Zhejiang Xinhua Chemical Co.,Ltd (SHSE:603867) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

Zhejiang Xinhua Chemical Co.,Ltd (SHSE:603867) Stock Has Shown Weakness Lately But Financials Look Strong: Should Prospective Shareholders Make The Leap?

Zhejiang Xinhua ChemicalLtd (SHSE:603867) has had a rough three months with its share price down 17%. However, a closer look at its sound financials might cause you to think again. Given that fundamentals usually drive long-term market outcomes, the company is worth looking at. In this article, we decided to focus on Zhejiang Xinhua ChemicalLtd's ROE.

浙江新华化工股份有限公司(SHSE:603867)近三个月股价下跌17%。然而,仔细研究其健康的财务状况可能会使您重新考虑。鉴于基本面通常是长期市场结果的驱动力,因此值得关注该公司。本文决定重点关注浙江新华化工有限公司的 roe。

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

对于股东来说,股东回报率(ROE)是一个重要的考虑因素,因为它告诉股东他们的资本被有效地再投资了多少。换句话说,它是一个衡量公司股东提供的资本回报率的盈利能力比率。

How To Calculate Return On Equity?

如何计算股东权益报酬率?

The formula for return on equity is:

权益回报率的计算公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

净资产收益率 = 净利润(从持续经营中获得)÷ 股东权益

So, based on the above formula, the ROE for Zhejiang Xinhua ChemicalLtd is:

那么,根据上述公式,浙江新华化工股份有限公司的 roe 为:

12% = CN¥292m ÷ CN¥2.5b (Based on the trailing twelve months to March 2024).

12% = CN¥29200万 ÷ CN¥25亿 (基于截至2024年3月的最近十二个月)。

The 'return' is the yearly profit. Another way to think of that is that for every CN¥1 worth of equity, the company was able to earn CN¥0.12 in profit.

“回报”是每年的利润。另一种思考方式是,该公司能够在每元1元的净资产中赚取0.12元的利润。

What Has ROE Got To Do With Earnings Growth?

ROE与盈利增长有什么关系?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don't share these attributes.

到目前为止,我们已经了解了ROE是衡量公司盈利能力的一种指标。根据公司选择重新投资或“保留”的利润数量,我们能够评估公司未来产生利润的能力。一般而言,其他条件相等的情况下,具有高股东回报率和利润保留能力的公司比不具备这些属性的公司具有更高的增长率。

A Side By Side comparison of Zhejiang Xinhua ChemicalLtd's Earnings Growth And 12% ROE

对比浙江新华化工股份有限公司的收益增长和12%的 roe。

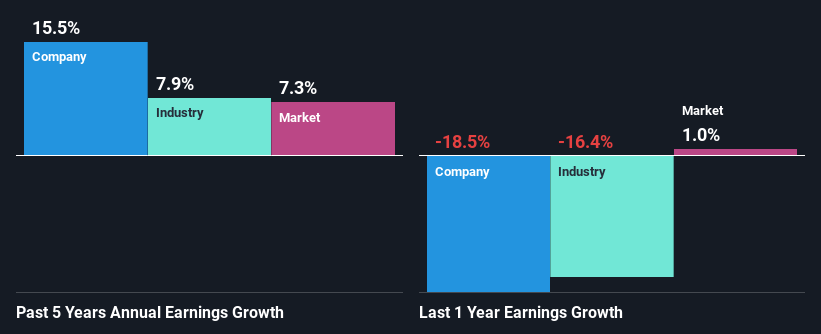

At first glance, Zhejiang Xinhua ChemicalLtd seems to have a decent ROE. Further, the company's ROE compares quite favorably to the industry average of 6.3%. This probably laid the ground for Zhejiang Xinhua ChemicalLtd's moderate 16% net income growth seen over the past five years.

乍一看,浙江新华化工股份有限公司似乎有一个不错的 roe。此外,该公司的 roe 与行业平均水平6.3%相比也非常优良。这可能为浙江新华化工股份有限公司过去五年中适度的16%的净利润增长奠定了基础。

Next, on comparing with the industry net income growth, we found that Zhejiang Xinhua ChemicalLtd's growth is quite high when compared to the industry average growth of 7.9% in the same period, which is great to see.

接下来,我们将浙江新华化工股份有限公司的净利润增长与行业平均水平相比较,发现其相对行业平均水平7.9%的增长非常高,这是一个好的迹象。

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Zhejiang Xinhua ChemicalLtd is trading on a high P/E or a low P/E, relative to its industry.

收益增长是股票估值的一项重要因素。投资者需要判断的下一个问题是预期的收益增长,或其缺乏,是否已经被纳入股价之中。这有助于他们判断股票是迎来光明未来还是黯淡前景。预期收益增长的一个很好的指标是市盈率,它根据股票的收益前景确定市场愿意支付的价格。因此,您可能需要检查一下与行业相比,浙江新华化工股份有限公司的市盈率是高还是低。

Is Zhejiang Xinhua ChemicalLtd Using Its Retained Earnings Effectively?

浙江新华化工股份有限公司是否有效利用留存收益?

Zhejiang Xinhua ChemicalLtd has a healthy combination of a moderate three-year median payout ratio of 33% (or a retention ratio of 67%) and a respectable amount of growth in earnings as we saw above, meaning that the company has been making efficient use of its profits.

浙江新华化工股份有限公司有一个适度的三年中位数支付比率为33%(或留存比率为67%)和一定量收益的健康组合,正如我们上面所看到的,这意味着公司一直在有效地利用其利润。

Besides, Zhejiang Xinhua ChemicalLtd has been paying dividends over a period of five years. This shows that the company is committed to sharing profits with its shareholders.

此外,浙江新华化工股份有限公司在过去五年中一直在支付股息。这表明该公司致力于与其股东分享利润。

Summary

总的来说,我们对伟明环保的表现非常满意。具体而言,我们喜欢公司以高回报率再投资了其利润的很大一部分。当然,这导致公司的收益大幅增长。但是,最新的行业分析师预测表明,该公司的收益预计将加速增长。

On the whole, we feel that Zhejiang Xinhua ChemicalLtd's performance has been quite good. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

总体而言,我们认为浙江新华化工股份有限公司的表现相当不错。特别是,看到该公司大力投资业务,并伴随高回报率,其收益也随之呈现相当大的增长,我们感到非常欣慰。然而,最新的行业分析师预测显示,该公司的收益预计将加速增长。关于该公司最新的分析师预测的更多信息,请查看该公司的分析师预测可视化。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者,发送电子邮件至editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者发送电子邮件至editorial-team@simplywallst.com。