Behind the Scenes of United Parcel Service's Latest Options Trends

Behind the Scenes of United Parcel Service's Latest Options Trends

Deep-pocketed investors have adopted a bullish approach towards United Parcel Service (NYSE:UPS), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in UPS usually suggests something big is about to happen.

资金雄厚的投资者采取了对联合包裹(纽交所:UPS)看涨的态度,这是市场参与者不应忽视的事情。我们在本杰明的公开期权记录上追踪到了今天这一重大举动。这些投资者的身份仍然不为人知,但这样一个重大的举动通常意味着即将发生一些重要事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 18 extraordinary options activities for United Parcel Service. This level of activity is out of the ordinary.

我们从观察到本杰明选项扫描器突出了18项异常的联合包裹期权活动中,得出了这个信息。这种活动水平是不寻常的。

The general mood among these heavyweight investors is divided, with 55% leaning bullish and 33% bearish. Among these notable options, 6 are puts, totaling $321,277, and 12 are calls, amounting to $535,813.

这些重量级投资者的整体态度是分裂的,55%看涨,33%看淡。在这些显著的期权中,有6个是看跌期权,总额为321,277美元,还有12个是看涨期权,总额为535,813美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $127.0 to $165.0 for United Parcel Service over the recent three months.

根据交易活动,显然这些重要的投资者目标是在最近三个月内将联合包裹的价格区间从127.0美元至165.0美元。

Volume & Open Interest Trends

成交量和未平仓量趋势

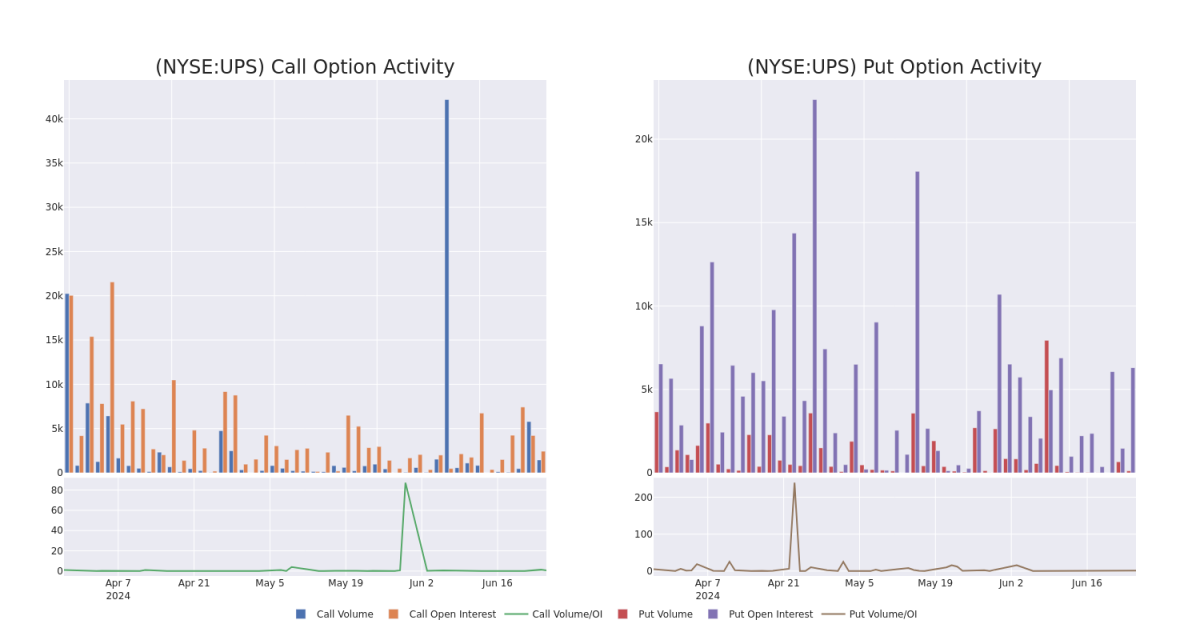

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for United Parcel Service's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across United Parcel Service's significant trades, within a strike price range of $127.0 to $165.0, over the past month.

研究成交量和持仓量为股票研究提供了重要的见解。这些信息对于衡量联合包裹期权在特定执行价格上的流动性和利益水平至关重要。以下是我们在过去一个月内在一个执行价格区间为127.0美元至165.0美元的联合包裹重要交易中调查成交量和持仓量趋势的快照。

United Parcel Service Call and Put Volume: 30-Day Overview

联合包裹看涨和看跌期权的成交量:30天概述

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | CALL | SWEEP | BULLISH | 01/17/25 | $7.9 | $7.8 | $7.9 | $140.00 | $94.8K | 690 | 98 |

| UPS | PUT | SWEEP | BEARISH | 08/16/24 | $16.15 | $15.15 | $16.15 | $150.00 | $80.7K | 40 | 54 |

| UPS | CALL | SWEEP | BULLISH | 01/17/25 | $8.0 | $7.95 | $8.0 | $140.00 | $66.8K | 690 | 10 |

| UPS | PUT | SWEEP | BULLISH | 01/17/25 | $9.4 | $9.1 | $9.1 | $135.00 | $63.7K | 1.7K | 0 |

| UPS | CALL | SWEEP | BEARISH | 08/16/24 | $5.65 | $5.65 | $5.65 | $135.00 | $62.7K | 433 | 498 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | 看涨 | SWEEP | 看好 | 01/17/25 | $7.9 | $7.8 | $7.9 | $140.00 | $94.8K | 690 | 98 |

| UPS | 看跌 | SWEEP | 看淡 | 08/16/24 | $16.15 | $15.15 | $16.15 | $150.00 | $80.7K | 40 | 54 |

| UPS | 看涨 | SWEEP | 看好 | 01/17/25 | $8.0 | $7.95 | $8.0 | $140.00 | $66.8K | 690 | 10 |

| UPS | 看跌 | SWEEP | 看好 | 01/17/25 | 9.4美元 | $9.1 | $9.1 | $135.00 | $63.7K | 1.7K | 0 |

| UPS | 看涨 | SWEEP | 看淡 | 08/16/24 | $5.65 | $5.65 | $5.65 | $135.00 | $62.7千美元 | 433 | 498 |

About United Parcel Service

关于联合包裹

As the world's largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS' domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing "strategic alternatives" for its truck brokerage unit, Coyote, which it acquired in 2015.

作为全球最大的包裹递送公司,联合包裹 (UPS) 管理着一个庞大的机队,拥有超过500架飞机和10万辆车辆,以及数百个分拣设施,每天向全球住宅和企业递送约2200万个包裹。UPS的美国国内包裹业务占据总营业收入的约64%,而国际包裹业务占据20%。航空和海运货运,卡车运输中介和合同物流业务占据其余部分。UPS目前正在为其于2015年收购的卡车运输中介部门Coyote寻求“战略替代方案”。

Following our analysis of the options activities associated with United Parcel Service, we pivot to a closer look at the company's own performance.

在分析与联合包裹相关的期权活动之后,我们转向更仔细地观察该公司自身的表现。

Current Position of United Parcel Service

联合包裹的当前位置

- With a volume of 2,366,468, the price of UPS is down -3.13% at $134.26.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 28 days.

- 联合包裹的成交量为2,366,468美元,价格下跌3.13%,为134.26美元。

- RSI指标暗示该标的股票目前处于超买和超卖的中立区间。

- 下一个季度收益预计在28天内公布。

Expert Opinions on United Parcel Service

关于联合包裹的专家意见

2 market experts have recently issued ratings for this stock, with a consensus target price of $150.5.

2位市场专家最近对这只股票发表了评级,目标价为150.5美元。

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for United Parcel Service, targeting a price of $145.

- An analyst from Wells Fargo downgraded its action to Overweight with a price target of $156.

- evercore的一位分析师继续持有联合包裹的中性评级,目标价为145美元。

- 富国银行的一位分析师将其行动下调为超配,目标价为156美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for United Parcel Service with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高的利润潜力。精明的交易者通过持续的教育、战略性的交易调整、利用各种因子以及关注市场动态来降低这些风险。通过Benzinga Pro了解联合包裹的最新期权交易情况,获取实时提醒。