Is It Time To Consider Buying Freshpet, Inc. (NASDAQ:FRPT)?

Is It Time To Consider Buying Freshpet, Inc. (NASDAQ:FRPT)?

Freshpet, Inc. (NASDAQ:FRPT), is not the largest company out there, but it received a lot of attention from a substantial price increase on the NASDAQGM over the last few months. The company's trading levels have reached its high for the past year, following the recent bounce in the share price. As a mid-cap stock with high coverage by analysts, you could assume any recent changes in the company's outlook is already priced into the stock. However, could the stock still be trading at a relatively cheap price? Let's examine Freshpet's valuation and outlook in more detail to determine if there's still a bargain opportunity.

Freshpet,Inc.(纳斯达克:FRPT)并不是最大的公司,但它在过去几个月里在纳斯达克GM上出现了大幅上涨,受到了很多关注。公司的交易水平已经达到了过去一年的高点,这是由于股价最近回升所致。作为一只被分析师广泛关注的中型股,您可以认为公司前景的任何近期变化已经计入股票的价格了。然而,这支股票仍然可能在相对便宜的价格交易,让我们更详细地审查Freshpet的估值和前景,以确定是否有折扣机会。

What's The Opportunity In Freshpet?

Freshpet的机会在哪里?

According to our valuation model, Freshpet seems to be fairly priced at around 8.68% above our intrinsic value, which means if you buy Freshpet today, you'd be paying a relatively fair price for it. And if you believe that the stock is really worth $120.73, then there isn't really any room for the share price grow beyond what it's currently trading. So, is there another chance to buy low in the future? Given that Freshpet's share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us an opportunity to buy later on. This is based on its high beta, which is a good indicator for share price volatility.

根据我们的估值模型,Freshpet的价格似乎是公平的,大约比我们的内在价值高了8.68%,这意味着如果您今天买入Freshpet,您将为它付出一个相对公平的价格。如果您相信这支股票真的值120.73美元,那么它的股价就没有什么增长空间了。那么在未来还有其他买入机会吗?考虑到Freshpet的股价相当波动(即其价格波动相对于市场其他板块放大),这可能意味着股价可以进一步下跌,为我们提供买入机会。这基于它高的β值,这是股价波动性的一个良好指标。

What kind of growth will Freshpet generate?

Freshpet将产生什么样的增长?

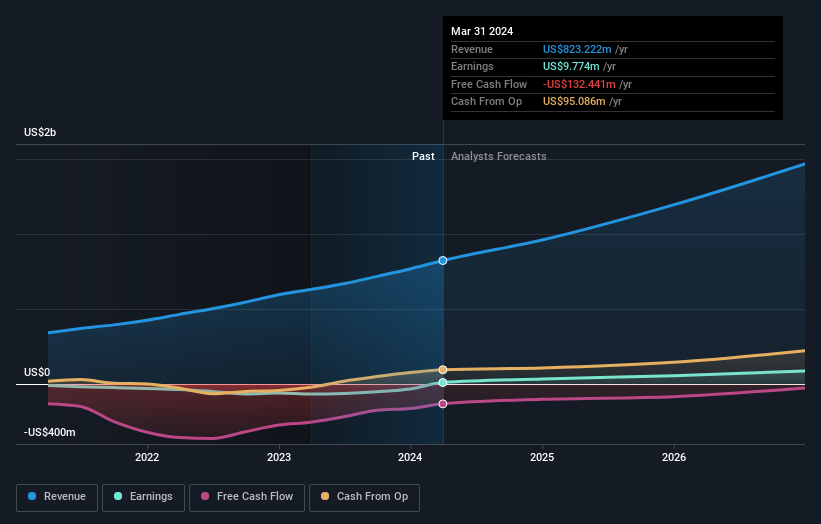

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it's the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. With profit expected to more than double over the next couple of years, the future seems bright for Freshpet. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

寻求投资组合增长的投资者可能想在购买其股票之前考虑一家公司的前景。尽管价值投资者会认为内在价值与价格相对最重要,但更有说服力的投资论点是,在相对便宜的价格下具有高增长潜力。随着预计在未来几年内利润将增长一倍以上,Freshpet的未来似乎是光明的。看起来,该股票的现金流量将更高,这应该会带来更高的股票估值。

What This Means For You

这对您意味着什么?

Are you a shareholder? FRPT's optimistic future growth appears to have been factored into the current share price, with shares trading around its fair value. However, there are also other important factors which we haven't considered today, such as the financial strength of the company. Have these factors changed since the last time you looked at the stock? Will you have enough confidence to invest in the company should the price drop below its fair value?

您是股东吗?FRPT的乐观未来增长似乎已经计入了当前股价,股票交易价格合理。然而,还有其他重要因素我们今天没有考虑,比如公司的财务实力。自您上次看过该股票以来,这些因素发生了变化吗?如果股价低于其合理价值,您是否有足够的信心投资于该公司?

Are you a potential investor? If you've been keeping tabs on FRPT, now may not be the most advantageous time to buy, given it is trading around its fair value. However, the optimistic prospect is encouraging for the company, which means it's worth further examining other factors such as the strength of its balance sheet, in order to take advantage of the next price drop.

您是潜在投资者吗?如果您一直关注FRPT,现在可能不是最有利的购买时机,因为它正以合理的价格交易。然而,该公司的乐观前景令人鼓舞,这意味着有必要进一步研究其他因素,比如其资产负债表的强度,以利用下一轮的股价下跌。

So while earnings quality is important, it's equally important to consider the risks facing Freshpet at this point in time. Case in point: We've spotted 1 warning sign for Freshpet you should be aware of.

因此,尽管盈利质量很重要,但考虑Freshpet目前面临的风险同样重要。例如,我们发现了1个Freshpet的警告信号,您应该注意。

If you are no longer interested in Freshpet, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

如果您不再对Freshpet感兴趣,您可以使用我们的免费平台查看我们的另外50只具备高增长潜力的股票列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者,发送电子邮件至editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者发送电子邮件至editorial-team@simplywallst.com。

Are you a shareholder? FRPT's optimistic future growth appears to have been factored into the current share price, with shares trading around its fair value. However, there are also other important factors which we haven't considered today, such as the financial strength of the company. Have these factors changed since the last time you looked at the stock? Will you have enough confidence to invest in the company should the price drop below its fair value?

Are you a shareholder? FRPT's optimistic future growth appears to have been factored into the current share price, with shares trading around its fair value. However, there are also other important factors which we haven't considered today, such as the financial strength of the company. Have these factors changed since the last time you looked at the stock? Will you have enough confidence to invest in the company should the price drop below its fair value?