Rising U.S. Treasury Trades: Besides Tech Stocks, New Opportunities Beckon

Rising U.S. Treasury Trades: Besides Tech Stocks, New Opportunities Beckon

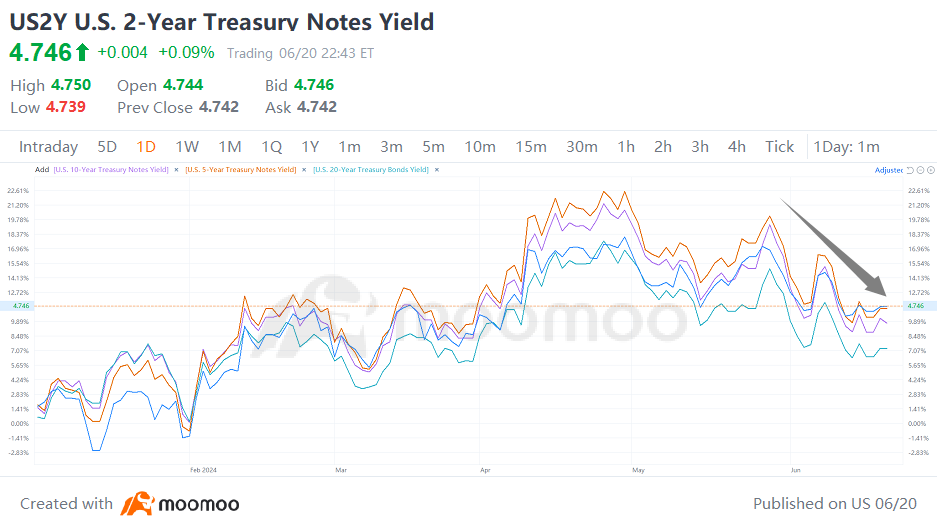

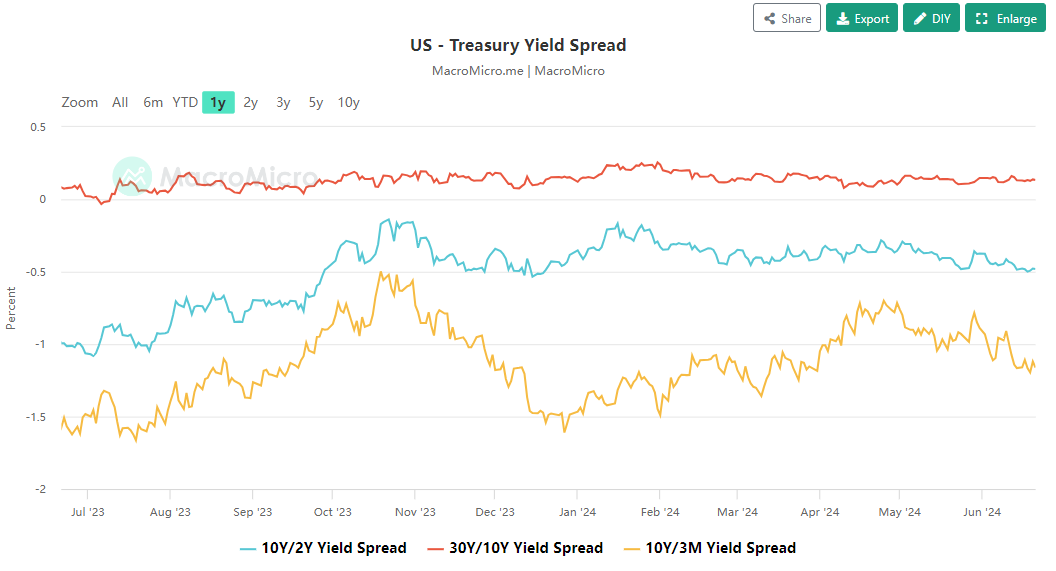

U.S. Treasuries have been on a roller coaster ride this year. Yields kept climbing until May, as rate cut expectations were repeatedly thwarted. Since then, with the gradual recovery of these expectations and the impact of geopolitical risks, the trend has reversed. The 10-year note yield has dropped 37 basis points to 4.26%, and the 2-year yield has fallen below the 4.8% mark. The Bloomberg Treasury Index is now almost back to where it started the year, with just a 0.1% dip. As yields peak and retreat, they're inching closer to their year-ago levels, signaling a recovery for U.S. Treasuries.

今年以来,美国国债一直经历过山车般的波动。期望降息一再受挫,收益率一路攀升直至5月。自那时起,随着这些期望的逐渐恢复以及地缘政治风险的影响,趋势逆转。十年期国债收益率下降了37个基点至4.26%,两年期收益率已经跌破了4.8%的关口。布隆伯格国债指数现在几乎回到了一年初的起点,仅下跌了0.1%。随着收益率的峰值和回撤,它们正在逐渐接近去年的水平,这预示着美国国债的复苏。

Sluggish Macro Data Bolsters Rate Cut Expectations, Fueling Optimism in the Bond Market

经济数据疲软,增强了降息预期,在债券市场引发了乐观情绪

Retail sales in the U.S. edged up by a modest 0.1% in May, according to data released on Tuesday, falling short of the anticipated 0.3% increase. Last week's inflation figures indicated a larger-than-expected decline, with the core CPI dropping to a three-year low and the May PPI falling 0.2% month-over-month, contrary to expectations of a 0.1% rise. More disappointing data followed on Thursday: initial jobless claims for the week totaled 238,000, exceeding the expected 235,000, while new housing starts in May plummeted by 5.5%, marking the lowest level in four years.

根据周二公布的数据,美国零售销售在5月份小幅上升0.1%,未达预期的0.3%增长。上周的通胀数据显示下降幅度大于预期,核心CPI降至三年低点,5月份PPI环比下降0.2%,而预期为上涨0.1%。更令人失望的数据是,上周四公布的初请失业金人数为23.8万人,超过预期的23.5万人,而5月新住房开工急剧下跌5.5%,创下四年来的最低水平。

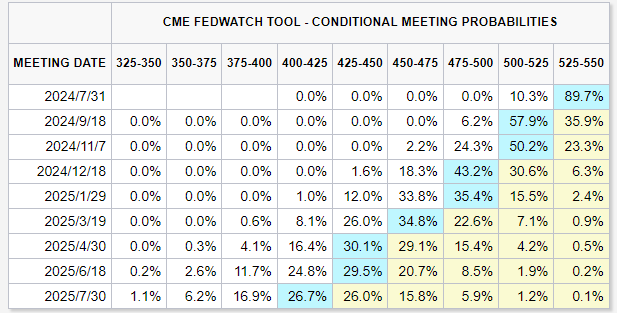

Despite Fed Chair Powell's hawkish stance on rate cuts following the FOMC meeting, the market remains focused on weak economic data. According to CME FedWatch, expectations for a rate cut in September have risen to 64.1%, with two 25 basis point cuts anticipated by 2024.

尽管美联储主席鲍威尔在联邦公开市场委员会会议后对降息持鹰派立场,但市场仍集中在经济疲软的数据上。根据CME FedWatch,9月份降息的预期已经升至64.1%,到2024年预计会有两次25个基点的降息。

According to Bloomberg, the past week has seen a significant surge in demand for futures contracts in the bond market; the momentum in the spot market is also gaining strength, with a JPMorgan survey indicating the largest net long position in the spot market in about a month. Meanwhile, the auction of $13 billion in 20-year U.S. Treasury bonds yielded significantly lower rates than pre-auction yields, signaling stronger-than-expected demand.

据彭博社报道,上周债券期货合约需求急剧上升;现货市场的动量也在增强,摩根大通的一项调查显示,现货市场净多头头寸约为一个月来的最高水平。与此同时,130亿美元20年期美国国债的拍卖收益率显著低于拍卖前收益率,标志着需求强于预期。

Why the Bond Market Is Poised for a Bull Run Amid Rate Cut Expectations

为什么在降息预期中,债券市场做多的趋势更加明显

As the prospect of an interest rate cut looms, U.S. Treasury yields are poised to continue their descent, presenting opportunities for bond allocation.

随着降息的前景逐渐浮现,美国国债收益率有望继续下降,为债券配置提供机会

Market expectations of a rate cut are driving the downward movement of risk-free rates, providing solid support for bond prices. Bart Melek, Head of Commodity Strategy at TD Securities, said, "The market is increasingly convinced that the Federal Reserve will initiate an easing cycle. I believe we may start to establish some long positions in the market."

With the soaring stock prices of major tech companies like Nvidia and Apple, investors are concerned about the sustainability of the stock market's rally and are looking to diversify into lower-risk assets such as bonds.

市场对降息的预期推动着无风险利率的下降,为债券价格提供了有力的支持。TD证券的商品策略负责人Bart Melek表示,“市场越来越相信联邦储备委员会将启动放宽周期。我相信我们可以开始在市场上建立一些多头头寸”。

随着英伟达和苹果等主要科技公司的股价飙升,投资者对于股市行情的持续性越来越担忧,正在寻求多样化风险更小的资产,如债券。

What Type of Bonds to Choose for the Upcoming Rate Cut?

在即将到来的降息环境下,该选择哪种类型的债券?

Some analysts are optimistic about investment opportunities in long-term bonds.

一些分析师对于长期债券的投资机会持乐观态度。

Rachana Mehta, Regional Co-Head of Fixed Income at Malayan Banking Asset Management, believes that the yield on the 10-year U.S. Treasury note is roughly between 4.2% and 4.5%. She thinks it's a good buying opportunity when the yield approaches the top of this range. Mehta said, "Given the recent U.S. data, we hope the volatility we've seen is behind us." "You can continue to hold the 10-year U.S. Treasury note with yields of 4.4% to 4.5%."

马来亚银行资产管理有限公司固定收益业务区域联席主管Rachana Mehta认为,十年期美国国债收益率大约在4.2%至4.5%之间。她认为,当收益率接近这个范围的顶部时,这是一个很好的买入机会。Mehta说:“鉴于最近的美国数据,我们希望我们看到的波动已经落后了。” “你可以继续持有10年期美国国债,收益率为4.4%至4.5%。”

Padhraic Garvey, Global Head of Debt and Interest Rate Strategy for Financial Markets at ING Group, said, "We continue to see 4% as a viable target for the yield on the 10-year U.S. Treasury note.

荷兰国际集团金融市场固定收益和利率策略全球负责人Padhraic Garvey表示,“我们继续认为,10年期美国国债收益率4%是一个可行的目标。”

Opinions are divided, with some analysts bullish on short-term Treasury bonds due to their heightened sensitivity to monetary policy. Since the start of the year, the yield curve inversion between the 2-year and 10-year U.S. Treasuries has significantly tightened, with the spread narrowing by 51 basis points to 48 basis points.

分析师对于短期国债持看多态度,因为它们对货币政策的敏感性更高。自年初以来,2年期和10年期美国国债之间的收益率曲线明显拉紧,利差由51个基点缩小至48个基点。

It's important to note that not everyone is bullish on U.S. Treasuries. Earlier this month, analysts Anshul Pradhan and Amrut Nashikkar at Barclays wrote in a report that the market may be overinterpreting the weakness in recent data such as CPI. 'We believe that a rebound in economic activity could surprise the market and lead to higher interest rates,' they wrote.

值得注意的是,并不是每个人都看好美国国债。巴克莱银行的分析师Anshul Pradhan和Amrut Nashikkar本月早些时候在一份报告中写道,市场可能过度解读了一些最近数据的疲软,如CPI,他们写道:“我们相信,经济活动的反弹可能会出乎市场的意料,导致利率上升。”

Beyond U.S. Treasuries, there are other bonds with investment opportunities. David Kelly and his team at JP Morgan Asset Management believe that 'as the Fed eventually begins reducing rates, core high-quality intermediate bonds should prove to be an equity diversifier and ballast in client portfolios once again.'

除了美国国债之外,其他债券也具有投资机会。JP Morgan资产管理公司的David Kelly及其团队认为,“当美联储最终开始降息时,核心高质量中期债券应该再次证明是客户投资组合中的股票分散风险和基础。”

Michel Vernier, Head of Fixed Income Strategy at Barclays, mentions 'A mix of medium-term investment grade credit in combination with other segments, like high yield (BB-rated), emerging markets, and some inflation-linked debt, seems to be a reasonable approach to meet uncertainty over the upcoming path while delivering likely higher returns than cash over the long term.'"

巴克莱银行的固定收益策略全球负责人Michel Vernier提到:“混合投资级信用债和其他领域的债券(如高收益(BB评级)、新兴市场和一些与通胀相关的债券),似乎是满足未来不确定性的合理做法,同时可以实现长期回报优于现金。”