Carnival Rallies Over 8% On 2024's Best Day After Strong Earnings: It 'Hit The Key Marks That Investors Were Looking For'

Carnival Rallies Over 8% On 2024's Best Day After Strong Earnings: It 'Hit The Key Marks That Investors Were Looking For'

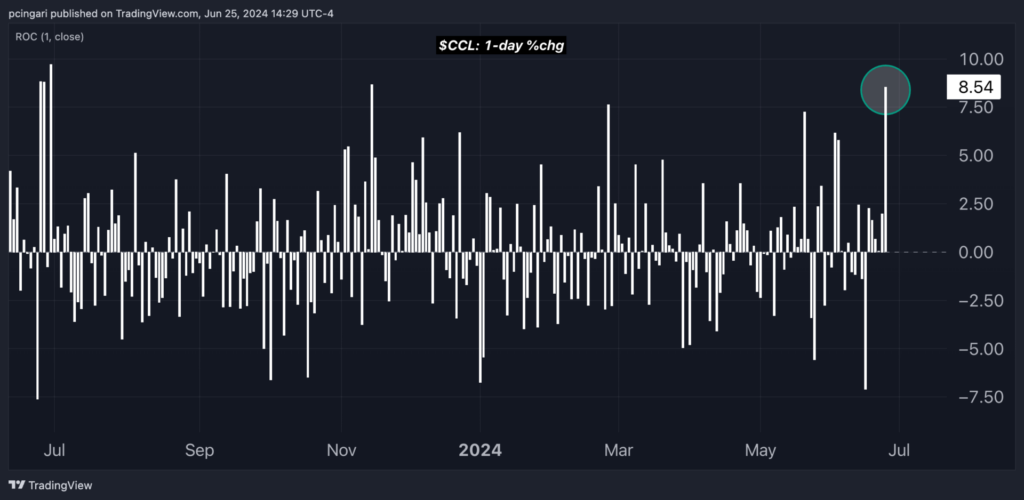

Carnival Corp. (NASDAQ:CCL) rallied over 8% by 2:30 p.m. ET Tuesday, eyeing its best trading session of 2024 after delivering second-quarter earnings that significantly beat expectations.

邮轮概念股嘉年华邮轮(NASDAQ:CCL)截至美国东部时间周二下午2:30上涨8%以上,成交达2024年以来的最佳交易,原因是其平均每股收益强于预期。

Goldman Sachs analyst Lizzie Dove highlighted that the cruise line's Q2 beat and the Q3 guidance "hit the key marks that investors were looking for," driving the positive market reaction.

高盛分析师Lizzie Dove指出,邮轮公司第二季度的业绩超预期,第三季度的指导预期达到了投资者的期望,推动了股票市场的正面反应。

The investment bank maintained a 'Buy' rating on Carnival, setting a 12-month price target of $22 per share, implying a robust 34% surge from current levels.

该投资银行维持对嘉年华邮轮的“买入”评级,并将每股股价的12个月价格目标定为22美元,相当于比目前水平强劲的34%增长。

Other cruise-line stocks rallied in sympathy with Carnival on Tuesday. Royal Caribbean Cruise Ltd. (NYSE:RCL) and Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) soared by 4.2% and 5.6%, respectively.

其他邮轮公司的股票也在周二因受到嘉年华邮轮公司的牵引而大幅上涨。纽约交易所皇家加勒比邮轮公司(NYSE: RCL)和挪威邮轮控股有限公司(NYSE:NCLH)的股票分别上涨了4.2%和5.6%。

Chart: Carnival Eyes Strongest Session Since November 2023

图表:嘉年华邮轮着眼于自2013年11月以来的最强交易日

Carnival Q2 Earnings: Key Highlights

嘉年华邮轮第二季度财报:关键要点

Carnival reported an adjusted EBITDA of $1.2 billion, far surpassing the consensus estimate of $1.06 billion and its guidance of $1.05 billion. Revenue came in at $5.78 billion, above the expected $5.7 billion.

嘉年华邮轮报告调整后的每股收益为12亿美元,远超预期的10.6亿美元和其指导的10.5亿美元。营业收入为57.8亿美元,高于估计的57亿美元。

Adjusted earnings per share (EPS) came in at $0.11, well above the consensus estimate of a $0.02 loss.

调整后每股收益为0.11美元,大大超过预期的亏损0.02美元。

Dove noted several key metrics that contributed to the strong quarterly performance.

Dove指出,有几项关键指标促成了强劲的季度业绩表现。

- Ticket revenue per Passenger Cruise Days (PCD) was $154.49 beating Goldman Sachs' estimates and increasing 7.2% year-over-year.

- Onboard revenue per PCD grew by 2.9%, an improvement from the previous quarter's decline, indicating strong consumer spending.

- Occupancy rates reached 104%, surpassing the estimate of 103.3%; net yields of $186.55 exceeded expectations, marking a 12.2% year-over-year increase.

- Carnival also improved its efficiency from a cost perspective, as net cruise costs ex fuel fell 0.3% year-over-year compared to a 3% rise according to previous guidance.

- 每乘客邮轮日的票务收入为154.49美元,超过高盛的预期,并同比增长7.2%。

- 每乘客邮轮日的船上收入增长了2.9%,较上一季度有所改善,有力地展现了强劲的消费支出。

- 入住率达到了104%,超过了预期的103.3%;每个旅客邮轮日的净收益为186.55美元,超出了预期,并同比增长12.2%。

- 嘉年华邮轮从成本角度改进了其效率,因为其除燃油成本外的船舶旅游成本同比下降0.3%,而根据以前的预测,该成本将同比上涨3%。

Carnival Raises Q3 2024 Guidance

嘉年华邮轮提高了2024年第三季度指引

Carnival also raised the full-year outlook, indicate Carnival's effective management and strategic growth.

嘉年华邮轮公司还提高了全年业绩预期,表明嘉年华的有效管理和战略增长。

The company now expects adjusted EBITDA of $5.83 billion, up from $5.63 billion, and adjusted EPS of $1.18, up from $0.98.

该公司现预计调整后的每股收益达到1.18美元,而不是之前的0.98美元,调整后的EBITDA预计为58.3亿美元,而不是之前的56.3亿美元。

For the third quarter, Carnival forecasts an EBITDA of $2.66 billion and net yield growth of 8% year-on-year.

第三季度,嘉年华邮轮预计EBITDA为26.6亿美元,净收益同比增长8%。

Now Read: Chipmakers, Cruise Lines, Crypto Rally, Nvidia Reclaims $3 Trillion; Blue Chips, Small Caps Dip: What's Driving Markets Tuesday?

现在就阅读吧: 芯片制造商,邮轮股票,加密货币的涨势,英伟达正回购3万亿美元股票;大型蓝筹股和小市值股票下跌:周二是什么推动市场的?

Image: Pixabay

图片:Pixabay