Take Care Before Jumping Onto Guangdong KinLong Hardware Products Co.,Ltd. (SZSE:002791) Even Though It's 30% Cheaper

Take Care Before Jumping Onto Guangdong KinLong Hardware Products Co.,Ltd. (SZSE:002791) Even Though It's 30% Cheaper

Guangdong KinLong Hardware Products Co.,Ltd. (SZSE:002791) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 54% loss during that time.

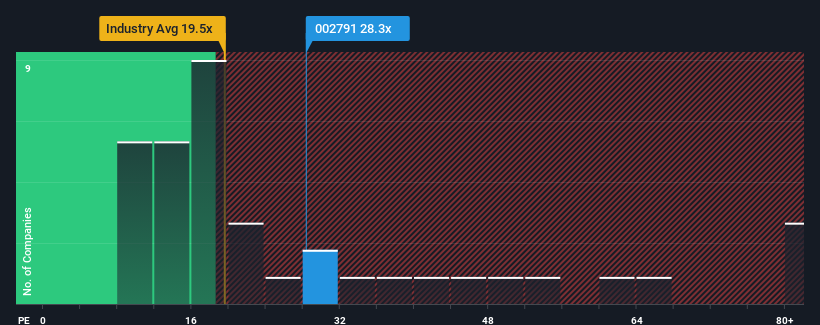

Although its price has dipped substantially, there still wouldn't be many who think Guangdong KinLong Hardware ProductsLtd's price-to-earnings (or "P/E") ratio of 28.3x is worth a mention when the median P/E in China is similar at about 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been advantageous for Guangdong KinLong Hardware ProductsLtd as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

What Are Growth Metrics Telling Us About The P/E?

Guangdong KinLong Hardware ProductsLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 248%. However, this wasn't enough as the latest three year period has seen a very unpleasant 59% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 30% per annum over the next three years. That's shaping up to be materially higher than the 25% per year growth forecast for the broader market.

In light of this, it's curious that Guangdong KinLong Hardware ProductsLtd's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

With its share price falling into a hole, the P/E for Guangdong KinLong Hardware ProductsLtd looks quite average now. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Guangdong KinLong Hardware ProductsLtd currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Guangdong KinLong Hardware ProductsLtd with six simple checks.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com