What the Options Market Tells Us About Thermo Fisher Scientific

What the Options Market Tells Us About Thermo Fisher Scientific

Investors with significant funds have taken a bullish position in Thermo Fisher Scientific (NYSE:TMO), a development that retail traders should be aware of.

拥有大量资金的投资者已对Thermo Fisher Scientific (NYSE:TMO)采取看好头寸,零售交易者应该注意。

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in TMO usually indicates foreknowledge of upcoming events.

今天经由我们在Benzinga监控公共期权数据得知了这一点。这些投资者的确切本质仍然是个谜,但这样在TMO的主要行情通常表明其对即将发生的事件有预知。

Today, Benzinga's options scanner identified 8 options transactions for Thermo Fisher Scientific. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 62% being bullish and 0% bearish. Of all the options we discovered, 7 are puts, valued at $336,100, and there was a single call, worth $36,400.

今天,Benzinga的期权扫描程序发现了8个Thermo Fisher Scientific的期权交易。这是个飞凡的情况。这些大规模交易者的情绪是复杂的,其中62%看涨,0%看淡。我们发现的所有期权中,有7个看跌期权,价值33.61万美元,还有一个看涨期权,价值3.64万美元。

What's The Price Target?

价格目标是什么?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $580.0 to $610.0 for Thermo Fisher Scientific during the past quarter.

分析这些合约的成交量和未平仓合约量,似乎大牌已经在过去的一个季度里关注Thermo Fisher Scientific的价格区间为580.0美元至610.0美元之间。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

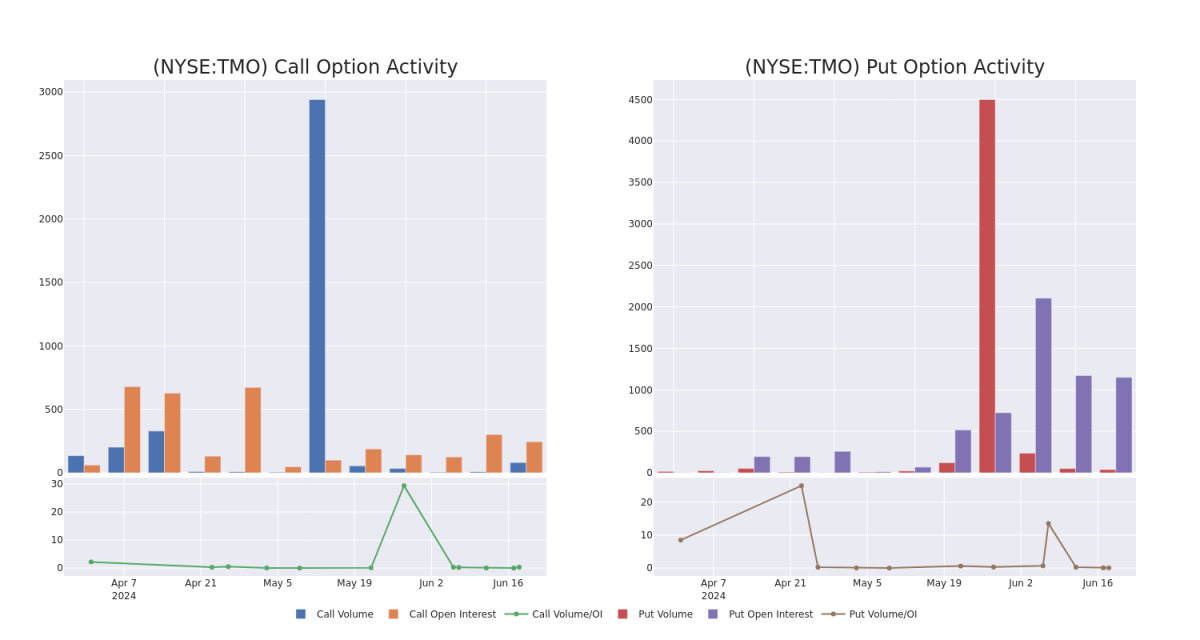

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Thermo Fisher Scientific's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Thermo Fisher Scientific's substantial trades, within a strike price spectrum from $580.0 to $610.0 over the preceding 30 days.

衡量期权交易量和未平仓合约量是期权交易中的一个战略性步骤。这些指标揭示了Thermo Fisher Scientific股票期权在特定执行价的流动性和投资者兴趣。以下即将呈现过去30天时间内Thermo Fisher Scientific的看涨/看跌期权成交量和未平仓合约量变化图表,帮助理解形成$580.00至$610.00执行价区间内的交易量和未平仓合约量的因素。

Thermo Fisher Scientific Option Activity Analysis: Last 30 Days

赛默飞世尔期权活动分析:最近30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMO | PUT | TRADE | BULLISH | 01/17/25 | $35.4 | $34.3 | $34.3 | $580.00 | $85.7K | 611 | 0 |

| TMO | PUT | TRADE | BULLISH | 12/20/24 | $38.5 | $32.9 | $34.1 | $580.00 | $51.1K | 425 | 0 |

| TMO | PUT | TRADE | NEUTRAL | 12/20/24 | $34.2 | $31.2 | $32.6 | $580.00 | $45.6K | 425 | 36 |

| TMO | PUT | TRADE | BULLISH | 01/17/25 | $35.6 | $32.6 | $33.7 | $580.00 | $43.8K | 611 | 25 |

| TMO | PUT | TRADE | NEUTRAL | 01/17/25 | $34.5 | $32.8 | $33.7 | $580.00 | $40.4K | 611 | 38 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMO | 看跌 | 交易 | 看好 | 01/17/25 | $35.4 | $34.3 | $34.3 | $580.00 | 85.7K美元 | 611 | 0 |

| TMO | 看跌 | 交易 | 看好 | 12/20/24 | $38.5 | 32.9美元 | $34.1 | $580.00 | $51.1K | 425 | 0 |

| TMO | 看跌 | 交易 | 中立 | 12/20/24 | 34.2美元 | $31.2 | $32.6 | $580.00 | $45.6K | 425 | 36 |

| TMO | 看跌 | 交易 | 看好 | 01/17/25 | $35.6 | $32.6 | $33.7 | $580.00 | $43.8千美元 | 611 | 25 |

| TMO | 看跌 | 交易 | 中立 | 01/17/25 | $34.5 | $32.8 | $33.7 | $580.00 | $40.4K | 611 | 38 |

About Thermo Fisher Scientific

关于赛默飞世尔科技(Thermo Fisher Scientific)

Thermo Fisher Scientific sells scientific instruments and laboratory equipment, diagnostics consumables, and life science reagents. The firm operates through four segments as of end-2023 (revenue figures include some cross-segment revenue): analytical technologies (17% of sales); specialty diagnostic products (10%); life science solutions (23%); and lab products and services, which includes CRO services (54%).

赛默飞世尔出售科学仪器和实验室设备、诊断用耗材和生命科学试剂。截至2023年底,公司通过四个业务板块运营(营收数字包括部分跨板块收入):分析技术(销售额的17%);特种诊断产品(销售额的10%);生命科学解决方案(销售额的23%);实验室产品和服务,包括CRO服务(销售额的54%)。

In light of the recent options history for Thermo Fisher Scientific, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于Thermo Fisher Scientific的最近期权历史,现在应关注公司本身。我们的目标是探索其当前表现。

Current Position of Thermo Fisher Scientific

赛默飞世尔的当前位置

- With a volume of 234,396, the price of TMO is up 0.9% at $569.65.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 30 days.

- TMO成交量为234396股,股价上涨0.9%,报569.65美元。

- RSI指标暗示该标的股票目前处于超买和超卖的中立区间。

- 下一个收益预计在30天内发布。

What Analysts Are Saying About Thermo Fisher Scientific

分析师对赛默飞世尔科技的看法

In the last month, 1 experts released ratings on this stock with an average target price of $650.0.

在过去的一个月中,有1位分析师对该股票发布了评级,平均目标价为$650.0。

- In a cautious move, an analyst from Jefferies downgraded its rating to Buy, setting a price target of $650.

- 一位来自Jefferies的分析师以保守的态度将其评级下调为买入,并设定了$650.0的目标价。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Thermo Fisher Scientific with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过不断的教育,战略性的交易调整,利用各种因子指数,并保持对市场动态的敏锐感来减轻这些风险。通过Benzinga Pro获取Thermo Fisher Scientific的最新期权交易,以获取实时警报。