Spotlight on Devon Energy: Analyzing the Surge in Options Activity

Spotlight on Devon Energy: Analyzing the Surge in Options Activity

Investors with a lot of money to spend have taken a bearish stance on Devon Energy (NYSE:DVN).

拥有大量资金的投资者对戴文能源(NYSE:DVN)采取了看淡的态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DVN, it often means somebody knows something is about to happen.

无论这些投资者是机构还是富人,我们都不清楚。但是当发生这样大的事情时,常常意味着有些人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 9 uncommon options trades for Devon Energy.

今天,Benzinga的期权扫描器发现了9笔戴文能源的不寻常的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 22% bullish and 77%, bearish.

这些大额交易者的总体情绪分为22%看好和77%看淡。

Out of all of the special options we uncovered, 4 are puts, for a total amount of $120,995, and 5 are calls, for a total amount of $355,235.

在我们发现的所有特殊期权中,有4个是认沽期权,总金额为120,995美元,有5个是认购期权,总金额为355,235美元。

Predicted Price Range

预测价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $45.0 to $55.0 for Devon Energy during the past quarter.

分析这些合同的成交量和未平仓合约,似乎大玩家们在过去的一个季度一直在关注戴文能源的价格区间在45.0到55.0之间。

Volume & Open Interest Trends

成交量和未平仓量趋势

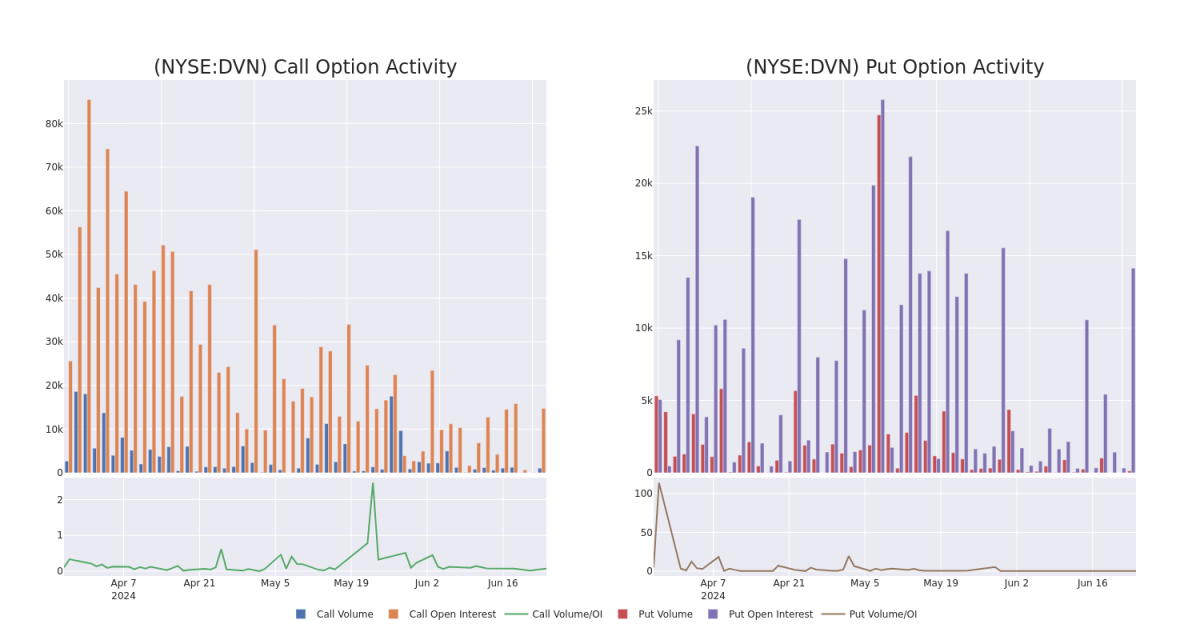

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Devon Energy's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Devon Energy's substantial trades, within a strike price spectrum from $45.0 to $55.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易的一个战略步骤。这些指标揭示了在指定行权价格下机构对戴文能源期权的流动性和投资者兴趣。即将到来的数据可视化呈现从45.0到55.0的行权价格区间内,关联戴文能源重要交易的认购和认沽期权的成交量和未平仓合约的波动情况,时间跨度为过去30天。

Devon Energy Option Activity Analysis: Last 30 Days

戴文能源期权活动分析:过去30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DVN | CALL | TRADE | BULLISH | 06/20/25 | $2.86 | $1.9 | $2.7 | $55.00 | $202.5K | 1.9K | 0 |

| DVN | CALL | SWEEP | BEARISH | 10/18/24 | $2.7 | $2.62 | $2.62 | $47.50 | $52.4K | 3.0K | 204 |

| DVN | CALL | TRADE | BEARISH | 10/18/24 | $2.54 | $2.35 | $2.35 | $47.50 | $47.0K | 3.0K | 1 |

| DVN | PUT | SWEEP | BEARISH | 01/17/25 | $3.65 | $3.6 | $3.65 | $47.50 | $32.8K | 5.9K | 15 |

| DVN | PUT | TRADE | BULLISH | 06/20/25 | $9.6 | $7.15 | $8.1 | $52.50 | $32.4K | 2.6K | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 戴文能源 | 看涨 | 交易 | 看好 | 06/20/25 | $2.86 | $1.9 | $2.7 | $55.00 | $202.5K | 1.9K | 0 |

| 戴文能源 | 看涨 | SWEEP | 看淡 | 10/18/24 | $2.7 | $2.62 | $2.62 | $47.50 | $52.4千美元 | 3.0K | 204 |

| 戴文能源 | 看涨 | 交易 | 看淡 | 10/18/24 | $2.54 | $2.35 | $2.35 | $47.50 | $47.0千美元 | 3.0K | 1 |

| 戴文能源 | 看跌 | SWEEP | 看淡 | 01/17/25 | $3.65 | $3.6 | $3.65 | $47.50 | $32.8千美元 | 5.9K | 15 |

| 戴文能源 | 看跌 | 交易 | 看好 | 06/20/25 | 9.6 | $7.15 | $8.1 | $52.50 | $32.4K应翻译为$32,400 | 2.6K | 0 |

About Devon Energy

关于戴文能源

Devon Energy is an oil and gas producer with acreage in several top US shale plays. While roughly two thirds of its production comes from the Permian Basin, it also holds a meaningful presence in the Anadarko, Eagle Ford, and Bakken basins. At the end of 2023, Devon reported net proved reserves of 1.8 billion barrels of oil equivalent. Net production averaged roughly 658,000 barrels of oil equivalent per day in 2023 at a ratio of 73% oil and natural gas liquids and 27% natural gas.

戴文能源是一家在美国多个顶级页岩油气领域拥有土地的石油和天然气生产商。尽管其产量近三分之二来自Permian盆地,但其在Anadarko盆地,Eagle Ford盆地和Bakken盆地也占有重要地位。戴文在2023年底报告了净证明储量为18亿桶石油当量。2023年净产量平均约为658,000桶石油当量/日,比例为73%的石油和天然气液体和27%的天然气。

In light of the recent options history for Devon Energy, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于戴文能源最近的期权历史,现在应该集中关注公司本身。我们的目标是探索其当前表现。

Current Position of Devon Energy

戴文能源的当前位置

- Trading volume stands at 4,088,710, with DVN's price up by 3.99%, positioned at $47.65.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 36 days.

- 交易量为4,088,710股,DVN的价格上涨了3.99%,位于47.65美元。

- RSI指标显示该股票目前处于超买和超卖之间的中立状态。

- 预计在 36 天内发布收益公告。

What Analysts Are Saying About Devon Energy

关于戴文能源,分析师们的看法

1 market experts have recently issued ratings for this stock, with a consensus target price of $64.0.

1位市场专家最近对该股票发表了评级,平均目标价为64.0美元。

- An analyst from B of A Securities has revised its rating downward to Buy, adjusting the price target to $64.

- B of A Securities的一位分析师已将其评级下调为买入,并将价格目标调整为64.0美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。