market has breached 157.47 upwards and is continuing to develop a growth wave towards 158.74. After reaching this level, a correction down to the level of 157.47 is a possibility (test from above). We will then assess the probability of continuing the growth wave to 159.36. Technically, this scenario is supported by the MACD indicator, with its signal line above the zero level and pointing upwards.

在H4美元/日元图表上,市场已上涨至157.47以上,正在发展一波涨势,目标为158.74。达到该水平后,回落到157.47的修正波浪可能性(从上方测试)很大。我们将评估继续涨势至159.36的可能性。从技术上来说,MACD指标支持该情景,其信号线在零轴上方并向上指向。

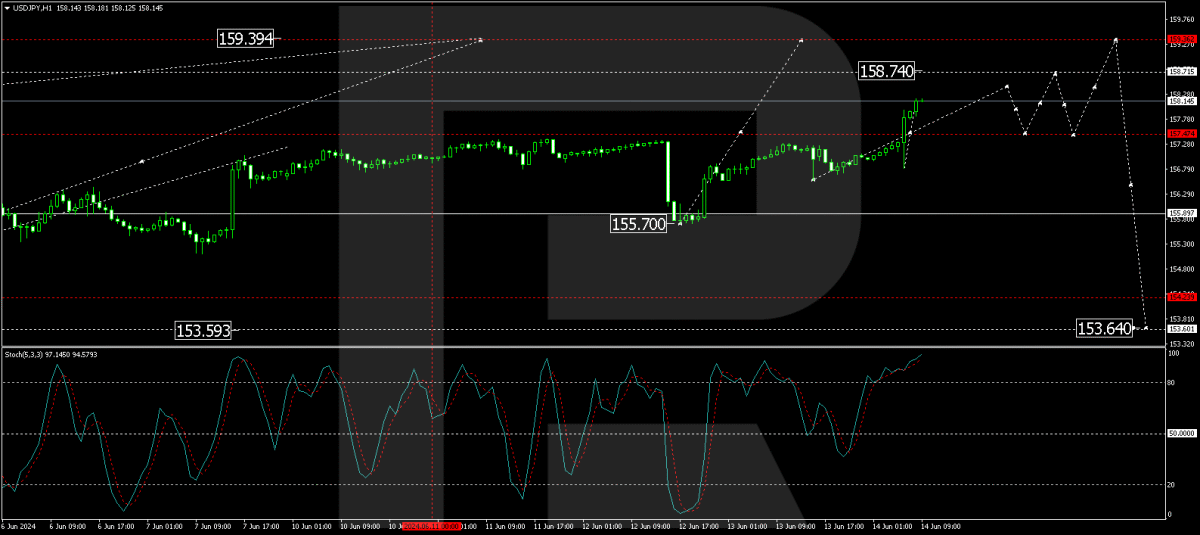

On the H1 USD/JPY chart, the market continues to develop a wave of growth to the level of 158.40. Further, a correction wave to 157.47 is possible, followed by growth to 158.74, the local target. Technically, this scenario is confirmed by the Stochastic oscillator, with its signal line above level 80 and preparing to decline to level 20.

在H1美元/日元图表上,市场正在发展一波涨势,目标为158.40。进一步,回落至157.47的修正波浪是可能的,然后再上升至158.74的当地目标。从技术上来说,随机指标确认该情景,其信号线在80以上并准备下降至20。

Disclaimer

免责声明

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

任何包含在此处的预测都基于作者的观点。本分析不应被视为交易建议。RoboForex对基于本文的交易建议和评论所产生的交易结果不承担任何责任。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文来自非报酬的外部投稿人。它不代表Benzinga的报道,并且没有因为内容或准确性而被编辑。

In its comments, the regulator noted that it will continue to buy Japanese government bonds at the same pace as agreed in March until its July meeting. Thus, market expectations were ignored, which worked against the JPY. Investors hoped that the BoJ would at least carefully consider gradually reducing its balance sheet through government bonds as part of a smooth monetary policy transition from quantitative easing to tightening.

In its comments, the regulator noted that it will continue to buy Japanese government bonds at the same pace as agreed in March until its July meeting. Thus, market expectations were ignored, which worked against the JPY. Investors hoped that the BoJ would at least carefully consider gradually reducing its balance sheet through government bonds as part of a smooth monetary policy transition from quantitative easing to tightening.