PDD Holdings Unusual Options Activity

PDD Holdings Unusual Options Activity

Financial giants have made a conspicuous bullish move on PDD Holdings. Our analysis of options history for PDD Holdings (NASDAQ:PDD) revealed 74 unusual trades.

金融巨头对pdd holdings进行了明显的看好举动。我们对pdd holdings(NASDAQ:PDD)期权历史记录的分析显示,出现了74宗不同寻常的交易。

Delving into the details, we found 62% of traders were bullish, while 29% showed bearish tendencies. Out of all the trades we spotted, 29 were puts, with a value of $2,080,659, and 45 were calls, valued at $3,580,846.

进一步了解后,我们发现62%的交易员持有看涨期权,而29%的交易员则表现出看淡趋势。在我们发现的所有交易中,有29次是看跌期权,价值2080659美元;45次是看涨期权,价值3580846美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $105.0 to $180.0 for PDD Holdings over the recent three months.

根据交易活动,显然重要的投资者们正在瞄准PDD Holdings未来三个月的交易价位区间,从105.0美元到180.0美元之间。

Insights into Volume & Open Interest

成交量和持仓量分析

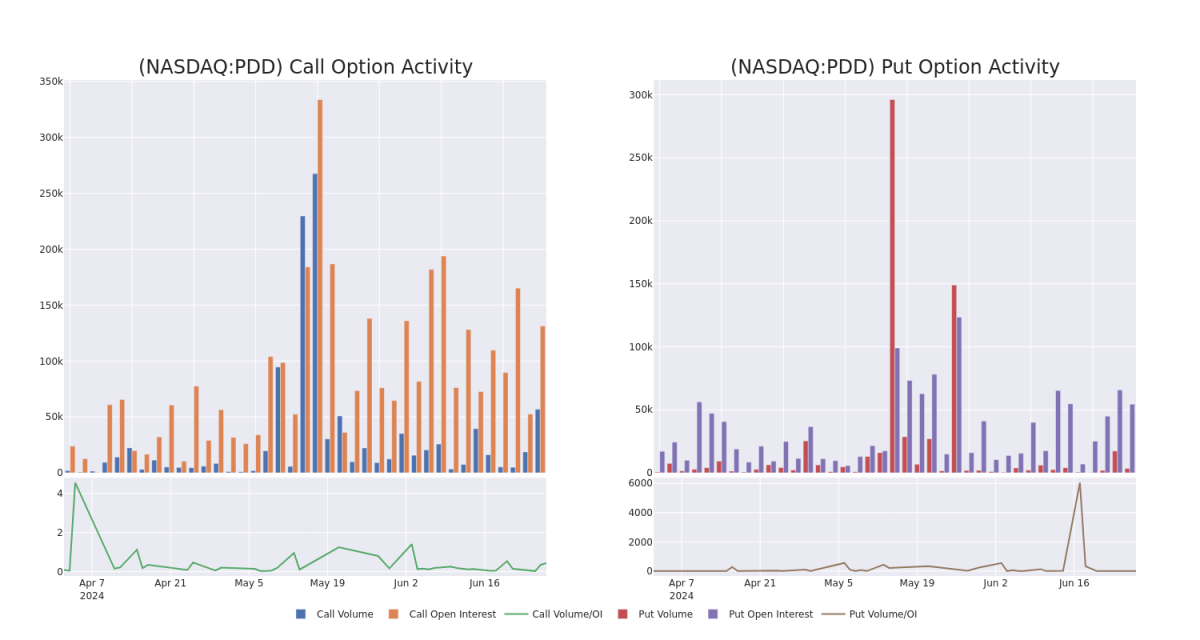

In today's trading context, the average open interest for options of PDD Holdings stands at 6883.67, with a total volume reaching 58,428.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in PDD Holdings, situated within the strike price corridor from $105.0 to $180.0, throughout the last 30 days.

在当前的交易环境下,PDD Holdings期权的平均持仓量为6883.67,总成交量达到58428.00。以下图表显示了在过去30天内,在strike price(行权价)区间从105.0美元到180.0美元内,PDD Holdings的看跌和看涨期权成交量和持仓量的变化。

PDD Holdings Option Volume And Open Interest Over Last 30 Days

PDD Holdings在过去30天内的期权成交量和未平仓金额

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | CALL | TRADE | BULLISH | 07/12/24 | $3.0 | $2.87 | $3.0 | $134.00 | $786.3K | 0 | 681 |

| PDD | CALL | TRADE | BULLISH | 01/16/26 | $47.65 | $46.2 | $47.6 | $105.00 | $476.0K | 52 | 2 |

| PDD | PUT | TRADE | BULLISH | 11/15/24 | $5.95 | $5.8 | $5.8 | $120.00 | $290.0K | 59 | 0 |

| PDD | CALL | TRADE | BULLISH | 01/16/26 | $48.2 | $47.1 | $48.2 | $105.00 | $255.4K | 52 | 206 |

| PDD | PUT | TRADE | BULLISH | 07/19/24 | $3.65 | $3.5 | $3.5 | $133.00 | $245.0K | 545 | 16 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | 看涨 | 交易 | 看好 | 07/12/24 | $3.0 | $2.87 | $3.0 | $134.00 | $786.3K | 0 | 681 |

| PDD | 看涨 | 交易 | 看好 | 01/16/26 | $47.65 | $46.2 | $47.6 | $105.00 | $476.0K | 52 | 2 |

| PDD | 看跌 | 交易 | 看好 | 11/15/24 | $5.95 | $5.8 | $5.8 | $120.00 | $290.0K | 59 | 0 |

| PDD | 看涨 | 交易 | 看好 | 01/16/26 | $48.2 | $47.1 | $48.2 | $105.00 | 255.4K | 52 | 206 |

| PDD | 看跌 | 交易 | 看好 | 07/19/24 | $3.65 | $3.5 | $3.5 | $133.00 | $245.0K | 545 | 16 |

About PDD Holdings

关于pdd holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. PDD aims to bring more businesses and people into the digital economy so that local communities and small businesses can benefit from the increased productivity and new opportunities. PDD has built a network of sourcing, logistics, and fulfillment capabilities that support its underlying businesses.

PDD Holdings是一家跨国商业集团,拥有和经营一系列业务。PDD的目标是将更多的企业和人们引入数字经济,从而使当地社区和小企业能从增加的生产率和新的机会中受益。PDD建立了一个支持其基础业务的采购、物流和履行能力网络。

Where Is PDD Holdings Standing Right Now?

PDD Holdings现在处于什么状态?

- Currently trading with a volume of 5,673,313, the PDD's price is down by -3.48%, now at $133.42.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 61 days.

- 目前的交易量为5673313股,PDD公司的股票价格下跌3.48%,报133.42美元。

- RSI读数表明该股票目前可能被超卖。

- 预计还有61天的财报发布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。