Only Three Days Left To Cash In On Zhejiang Yilida VentilatorLtd's (SZSE:002686) Dividend

Only Three Days Left To Cash In On Zhejiang Yilida VentilatorLtd's (SZSE:002686) Dividend

It looks like Zhejiang Yilida Ventilator Co.,Ltd. (SZSE:002686) is about to go ex-dividend in the next 3 days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Accordingly, Zhejiang Yilida VentilatorLtd investors that purchase the stock on or after the 28th of June will not receive the dividend, which will be paid on the 28th of June.

看起来,亿利达公司(SZSE:002686)将在未来3天内进行除息。除息日是公司股权登记日的前一天,股权登记日是公司确定哪些股东有权获得红利的日期。除息日很重要,因为结算过程需要两个完整的工作日。因此,如果您错过了该日期,您将不会在股权登记日出现在公司名册上。因此,自6月28日或之后购买该公司的亿利达公司的投资者将不会收到分红派息,该分红将于6月28日支付。

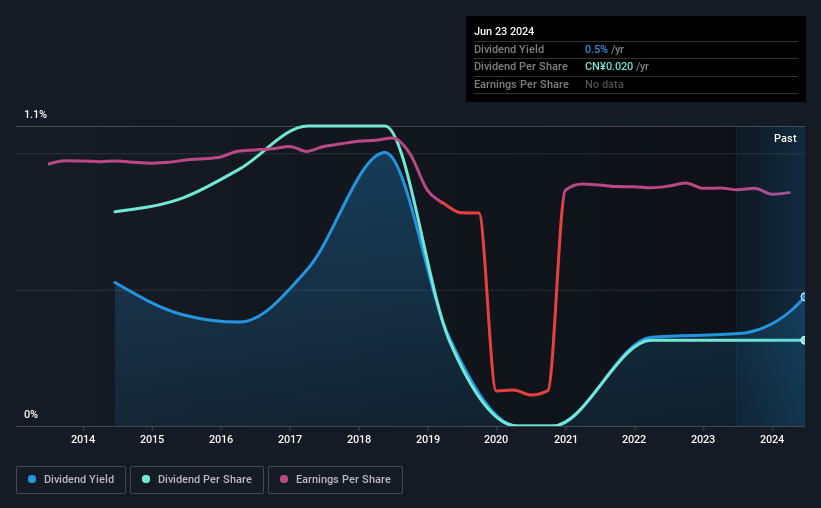

The company's next dividend payment will be CN¥0.02 per share. Last year, in total, the company distributed CN¥0.02 to shareholders. Calculating the last year's worth of payments shows that Zhejiang Yilida VentilatorLtd has a trailing yield of 0.5% on the current share price of CN¥4.22. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

该公司的下一个股息支付将是每股人民币0.02元。去年,该公司总共向股东分配了人民币0.02元。计算去年的支付金额显示,亿利达公司的股息率是当前每股人民币4.22元的股价下0.5%。分红是许多股东的重要收入来源,但企业的健康状况对于维持这些股息至关重要。我们需要看看是否股息被收益所覆盖,以及它是否正在增长。

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately Zhejiang Yilida VentilatorLtd's payout ratio is modest, at just 45% of profit. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out more than half (54%) of its free cash flow in the past year, which is within an average range for most companies.

分红通常是从公司收益中支付的。如果公司支付的股息超过了其盈利额,则股息可能不可持续。幸运的是,亿利达公司的派息比率很适中,仅占利润的45%。但是,对于评估股息而言,现金流比收益更加重要,因此我们需要看看该公司是否产生了足够的现金来支付其分配。在过去的一年中,它支付了自由现金流的一半以上(54%),这是大多数公司的平均范围内。

It's positive to see that Zhejiang Yilida VentilatorLtd's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

看到亿利达公司的股息既被利润也被现金流所覆盖,这是积极的,因为这通常是股息可持续的迹象,较低的派息比率通常意味着在削减股息之前有更大的安全边际。

Click here to see how much of its profit Zhejiang Yilida VentilatorLtd paid out over the last 12 months.

点击此处查看亿利达公司上一年度支付的利润金额。

Have Earnings And Dividends Been Growing?

收益和股息一直在增长吗?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Readers will understand then, why we're concerned to see Zhejiang Yilida VentilatorLtd's earnings per share have dropped 5.1% a year over the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

收益下降的公司对于股息股东来说风险较高。如果盈利下降,公司被迫削减股息,股东可能会看到其投资价值烟消云散。读者们将理解,为什么我们担心亿利达公司过去五年中每股收益下降了5.1%。如此剧烈的下降对于股息未来可持续性产生了怀疑。

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Zhejiang Yilida VentilatorLtd has seen its dividend decline 8.8% per annum on average over the past 10 years, which is not great to see. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

大多数投资者评估公司的股息前景的主要方法是检查股息增长的历史速度。亿利达公司在过去的10年中,平均每年看到其股息下降了8.8%,这不是令人满意的。看到盈利和股息下降从来不是好事,但管理层至少削减了股息,而不是为了维持股息而潜在地危及公司的健康。

Final Takeaway

最后的结论

From a dividend perspective, should investors buy or avoid Zhejiang Yilida VentilatorLtd? Earnings per share have fallen significantly, although at least Zhejiang Yilida VentilatorLtd paid out less than half of its profits and free cash flow over the last year, leaving some margin of safety. Overall, it's hard to get excited about Zhejiang Yilida VentilatorLtd from a dividend perspective.

从股息角度来看,投资者该买还是避免亿利达公司?每股收益显着下降,尽管至少亿利达公司过去一年的利润和自由现金流不到一半被支付了,留下一些安全边际。总而言之,从股息角度来看,亿利达公司并不令人兴奋。

Curious about whether Zhejiang Yilida VentilatorLtd has been able to consistently generate growth? Here's a chart of its historical revenue and earnings growth.

想知道亿利达公司是否一直能够保持增长?以下是其历史营收和收益增长的图表。

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

一般来说,我们不建议仅仅购买第一个股息股票。下面是一个经过策划的有趣的、股息表现良好的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者,发送电子邮件至editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者发送电子邮件至editorial-team@simplywallst.com。

It's positive to see that Zhejiang Yilida VentilatorLtd's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater

It's positive to see that Zhejiang Yilida VentilatorLtd's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater