Market Whales and Their Recent Bets on ABT Options

Market Whales and Their Recent Bets on ABT Options

Financial giants have made a conspicuous bullish move on Abbott Laboratories. Our analysis of options history for Abbott Laboratories (NYSE:ABT) revealed 8 unusual trades.

金融巨头们对雅培公司进行了明显的看好操作。我们对雅培公司的期权历史进行分析(NYSE:ABT),发现有8次飞凡交易。

Delving into the details, we found 50% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $93,318, and 5 were calls, valued at $681,133.

具体来看,我们发现50%的交易者看涨,而37%显示出看淡的倾向。我们发现所有被发现的交易中有3次看跌,价值为$93,318,5次看涨,价值为$681,133。

What's The Price Target?

价格目标是什么?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $115.0 for Abbott Laboratories over the recent three months.

从交易活动来看,重要的投资者似乎瞄准了过去三个月雅培公司的价格区间,从$100.0到$115.0。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

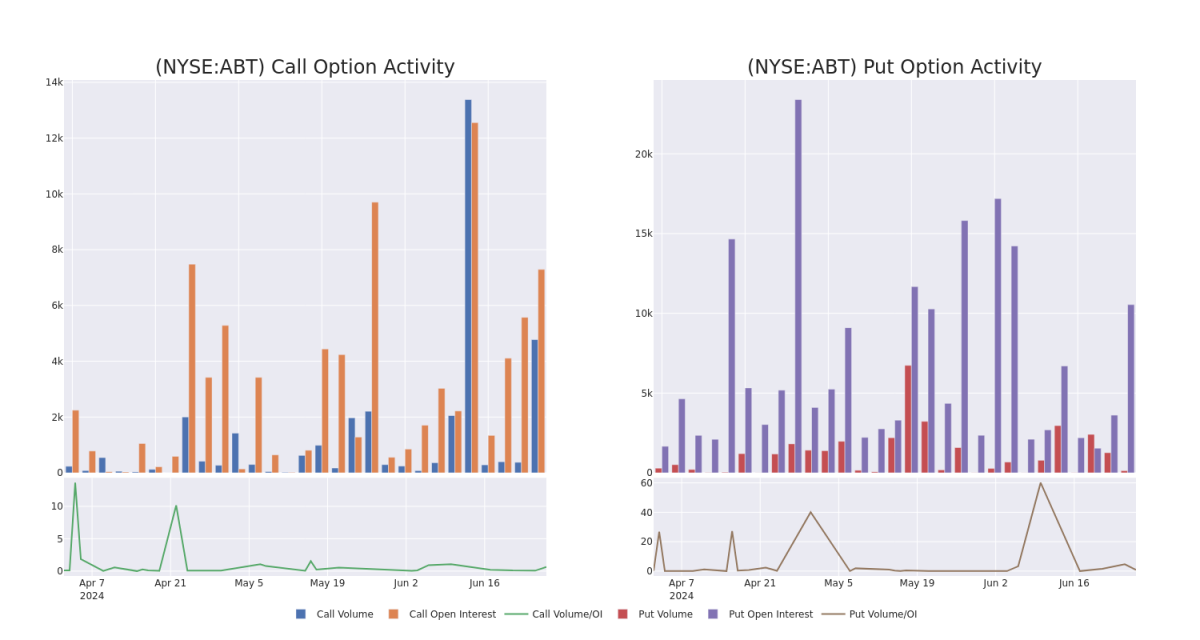

In terms of liquidity and interest, the mean open interest for Abbott Laboratories options trades today is 2972.17 with a total volume of 4,909.00.

就流动性和兴趣而言,雅培公司期权交易今天的平均未平仓合约量为2972.17,总成交量为4,909.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Abbott Laboratories's big money trades within a strike price range of $100.0 to $115.0 over the last 30 days.

在下图中,我们可以追踪雅培公司大宗交易的看跌和看涨期权成交量和未平仓合约的发展情况,范围在$100.0到$115.0之间,历时30天。

Abbott Laboratories Option Volume And Open Interest Over Last 30 Days

雅培公司在过去30天内的期权成交量和未平仓合约

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABT | CALL | SWEEP | NEUTRAL | 07/12/24 | $1.36 | $1.05 | $1.18 | $106.00 | $420.9K | 86 | 403 |

| ABT | CALL | TRADE | BULLISH | 08/16/24 | $1.12 | $1.06 | $1.11 | $110.00 | $166.5K | 5.7K | 109 |

| ABT | PUT | SWEEP | BEARISH | 07/12/24 | $0.7 | $0.63 | $0.7 | $102.00 | $35.0K | 25 | 20 |

| ABT | CALL | SWEEP | BULLISH | 11/15/24 | $1.96 | $1.85 | $1.96 | $115.00 | $34.4K | 1.4K | 4 |

| ABT | CALL | SWEEP | BULLISH | 07/12/24 | $1.04 | $1.03 | $1.04 | $106.00 | $32.8K | 86 | 4.2K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABT | 看涨 | SWEEP | 中立 | 07/12/24 | $1.36 | $1.05 | $1.18 | $106.00 | $420.9K | 86 | 403 |

| ABT | 看涨 | 交易 | 看好 | 08/16/24 | $1.12 | 1.06美元 | $1.11 | $110.00 | $166.5K | 5.7千 | 109 |

| ABT | 看跌 | SWEEP | 看淡 | 07/12/24 | 0.7美元 | $0.63 | 0.7美元 | $102.00 | $35.0K | 25 | 20 |

| ABT | 看涨 | SWEEP | 看好 | 11/15/24 | 1.96美元 | $1.85 | 1.96美元 | $115.00 | 成交量: $34.4K | 1.4千 | 4 |

| ABT | 看涨 | SWEEP | 看好 | 07/12/24 | $1.04 | $1.03 | $1.04 | $106.00 | $32.8千美元 | 86 | 4.2千 |

About Abbott Laboratories

关于Abbott Laboratories

Abbott manufactures and markets cardiovascular and diabetes devices, adult and pediatric nutritional products, diagnostic equipment and testing kits, and branded generic drugs. Products include pacemakers, implantable cardioverter defibrillators, neuromodulation devices, coronary stents, catheters, infant formula, nutritional liquids for adults, continuous glucose monitors, and immunoassays and point-of-care diagnostic equipment. Abbott derives approximately 60% of sales outside the United States.

Abbott Laboratories生产和销售心血管和糖尿病设备、成人和儿童营养产品、诊断设备和测试工具以及品牌通用药品。其产品包括起搏器、可植入式心律转复除颤器、神经调节器、冠状动脉支架、导管、婴儿配方奶粉、成人营养液、连续血糖监测仪、免疫测定和现场诊断设备。Abbott Laboratories约60%的销售额来自美国以外的市场。

After a thorough review of the options trading surrounding Abbott Laboratories, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对雅培公司的期权交易进行彻底审核后,我们进一步检查该公司的详细情况,包括对其当前市场状态和表现进行评估。

Where Is Abbott Laboratories Standing Right Now?

雅培公司目前处于什么位置?

- With a volume of 1,979,841, the price of ABT is down -0.59% at $104.26.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 21 days.

- 雅培的成交量为1,979,841,股票价格下跌了-0.59%,为$104.26。

- RSI指标暗示该股票可能要超买了。

- 预计下次发布收益报告距今21天。

What The Experts Say On Abbott Laboratories

专家对雅培公司的评论

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $123.0.

过去30天中,已有2位专业分析师对这只股票发表了看涨的评论,设定了平均目标价为$123.0。

- An analyst from Goldman Sachs has revised its rating downward to Buy, adjusting the price target to $121.

- In a cautious move, an analyst from RBC Capital downgraded its rating to Outperform, setting a price target of $125.

- 高盛的一位分析师已将其评级调降至买入,并将目标价调整为121美元。

- 在一个谨慎的举动中,RBC Capital将其评级降级为强于市场表现,设定目标价为125美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Abbott Laboratories options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在回报。精明的交易者通过不断学习、调整策略、监控多个因子和紧密关注市场变化来管理这些风险。通过Benzinga Pro实时警报了解最新的雅培公司期权交易情况。