Smart Money Is Betting Big In AMGN Options

Smart Money Is Betting Big In AMGN Options

Investors with a lot of money to spend have taken a bearish stance on Amgen (NASDAQ:AMGN).

资金雄厚的投资者对安进(纳斯达克:AMGN)持看淡态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AMGN, it often means somebody knows something is about to happen.

不管这些投资者是机构还是富有的个人,我们不得而知。但当AMGN发生如此重大的事件时,通常意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 27 uncommon options trades for Amgen.

今日,Benzinga的期权扫描器发现了27笔不常见的安进期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 37% bullish and 55%, bearish.

这些大单交易的整体情绪在看好和看淡之间分为37%和55%。

Out of all of the special options we uncovered, 5 are puts, for a total amount of $163,558, and 22 are calls, for a total amount of $1,426,699.

在我们发现的所有特殊期权交易中,有5个看跌期权,总金额为163,558美元,22个看涨期权,总金额为1,426,699美元。

Predicted Price Range

预测价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $230.0 to $340.0 for Amgen over the recent three months.

根据交易活动,看起来这些重要投资者在过去三个月内瞄准了一个价格区间,从230.0美元到340.0美元的安进。

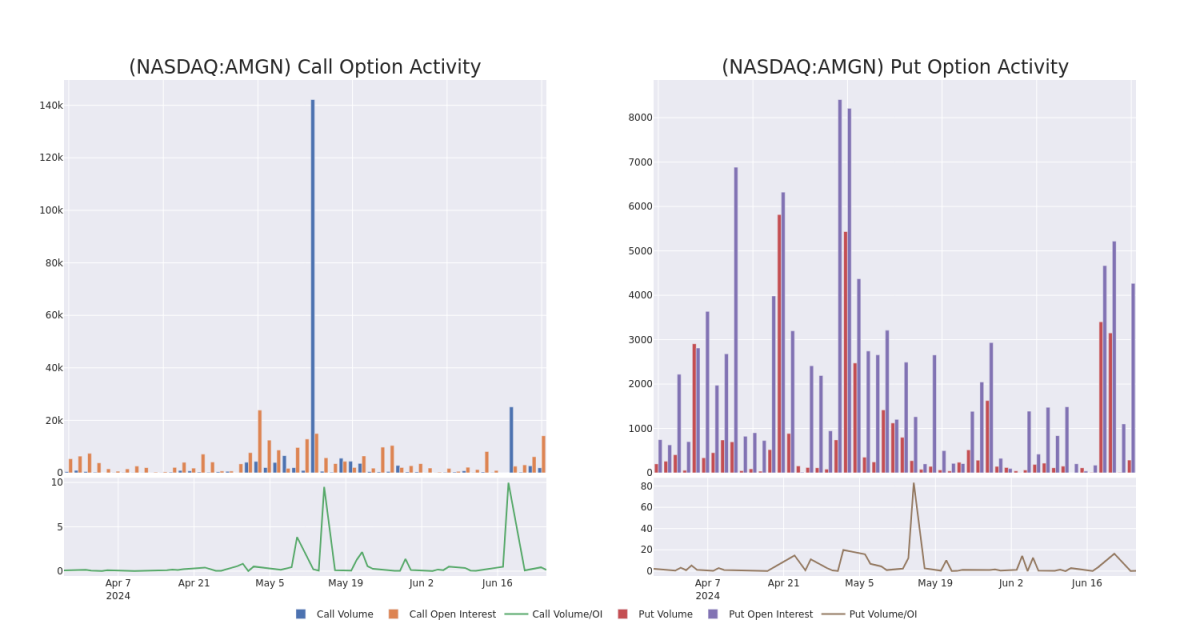

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In terms of liquidity and interest, the mean open interest for Amgen options trades today is 1080.41 with a total volume of 2,179.00.

就流动性和兴趣而言,安进期权交易今天的平均持仓量为1080.41,总成交量为2,179.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Amgen's big money trades within a strike price range of $230.0 to $340.0 over the last 30 days.

在下面的图表中,我们可以追踪过去30天内安进看涨和看跌期权的交易量和持仓量,这些期权的行权价格区间在230.0美元到340.0美元之间。

Amgen 30-Day Option Volume & Interest Snapshot

安进30天期权成交量和持仓量快照

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | CALL | SWEEP | BULLISH | 06/28/24 | $12.5 | $11.4 | $12.5 | $312.50 | $188.7K | 283 | 50 |

| AMGN | CALL | TRADE | BULLISH | 01/17/25 | $57.25 | $54.5 | $56.15 | $280.00 | $174.0K | 1.7K | 21 |

| AMGN | CALL | TRADE | BULLISH | 01/17/25 | $57.1 | $54.5 | $56.15 | $280.00 | $140.3K | 1.7K | 65 |

| AMGN | CALL | TRADE | BULLISH | 01/17/25 | $56.4 | $54.15 | $55.85 | $280.00 | $106.1K | 1.7K | 2 |

| AMGN | CALL | SWEEP | BULLISH | 07/19/24 | $10.15 | $8.95 | $10.15 | $320.00 | $101.5K | 2.4K | 4 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | 看涨 | SWEEP | 看好 | 06/28/24 | $12.5 | $11.4 | $12.5 | $312.50 | $188.7K | 283 | 50 |

| AMGN | 看涨 | 交易 | 看好 | 01/17/25 | $57.25 | $54.5 | $56.15 | $280.00 | $174.0K | 1.7K | 21 |

| AMGN | 看涨 | 交易 | 看好 | 01/17/25 | $57.1 | $54.5 | $56.15 | $280.00 | $140.3K | 1.7K | 65 |

| AMGN | 看涨 | 交易 | 看好 | 01/17/25 | $56.4 | $54.15 | $55.85 | $280.00 | $106.1K | 1.7K | 2 |

| AMGN | 看涨 | SWEEP | 看好 | 07/19/24 | $10.15 | $8.95 | $10.15 | $320.00 | $101.5千 | 2.4K | 4 |

About Amgen

关于安进

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

安进是生物技术制药领域的领导者。旗舰药物包括增加红细胞计数的艾普毕与阿拉尼许、增强免疫系统的奈帕姆和奈乌细胞移植因子、以及针对炎症性疾病的恩布瑞尔和欧特兹拉。安进在2006年推出了首个癌症治疗药物Vectibix,并推出了增强骨密度的药物Prolia/Xgeva(于2010年获批)和Evenity(于2019年获批)。对Onyx的收购增强了该公司在治疗肿瘤领域的药物组合,其中包括Kyprolis。最近推出的药物包括Repatha(降低胆固醇)、Aimovig(缓解偏头痛)、Lumakras(治疗肺癌)以及Tezspire(治疗哮喘)。2023年Horizon收购带来了几种罕见疾病药物,其中包括治疗甲状腺眼病的Tepezza。安进还拥有不断增长的生物类似物组合。

Amgen's Current Market Status

安进当前市场状态

- With a trading volume of 1,172,634, the price of AMGN is up by 0.34%, reaching $319.24.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 37 days from now.

- 安进(AMGN)的交易量为1,172,634,价格上涨0.34%,达到319.24美元。

- 当前RSI值表明股票可能已经超买。

- 下一个盈利报告将在 37 天后发布。

What Analysts Are Saying About Amgen

分析师对安进的评论

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $332.0.

过去一个月中,有1位行业分析师分享了他们对该股票的见解,提出了332.0美元的平均目标价。

- Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Amgen, targeting a price of $332.

- RBC Capital的一位分析师维持了对安进的推荐评级,并以$332.0的价格为目标。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。