Gilead Sciences's Options Frenzy: What You Need to Know

Gilead Sciences's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bearish approach towards Gilead Sciences (NASDAQ:GILD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GILD usually suggests something big is about to happen.

深口袋的投资者对吉利德科学 (纳斯达克:GILD) 采取了看淡的态度,市场参与者不应忽视。我们在 Benzinga 跟踪的公开期权记录中发现了这一重大动态。这些投资者的身份尚不明确,但 GILD 的这种重大变动通常意味着有重大事情即将发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 15 extraordinary options activities for Gilead Sciences. This level of activity is out of the ordinary.

我们从今天的观察中得知这一信息,当Benzinga的选项扫描器突出显示吉利德科学的15项非凡的期权交易活动时。这种活动水平是不同寻常的。

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 60% bearish. Among these notable options, 4 are puts, totaling $214,328, and 11 are calls, amounting to $708,487.

这些重量级投资者的总体心情是分裂的,33% 倾向于看涨,而 60% 看淡。在这些值得关注的期权中,有 4 笔看跌期权,总金额为 $214,328,11 笔看涨期权,总金额为 $708,487。

What's The Price Target?

价格目标是什么?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $60.0 and $74.0 for Gilead Sciences, spanning the last three months.

通过对成交量和未平仓合约进行评估,显然主要的市场推手正在关注 Gilead Sciences 60.0 到 74.0 美元之间的价格区间,跨越过去三个月。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

In terms of liquidity and interest, the mean open interest for Gilead Sciences options trades today is 1121.55 with a total volume of 994.00.

就流动性和关注度而言,吉利德科学期权交易今天的平均未平仓合约为 1121.55,总成交量为 994.00。

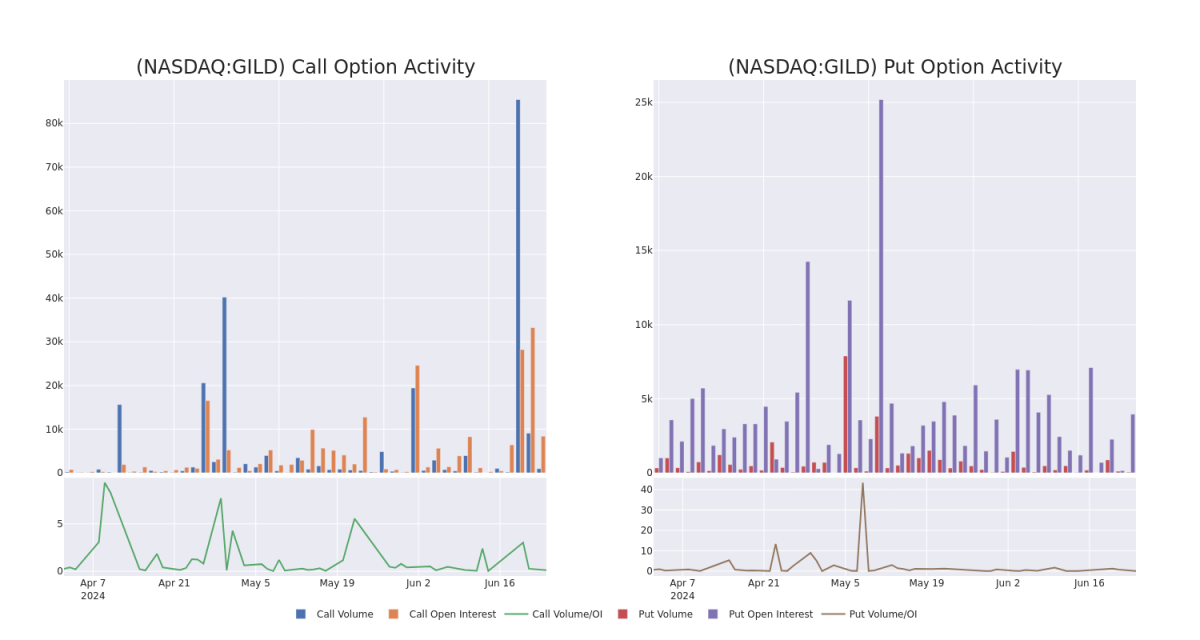

In the following chart, we are able to follow the development of volume and open interest of call and put options for Gilead Sciences's big money trades within a strike price range of $60.0 to $74.0 over the last 30 days.

在以下的图表中,我们能够跟踪过去 30 天内 Gilead Sciences 大额交易的看跌和看涨期权的成交量和未平仓合约的发展,其行使价格在 60.0 到 74.0 美元的范围内。

Gilead Sciences Call and Put Volume: 30-Day Overview

Gilead Sciences 看涨和看跌期权成交量:30 天概览

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILD | CALL | SWEEP | BULLISH | 01/17/25 | $7.0 | $6.85 | $7.0 | $70.00 | $157.5K | 2.8K | 111 |

| GILD | CALL | SWEEP | BEARISH | 07/19/24 | $11.85 | $11.6 | $11.69 | $60.00 | $116.1K | 469 | 100 |

| GILD | PUT | SWEEP | BULLISH | 09/20/24 | $3.9 | $3.75 | $3.75 | $72.50 | $96.7K | 78 | 2 |

| GILD | CALL | SWEEP | BEARISH | 08/16/24 | $9.85 | $9.8 | $9.8 | $62.50 | $73.5K | 1.7K | 0 |

| GILD | CALL | SWEEP | BULLISH | 07/19/24 | $12.05 | $11.65 | $11.65 | $60.00 | $67.4K | 469 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILD | 看涨 | SWEEP | 看好 | 01/17/25 | $7.0 | $6.85 | $7.0 | 70.00美元 | $157.5K | 2.8K | 111 |

| GILD | 看涨 | SWEEP | 看淡 | 07/19/24 | 11.85美元 | $11.6 | $11.69 | $60.00 | 116.1K | 469 | 100 |

| GILD | 看跌 | SWEEP | 看好 | 09/20/24 | $3.9 | $3.75 | $3.75 | $72.50 | $96.7K | 78 | 2 |

| GILD | 看涨 | SWEEP | 看淡 | 08/16/24 | $9.85 | $9.8 | $9.8 | $62.50 | $73.5K | 1.7K | 0 |

| GILD | 看涨 | SWEEP | 看好 | 07/19/24 | $12.05 | $11.65 | $11.65 | $60.00 | $67.4K | 469 | 0 |

About Gilead Sciences

关于吉利德科学

Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. The acquisitions of Corus Pharma, Myogen, CV Therapeutics, Arresto Biosciences, and Calistoga have broadened this focus to include pulmonary and cardiovascular diseases and cancer. Gilead's acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of combination drug Harvoni, and the Kite, Forty Seven, and Immunomedics acquisitions boost Gilead's exposure to cell therapy and noncell therapy in oncology.

吉利德科学公司开发和推广治疗威胁生命的传染病的疗法,其核心产品组合主要集中在治疗艾滋病毒和乙型及丙型肝炎方面。通过收购 Corus Pharma、Myogen、CV Therapeutics、Arresto Biosciences 和 Calistoga,公司将业务口径拓展至肺部和心血管疾病以及癌症治疗领域。吉利德对 Pharmasset 的收购带来了治疗丙型肝炎药物 Sovaldi 的权利,这也是组合药物 Harvoni 的一部分,而 Kite、Forty Seven 和 Immunomedics 的收购则提高了吉利德在细胞治疗和非细胞治疗肿瘤领域中的曝光度。

Following our analysis of the options activities associated with Gilead Sciences, we pivot to a closer look at the company's own performance.

在分析与吉利德科学相关的期权交易活动之后,我们转而更加关注公司自身的表现。

Current Position of Gilead Sciences

吉利德科学的当前位置

- Currently trading with a volume of 2,982,844, the GILD's price is up by 0.99%, now at $71.37.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 38 days.

- 目前的交易额为 2,982,844 美元,GILD 的价格上涨了 0.99%,现在为 71.37 美元。

- RSI读数表明股票目前可能超买。

- 预计将在 38 天内公布收益。

Expert Opinions on Gilead Sciences

关于吉利德科学的专家意见

In the last month, 2 experts released ratings on this stock with an average target price of $77.0.

上个月内,有 2 位专家对该股票发布了评级,平均目标价为 77.0 美元。

- Maintaining their stance, an analyst from Baird continues to hold a Neutral rating for Gilead Sciences, targeting a price of $80.

- An analyst from RBC Capital has revised its rating downward to Sector Perform, adjusting the price target to $74.

- 维持他们的立场,来自 Baird 的分析师继续持有吉利德科学的中立评级,目标价为 80 美元。

- RBC Capital 的分析师将其评级下调为板块表现,调整价格目标至 74 美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。