Individual Investors Invested in Anhui Heli Co.,Ltd. (SHSE:600761) Copped the Brunt of Last Week's CN¥1.1b Market Cap Decline

Individual Investors Invested in Anhui Heli Co.,Ltd. (SHSE:600761) Copped the Brunt of Last Week's CN¥1.1b Market Cap Decline

Key Insights

主要见解

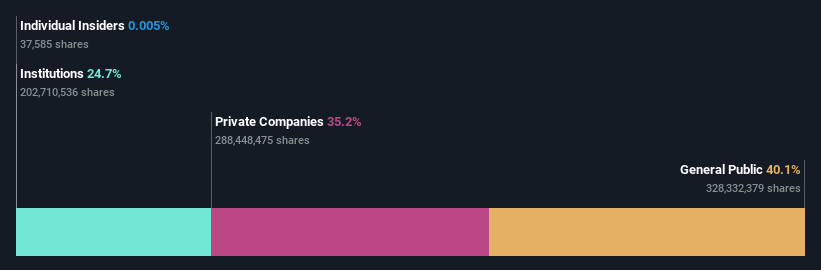

- Significant control over Anhui HeliLtd by individual investors implies that the general public has more power to influence management and governance-related decisions

- 50% of the business is held by the top 12 shareholders

- Institutions own 25% of Anhui HeliLtd

- 个人投资者在安徽合力有限公司拥有的重大控制权意味着普通公众有更多的权力来影响管理和治理相关决策。

- 前12名股东持有该业务的50%。

- 机构拥有安徽合力有限公司的25%。

Every investor in Anhui Heli Co.,Ltd. (SHSE:600761) should be aware of the most powerful shareholder groups. The group holding the most number of shares in the company, around 40% to be precise, is individual investors. Put another way, the group faces the maximum upside potential (or downside risk).

安徽合力股份有限公司(SHSE:600761)的每个投资者都应该知道最强大的股东群体。拥有公司股份最多的群体约40%,具体来说是个人投资者。换句话说,该群体面临着最大的上行潜力(或下行风险)。

As a result, individual investors as a group endured the highest losses last week after market cap fell by CN¥1.1b.

因此,个人投资者作为一个群体,在市值下跌CN¥11亿后上周遭受了最大的损失。

Let's take a closer look to see what the different types of shareholders can tell us about Anhui HeliLtd.

让我们更仔细地看看不同类型的股东给我们关于安徽合力有限公司的什么信息。

What Does The Institutional Ownership Tell Us About Anhui HeliLtd?

机构所有权对安徽合力有限公司的启示是什么?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

机构通常在向自己的投资者报告时会针对一个基准进行衡量,因此一旦某只股票被纳入主要指数,他们通常会更加热衷于该股票。我们预计大多数公司都会有一些机构在登记簿上,尤其是那些正在增长的公司。

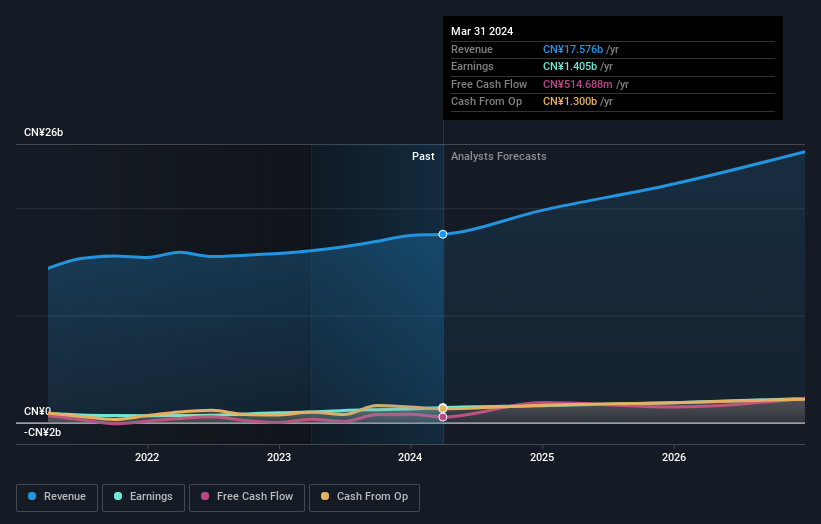

Anhui HeliLtd already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Anhui HeliLtd, (below). Of course, keep in mind that there are other factors to consider, too.

安徽合力有限公司已经有机构在持股名册上。实际上,他们在公司中拥有可观的股份。这意味着为这些机构工作的分析师已经看了这只股票并且他们喜欢它。但是就像其他人一样,他们也可能会错。如果两个大型机构投资者同时试图卖出一只股票,那么看到一个大跌是很常见的。因此,值得检查安徽合力有限公司的过去收益轨迹(如下所示)。当然,也要记住还有其他要考虑的因素。

Hedge funds don't have many shares in Anhui HeliLtd. Anhui Forklift Truck Group Co., Ltd. is currently the largest shareholder, with 35% of shares outstanding. With 2.2% and 1.8% of the shares outstanding respectively, Invesco Great Wall Fund Management Co. Ltd and China Southern Asset Management Co., Ltd. are the second and third largest shareholders.

对于安徽合力有限公司,对冲基金没有太多的股份。安徽叉车集团有限公司是目前拥有35%流通股的最大股东。中国南方资产管理股份有限公司和景顺长城基金管理有限公司分别拥有流通股的2.2%和1.8%,是第二和第三大股东。

After doing some more digging, we found that the top 12 have the combined ownership of 50% in the company, suggesting that no single shareholder has significant control over the company.

经过一些调查,我们发现前12名股东在公司中拥有50%的股份,表明没有单一股东对公司具有重大控制权。

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

尽管有道理去研究一家公司的机构所有权数据,但了解分析师的观点也很有道理,以便知道市场的风向。由于相当多的分析师涵盖了该股票,因此您可以很容易地研究预测的增长。

Insider Ownership Of Anhui HeliLtd

安徽合力有限公司内部所有权

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

公司内部人员的定义可能是主观的,并在不同的司法管辖区之间有所不同。我们的数据反映了个人内部人员,至少包括董事会成员。管理层最终向董事会负责。然而,经理们成为执行董事会成员并不罕见,尤其是如果他们是创始人或首席执行官。

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

我通常认为内部人士持股是一件好事。但是,在某些情况下,它会使其他股东更难以对董事会的决定进行问责。

Our information suggests that Anhui Heli Co.,Ltd. insiders own under 1% of the company. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. It's a big company, so even a small proportional interest can create alignment between the board and shareholders. In this case insiders own CN¥798k worth of shares. It is always good to see at least some insider ownership, but it might be worth checking if those insiders have been selling.

我们的信息表明,安徽合力有限公司的内部人士拥有不到1%的股份。但我们注意到,内部人士可能通过私人公司或其他公司结构间接持有利益。这是一个大公司,所以即使一个小比例的股份也会在董事会和股东之间产生协作关系。在这种情况下,内部人士拥有价值CN¥79.8万的股份。看到至少有一些内部人士的所有权总是好的,但也值得检查这些内部人士是否一直在减持。

General Public Ownership

一般大众所有权

The general public-- including retail investors -- own 40% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

包括散户在内的大众拥有该公司40%的股份,因此很难被忽视。尽管这群人不能通过股份来直接控制公司,但肯定会对公司的运行产生实际的影响。

Private Company Ownership

私有公司的所有权

It seems that Private Companies own 35%, of the Anhui HeliLtd stock. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

似乎私人公司持有安徽合力有限公司的35%股份。私人公司可能是相关方。有时,内部人士通过私人公司持有公共公司的利益,而不是作为个人持股。虽然很难得出任何广泛的结论,但还是值得注意作为进一步研究的区域。

Next Steps:

下一步:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Anhui HeliLtd .

虽然考虑拥有一家公司的不同群体都值得,但还有其他更重要的因素。因此,您应该了解我们已经发现的安徽合力有限公司的2个警告信号。

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

但最终,决定该业务所有者将获得多大利益的是未来而非过去。因此,我们认为最好查看此免费报告,以了解分析师是否预测更光明的未来。

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

注:本文中的数据是使用最后一个财务报表日期结束的为期12个月的数据计算的。这可能与全年年度报告数据不一致。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?关于内容有所顾虑?直接和我们联系。或电邮 editorial-team (at) simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

对本文有反馈?关于内容有所顾虑?直接和我们联系。或者,也可以发送电子邮件至editorial-team@simplywallst.com