Decoding Snap's Options Activity: What's the Big Picture?

Decoding Snap's Options Activity: What's the Big Picture?

Whales with a lot of money to spend have taken a noticeably bullish stance on Snap.

资本雄厚的鲸鱼们对Snap采取了明显看好的立场。

Looking at options history for Snap (NYSE:SNAP) we detected 8 trades.

查看Snap(纽交所:SNAP)的期权历史,我们发现了8笔交易。

If we consider the specifics of each trade, it is accurate to state that 75% of the investors opened trades with bullish expectations and 25% with bearish.

如果我们考虑每项交易的具体细节,可以准确地说75%的投资者持看涨预期,25%的投资者持看淡预期。

From the overall spotted trades, 3 are puts, for a total amount of $205,258 and 5, calls, for a total amount of $137,239.

从总体上看,我们发现3个看跌期权,总金额为205,258美元;5个看涨期权,总金额为137,239美元。

Expected Price Movements

预期价格波动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $10.0 to $22.0 for Snap during the past quarter.

分析这些合同的成交量和持仓量,似乎大牌们在过去的季度里一直注视着Snap在10.0美元至22.0美元之间的价格区间。

Insights into Volume & Open Interest

成交量和持仓量分析

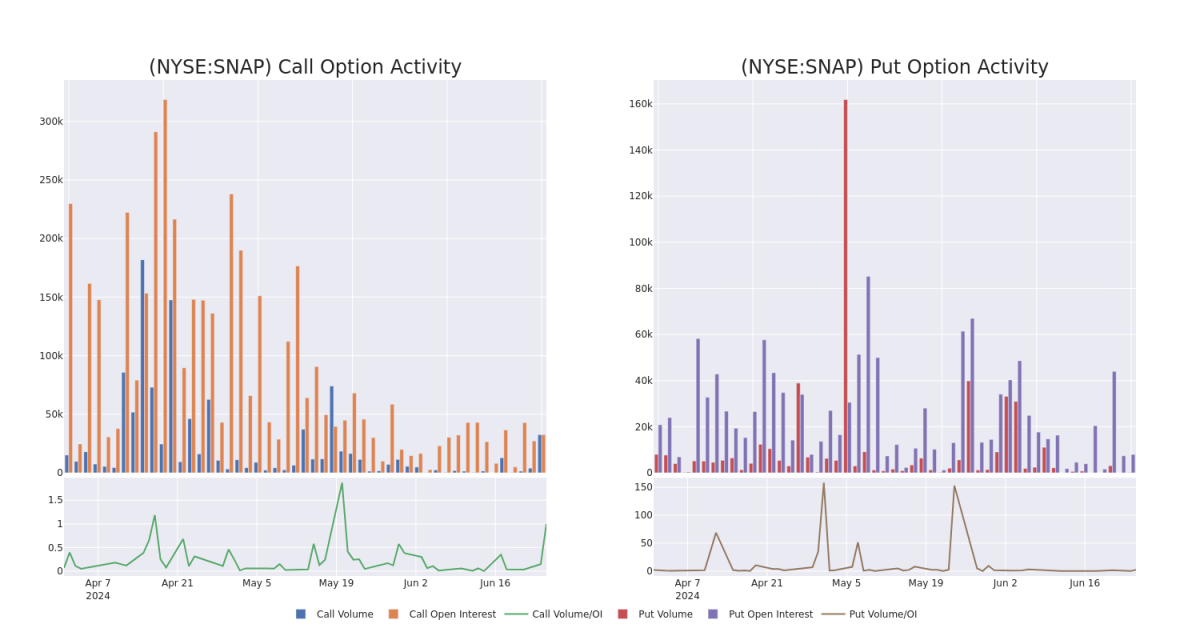

In today's trading context, the average open interest for options of Snap stands at 2593.38, with a total volume reaching 648.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Snap, situated within the strike price corridor from $10.0 to $22.0, throughout the last 30 days.

在今天的交易背景下,Snap期权的平均持仓量为2593.38,总成交量达到648.00。附带的图表描绘了过去30天Snap高价值交易的看涨和看跌期权成交量和持仓量的变化情况,位于10.0美元至22.0美元的行权价格走廊内。

Snap Call and Put Volume: 30-Day Overview

Snap看涨和看跌期权成交量概览:30天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | PUT | SWEEP | BEARISH | 01/17/25 | $6.55 | $6.5 | $6.55 | $22.00 | $122.4K | 1.3K | 0 |

| SNAP | PUT | SWEEP | BULLISH | 09/20/24 | $2.75 | $2.74 | $2.74 | $18.00 | $43.2K | 451 | 0 |

| SNAP | PUT | SWEEP | BULLISH | 05/16/25 | $0.89 | $0.79 | $0.79 | $10.00 | $39.5K | 1.5K | 0 |

| SNAP | CALL | TRADE | BULLISH | 07/19/24 | $1.7 | $1.69 | $1.7 | $15.00 | $32.3K | 8.0K | 9 |

| SNAP | CALL | SWEEP | BULLISH | 09/20/24 | $1.54 | $1.51 | $1.54 | $18.00 | $27.5K | 1.9K | 9 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | 看跌 | SWEEP | 看淡 | 01/17/25 | $ 6.55 | $6.5 | $ 6.55 | $22.00 | $122.4K | 1.3K | 0 |

| SNAP | 看跌 | SWEEP | 看好 | 09/20/24 | $2.75 | $2.74 | $2.74 | $18.00 | $43.2K | 451 | 0 |

| SNAP | 看跌 | SWEEP | 看好 | 05/16/25 | $0.89 | $0.79 | $0.79 | $10.00 | $39.5千 | 1.5K | 0 |

| SNAP | 看涨 | 交易 | 看好 | 07/19/24 | $1.7 | $1.69 | $1.7 | 15.00美元 | $32.3K | 8.0K | 9 |

| SNAP | 看涨 | SWEEP | 看好 | 09/20/24 | $1.54 | $1.51 | $1.54 | $18.00 | $27.5K | 1.9K | 9 |

About Snap

关于Snap

Snap owns one of the most popular social networking apps, Snapchat, claiming more than 400 million daily active users as of the end of 2023. Snap generates nearly all its revenue from advertising. While only about one quarter of users are in North America, the region accounts for about 65% of sales.

Snap拥有最受欢迎的社交网络应用程序之一Snapchat,在2023年底拥有超过4亿日活跃用户。Snap几乎所有的收入都来自广告。尽管只有大约四分之一的用户在北美,但该地区占销售额的约65%。

Where Is Snap Standing Right Now?

Snap目前所处的地位在哪里?

- With a trading volume of 4,639,239, the price of SNAP is down by -0.06%, reaching $16.7.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 27 days from now.

- Snap交易量为4,639,239,价格下跌了0.06%,达到了16.7美元。

- 当前RSI值表明该股票可能接近超买状态。

- 下一个财报将在27天后发布。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Snap with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高的利润潜力。精明的交易者通过持续的教育、战略性的交易调整、利用各种因子以及保持市场动态的关注来降低这些风险。通过Benzinga Pro获取Snap的最新期权交易,获得实时提示。