Behind the Scenes of CVS Health's Latest Options Trends

Behind the Scenes of CVS Health's Latest Options Trends

Deep-pocketed investors have adopted a bullish approach towards CVS Health (NYSE:CVS), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CVS usually suggests something big is about to happen.

资金雄厚的投资者已经采取了看好西维斯健康(纽交所:CVS)的方法,这是市场参与者不应忽视的。我们在Benzinga追踪的公共期权记录揭示了这一重要的动态。这些投资者的身份还未知,但是在西维斯健康(CVS)出现如此重大的动态时,通常意味着即将发生一些重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for CVS Health. This level of activity is out of the ordinary.

我们今天从观察中得到了这些信息,当Benzinga的期权扫描仪突出了CVS Health的9个非同寻常的期权活动时。这种活动水平是不寻常的。

The general mood among these heavyweight investors is divided, with 55% leaning bullish and 44% bearish. Among these notable options, 6 are puts, totaling $323,459, and 3 are calls, amounting to $149,731.

这些重量级投资者的总体情绪是分裂的,55%倾向于看涨,44%倾向于看跌。在这些值得注意的期权中,6个是认购期权,总计323,459美元,而3个是认沽期权,总计149,731美元。

What's The Price Target?

价格目标是什么?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $37.5 and $65.0 for CVS Health, spanning the last three months.

在评估交易量和持仓量后,显然,主要市场运动者正在关注西维斯健康的价格区间,该区间为37.5美元至65.0美元,涵盖了过去三个月。

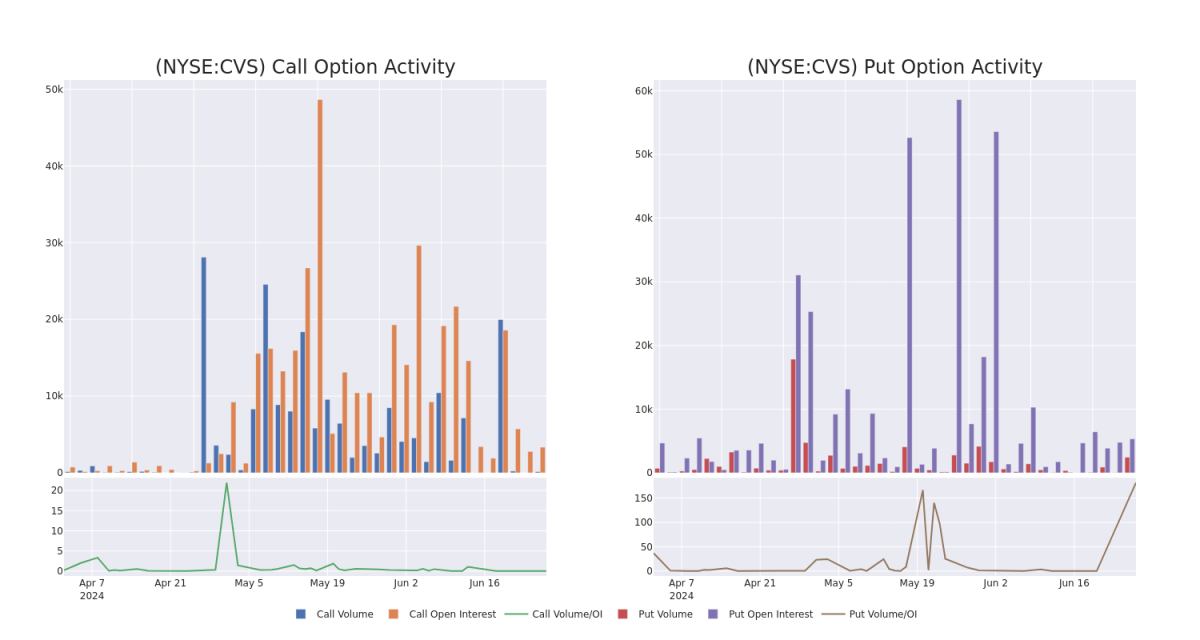

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in CVS Health's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to CVS Health's substantial trades, within a strike price spectrum from $37.5 to $65.0 over the preceding 30 days.

评估交易量和持仓量是期权交易的战略步骤。这些指标揭示了CVS Health特定行使价的期权的流动性和投资者兴趣。即将到来的数据可视化了过去30天内,$37.5美元至$65.0美元行使价范围内与CVS Health大额交易相关的认购期权和认沽期权的交易和持仓量波动。

CVS Health 30-Day Option Volume & Interest Snapshot

西维斯健康30天期权成交量和持仓量快照

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVS | CALL | TRADE | BEARISH | 01/17/25 | $2.62 | $2.5 | $2.5 | $65.00 | $75.0K | 3.2K | 8 |

| CVS | PUT | SWEEP | BEARISH | 07/19/24 | $0.74 | $0.5 | $0.74 | $56.00 | $61.5K | 12 | 2.0K |

| CVS | PUT | TRADE | BULLISH | 07/19/24 | $0.82 | $0.72 | $0.73 | $56.00 | $60.8K | 12 | 167 |

| CVS | PUT | SWEEP | BEARISH | 12/18/26 | $4.2 | $2.54 | $2.8 | $40.00 | $60.3K | 456 | 0 |

| CVS | PUT | SWEEP | BEARISH | 08/16/24 | $2.73 | $2.69 | $2.7 | $57.50 | $54.0K | 4.2K | 32 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVS | 看涨 | 交易 | 看淡 | 01/17/25 | $2.62 | $2.5 | $2.5 | $65.00 | $75.0K | 3.2K | 8 |

| CVS | 看跌 | SWEEP | 看淡 | 07/19/24 | 每加元0.74 | $0.5 | 每加元0.74 | $56.00 | $61.5K | 12 | 2.0K |

| CVS | 看跌 | 交易 | 看好 | 07/19/24 | $0.82 | 0.72美元 | 0.73美元 | $56.00 | $60.8K | 12 | 167 |

| CVS | 看跌 | SWEEP | 看淡 | 12/18/26 | $4.2 | $2.54 | $2.8 | $40.00 | $60.3K | 456 | 0 |

| CVS | 看跌 | SWEEP | 看淡 | 08/16/24 | $2.73 | $2.69 | $2.7 | $57.50 | $54.0K | 4.2千 | 32 |

About CVS Health

关于西维斯健康

CVS Health offers a diverse set of healthcare services. Its roots are in its retail pharmacy operations, where it operates over 9,000 stores primarily in the us. CVS is also a large pharmacy benefit manager (acquired through Caremark), processing about 2 billion adjusted claims annually. It also operates a top-tier health insurer (acquired through Aetna) where it serves about 26 million medical members. The company's recent acquisition of Oak Street adds primary care services to the mix, which could have significant synergies with all its existing business lines.

CVS Health提供多样化的医疗保健服务。它的根源在于其零售药店业务,主要在美国拥有超过9,000家门店。CVS还是大型药店效益管理者(通过Caremark收购),每年处理约20亿个调整后的索赔。它还运营着一家顶尖的健康保险公司(通过Aetna收购),为大约2,600万名医疗成员提供服务。其最近收购的Oak Street为混合服务增加了初级保健服务,这可能与其所有现有业务线具有重要的协同效应。

Where Is CVS Health Standing Right Now?

西维斯健康现在处于什么状态?

- Trading volume stands at 3,119,134, with CVS's price down by -4.22%, positioned at $58.07.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 34 days.

- 交易量为3,119,134股,CVS Health的价格下跌了-4.22%,定位于58.07美元。

- RSI指标显示该股票可能接近超买。

- 将在34天内公布盈利报告。

What The Experts Say On CVS Health

专家对西维斯健康的评价

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $68.33333333333333.

在过去30天内,共有3名专业分析师对该股票发表了意见,设定了68.33333333333333美元的平均目标价。

- An analyst from JP Morgan has decided to maintain their Overweight rating on CVS Health, which currently sits at a price target of $86.

- An analyst from Baird has revised its rating downward to Neutral, adjusting the price target to $61.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Neutral with a new price target of $58.

- 来自摩根大通的分析师已决定维持他们对西维斯健康的超额评级,目前的价格目标为86美元。

- 来自贝尔德的分析师将其评级下调为中立,并将价格目标调整为61美元。

- 反映担忧,来自康泰纳仕的分析师将其评级下调为中立,并设定了新的58美元价格目标。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest CVS Health options trades with real-time alerts from Benzinga Pro.

期权交易提高了风险和潜在回报。精明的交易者通过不断地学习、调整策略、监控多种因子和密切关注市场动态来管理这些风险。通过Benzinga Pro的实时提醒,了解最新的西维斯健康期权交易情况。