Unpacking the Latest Options Trading Trends in Albemarle

Unpacking the Latest Options Trading Trends in Albemarle

Deep-pocketed investors have adopted a bearish approach towards Albemarle (NYSE:ALB), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ALB usually suggests something big is about to happen.

资深投资者对美国雅保(纽交所:ALB)采取了看淡的态度,市场参与者不应忽视这一点。我们在Benzinga跟踪公开期权记录时发现了这一重大举措。这些投资者的身份仍未得知,但这种对ALB的实质性变动通常表明有大事件即将发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 15 extraordinary options activities for Albemarle. This level of activity is out of the ordinary.

我们从今天Benzinga的期权扫描器中观察得知这些信息,发现了15个美国雅保的非同寻常的期权合约。这种活动水平超出了平时。

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 66% bearish. Among these notable options, 10 are puts, totaling $549,822, and 5 are calls, amounting to $205,530.

这些重量级的投资者的态度总体上是分歧的,其中有33%看好,66%看淡。在这些著名的期权合约中,10个是认沽期权,总计549,822美元,5个是认购期权,总计205,530美元。

What's The Price Target?

价格目标是什么?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $90.0 to $120.0 for Albemarle over the last 3 months.

考虑这些期权合约的成交量和持仓量,似乎过去的3个月里大鲸鱼一直在针对美国雅保的价格区间为90.0至120.0美元。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

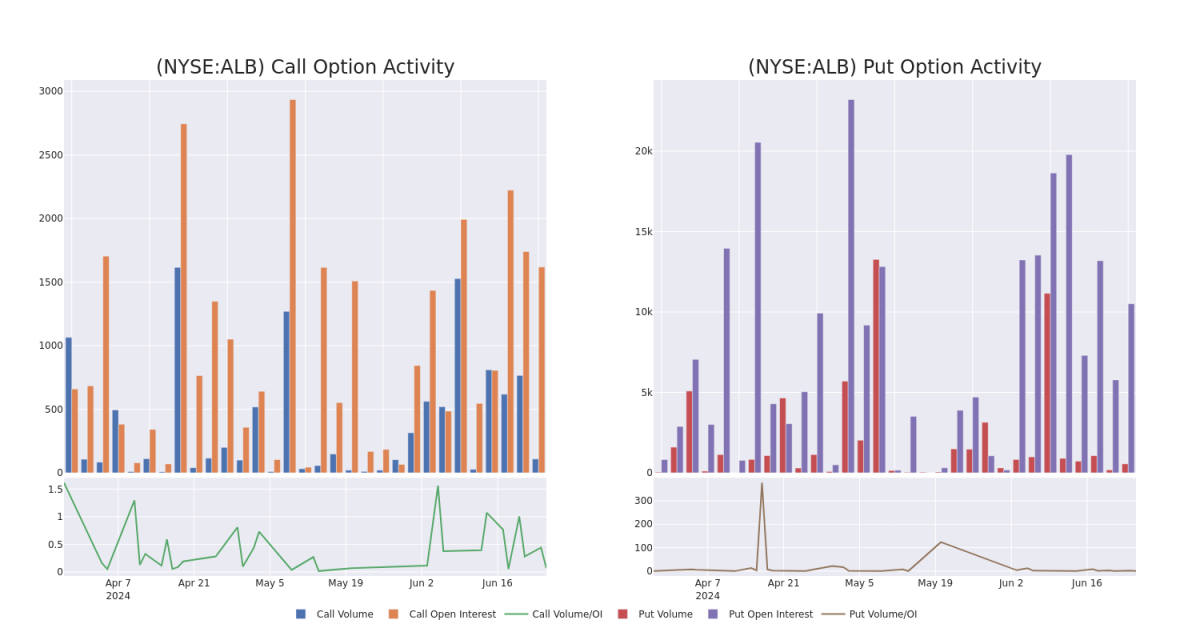

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Albemarle's options for a given strike price.

这些数据可以帮助您跟踪Albemarle特定行权价的期权流动性和利益。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Albemarle's whale activity within a strike price range from $90.0 to $120.0 in the last 30 days.

以下是过去30天里的所有美国雅保大鲸鱼活动的认购期权和认沽期权成交量和持仓量的演变,其执行价格范围为90.0至120.0美元。

Albemarle Option Activity Analysis: Last 30 Days

美国雅保期权活动分析:过去30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALB | CALL | TRADE | BEARISH | 01/16/26 | $23.5 | $23.0 | $23.0 | $100.00 | $69.0K | 182 | 0 |

| ALB | PUT | TRADE | BEARISH | 06/20/25 | $20.05 | $19.95 | $20.05 | $100.00 | $68.1K | 651 | 0 |

| ALB | PUT | TRADE | BEARISH | 06/20/25 | $20.05 | $19.95 | $20.05 | $100.00 | $68.1K | 651 | 0 |

| ALB | PUT | TRADE | BEARISH | 03/21/25 | $17.1 | $17.05 | $17.1 | $100.00 | $64.9K | 798 | 64 |

| ALB | PUT | TRADE | BULLISH | 06/20/25 | $21.1 | $19.8 | $20.05 | $100.00 | $60.1K | 651 | 140 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALB | 看涨 | 交易 | 看淡 | 01/16/26 | $23.5 | $23.0 | $23.0 | $100.00。 | $69.0K | 182 | 0 |

| ALB | 看跌 | 交易 | 看淡 | 06/20/25 | 20.05美元 | $19.95 | 20.05美元 | $100.00。 | $68.1K | 651 | 0 |

| ALB | 看跌 | 交易 | 看淡 | 06/20/25 | 20.05美元 | $19.95 | 20.05美元 | $100.00。 | $68.1K | 651 | 0 |

| ALB | 看跌 | 交易 | 看淡 | 03/21/25 | $17.1 | $17.05 | $17.1 | $100.00。 | $64.9K | 798 | 64 |

| ALB | 看跌 | 交易 | 看好 | 06/20/25 | $21.1 | 19.8美元 | 20.05美元 | $100.00。 | $60.1K | 651 | 140 |

About Albemarle

关于美国雅保

Albemarle is one of the world's largest lithium producers. In the lithium industry, the majority of demand comes from batteries, where lithium is used as the energy storage material, particularly in electric vehicles. Albemarle is a fully integrated lithium producer. Its upstream resources include salt brine deposits in Chile and the US and two hard rock mines in Australia, both of which are joint ventures. The company operates lithium refining plants in Chile, the US, Australia, and China. Albemarle is a global leader in the production of bromine, used in flame retardants. It is also a major producer of oil refining catalysts.

Albemarle是世界上最大的锂生产商之一。在锂行业中,大部分需求来自电池,锂被用作储能材料,特别是用于新能源车。Albemarle是一个完全集成的锂生产商。其上游资源包括智利和美国的盐卤矿床和澳洲的两个硬岩矿山,均为合资企业。该公司在智利、美国、澳洲和中国设有锂精炼厂。Albemarle是全球溴化剂生产领先者,用于阻燃。它也是石油炼制催化剂的主要生产商。

Where Is Albemarle Standing Right Now?

目前美国雅保的表现如何?

- With a volume of 1,745,823, the price of ALB is down -3.33% at $93.19.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 36 days.

- 美国雅保的成交量为1,745,823,目前的价格为93.19美元,下跌了3.33%。

- RSI指标表明该基础股票可能被超卖。

- 预计下一轮收益发布还有36天。

Expert Opinions on Albemarle

关于美国雅保的专家意见

2 market experts have recently issued ratings for this stock, with a consensus target price of $109.5.

有2位市场专家最近为这只股票发表了评级,一致目标价为109.5美元。

- An analyst from Piper Sandler has decided to maintain their Underweight rating on Albemarle, which currently sits at a price target of $95.

- Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on Albemarle with a target price of $124.

- 派杰投资的一位分析师决定维持对美国雅保的减持评级,目前的目标价为95美元。

- UBS的分析师始终看待美国雅保持中立态度,目标价为124美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Albemarle options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。精明的交易员通过不断学习、调整策略、监测多种因子并密切关注市场动向来控制风险。从Benzinga Pro获得最新的美国雅保期权交易实时提醒。