This Is What Whales Are Betting On Applied Mat

This Is What Whales Are Betting On Applied Mat

Financial giants have made a conspicuous bullish move on Applied Mat. Our analysis of options history for Applied Mat (NASDAQ:AMAT) revealed 8 unusual trades.

应用材料的股票吸引了金融巨头的注意并看好。对应用材料(纳斯达克股票代码:AMAT)期权历史的分析显示了8笔不寻常的交易。

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $161,576, and 5 were calls, valued at $224,977.

深入研究发现,交易者有50%看好,50%看淡。我们发现所有交易中有3笔看淡,价值为161576美元,有5笔看好交易,价值为224977美元。

Predicted Price Range

预测价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $130.0 to $280.0 for Applied Mat over the recent three months.

基于交易活动,我们发现重要投资者的目标价区间为130.0美元至280.0美元,并将重点关注应用材料最近三个月的价格。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

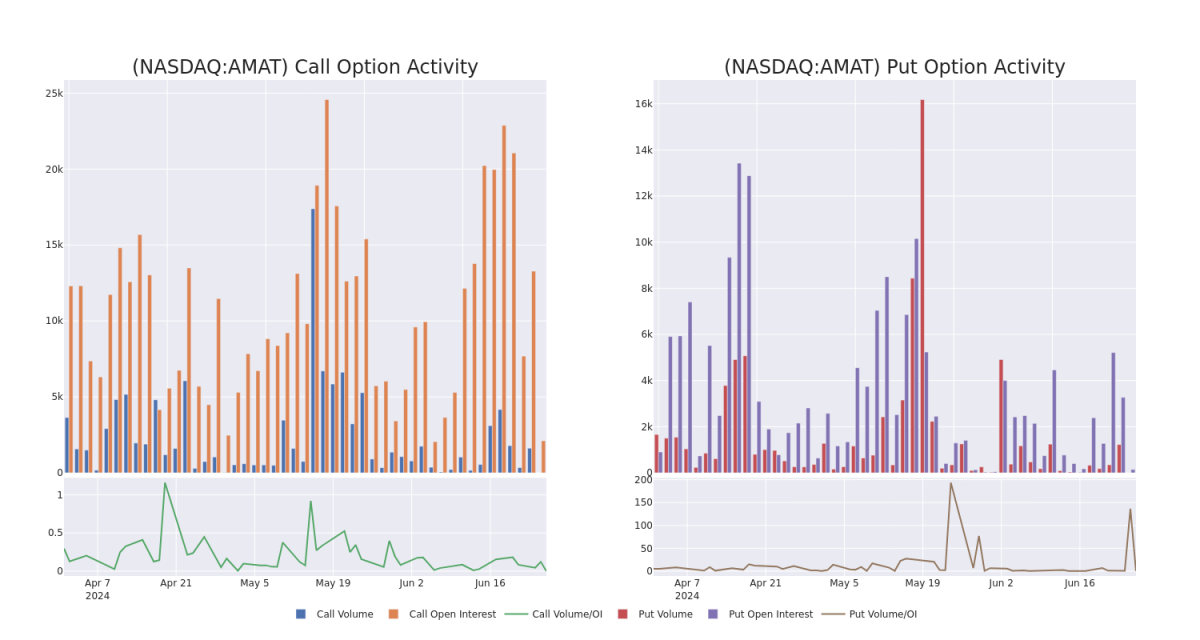

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Applied Mat's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Applied Mat's significant trades, within a strike price range of $130.0 to $280.0, over the past month.

观察成交量和持仓量可为股票研究提供至关重要的见解。这些信息在确定应用材料某些行权价格的期权流动性和利益水平时非常关键。下面,我们为应用材料的重要交易在130.0美元至280.0美元行权价格范围内的看涨和看跌期权趋势提供一个快照,时间跨度为一个月。

Applied Mat 30-Day Option Volume & Interest Snapshot

Applied Mat 30天期权成交量和未平仓利润快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | CALL | SWEEP | BEARISH | 07/19/24 | $2.05 | $1.97 | $1.97 | $255.00 | $68.7K | 39 | 0 |

| AMAT | PUT | SWEEP | BEARISH | 01/16/26 | $3.75 | $3.7 | $3.7 | $130.00 | $62.5K | 88 | 0 |

| AMAT | PUT | SWEEP | BULLISH | 11/15/24 | $22.0 | $21.85 | $21.89 | $240.00 | $54.6K | 26 | 0 |

| AMAT | CALL | SWEEP | BEARISH | 07/19/24 | $2.0 | $1.99 | $1.99 | $255.00 | $54.5K | 39 | 0 |

| AMAT | CALL | TRADE | BEARISH | 01/16/26 | $43.1 | $41.95 | $42.35 | $250.00 | $46.5K | 767 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | 看涨 | SWEEP | 看淡 | 07/19/24 | $2.05 | $1.97 | $1.97 | $255.00 | $68.7K | 39 | 0 |

| AMAT | 看跌 | SWEEP | 看淡 | 01/16/26 | $3.75 | $3.7 | $3.7 | $130.00 | $62.5K | 88 | 0 |

| AMAT | 看跌 | SWEEP | 看好 | 11/15/24 | $22.0 | $21.85 | $21.89 | $240.00 | $54.6K | 26 | 0 |

| AMAT | 看涨 | SWEEP | 看淡 | 07/19/24 | $2.0 | $1.99 | $1.99 | $255.00 | 54.5K美元 | 39 | 0 |

| AMAT | 看涨 | 交易 | 看淡 | 01/16/26 | $43.1 | $41.95 | $42.35 | $250.00 | $46.5K | 767 | 0 |

About Applied Mat

关于应用材料

Applied Materials is the largest semiconductor wafer fabrication equipment, or WFE, manufacturer in the world. Applied Materials has a broad portfolio spanning nearly every corner of the WFE ecosystem. Specifically, Applied Materials holds a market share leadership position in deposition, which entails the layering of new materials on semiconductor wafers. It is more exposed to general-purpose logic chips made at integrated device manufacturers and foundries. It counts the largest chipmakers in the world as customers, including TSMC, Intel, and Samsung.

应用材料是全球最大的半导体硅片制造设备或WFE制造商。应用材料拥有广泛的产品组合,几乎涵盖了WFE生态系统中的每个角落。具体而言,应用材料在沉积领域占据市场份额领先地位,该领域包括在半导体晶片上堆叠新材料。它更多地暴露于集成器件制造商和代工厂制造的通用逻辑芯片。它将全球最大的芯片制造商(包括台积电,英特尔和三星)视为客户。

Having examined the options trading patterns of Applied Mat, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在审查应用材料期权交易模式之后,我们的注意力现在直接转向公司。这个转变使我们能够深入探究它目前的市场地位和表现。

Where Is Applied Mat Standing Right Now?

应用材料现在处于什么地位?

- Currently trading with a volume of 769,171, the AMAT's price is up by 0.25%, now at $234.86.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 50 days.

- 目前成交量为769,171的AMAT价格上涨0.25%,现报234.86美元。

- RSI读数表明该股目前可能接近超买水平。

- 预计收益报告将在50天内发布。

What Analysts Are Saying About Applied Mat

分析师对应用材料的评论

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $268.3333333333333.

过去一个月,有3家行业分析师分享了他们对这只股票的观点,提出了268.3333333333333美元的平均目标价。

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Applied Mat, targeting a price of $280.

- Maintaining their stance, an analyst from B. Riley Securities continues to hold a Buy rating for Applied Mat, targeting a price of $300.

- An analyst from Barclays has elevated its stance to Equal-Weight, setting a new price target at $225.

- 维持其态度,富国银行的分析师继续维持应用材料的股票评级为超额表现,目标价为280美元。

- 维持其态度,B·莱利证券的分析师继续维持对应用材料的买入评级,目标价为300美元。

- 巴克莱银行的分析师将其立场提升至平权,并将目标价设定为225美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Applied Mat with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。聪明的交易者通过持续的教育、战略性的交易调整、利用各种因子以及关注市场动态来减轻这些风险。使用Benzinga Pro以获得Applied Mat的最新期权交易情况,并获得实时警报。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Applied Mat's options at certain strike prices. Below, we present a snapshot of the

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Applied Mat's options at certain strike prices. Below, we present a snapshot of the