GameStop Unusual Options Activity For June 21

GameStop Unusual Options Activity For June 21

Deep-pocketed investors have adopted a bullish approach towards GameStop (NYSE:GME), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GME usually suggests something big is about to happen.

资深投资者已对游戏驿站(纽交所:GME)采取了看好的态度,市场参与者不应忽视此情况。本站在跟踪贝芝加公开期权记录时发现了这一重大动向。尽管这些投资者的身份尚不为人所知,但是在GME出现这种重大变化通常意味着即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for GameStop. This level of activity is out of the ordinary.

我们从本站期权扫描器今天突出的11项非同寻常的游戏驿站期权活动中概括了这些信息。这种活动水平是非同寻常的。

The general mood among these heavyweight investors is divided, with 54% leaning bullish and 36% bearish. Among these notable options, 2 are puts, totaling $132,333, and 9 are calls, amounting to $573,410.

这些重量级投资者中普遍情绪分散,其中54%看好,36%看淡。在这些显著期权中,2项为看跌,总额为$ 132,333,9项为看涨,总额为$ 573,410。

Predicted Price Range

预测价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $10.0 and $125.0 for GameStop, spanning the last three months.

在评估成交量和未平仓量后,很明显,主要市场推动者正在关注游戏驿站在$10.0至$125.0之间的价格区间,该区间跨越最近三个月。

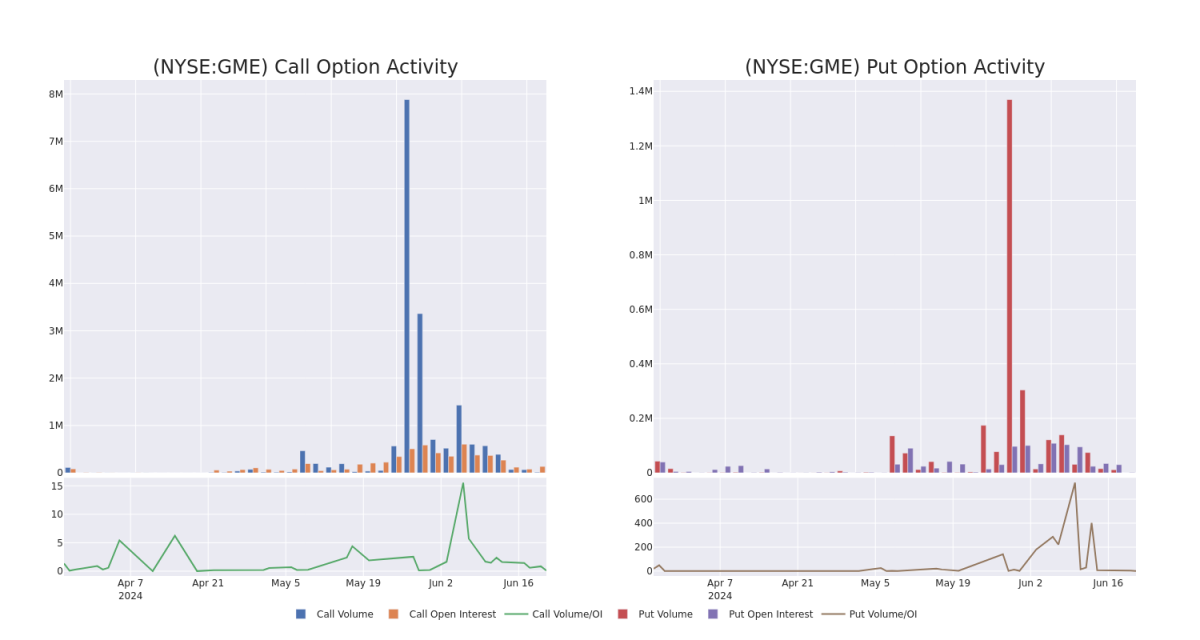

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in GameStop's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to GameStop's substantial trades, within a strike price spectrum from $10.0 to $125.0 over the preceding 30 days.

评估成交量和未平仓量是期权交易的战略步骤。这些指标揭示了游戏驿站在指定行权价上的期权的流动性和投资者兴趣。即将发布的数据可视化了过去30天关于$ 10.0至$ 125.0期权行权价范围内与游戏驿站实际交易相对应的看涨和看跌期权的成交量和未平仓量的波动情况。

GameStop Call and Put Volume: 30-Day Overview

游戏驿站看涨和看跌期权的成交量:30天概述

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | TRADE | BULLISH | 06/21/24 | $4.3 | $4.1 | $4.3 | $21.00 | $216.7K | 4.0K | 9 |

| GME | CALL | TRADE | BULLISH | 07/19/24 | $4.4 | $4.35 | $4.4 | $25.00 | $88.0K | 14.3K | 17 |

| GME | PUT | SWEEP | NEUTRAL | 07/19/24 | $16.8 | $15.85 | $16.33 | $40.00 | $68.5K | 715 | 5 |

| GME | PUT | SWEEP | BULLISH | 06/28/24 | $16.0 | $14.7 | $15.17 | $40.00 | $63.7K | 689 | 11 |

| GME | CALL | SWEEP | BEARISH | 06/28/24 | $1.65 | $1.57 | $1.58 | $26.00 | $56.0K | 3.4K | 2.3K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | 看涨 | 交易 | 看好 | 06/21/24 | $4.3 | $4.1 | $4.3 | 21.00美元 | $ 216.7K | 4.0K | 9 |

| GME | 看涨 | 交易 | 看好 | 07/19/24 | $4.4 | $4.35 | $4.4 | $25.00 | $88.0K | 14.3K | 17 |

| GME | 看跌 | SWEEP | 中立 | 07/19/24 | $16.8 | $15.85 | $ 16.33 | $40.00 | $ 68.5K | 715 | 5 |

| GME | 看跌 | SWEEP | 看好 | 06/28/24 | $16.0 | $14.7 | $ 15.17 | $40.00 | $63.7K | 689 | 11 |

| GME | 看涨 | SWEEP | 看淡 | 06/28/24 | $1.65 | $1.57 | $1.58 | 26.00美元 | $56.0K | 3.4千 | 2.3K |

About GameStop

关于游戏驿站

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

游戏驿站公司是一家美国多渠道视频游戏、消费电子和服务零售商,在欧洲、加拿大、澳大利亚和美国均有业务。游戏驿站通过游戏驿站、EB Games和Micromania商店以及国际电商网站销售新旧视频游戏硬件、实体和数字视频游戏软件和视频游戏配件,销售的大部分来自美国。

In light of the recent options history for GameStop, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到游戏驿站的最近期权历史,现在应该关注公司本身。我们旨在探讨其当前业绩。

Where Is GameStop Standing Right Now?

游戏驿站现状如何?

- With a volume of 9,434,153, the price of GME is down -3.37% at $24.73.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 75 days.

- 游戏驿站成交量为9,434,153美元,价格下跌-3.37%至$ 24.73。

- RSI指标暗示该股票可能要超买了。

- 下次盈利预计在75天内公布。

What Analysts Are Saying About GameStop

分析师对游戏驿站的评论

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $11.0.

在过去一个月中,有1位行业分析师分享了他们对该股票的见解,提出了平均目标价为$ 11.0。

- An analyst from Wedbush persists with their Underperform rating on GameStop, maintaining a target price of $11.

- Wedbush的一位分析师坚持对GameStop的跑输市场评级,并维持目标价为$11。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GameStop options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。精明的交易者通过不断地自我教育、调整他们的策略、监视多个因子并密切关注市场变动来管理这些风险。通过本站实时提醒了解最新的GameStop期权交易。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $10.0 and $125.0 for GameStop, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $10.0 and $125.0 for GameStop, spanning the last three months.