Super Micro Computer Options Trading: A Deep Dive Into Market Sentiment

Super Micro Computer Options Trading: A Deep Dive Into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bullish stance on Super Micro Computer.

资本雄鲸在超微电脑上采取了显著的看好态度。

Looking at options history for Super Micro Computer (NASDAQ:SMCI) we detected 10 trades.

查看纳斯达克上超微电脑(NASDAQ:SMCI)的期权历史记录,我们发现了10笔交易。

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 20% with bearish.

如果我们考虑每笔交易的具体情况,可以准确地说,40%的投资者对好的预期进行了交易,而20%的投资者则以看淡为策略。

From the overall spotted trades, 5 are puts, for a total amount of $278,398 and 5, calls, for a total amount of $220,840.

从目前发现的交易中,有5份认购期权,总额为278398美元,还有5份认沽期权,总额为220840美元。

Predicted Price Range

预测价格区间

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $835.0 to $1130.0 for Super Micro Computer over the last 3 months.

考虑这些合同的成交量和持仓量,过去三个月内资本雄鲸一直瞄准超微电脑在835.0美元至1130.0美元的价格区间。

Volume & Open Interest Trends

成交量和未平仓量趋势

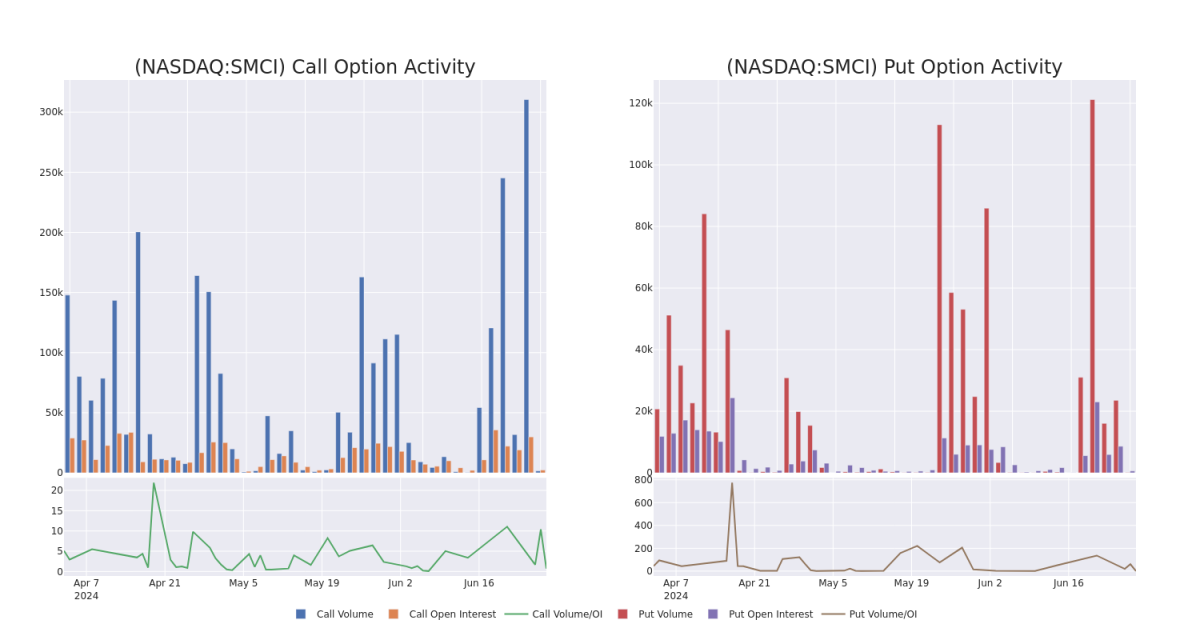

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Super Micro Computer's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Super Micro Computer's whale trades within a strike price range from $835.0 to $1130.0 in the last 30 days.

在交易期权时,关注成交量和持仓量是一种强有力的策略。这些数据可以帮助您追踪超微电脑期权在给定行使价格下的流动性和利益。下面,我们可以观察到在最近30天内,资本雄鲸在超微电脑的所有看好和看淡期权交易中,对835.0美元至1130.0美元行使价格区间下的认购和认沽期权的成交量和持仓量的变化。

Super Micro Computer 30-Day Option Volume & Interest Snapshot

超微电脑30天期权成交量和持仓量快照

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMCI | PUT | SWEEP | BEARISH | 12/20/24 | $170.0 | $161.8 | $170.0 | $900.00 | $153.0K | 6 | 0 |

| SMCI | CALL | TRADE | BULLISH | 09/20/24 | $146.5 | $144.8 | $146.5 | $860.00 | $87.9K | 177 | 0 |

| SMCI | CALL | TRADE | BULLISH | 06/28/24 | $57.5 | $55.0 | $64.0 | $835.00 | $51.2K | 238 | 0 |

| SMCI | PUT | TRADE | NEUTRAL | 07/12/24 | $49.0 | $47.0 | $48.0 | $880.00 | $38.4K | 30 | 15 |

| SMCI | PUT | TRADE | NEUTRAL | 07/19/24 | $41.8 | $40.2 | $40.91 | $850.00 | $32.7K | 278 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 超微 | 看跌 | SWEEP | 看淡 | 12/20/24 | $170.0 | $161.8 | $170.0 | $900.00 | $153.0K | 6 | 0 |

| 超微 | 看涨 | 交易 | 看好 | 09/20/24 | $146.5 | $144.8 | $146.5 | $860.00 | $87.9K | 177 | 0 |

| 超微 | 看涨 | 交易 | 看好 | 06/28/24 | $57.5 | $55.0 | $64.0 | $835.00 | $51.2K | 238 | 0 |

| 超微 | 看跌 | 交易 | 中立 | 07/12/24 | $49.0 | $47.0 | $48.0 | $880.00 | $38.4K | 30 | 15 |

| 超微 | 看跌 | 交易 | 中立 | 07/19/24 | $41.8 | $ 40.2 | $40.91 | $850.00 | $32.7K | 278 | 0 |

About Super Micro Computer

关于超微电脑

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and "Internet of Things" embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm's revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

超微电脑公司提供高效的服务器技术服务,面向云计算、数据中心、大数据、高性能计算和 "物联网" 嵌入式市场。其解决方案包括服务器、存储、叶片服务器、工作站、整个机架、网络设备和服务器管理软件。该公司采用一种模块化的架构方法,提供灵活性以提供定制化的解决方案。该公司在一个运营部门中运营,该部门基于一种创新、模块化和开放标准体系结构开发和提供高性能服务器解决方案。该公司的营收超过一半来自美国,其余来自欧洲、亚洲和其他地区。

In light of the recent options history for Super Micro Computer, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考虑到超微电脑的期权历史记录,现在适合关注公司的本身表现。我们旨在探讨其当前表现。

Where Is Super Micro Computer Standing Right Now?

超微电脑现状如何?

- With a volume of 230,426, the price of SMCI is up 0.24% at $892.52.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 39 days.

- 超微电脑(SMCI)的交易量为230426,价格上涨0.24%,为892.52美元。

- RSI指标暗示该股票可能要超买了。

- 下次收益预计将在39天后公布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。