Tech, AI Drive $12.2B Inflows Into Growth ETFs, Marking Record Outperformance Over Value

Tech, AI Drive $12.2B Inflows Into Growth ETFs, Marking Record Outperformance Over Value

Exchange-traded funds (ETFs) focused on growth equities – characterized by robust revenue growth, high valuations, and strong potential for innovation – experienced elevated inflows in June.

6月份以来,聚焦于营业收入快速增长、估值高、创新潜力强的成长股的交易所交易基金(etf)吸引了大量资金流入。

This surge in interest towards growth-linked funds coincided with a significant outperformance of growth over value stocks, reflecting increased investor confidence in the tech sector and disruptive innovations like artificial intelligence.

对成长股基金兴趣的激增,与成长股相比价值股表现不佳有关,反映了投资者对科技板块和人工智能等颠覆性创新的信恳智能上升。

The eight largest growth-linked ETFs by assets under management (AUM) collectively experienced a substantial $12.2 billion in inflows from the beginning of the month through June 24.

按资产管理规模排序的8只最大的成长股etf总共吸引了122亿美元的大量资金流入,时间区间为本月初至6月24日。

Leading the pack, the Vanguard Growth ETF (NYSE:VUG) saw the highest monthly inflows among its peers, attracting an impressive $5.68 billion. This remarkable figure is set to mark the Vanguard Growth ETF's record monthly inflows, ranking second in June only to the nearly $10 billion attracted by the broader iShares Core S&P 500 ETF (NYSE:IVV).

在这些基金中,成长股etf-vanguard是领头羊,相比同类产品在6月份涨了最多,吸引了惊人的56.8亿美元资金流入,这一出色表现是成长股etf-vanguard的创纪录的月度资金净流入,仅次于黑岩标普500 etf (nyse:ivv)吸引的近100亿美元流入。

| Growth ETF | AUM | June Flows (as of June 24) |

|---|---|---|

| Total | $12.2B | |

| Vanguard Growth ETF | $139.84B | $5.68B |

| IShares Russell 1000 Growth ETF (NYSE:IWF) | $97.00B | $0.03B |

| IShares S&P 500 Growth ETF (NYSE:IVW) | $52.96B | $4.01B |

| Schwab U.S. Large-Cap Growth ETF (NYSE:SCHG) | $30.62B | $0.44B |

| SPDR Portfolio S&P 500 Growth ETF (NYSE:SPYG) | $29.40B | $0.47B |

| Vanguard Mega Cap Growth ETF (NYSE:MGK) | $22.39B | $1.08B |

| Vanguard Russell 1000 Growth ETF (NYSE:VONG) | $20.81B | $0.08B |

| IShares Core S&P U.S. Growth ETF (NYSE:IUSG) | $18.94B | $0.15B |

| Vanguard Small-Cap Growth ETF (NYSE:VBK) | $17.25B | $0.26B |

| 成长股etf | 资产管理规模 | 6月资金流向 (截至6月24日) |

|---|---|---|

| 总费用 | 122亿美元 | |

| 成长股etf-vanguard | $139.84B | $5.68B |

| 罗素1000成长指数etf-ishares (NYSE:IWF) | $97.00B | $0.03B |

| 标普500成长指数etf-ishares(NYSE:IVW) | $52.96B | $4.01B |

| 查布美国大型成长股ETF (NYSE:SCHG) | $30.62B | 440百万美元 |

| SPDR组合标普500成长股票ETF(NYSE:SPYG) | 2940亿美元 | 470百万美元 |

| 大型成长股ETF-Vanguard (NYSE:MGK) | 2239亿美元 | 108百万美元 |

| 罗素1000成长指数ETF-Vanguard (NYSE:VONG) | 2081亿美元 | 8百万美元 |

| iShares Core S&P美国成长ETF (NYSE:IUSG) | 1894亿美元 | 15百万美元 |

| 小盘成长股ETF-Vanguard (NYSE:VBK) | 1725亿美元 | 26百万美元 |

Growth Stocks Surge To Record Highs Against Value

成长股票创下对价值股票的创纪录高峰

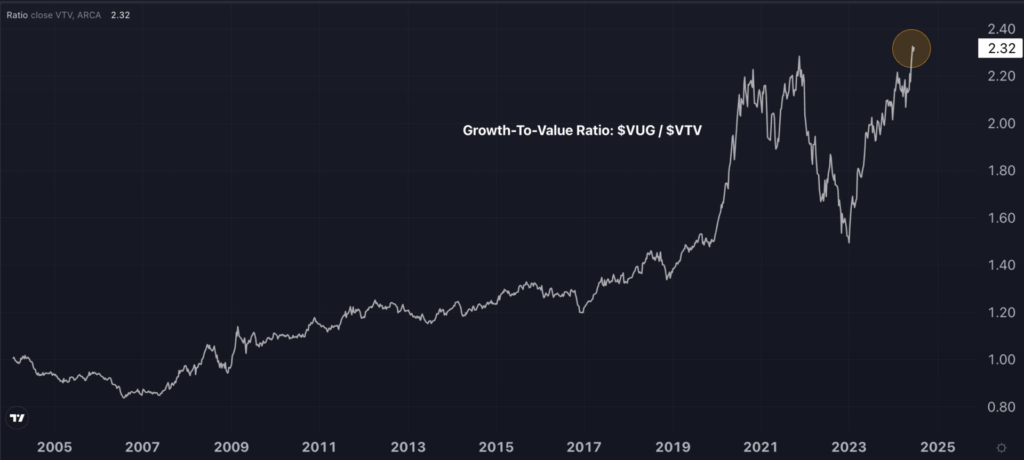

The Vanguard Growth ETF's relative performance against its counterpart, the Vanguard Value ETF (NYSE:VTV), set new record highs in June, surpassing the previous peaks achieved in November 2021, as illustrated in the chart below, sourced from Benzinga Pro.

该指数来源于Benzinga Pro,图表显示,Vanguard Growth ETF与其对手Vanguard Value ETF (NYSE:VTV) 相对表现在6月份创下了新高,超过了2021年11月的历史峰值。

The primary drivers of the growth style's outperformance in June were tech giants Nvidia Corp. (NASDAQ:NVDA) and Apple Inc. (NASDAQ:AAPL), which saw robust rallies of 15% and 8.8%, respectively.

六月成长股票风格表现的主要推动力来自技术巨头Nvidia Corp. (NASDAQ:NVDA)和Apple Inc. (NASDAQ:AAPL),分别实现了15%和8.8%的强劲上涨。

- Growth Stocks Leave Value Stocks In The Dust: 4 Reasons For Biggest Monthly Lead In Over A Year

- 成长型股票表现远超价值型股票:超过一年来的最大月度领先的4个原因

Image generated using artificial intelligence via Midjourney.

这张图片是通过Midjourney使用人工智能生成的。

Leading the pack, the Vanguard Growth ETF (NYSE:VUG) saw the highest monthly inflows among its peers, attracting an impressive $5.68 billion. This remarkable figure is set to mark the Vanguard Growth ETF's record monthly inflows, ranking second in June only to the nearly $10 billion attracted by the broader iShares Core S&P 500 ETF (NYSE:IVV).

Leading the pack, the Vanguard Growth ETF (NYSE:VUG) saw the highest monthly inflows among its peers, attracting an impressive $5.68 billion. This remarkable figure is set to mark the Vanguard Growth ETF's record monthly inflows, ranking second in June only to the nearly $10 billion attracted by the broader iShares Core S&P 500 ETF (NYSE:IVV).