Is Now The Time To Put AptarGroup (NYSE:ATR) On Your Watchlist?

Is Now The Time To Put AptarGroup (NYSE:ATR) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

投资者通常会追求发现“下一个大事情”的想法,即使这意味着购买没有任何收入,更不用说利润的“故事股”。有时候这些故事会迷惑投资者的思想,导致他们凭情绪而非基本面投资。亏损的公司尚未通过利润证明自己,最终外部资本流入可能会枯竭。

In contrast to all that, many investors prefer to focus on companies like AptarGroup (NYSE:ATR), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

与此相反,许多投资者更喜欢关注像AptarGroup (NYSE:ATR) 这样不仅拥有营业收入,而且还有利润的公司。尽管利润不是投资时唯一考虑的指标,但值得认识的是能够稳定产生利润的企业。

How Fast Is AptarGroup Growing?

AptarGroup 的增长速度有多快?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, AptarGroup has grown EPS by 8.0% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

如果一家公司能够保持足够长时间的每股收益 (EPS) 增长,其股价最终应该会跟随。因此,有经验的投资者在进行投资研究时会密切关注公司的每股收益。在过去的三年中,AptarGroup 的每股收益年增长率为 8.0%。虽然这种增长率并不是特别亮眼,但它确实表明企业正在增长。

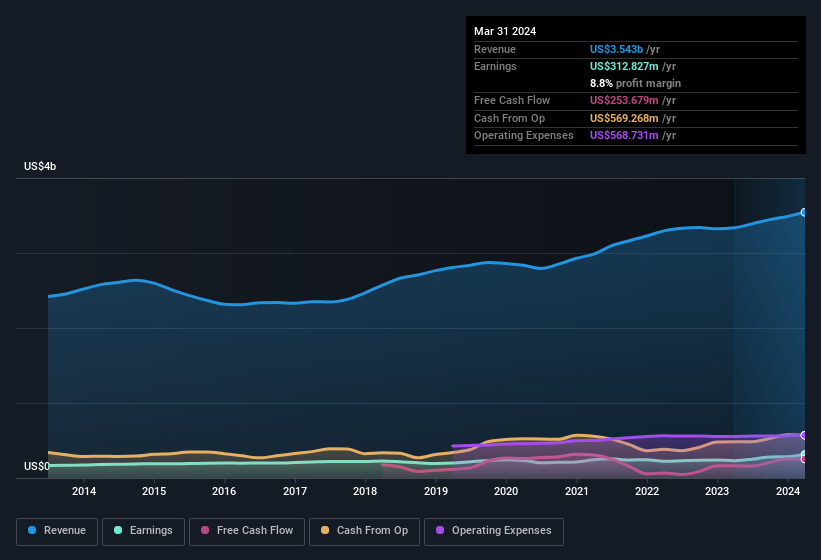

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. AptarGroup shareholders can take confidence from the fact that EBIT margins are up from 11% to 13%, and revenue is growing. Both of which are great metrics to check off for potential growth.

高增长率是增长可持续性的重要指标,再加上高的利息税前利润率,这对一家公司来说是在市场上保持竞争优势的绝佳方式。AptarGroup 的股东可以对税息前利润率从 11% 上升到 13% 并增长的营业收入感到自信。这两个指标都是潜在增长的重要衡量标准。

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

NasdaqGS: CTAS 财务历史纪录 2024年6月2日

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of AptarGroup's forecast profits?

在投资中,与生活一样,未来比过去更重要。所以,不妨查看AptarGroup的这个免费互动可视化工具。预测利润?

Are AptarGroup Insiders Aligned With All Shareholders?

AptarGroup内部股东是否与所有股东保持一致?

Owing to the size of AptarGroup, we wouldn't expect insiders to hold a significant proportion of the company. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Holding US$66m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

由于AptarGroup的规模,我们不会期望内部股东持有公司的大比例股份。但由于他们对公司的投资,很高兴看到他们仍然有与股东保持一致的激励。持有价值6600万美元的公司股票不是小数目,内部人员将致力于为股东提供最佳的回报。这足以让股东了解管理层将非常专注于长期增长。

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to AptarGroup, with market caps over US$8.0b, is around US$14m.

看到公司内部人员有投资企业的行为是好事,但薪酬水平合理吗?基于CEO薪酬,你可以认为薪酬水平确实合理。与 AptarGroup 规模类似、市值超过80亿美元的公司的CEO的中位数总薪酬约为1400万美元。

The AptarGroup CEO received US$8.9m in compensation for the year ending December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

截至2023年12月结束的一年中,AptarGroup的CEO获得了890万美元的报酬。这低于类似规模公司的平均水平,似乎相当合理。CEO薪酬水平不是投资者最重要的指标,但当薪酬水平适度时,这确实支持CEO与普通股东之间的协作。一般来说,如果薪酬水平合理,则表明做出了良好的决策。

Should You Add AptarGroup To Your Watchlist?

你应该把AptarGroup加入自选吗?

As previously touched on, AptarGroup is a growing business, which is encouraging. Earnings growth might be the main attraction for AptarGroup, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, you'd argue this one is worthy of the watchlist, at least. We should say that we've discovered 1 warning sign for AptarGroup that you should be aware of before investing here.

AptarGroup是一家增长型企业,这是令人鼓舞的。对AptarGroup而言,盈利增长可能是最大的吸引力,但乐趣并不止于此。既然管理层报酬相对适中,内部持股也相对较高,那么我们可以认为这个企业值得进一步观察。我们应该说,在在此之前我们已经发现了一个值得警惕的信号,你在进行投资前应该知道。没有总而言之,拥有既适度的CEO报酬又相当高的内部持股,AptarGroup值得加入自选。此外,在决定将某支股票添加到自选列表之前,我们还应该考虑财务指标和可持续性等其他因素。

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by significant insider holdings.

总有可能买入没有利润增长和没有内部人买入股票的股票而获得好的回报。但对于那些认为这些指标很重要的人,我们鼓励您查看具备这些特征的公司。您可以访问定制的马来西亚公司列表,其中这些公司已经证明了由内部人拥有的重要性所支持的成长。不应成长收益的公司中并展示没有但对于那些认为这些指标很重要的人来说,我们鼓励您查看那些具有这些特征的公司。您可以查看由内部人士持有股份支持的增长的定制公司列表。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

请注意,本文讨论的内部交易是指在相关司法管辖区中报告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者,发送电子邮件至editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者发送电子邮件至editorial-team@simplywallst.com。

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT)

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT)