A Closer Look at Booking Holdings's Options Market Dynamics

A Closer Look at Booking Holdings's Options Market Dynamics

Financial giants have made a conspicuous bullish move on Booking Holdings. Our analysis of options history for Booking Holdings (NASDAQ:BKNG) revealed 17 unusual trades.

投资巨头在Booking Holdings上做出了明显的看好动作。我们对Booking Holdings(NASDAQ:BKNG)期权历史分析发现有17种飞凡交易。

Delving into the details, we found 47% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $179,720, and 11 were calls, valued at $522,810.

深入分析后,我们发现47%的交易者看好,而41%的交易者看淡。我们发现的所有交易中,有6个看跌期权交易,价值为179,720美元,有11个看涨期权交易,价值为522,810美元。

Expected Price Movements

预期价格波动

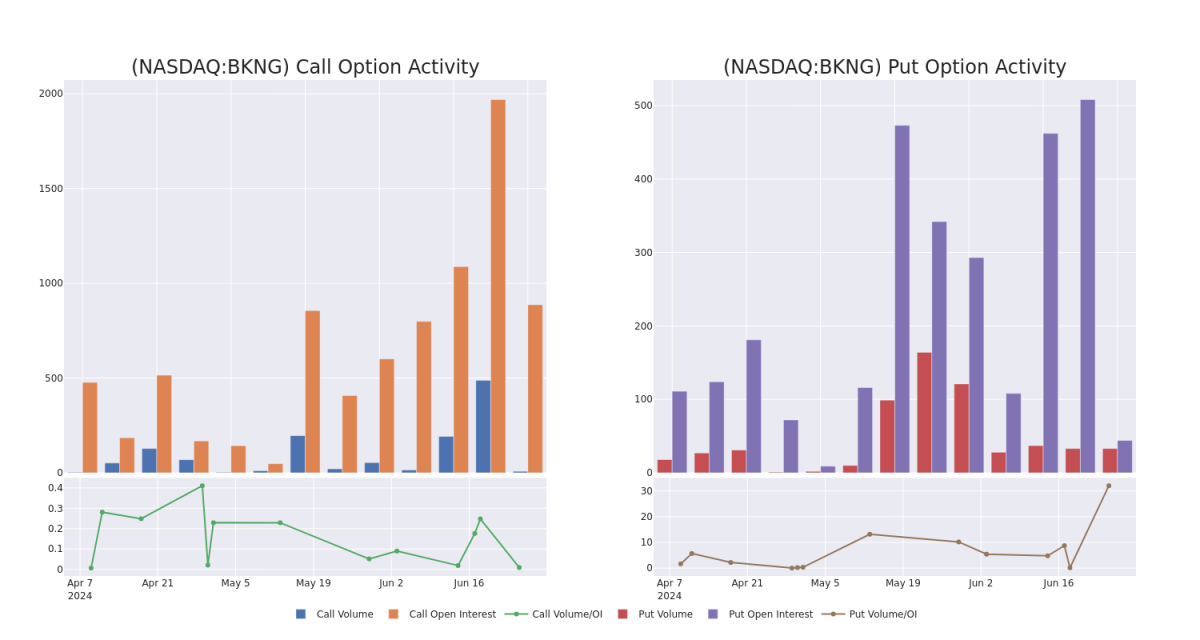

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $3500.0 and $4250.0 for Booking Holdings, spanning the last three months.

经过对成交量和持仓量的评估,明显市场的主要推手正在专注于Booking Holdings的价格区间,该价格区间为3500.0美元和4250.0美元之间,跨越了过去三个月。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In today's trading context, the average open interest for options of Booking Holdings stands at 84.0, with a total volume reaching 40.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Booking Holdings, situated within the strike price corridor from $3500.0 to $4250.0, throughout the last 30 days.

在当今的交易背景下,Booking Holdings期权的平均持仓量为84.0,总成交量达到40.00。伴随图表描述了Booking Holdings高价值交易的看涨和看跌期权成交量和持仓量的变化情况,这些高价值交易位于罢工价格走廊范围内,从3500.0美元到4250.0美元,在过去30天内。

Booking Holdings 30-Day Option Volume & Interest Snapshot

Booking Holdings 30天期权成交量和持仓量快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BKNG | CALL | TRADE | NEUTRAL | 09/20/24 | $181.3 | $172.7 | $177.5 | $4100.00 | $177.5K | 16 | 0 |

| BKNG | CALL | TRADE | BULLISH | 07/19/24 | $537.8 | $526.3 | $535.0 | $3500.00 | $53.5K | 19 | 0 |

| BKNG | CALL | TRADE | BEARISH | 01/17/25 | $395.0 | $379.8 | $383.35 | $4000.00 | $38.3K | 205 | 2 |

| BKNG | CALL | TRADE | BULLISH | 01/17/25 | $356.5 | $340.4 | $353.85 | $4050.00 | $35.3K | 12 | 1 |

| BKNG | CALL | TRADE | BULLISH | 06/28/24 | $87.9 | $73.1 | $85.0 | $3940.00 | $34.0K | 7 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BKNG | 看涨 | 交易 | 中立 | 09/20/24 | 181.3美元 | 172.7美元 | 177.5美元 | $4100.00 | $177.5K | 16 | 0 |

| BKNG | 看涨 | 交易 | 看好 | 07/19/24 | 537.8美元 | 526.3美元 | $535.0 | $3500.00 | $53.5K | 19 | 0 |

| BKNG | 看涨 | 交易 | 看淡 | 01/17/25 | 395.0美元 | 379.8美元 | 383.35美元 | 4000.00美元 | $38.3K | 205 | 2 |

| BKNG | 看涨 | 交易 | 看好 | 01/17/25 | 356.5美元 | 340.4美元 | 353.85美元 | $4050.00 | $35.3K | 12 | 1 |

| BKNG | 看涨 | 交易 | 看好 | 06/28/24 | 87.9美元 | 73.1美元 | $85.0 | 3940.00美元 | $34.0K | 7 | 0 |

About Booking Holdings

关于Booking Holdings

Booking is the world's largest online travel agency by sales, offering booking and payment services for hotel and alternative accommodation rooms, airline tickets, rental cars, restaurant reservations, cruises, experiences, and other vacation packages. The company operates several branded travel booking sites, including Booking.com, Agoda, OpenTable, and Rentalcars.com, and has expanded into travel media with the acquisitions of Kayak and Momondo. Transaction fees for online bookings account for the bulk of revenue and profits.

Booking是全球销售额最大的在线旅游机构,提供酒店和替代住宿房间的预订和付款服务、机票、租车、餐厅预订、邮轮、体验和其他度假套餐。该公司经营多个品牌的旅游预订网站,包括Booking.com、Agoda、OpenTable和Rentalcars.com,并通过收购Kayak和Momondo进军旅游媒体。在线预订的交易费用占营业收入和利润的大部分。

Present Market Standing of Booking Holdings

Booking Holdings目前市场地位

- Currently trading with a volume of 48,070, the BKNG's price is up by 0.67%, now at $4007.73.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 37 days.

- 现在成交量为48,070股,BKNG的价格涨了0.67%,现在为$4007.73。

- RSI读数表明股票目前可能超买。

- 预计37天后公布收益。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Booking Holdings with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供更高的利润潜力。精明的交易者通过持续的教育、战略性的交易调整、利用各种因子并保持市场动态的了解来降低这些风险。使用Benzinga Pro查询最新的Booking Holdings期权交易情况,以获取实时警报。

In today's trading context, the average open interest for options of Booking Holdings stands at 84.0, with a total volume reaching 40.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Booking Holdings, situated within the strike price corridor from $3500.0 to $4250.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Booking Holdings stands at 84.0, with a total volume reaching 40.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Booking Holdings, situated within the strike price corridor from $3500.0 to $4250.0, throughout the last 30 days.