Block Options Trading: A Deep Dive Into Market Sentiment

Block Options Trading: A Deep Dive Into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bullish stance on Block.

拥有大量资金的鲸鱼已经明显看涨Block。

Looking at options history for Block (NYSE:SQ) we detected 13 trades.

查看Block(纽交所:SQ)的期权历史,我们检测到13笔交易。

If we consider the specifics of each trade, it is accurate to state that 61% of the investors opened trades with bullish expectations and 30% with bearish.

如果我们考虑每个交易的具体情况,可以准确地说,61%的投资者对看好行情的交易开仓,30%的投资者对看淡行情的交易开仓。

From the overall spotted trades, 9 are puts, for a total amount of $569,064 and 4, calls, for a total amount of $138,661.

在整个交易中,卖出期权9手,总价值为569,064美元,买入期权4手,总价值为138,661美元。

Predicted Price Range

预测价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $42.5 and $82.5 for Block, spanning the last three months.

评估交易量和未平仓合约后,可以发现主要的市场动力正在关注于Block的价格区间,跨越了过去三个月中的42.5美元到82.5美元之间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

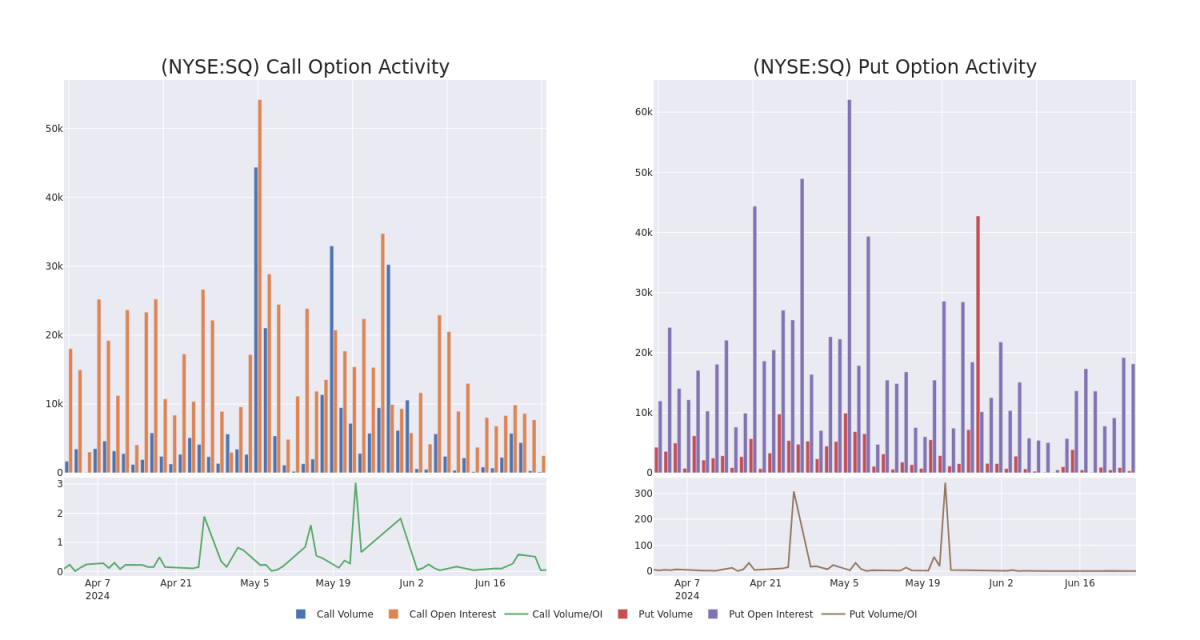

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Block's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Block's whale trades within a strike price range from $42.5 to $82.5 in the last 30 days.

在交易期权时,查看交易量和未平仓合约是一个强有力的策略。这些数据可以帮助您跟踪Block的某个执行价格的期权的流动性和利益。下面,我们可以观察到在过去30天内,在42.5美元到82.5美元执行价格范围内的所有Block鲸鱼交易的认购和认沽期权的成交量和未平仓合约的演变。

Block Option Activity Analysis: Last 30 Days

Block期权活动分析:最近30天

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | PUT | TRADE | BULLISH | 01/17/25 | $1.45 | $1.39 | $1.39 | $42.50 | $125.1K | 1.7K | 0 |

| SQ | PUT | SWEEP | BEARISH | 08/16/24 | $5.5 | $5.4 | $5.5 | $65.00 | $110.0K | 2.4K | 16 |

| SQ | PUT | SWEEP | BULLISH | 06/20/25 | $6.9 | $6.8 | $6.8 | $55.00 | $90.4K | 2.8K | 173 |

| SQ | PUT | SWEEP | BULLISH | 08/16/24 | $3.1 | $3.0 | $3.03 | $60.00 | $60.1K | 1.2K | 85 |

| SQ | PUT | SWEEP | BULLISH | 07/19/24 | $1.33 | $1.29 | $1.29 | $60.00 | $52.5K | 4.2K | 30 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | 看跌 | 交易 | 看好 | 01/17/25 | $1.45 | $1.39 | $1.39 | $42.50 | $125.1千美元 | 1.7K | 0 |

| SQ | 看跌 | SWEEP | 看淡 | 08/16/24 | $5.5 | $5.4 | $5.5 | $65.00 | $110.0K | 2.4K | 16 |

| SQ | 看跌 | SWEEP | 看好 | 06/20/25 | $6.9 | $6.8 | $6.8 | $55.00 | $90.4K | 2.8K | 173 |

| SQ | 看跌 | SWEEP | 看好 | 08/16/24 | $3.1 | $3.0 | $3.03 | $60.00 | $60.1K | 1.2K | 85 |

| SQ | 看跌 | SWEEP | 看好 | 07/19/24 | $1.33 | $1.29 | $1.29 | $60.00 | $52.5K | 4.2千 | 30 |

About Block

关于Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

成立于2009年的Block为商家提供支付服务及相关服务。公司还推出了Cash App,一款人对人的支付网络。在2023年,Square的支付金额略超过2亿美元。

Present Market Standing of Block

Block的现在市场地位

- With a trading volume of 2,464,918, the price of SQ is down by -0.86%, reaching $63.47.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 36 days from now.

- SQ的交易量为2,464,918,价格下跌0.86%,至63.47美元。

- 目前的RSI值表明该股票目前处于超买和超卖之间的中立状态。

- 下一个盈利报告将于36天后发布。

What The Experts Say On Block

专家对Block的看法

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $90.0.

在过去30天中,总共有2位专业分析师发表了他们对这只股票的看法,并设定了平均目标价格为90.0美元。

- Maintaining their stance, an analyst from Susquehanna continues to hold a Positive rating for Block, targeting a price of $100.

- An analyst from Goldman Sachs has revised its rating downward to Buy, adjusting the price target to $80.

- Susquehanna的分析师继续保持看好Block的立场,将目标价设定在100美元。

- 高盛的分析师将评级调降为买入,调整价格目标至80美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Block options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在利润。精明的交易员通过不断学习、调整策略、监控多个因子和密切关注市场动态来管理这些风险。随时在Benzinga Pro上了解最新的Block期权交易动态。