Unity Software Unusual Options Activity For June 20

Unity Software Unusual Options Activity For June 20

Whales with a lot of money to spend have taken a noticeably bullish stance on Unity Software.

有大量资金的鲸鱼显然看好 Unity Software。

Looking at options history for Unity Software (NYSE:U) we detected 8 trades.

查看 Unity Software(纽交所:U)的期权历史,我们发现了 8 笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,有50%的投资者带着看好的预期开仓,有50%的投资者带着看淡的预期开仓。

From the overall spotted trades, 3 are puts, for a total amount of $104,852 and 5, calls, for a total amount of $237,725.

在这些交易中,共有 3 笔看跌期权,总金额为 104,852 美元,5 笔看涨期权,总金额为 237,725 美元。

What's The Price Target?

价格目标是什么?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $15.0 to $25.0 for Unity Software during the past quarter.

分析这些合同的成交量和未平仓量,似乎大角色在过去的季度里一直在关注 Unity Software 的目标价区间在 15.0 到 25.0 美元之间。

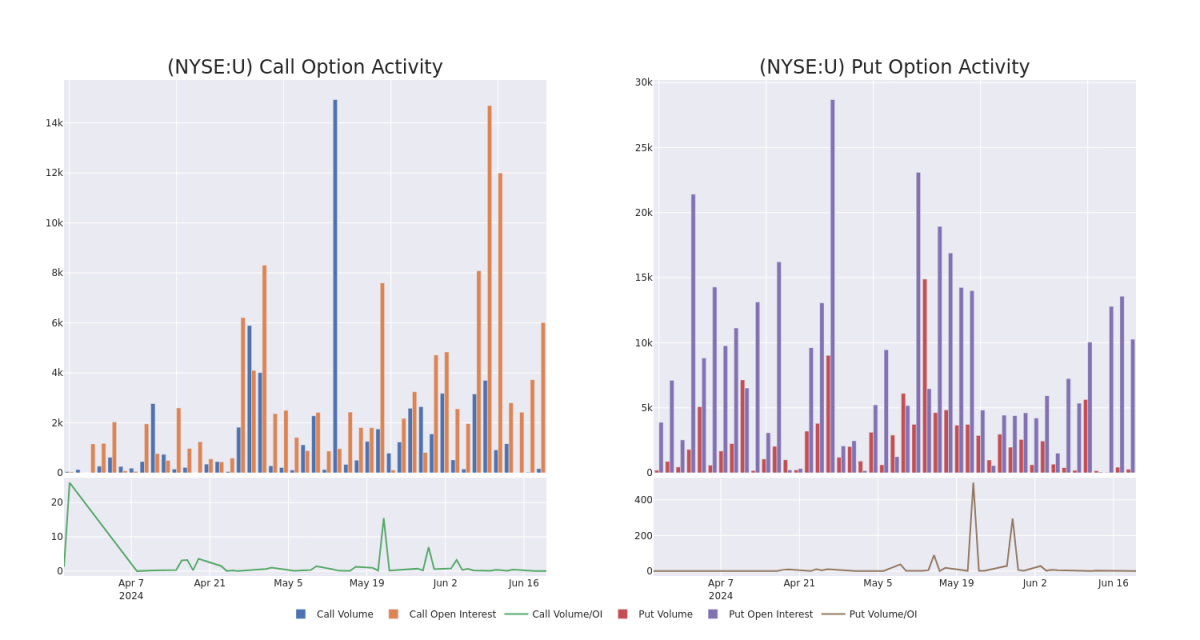

Volume & Open Interest Trends

成交量和未平仓量趋势

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Unity Software's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Unity Software's significant trades, within a strike price range of $15.0 to $25.0, over the past month.

检查成交量和未平仓量为股票研究提供了重要见解,这些信息是衡量 Unity Software 某些行使价格的期权流动性和兴趣水平的关键。下面,我们展示了过去一个月 Unity Software 在行使价格区间 15.0 到 25.0 美元内看涨期权和看跌期权成交量和未平仓量的趋势快照。

Unity Software Option Volume And Open Interest Over Last 30 Days

Unity Software 期权成交量和未平仓量过去 30 天内的状况

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| U | CALL | SWEEP | BEARISH | 08/16/24 | $0.72 | $0.7 | $0.7 | $19.00 | $67.1K | 906 | 62 |

| U | CALL | SWEEP | BULLISH | 01/17/25 | $3.1 | $3.0 | $3.1 | $16.00 | $53.6K | 371 | 30 |

| U | PUT | TRADE | BEARISH | 01/17/25 | $9.9 | $9.85 | $9.89 | $25.00 | $49.4K | 9.1K | 3 |

| U | CALL | SWEEP | BULLISH | 01/17/25 | $1.73 | $1.69 | $1.73 | $20.00 | $48.4K | 2.6K | 69 |

| U | CALL | TRADE | BEARISH | 01/17/25 | $3.75 | $3.65 | $3.66 | $15.00 | $36.6K | 259 | 1 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| U | 看涨 | SWEEP | 看淡 | 08/16/24 | 0.72美元 | 0.7美元 | 0.7美元 | 19.00美元 | $67.1K | 906 | 62 |

| U | 看涨 | SWEEP | 看好 | 01/17/25 | $3.1 | $3.0 | $3.1 | 16.00美元 | $53.6K | 371 | 30 |

| U | 看跌 | 交易 | 看淡 | 01/17/25 | $9.9 | $9.85 | $9.89 | $25.00 | 49,400 美元 | 9.1K | 3 |

| U | 看涨 | SWEEP | 看好 | 01/17/25 | $1.73 | $1.69 | $1.73 | $20.00 | $48.4K | 2.6K | 69 |

| U | 看涨 | 交易 | 看淡 | 01/17/25 | $3.75 | $3.65 | $3.66 | 15.00美元 | $36.6千 | 259 | 1 |

About Unity Software

关于 Unity Software

Unity Software Inc provides a software platform for creating and operating interactive, real-time 3D content. The platform can be used to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The business is spread across the United States, Greater China, EMEA, APAC, and Other Americas, of which key revenue is derived from the EMEA region. The products are used in the gaming industry, architecture and construction sector, animation industry, and designing sector.

Unity Software Inc 提供一种创建和操作交互式、实时3D内容的软件平台。该平台可用于为移动电话、平板电脑、个人电脑、主机游戏机和增强和虚拟现实设备创建、运行和赚取交互式、实时2D和3D内容。业务遍布美国、大中华、欧洲、中东、非洲、亚太地区和其他美洲,其中 EMEA 地区的主要收入来源。该产品用于游戏行业、建筑和建造业、动画行业和设计行业。

Following our analysis of the options activities associated with Unity Software, we pivot to a closer look at the company's own performance.

在分析与 Unity Software 相关的期权活动后,我们将目光转向公司的表现。

Current Position of Unity Software

Unity Software 的当前持仓

- Currently trading with a volume of 5,389,375, the U's price is down by -4.14%, now at $15.41.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 41 days.

- 目前的成交量为 5,389,375,U 的价格下跌了 -4.14%,现在是 $15.41。

- RSI读数表明该股票目前可能被超卖。

- 预计发布盈利报告还有 41 天。

What The Experts Say On Unity Software

关于 Unity Software 的专家意见

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $25.0.

在过去的一个月中,有 1 位行业分析师分享了他们对这只股票的见解,提出了平均目标价为 25.0 美元。

- An analyst from Stifel has decided to maintain their Buy rating on Unity Software, which currently sits at a price target of $25.

- Stifel 的一位分析师决定维持对 Unity Software 的买入评级,目标价目前为 25.0 美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。