Fox Complex: Extending Mine Life; A New Mine at the Stock Property; Exploration Has Driven the Prospect of Earlier Cash Flow

Fox Complex: Extending Mine Life; A New Mine at the Stock Property; Exploration Has Driven the Prospect of Earlier Cash Flow

TORONTO, June 20th, 2024 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to report on the progress at the Fox Complex, where we are advancing a new mine on the Stock Property. Production is planned to start in the second half of 2025. Pre-construction activities of the Stock portal have commenced, which will allow access to mining of the three gold zones, West, Main and East. In addition, the portal will provide cost-effective underground drill platforms to enable testing for expected depth extensions of these three zones. Recent exploration resulted in a 29% increase in the estimated gold resources for Stock's East Zone. The Fox Complex is comprised of several properties, including Stock, and has Measured and Indicated gold resources of 1,905,000 ounces at average grade of 4.20 g/t Au and Inferred gold resources of 549,000 ounces at average grade of 3.60 g/t Au.

2024年6月20日,多伦多th龙鼎黄金( McEwen Mining Inc.,纽交所代码: MUX,tsx代码: MUX)很高兴地报道了位于福克斯综合矿区的进展情况,我们正在该地区的股票产区开采新的矿山。计划于2025年下半年开始生产。股票矿口的预建设活动已经开始,将允许采掘西部,主要和东部的三个黄金区。此外,矿口将提供成本效益的地下钻探平台,以便测试这三个区域预期深度延伸。最近的勘探结果导致股票东部区域估计金资源增加了29%。福克斯综合矿区由几个属性组成,包括股票,并具有平均品位为4.20克/吨Au的1,905,000盎司的规定和暗示金资源,和平均品位为3.60克/吨Au的549,000盎司的暗示金资源。

Stock Ramp to Access Future Production

股票入口通往未来产量

The Stock Property hosts the Stock Mill and the former Stock Mine, which produced 137,000 ounces of gold from an underground operation between 1989 and 2005. Our exploration has successfully defined three deposits at Stock - the East, Main and West zones. This mineralization has been found on a three-kilometer-long mineralized trend situated along the prolific Destor-Porcupine Fault.

股票矿区拥有股票工厂和之前的股票矿山,该矿山在1989年至2005年间进行了地下开采,产量为137,000盎司黄金。我们的勘探成功地确定了三个位置:股票的东部,主要和西部区域。这种矿化物被发现位于沿着富含翠柏和豪猪故障的三公里长矿化趋势上。

Pre-construction activities have commenced at the portal with the removal of overburden. Underground development is expected to begin in Q3. The Stock Ramp will connect the West Zone and the East Zone to the existing historical underground workings of the Main Zone.

股票矿口的预建设活动已经开始移除覆盖层。地下开采预计将于第三季度开始。股票斜坡将使西区和东区连接到主区的现有历史地下工作中。

Stock is expected to provide increased gold production at a lower cost per ounce than our current production from the Froome Mine. The advantages of mining at Stock compared to Froome are significant and the reasons are three-fold: one, there is a significantly lower transportation or haulage cost. The Froome mine is deeper and located 35 kilometers from the Stock Mill, while the gold at Stock is at shallower depths and right next to the Mill; two, increased gold production due to expected higher mill throughput, as a result of the Stock material having a lower (softer) work index compared to what is currently being processed from the Froome Mine; and three, the bulk of Stock is free of royalties, whereas Froome is not.

股票预计将提供比我们现在从弗鲁姆矿获得更低成本的黄金生产。与弗鲁姆相比,股票采矿的优势显着,原因有三:一,运输或运输成本显着降低。弗鲁姆矿较深,距股票工厂35公里,而股票中的黄金处于较浅的深度,且位于工厂旁边。两个由于股票材料具有较低(更软)的工作指数,预计可以提高磨机通量,从而增加黄金生产量;以及三股票的大部分免于版税,而弗鲁姆则不是。

Mining will start in the East Zone, with a recently increased resource, and provide early production and cash flow. Our plan for the Stock development is to concurrently drive the Stock Ramp to the East Zone along with the ramps to the Main and West Zones. This approach will allow for multiple sources of mineralization to be accessed from the Stock Ramp.

采矿将从东部区域开始,最近增加了资源,从而提供早期产量和现金流。我们股票开发的计划是与主区和西区的坡道并行推进股票斜坡。这种方法将允许从股票斜坡访问多个矿产资源。

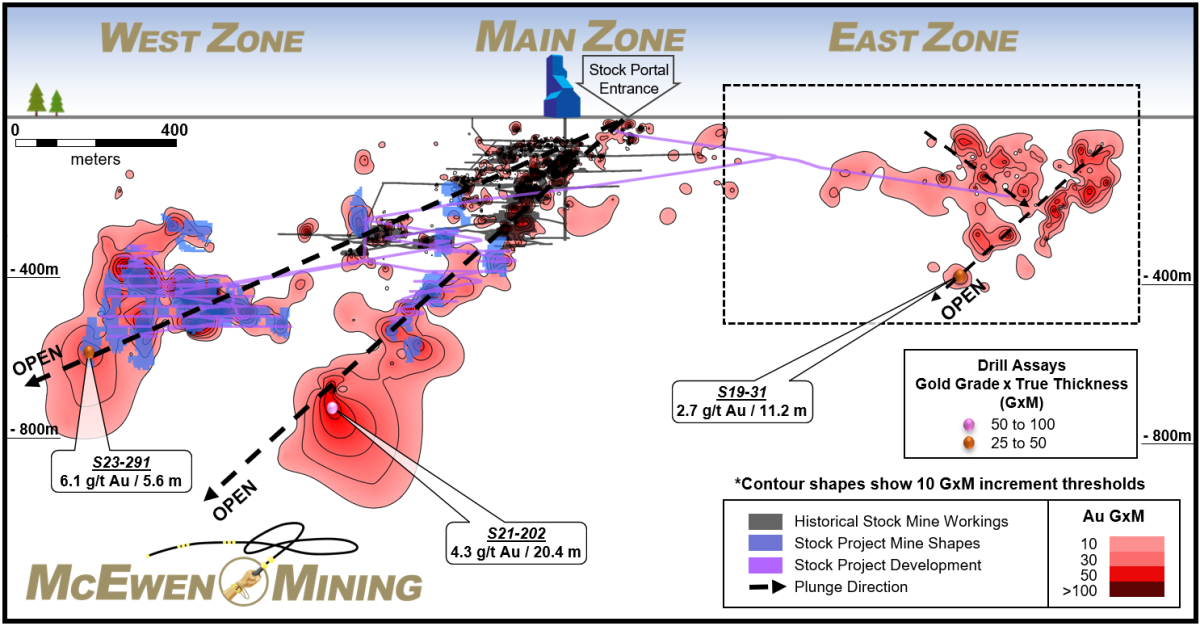

Figure 1 is a project wide longitudinal section at Stock, illustrating the proposed ramp development (shown as purple straight lines) and mining horizons (shapes in blue) associated with the West, Main and East Zones.

图1是股票的项目全面纵向断面,说明了推荐的坡道发展情况(显示为紫色直线)和与股票区的西部,主要和东部区域相关的采矿地平线(蓝色形状)。

Figure 1. Longitudinal Section for the Stock Deposit (Looking North)

图1.股票存款的纵向剖面(向北看)

Figure 1 illustrates three principal plunge directions for mineralization at the Stock Zones. The following historic drill intercepts located towards the lower end of these plunges suggest the gold mineralization could continue at depth: 6.1 g/t Au over 5.6 m (S23-291), 4.3 g/t Au over 20.4 m (S21-202) and 2.7 g/t Au over 11.2 m (S19-31).

图1说明了股票区域矿化物的三个主要航向。以下历史钻孔截面位于这些降幅向下的较低端,表明黄金矿化物可能在深处继续存在:6.1克/吨Au超过5.6米(S23-291),4.3克/吨Au超过20.4米(S21-202)和2.7克/吨Au超过11.2米(S19-31)).

Fox Complex's Large Resource Base

Fox矿区的庞大矿产资源库

Total Fox Complex Resources are now at 1,905,000 gold ounces of Measured and Indicated mineralization at an average grade of 4.20 g/t Au and 549,000 gold ounces of Inferred mineralization at an average grade of 3.60 g/t Au. These resources are sourced from several deposits, as listed in Figure 2.

总Fox矿区资源现在已达到1,905,000盎司的已测量和指示性矿化,在平均金品位为4.20 g/t Au和549,000盎司的推测矿化,平均品位为3.60 g/t Au。这些资源来自多个矿床,如图2所示的列表。

Table 1. Fox Complex Resources (May 20, 2024)

表1. Fox矿区资源(2024年5月20日)

|

Fox Complex Resources (May 20, 2024) |

Measured | Indicated | Inferred | ||||||

|

Tonnes (000s t) |

Grade (g/t) |

Contained Au (oz) |

Tonnes (000s t) |

Grade (g/t) |

Contained Au (oz) |

Tonnes (000s t) |

Grade (g/t) |

Contained Au (oz) |

|

| Black Fox | 304 | 5.80 | 57,000 | 91 | 5.44 | 16,000 | 149 | 5.33 | 26,000 |

| Froome | 568 | 3.99 | 73,000 | 284 | 3.95 | 36,000 | 143 | 3.44 | 16,000 |

| Grey Fox | - | - | - | 7,566 | 4.80 | 1,168,000 | 1,685 | 4.35 | 236,000 |

| Stock - West & Main | - | - | - | 1,938 | 3.31 | 206,000 | 1,386 | 2.96 | 132,000 |

| Stock - East Zone | - | - | - | 866 | 2.70 | 75,000 | 579 | 2.66 | 50,000 |

| Stock Project Total | - | - | - | 2,804 | 3.12 | 281,000 | 1,965 | 2.87 | 181,000 |

| Tamarack | - | - | - | 1,055 | 1.63 | 55,000 | - |

- |

- |

| Davidson-Tisdale | 200 | 7.25 | 47,000 | 75 | 6.42 | 15,000 | 105 | 4.35 | 15,000 |

| Fuller | - | - | - | 1,149 | 4.25 | 157,000 | 693 | 3.41 | 76,000 |

| Total Fox Complex Resources | 1,072 | 5.11 | 176,000 | 13,024 | 4.13 | 1,729,000 | 4,740 | 3.60 | 549,000 |

| Fox矿区资源 (2024年5月20日) |

测量 | 指示资源 | 详见2024年4月3日新闻稿 | ||||||

| 吨 (000吨) |

品位 (克/吨) |

含金量 (盎司) |

吨 (000吨) |

品位 (克/吨) |

含金量 (盎司) |

吨 (000吨) |

品位 (克/吨) |

含金量 (盎司) |

|

| Black Fox矿床 | 304 | 5.80 | 57,000 | 91 | 5.44 | 16,000 | 149 | 5.33 | 26,000 |

| Froome矿床 | 568 | 3.99 | 73,000 | 284 | 3.95 | 36,000 | 143 | 3.44 | 16,000 |

| Grey Fox矿床 | - | - | - | 7,566 | 4.80 | 1,168,000 | 1,685 | 4.35 | 236,000 |

| Stock - West & Main矿床 | - | - | - | 1,938 | 3.31 | 206,000 | 1,386 | 2.96 | 132,000 |

| 股票-东区 | - | - | - | 866 | 2.70 | 75000 | 579 | 2.66 | 50,000 |

| 股票项目总计 | - | - | - | 2,804 | 3.12 | 281,000 | 1,965 | 2.87 | 181,000 |

| Tamarack | - | - | - | 1,055 | 1.63 | 55000 | - |

- |

- |

| Davidson-Tisdale | 200 | 7.25 | 47,000 | 75 | 6.42 | 15,000 | 105 | 4.35 | 15,000 |

| Fuller | - | - | - | 1,149 | 4.25 | 157,000 | 693 | 3.41 | 76,000 |

| Fox综合资源总计 | 1,072 | 5.11 | 176,000 | 13,024 | 4.13 | 1,729,000 | 4,740 | 3.60 | 549,000 |

Note:

These resource estimates conform with the CIM (Canadian Institute of Mining, Metallurgy and Petroleum) guidelines for Reasonable Prospects for Eventual Economic Extraction (RPEEE), ensuring that only material that has a realistic potential to be mined economically is reported as a resource.

注:

这些资源评估符合加拿大矿业、冶金和石油学会(RPEEE)的合理开采前景指南,确保只有具有实际开采经济潜力的物质被报告为资源。

Stock: Growing the Gold Resource Base

股票:扩大黄金资源储备

Table 1 shows that the overall Stock resource (West Zone + Main Zone + East Zone) now contains 281,000 gold ounces of Indicated mineralization at a grade of 3.12 g/t Au and 181,000 gold ounces of Inferred mineralization at a grade of 2.87 g/t Au, an increase in total gold ounces of nearly 7% from the Dec 31, 2023 resource.

表1显示,整个股票资源(西区+主区+东区)现在含有281,000盎司黄金的指示矿化,品位为3.12克/吨Au和181,000盎司黄金的推测矿化,品位为2.87克/吨Au,总黄金盎司数比2023年12月31日的资源增加了近7%。

Recent Drill Results From the East Zone

东区的最新钻探结果

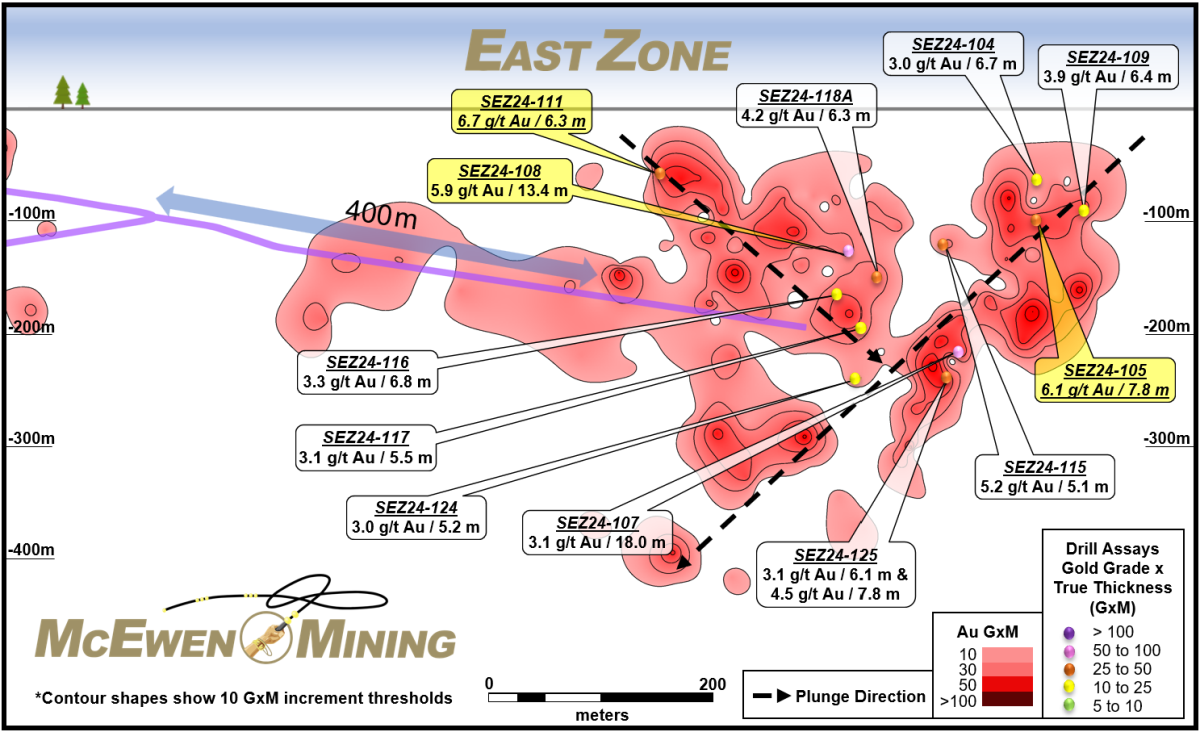

The 2024 infill drilling campaign at the East Zone was mainly executed within the two previously identified plunge directions (see Figure 2), yielding positive results and showing strong continuity between drillhole intercepts. Mineralization associated with the steeper of the two plunge directions below the 250 meters elevation will be more accessible for drilling from future underground drill platforms, at a lower cost per meter.

东区2024年填充钻探活动主要在两个先前确定的冲击方向内进行(见图2),产生了积极的结果,并显示了钻孔拦截之间的强连续性。与250米高程以下较陡的冲击方向相关的矿化将更易于从未来的地下钻探台井打孔,成本更低。

The intercepts highlighted in yellow in Figure 2, including: 5.9 g/t Au over 13.5 m (SEZ24-108), 6.1 g/t Au over 7.8 m (SEZ24-105), 6.7 g/t Au over 6.3 m (SEZ24-111), are well above the East Zone's current average Indicated resource grade of about 2.7 g/t Au.

图2中突出的拦截,包括:5.9 g/t Au(SEZ24-108),13.5 m,6.1 g/t Au(SEZ24-105),7.8 m,6.7 g/t Au(SEZ24-111),6.3 m。SEZ24-108), SEZ24-105SEZ24-105), 6.7克/吨黄金在6.3米处SEZ24-111)比东带的现有平均资源品位约为2.7克/吨的品位高得多。

Figure 2. Longitudinal Section for the East Zone at Stock (Looking North)

图2.股票东区的纵向剖面(向北看)

The 2024 drilling campaign at the East Zone was completed in early Q2. The intercepts highlighted in Figure 2 are included in Table 2 below.

东带2024钻探活动在二季度初完成。图2中突破口包括下表中的表2。

Table 2. Key Results From Recent Drilling at the East Zone

表2.东区最新钻探的关键结果

| Hole ID |

From (m) |

To (m) |

Core Length (m) |

True Width (m) |

Au Uncapped (g/t) |

Au x TW Uncapped (Gxm) |

| SEZ24-104 | 82.1 | 89.8 | 7.6 | 6.7 | 3.0 | 20.1 |

| SEZ24-105 | 106.6 | 116.8 | 10.1 | 7.8 | 6.1 | 47.6 |

| SEZ24-107 | 227.4 | 252.0 | 24.7 | 18.0 | 3.1 | 55.8 |

| SEZ24-108 | 113.8 | 134.4 | 20.7 | 13.4 | 5.9 | 79.2 |

| SEZ24-109 | 109.6 | 117.4 | 7.8 | 6.4 | 3.9 | 24.8 |

| SEZ24-111 | 72.2 | 79.0 | 6.8 | 6.3 | 6.7 | 42.4 |

| SEZ24-115 | 127.8 | 134.9 | 7.1 | 5.1 | 5.2 | 26.8 |

| SEZ24-116 | 211.4 | 219.2 | 7.8 | 6.8 | 3.3 | 22.4 |

| SEZ24-117 | 227.1 | 233.9 | 6.7 | 5.5 | 3.1 | 17.1 |

| SEZ24-118A | 198.3 | 205.3 | 6.9 | 6.3 | 4.2 | 26.6 |

| SEZ24-124 | 257.0 | 264.1 | 7.1 | 5.2 | 3.0 | 15.7 |

| SEZ24-125 | 221.1 | 230.0 | 8.9 | 6.1 | 3.1 | 18.9 |

| And | 259.0 | 270.3 | 11.3 | 7.8 | 4.5 | 35.2 |

| 孔ID | 起点 (米) |

要 (米) |

岩心长度 (米) |

真实宽度 (米) |

黄金未封顶 (克/吨) |

黄金×真实宽度未封顶 (克×米) |

| SEZ24-104 | 82.1 | 89.8 | 7.6 | 6.7 | 3.0 | 20.1 |

| SEZ24-105 | 106.6 | 116.8 | 10.1 | 7.8 | 6.1 | 47.6 |

| SEZ24-107 | 227.4 | 252.0 | 24.7 | 18.0 | 3.1 | 55.8 |

| SEZ24-108 | 113.8 | 134.4 | 20.7 | 13.4 | 5.9 | 79.2 |

| SEZ24-109 | 109.6 | 117.4 | 7.8 | 6.4 | 3.9 | 24.8 |

| SEZ24-111 | 6,652,787 | 79.0 | 6.8 | 6.3 | 6.7 | 42.4 |

| SEZ24-115 | 127.8 | 134.9 | 7.1 | 5.1 | 5.2 | 26.8 |

| SEZ24-116 | 211.4 | 219.2 | 7.8 | 6.8 | 3.3 | 22.4 |

| SEZ24-117 | 227.1 | 233.9 | 6.7 | 5.5 | 3.1 | 17.1 |

| SEZ24-118A | 198.3 | 205.3 | 6.9 | 6.3 | 4.2 | 26.6 |

| SEZ24-124 | 257.0 | 264.1 | 7.1 | 5.2 | 3.0 | 15.7 |

| SEZ24-125 | 221.1 | 230.0 | 8.9 | 6.1 | 3.1 | 18.9 |

| 以及 | 259.0 | 270.3 | 11.3 | 7.8 | 4.5 | 35.2 |

The above results were incorporated into the East Zone resource estimate dated May 20, 2024, and amounted to 75,000 gold ounces Indicated and 50,000 gold ounces Inferred, as shown in Table 3 below.

以上结果已纳入2024年5月20日的East Zone资源估算中,明示资源为75,000盎司黄金,暗示资源为50,000盎司黄金,详情请参见下表3。

Table 3. East Zone Resource Update (from Dec 31, 2023 to May 20, 2024)

表3. East Zone资源更新(从2023年12月31日到2024年5月20日)

| Resource Dates for East Zone | Category |

Tonnes (000s t) |

Au Grade (g/t) |

Gold (oz) |

|

Dec 31, 2023 |

Indicated | 1,232 | 2.40 | 95,000 |

| Inferred | 21 | 2.32 | 2,000 | |

|

May 20, 2024 |

Indicated | 866 | 2.70 | 75,000 |

| Inferred | 579 | 2.66 | 50,000 |

| East Zone的资源日期 | 类别 | 吨 (000吨) |

Au品位 (克/吨) |

黄金 (盎司) |

| 2023年12月31日 |

指示资源 | 1,232 | 2.40 | 95,000 |

| 详见2024年4月3日新闻稿 | 21 | 2.32 | 2,000 | |

|

2024年5月20日 |

指示资源 | 866 | 2.70 | 75000 |

| 详见2024年4月3日新闻稿 | 579 | 2.66 | 50,000 |

"The start of production at Stock will coincide with production decreasing at the Froome mine. Permit applications to mine the Grey Fox deposit will follow the start of mining at Stock. The growth of our gold resources and the prospect of a long mine life are becoming clear and are a direct result of our intense focus and large investments in exploration," said Rob McEwen, Chairman and Chief Owner.

“Stock矿开始生产时,Froome矿的产量将随之减少。Grey Fox存储的开采许可申请将紧随Stock矿的开采。我们的黄金资源增长和长期矿产前景正在变得清晰,并且是我们在勘探方面的强烈关注和大量投资的直接结果。”“这两个项目都旨在将采矿寿命延长9年以上,”说Rob McEwen,主席和首席所有者。

Technical Information

技术信息

Technical information pertaining to the Fox Complex exploration contained in this news release has been prepared under the supervision of Sean Farrell, P.Geo., Chief Exploration Geologist, who is a Qualified Person as defined by Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

Fox矿区勘探的技术信息由肖恩·法雷尔(Sean Farrell)P.Geo.主管准备,他是加拿大证券管理机构43-101《矿业项目披露标准》所定义的合格人员。

The technical information related to resource estimates in this news release has been reviewed and approved by Luke Willis, P.Geo., McEwen Mining's Director of Resource Modelling and a Qualified Person as defined by SEC S-K 1300 and Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

本新闻稿中涉及资源估算的技术信息经由鲁克·威利斯(Luke Willis)P.Geo.审查和批准,他是McEwen Mining的资源建模主管和美国证券交易委员会S-K 1300和加拿大证券管理机构43-101《矿业项目披露标准》所定义的合格人员。

Exploration drill core samples at the Stock Complex were submitted as 1/2 core. Analyses reported herein were performed by the photon assay method at the accredited laboratory MSA Labs in Timmins, Ontario, Canada (ISO 9001 & ISO 10725).

Stock矿区的勘探钻孔样品被提交为1/2的岩芯。此处报告的分析采用了位于加拿大安大略省蒂明斯的MSA Labs的光子测定方法(ISO 9001和ISO 10725)进行。

Notes on the Updated Resource at the East Zone:

关于East Zone更新资源的注释:

- Effective date of the updated Mineral Resource estimate is 20 May 2024. The QP for the estimate is Mr. Carson Cybolsky, P.Geo, an employee of McEwen Mining.

- Mineral Resources are reported using the 2014 CIM Definition Standards and in accordance with the CIM Best Practice Guidelines (2019). Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are reported above an economic cut-off grade of 1.95 g/t gold assuming underground extraction methods and based on costs per tonne of US$60.80 for mining, US$18.50 for process, US$7.98 for G&A, metallurgical recovery of 94%, and a gold price of US$1,725/oz.

- Mineral Resources include the 'must take' minor material below cut-off grade which is interlocked with blocks above the cut-off grade within the mineable shape optimizer stopes.

- Figures may not sum due to rounding.

- 更新的矿物资源估算的生效日期为2024年5月20日。估算的QP是McEwen Mining的员工卡森·西博尔斯基先生,P.Geo。

- 矿产资源报告使用2014年CIM定义标准,并按照CIM最佳实践指南(2019年)进行。非矿产储备的矿产资源没有表现出经济可行性。

- 矿产资源报告以上1.95克/吨黄金为经济切割品位,假设采用地下采矿法,并基于每吨60.80美元的开采成本、18.50美元的加工成本、7.98美元的G&A成本、94%的冶金回收率和每盎司1725美元的黄金价格。

- 矿产资源包含低于切割品位的“必取”微量物质,这些物质与高于切割品位块相互嵌套,位于可开采优化环形停止中。

- 由于四舍五入的原因,数字可能不精确。

For a list of drilling results at Stock since Feb 28, 2024, including hole location and alignment, click here:

https://www.mcewenmining.com/files/doc_news/archive/2024/2024_06_StockDrillResults.xlsx

有关股票自2024年2月28日起的钻井结果清单(包括孔位和对准),请点击此处:

https://www.mcewenmining.com/files/doc_news/archive/2024/2024_06_StockDrillResults.xlsx

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

关于前瞻性声明的注意事项:

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward--looking statements and information include, but are not limited to, effects of the COVID-19 pandemic, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the corporation to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

本新闻稿包含某些前瞻性声明和信息,包括《1995年私人证券诉讼改革法》中的“前瞻性声明”。截至本新闻稿发布日期,麦克尤恩矿业股份有限公司(“公司”)的前瞻性声明和信息表达了公司的预计、预测、投影、期望或信念作为未来事件和结果的陈述。前瞻性声明和信息必然基于估计和假设的一系列商业、经济和竞争性的不确定性、风险和不确定性因素,因此不能保证这些声明和信息将被证明准确。因此,实际结果和未来事件可能与这些声明和信息所预测的有所不同。导致结果或未来事件与前瞻性声明和信息所表达的当前预期存在差异的风险和不确定因素包括但不限于COVID-19疫情的影响,贵金属市场价格的波动,矿业行业风险,与外国运营相关的政治、经济、社会和安全风险,在与运营有关的许可证或其他批准方面及时或及时地收到公司的能力风险,与采矿作业的建设和生产及其预计成本相关的风险,与诉讼相关的风险,资本市场的状况风险,环境风险和危害,对矿物资源和储量计算的不确定性,以及其他风险。读者不应过分依赖此处包括的前瞻性声明或信息,仅限于本日期之后的新信息或事件,除非法律要求。有关公司前瞻性声明和信息相关的风险、不确定因素和其他因素的进一步信息,请参见麦克尤恩矿业的年度报告,截至2023年12月31日的10-K表,以及提交给证券交易委员会的其他文件,“风险因素”一章,以获取更多信息。本新闻稿中所作的所有前瞻性声明和信息均受到本警示声明的限制。

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by management of McEwen Mining Inc.

纽交所和安大略证券交易所未审查本新闻稿内容的充分性或准确性,该新闻稿是麦克尤因矿业公司管理层准备的。

ABOUT MCEWEN MINING

关于麦克尤因矿业:

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 47.7% of McEwen Copper which owns the large, advanced-stage Los Azules copper project in Argentina. Rob McEwen, Chairman and Chief Owner, has a personal investment in the company of US$220 million.

麦克尤恩矿业是一家在内华达州、加拿大、墨西哥和阿根廷拥有操作的黄金和白银生产商。此外,它拥有麦克尤恩铜的约47.7%股权,该公司拥有阿根廷的大型、先进阶段的洛斯阿苏莱斯铜矿项目。主席兼首席所有人Rob McEwen在该公司个人投资了2.2亿美元。

Want News Fast?

想要快速获取新闻吗?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

点击这里订阅我们的电子邮件列表:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

并及时获取新的资讯!

| WEB SITE | SOCIAL MEDIA | |||||

| www.mcewenmining.com |

McEwen Mining |

Facebook: | facebook.com/mcewenmining | |||

| LinkedIn: | linkedin.com/company/mcewen-mining-inc- | |||||

| CONTACT INFORMATION | Twitter: | twitter.com/mcewenmining | ||||

| 150 King Street West | Instagram: | instagram.com/mcewenmining | ||||

| Suite 2800, PO Box 24 | ||||||

| Toronto, ON, Canada |

McEwen Copper |

Facebook: | facebook.com/ mcewencopper | |||

| M5H 1J9 | LinkedIn: | linkedin.com/company/mcewencopper | ||||

| Twitter: | twitter.com/mcewencopper | |||||

| Relationship with Investors: | Instagram: | instagram.com/mcewencopper | ||||

| (866)-441-0690 - Toll free line | ||||||

| (647)-258-0395 |

Rob McEwen |

Facebook: | facebook.com/mcewenrob | |||

| Mihaela Iancu ext. 320 | LinkedIn: | linkedin.com/in/robert-mcewen-646ab24 | ||||

| info@mcewenmining.com | Twitter: | twitter.com/robmcewenmux |

| 网站 | 社交媒体 | |||||

| www.mcewenmining.com | McEwen Mining |

Facebook: | facebook.com/mcewenmining | |||

| LinkedIn: | linkedin.com/company/mcewen-mining-inc- | |||||

| 联系信息 | Twitter: | twitter.com/mcewenmining | ||||

| 加拿大安大略省多伦多金街西150号,2800套房,邮政信箱24,加拿大,邮编M5H1J9,投资者关系: | Instagram: | instagram.com/mcewenmining | ||||

| 2800套房,邮政信箱24号 | ||||||

| 加拿大安大略省多伦多 | McEwen Copper |

Facebook: | facebook.com/ mcewencopper | |||

| M5H 1J9 | LinkedIn: | linkedin.com/company/mcewencopper | ||||

| Twitter: | twitter.com/mcewencopper | |||||

| 关于业务 | Instagram: | instagram.com/mcewencopper | ||||

| (866)-441-0690 - 免费电话 | ||||||

| (647)-258-0395,Mihaela Iancu 分机320 | 罗伯特·麦克尤恩 |

Facebook: | facebook.com/mcewenrob | |||

| Mihaela Iancu 分机号320 | LinkedIn: | linkedin.com/in/robert-mcewen-646ab24 | ||||

| info@mcewenmining.com | Twitter: | twitter.com/robmcewenmux |

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/af6f5cde-005f-49c6-84ca-36f956a0f0e5https://www.globenewswire.com/NewsRoom/AttachmentNg/b3b2963b-c086-4c09-9b02-a54e26d4a68b

Source: McEwen Mining

来源:mcewen mining

Pre-construction activities have commenced at the portal with the removal of overburden. Underground development is expected to begin in Q3. The Stock Ramp will connect the West Zone and the East Zone to the existing historical underground workings of the Main Zone.

Pre-construction activities have commenced at the portal with the removal of overburden. Underground development is expected to begin in Q3. The Stock Ramp will connect the West Zone and the East Zone to the existing historical underground workings of the Main Zone.