Is Shanghai Haoyuan Chemexpress (SHSE:688131) Using Too Much Debt?

Is Shanghai Haoyuan Chemexpress (SHSE:688131) Using Too Much Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Shanghai Haoyuan Chemexpress Co., Ltd. (SHSE:688131) does use debt in its business. But the more important question is: how much risk is that debt creating?

沃伦•巴菲特曾经说过:"波动性远非代表风险。" 因此,当您考虑任何给定股票的风险时,您需要考虑债务,因为过多的债务可能会使公司陷入困境。而上海豪远化工有限公司(SHSE:688131)在业务中使用了债务。但更重要的问题是:这些债务创造了多少风险?

Why Does Debt Bring Risk?

为什么债务会带来风险?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

负债帮助企业,直到企业难以靠新的资本或自由现金流偿还为止。资本主义里的一部分和一整部分就是“创造性破坏”过程,其中破产的企业被银行家彻底清算。然而,更常见(但仍然代价高昂)的情况是,一家公司必须在股票价格便宜的情况下削弱股东权益,以控制债务。话虽如此,最常见的情况是一家公司合理管理其债务以及对其自身有利。当我们考虑一家公司对债务的利用情况时,我们首先查看现金和负债的总和。

What Is Shanghai Haoyuan Chemexpress's Debt?

上海豪远化工的债务是什么?

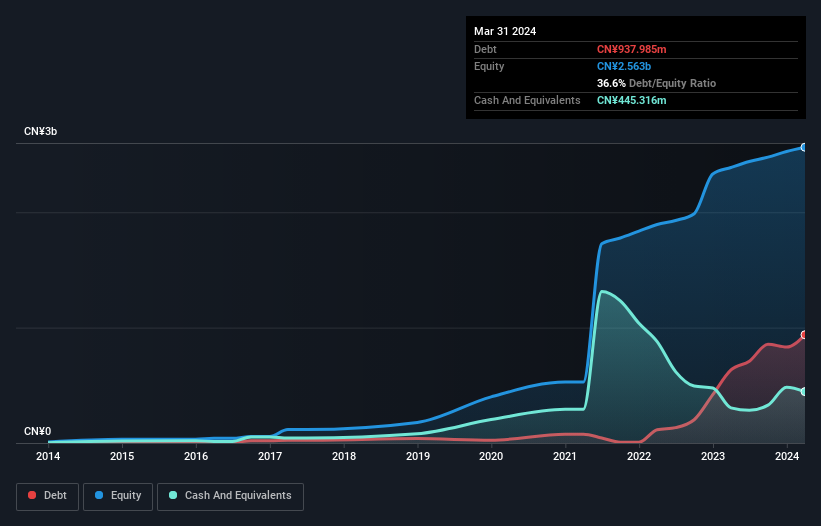

As you can see below, at the end of March 2024, Shanghai Haoyuan Chemexpress had CN¥938.0m of debt, up from CN¥632.9m a year ago. Click the image for more detail. However, it also had CN¥445.3m in cash, and so its net debt is CN¥492.7m.

正如您可以在下面看到的那样,在2024年3月底,上海豪远化工的债务为CN¥93800万,比一年前的CN¥63290万增加了。点击图片查看更多细节。 然而,它也拥有CN¥44530万的现金,因此其净债务为CN¥49270万。

A Look At Shanghai Haoyuan Chemexpress' Liabilities

查看上海豪远化工的负债

The latest balance sheet data shows that Shanghai Haoyuan Chemexpress had liabilities of CN¥1.21b due within a year, and liabilities of CN¥546.9m falling due after that. Offsetting this, it had CN¥445.3m in cash and CN¥598.3m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥714.5m.

最新的资产负债表数据显示,上海豪远化工有CN¥12.1亿的负债将在一年内到期,而之后会有CN¥54690万的负债。相抵消,它拥有CN¥44530万的现金和CN¥59830万的应收账款,这些款项将在12个月内到期。因此,其负债加权和(短期)应收账款总和超过了其现金的CN¥71450万。

Of course, Shanghai Haoyuan Chemexpress has a market capitalization of CN¥4.14b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

当然,上海豪远化工的市值为CN¥41.4亿,因此这些负债可能是可管理的。但是,我们建议股东们继续关注资产负债表的情况。

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

为了对公司的债务相对于其收益进行规模适应,我们计算其净债务与利息、税、折旧和摊销前收益(EBITDA)之比及其税前收益(EBIT)与利息支出之比(利息保障倍数)。因此,我们既考虑到不包括折旧和摊销费用在内的收益,又包括折旧和摊销费用的收益相对于债务。

Shanghai Haoyuan Chemexpress has net debt worth 2.2 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 3.8 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. The bad news is that Shanghai Haoyuan Chemexpress saw its EBIT decline by 17% over the last year. If earnings continue to decline at that rate then handling the debt will be more difficult than taking three children under 5 to a fancy pants restaurant. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Shanghai Haoyuan Chemexpress can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

上海豪远化工的净债务价值为EBITDA的2.2倍,这不算太多,但其利息覆盖率似乎有点偏低,因为EBIt仅有利息支出的3.8倍。虽然这并没有让我们太担心,但它确实表明利息支出有些负担。坏消息是,上海豪远化工去年的EBIt下降了17%。如果盈利率继续以那种速度下降,那么处理债务将比在一个花哨的餐厅里照顾三个5亿元以下的孩子要更加困难。毫无疑问,资产负债表是我们了解债务的主要途径。但最终,企业未来的盈利能力将决定上海豪远化工能否随时间加强其资产负债表。因此,如果您想了解专业人士的观点,您可能会发现这份有关分析师利润预测的免费报告很有趣。

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Shanghai Haoyuan Chemexpress saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

但我们最后要考虑的也很重要,因为公司无法用实现的利润来偿还债务;它需要的是冰冷的现金。因此,逻辑上,我们需要关注这些实际自由现金流所匹配的EBIT的比例。在过去的三年中,上海豪远化工的实际自由现金流仍然大幅为负值。虽然这可能是出于增长支出的原因,但这确实使得债务更加风险。

Our View

我们的观点

To be frank both Shanghai Haoyuan Chemexpress's EBIT growth rate and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. Having said that, its ability to handle its total liabilities isn't such a worry. Looking at the bigger picture, it seems clear to us that Shanghai Haoyuan Chemexpress's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Shanghai Haoyuan Chemexpress you should be aware of.

坦白说,上海豪远化工的EBIt增长率和将EBIt转换为自由现金流的记录让我们对其债务水平感到相当不舒服。尽管如此,它处理其总负债的能力并不令人担忧。从更大的角度来看,对我们来说,很明显上海豪远化工使用债务正在为公司创造风险。如果一切顺利,这应该会提高回报率,但相反,债务带来的永久性资本损失风险却得到提高。在分析债务水平时,资产负债表是一个显而易见的出发点。但最终,每家公司都可能包含存在于资产负债表之外的风险。一个例子就是:我们发现Shanghai Haoyuan Chemexpress的1个警告信号,你要注意。

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

当然,如果您是那种喜欢购买没有负债负担的股票的投资者,则今天就可以发现我们的独家净现金增长股清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者,发送电子邮件至editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者发送电子邮件至editorial-team@simplywallst.com。

The latest balance sheet data shows that Shanghai Haoyuan Chemexpress had liabilities of CN¥1.21b due within a year, and liabilities of CN¥546.9m falling due after that. Offsetting this, it had CN¥445.3m in cash and CN¥598.3m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥714.5m.

The latest balance sheet data shows that Shanghai Haoyuan Chemexpress had liabilities of CN¥1.21b due within a year, and liabilities of CN¥546.9m falling due after that. Offsetting this, it had CN¥445.3m in cash and CN¥598.3m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥714.5m.