Advising the Affluent: Building High Net Worth Relationships With SMA Option Income

Advising the Affluent: Building High Net Worth Relationships With SMA Option Income

Guest Author: Rob Emrich III, Founder, Managing Partner, Acruence Capital

客座作者:Acruence Capital创始人、管理合伙人Rob Emrich III

Make no mistake about it: option income is here to stay. The proliferation of option strategies to generate income (risk premia) and the growth of Exchange-Traded Funds (ETFs) have been remarkable in the last five years with AUM growing from approximately $2 billion in 2019 to over $77.7 billion as of March 28, 2024 (see chart 1). ETFs are highly attractive vehicles for option strategies for various reasons, including tax efficiency, exchange listings for easy purchase and daily transparency.

毫无疑问:期权收入已经来临。过去五年中,以产生收入(风险溢价)的期权策略的泛滥和交易基金(ETF)的增长令人瞩目,资产管理规模从2019年的约20亿美元增长到2024年3月28日的超过777亿美元(见图表1)。ETF由于具有许多优势而成为期权策略的极具吸引力的工具,其中包括税收效率、易于购买的交易所上市和每日透明度。

Chart 1

图1

Source: Cboe Global Markets

来源:芝加哥期权交易所

Undoubtedly, the landscape of investment income is undergoing a transformation that is both dynamic and enduring. The integration of option strategies as a means to generate income has seen a significant surge in the last five years, marking a particularly notable expansion. Exchange-Traded Funds (ETFs), in this context, stand out as highly appealing instruments for implementing these option strategies. Their allure can be attributed to a host of advantages: they offer tax efficiency, are readily available on exchanges for convenient trading and boast a high degree of transparency. We have found that high net worth individuals, particularly those with a liquid net worth exceeding $5 million, often opt for separately managed accounts.

毫无疑问,投资收入的投资环境正在经历一场既动态又持久的转型。过去五年中,利用期权策略产生收入的整合已经出现了显著的增长,标志着一种特别引人注目的扩张。在这种情况下,交易基金(ETF)尤其突出,成为实施这些期权策略的极具吸引力的工具。它们的吸引力归因于许多优势:它们提供税收效率,方便交易所交易,并具有高度的透明度。我们发现,高净值个人,特别是那些流动净值超过500万美元的个人,经常选择分开管理的账户。

This article will discuss several reasons for this preference, including customization and the ability to use leverage. We'll also discuss the favorable tax treatment of the preferred contracts, and some lesser-known tax benefits, of which many advisors and even CPAs may not be aware.

本文将讨论这种偏好的几个原因,包括定制和使用杠杆的能力。我们还将讨论优先合同的有利税收待遇,以及一些很少被人知道的税收好处,其中许多顾问甚至注册会计师可能不知道。

Most put-write strategies in the marketplace share common features: a fixed tenor, a fixed strike distance, and the potential for significant drawdowns, as the sold puts are typically uncapped. Using these strategies within a separately managed account allows for extensive customization. However, we advise exercising caution, as excessive complexity can adversely affect the strategy's resilience and consistency. We have identified several areas where customization can enhance robustness.

市场上的大多数看跌策略具有共同点:固定的限期、固定的行权价距离,以及潜在的重大回撤,因为出售的看跌期权通常是无上限的。在分开管理的账户中使用这些策略可以进行广泛的定制。然而,我们建议行使谨慎,因为过度的复杂性可能会对策略的弹性和一致性产生不利影响。我们已经确定了几个可以增强韧性的领域。

Distance of Sold Put from Spot

距离现价的看跌期权的距离

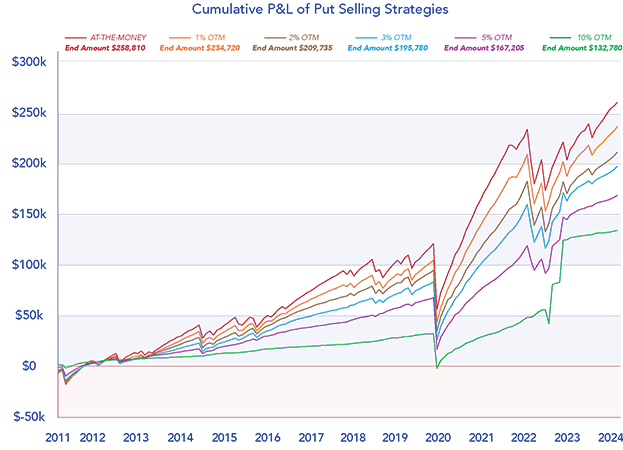

One approach is to dynamically adjust the sold put's distance from the current spot price (percent out-of-the-money). Unlike the Cboe PutWrite Index, which always writes put options at the money; varying the distance based on volatility or variance parameters provides a cushion. This adjustment produces a buffer zone which allows some market downturn without immediately affecting capital. However, there is a trade-off: while it may better preserve capital, it could result in lower premiums, as the distance from spot increases, premiums tend to decrease (see chart 2). This strategy can also potentially reduce variability and drawdowns, which could improve client retention by encouraging continued investment and potentially lead to better outcomes.

一种方法是根据当前现价(超出当前价格的百分比)动态调整看跌期权的距离。与Cboe PutWrite Index不同,Cboe PutWrite Index总是在当前的买卖价格(ATM)写入看跌期权。根据波动性或方差参数变化的距离提供了一个缓冲区。这种调整产生一个缓冲区,允许市场下跌一定程度而不立即影响资本。然而,存在一个权衡:虽然它可能更好地维护资本,但随着离现价的距离增加,保费 tend to 减少。这种策略还可以潜在地降低变化性和回撤,从而通过鼓励继续投资来提高客户保留率,从而潜在地带来更好的结果。

Chart 2

图表2

Source: Bloomberg Professional and WallachBeth Capital LLC

来源:Bloomberg Professional和WallachBeth Capital LLC

Customization

定制

Use a Put-Spread

使用看跌期权价差

Use of a put spread can significantly reduce downside exposure. Instead of selling a single leg (put) and exposing the client to undefined loss, a put spread with a clearly defined maximum loss, tailored to the client's risk tolerance, is often more attractive to investors. It allows them to remain invested with reduced risk, although it typically generates slightly lower income due to the cost of the purchased put that serves to cap the downside.

使用看跌期权价差可以显著降低下行风险。与出售单个腿(看跌期权)并使客户面临无限损失的方法相比,使用具有明确定义的最大损失的适合客户风险承受力的看跌期权价差对投资者更具吸引力。这使他们可以减少风险而保持投资,尽管由于购买的看跌期权成本导致其通常产生稍低的收入而限制了其收益下限。

Sell Puts Within a Desired Income Range

在所需收入范围内出售看跌期权

This parameter can have the benefit of reducing risk. A hypothetical example: In a low volatility regime (VIX 25) it may be possible to sell the put 10% OTM and still achieve the 7% annualized income target and reduce the probability of the sold put expiring ITM (in-the-money). This approach helps clients understand the associated risks: a strategy aiming for a 20% option premium inherently carries more risk than one aiming for 5%. While income targets offer no guarantees, they guide investors on the potential risk involved in option placements. The goal is to clearly communicate risk, not to promote the "income". Be mindful of industry regulations that prevent targeting specific returns.

该参数可以有助于降低风险。一个假想的例子:在低波动率的环境中(VIX25),则可能会将看跌期权卖出至超出当前价格的10% out-of-the-money 并仍能实现7%的年化收入目标,从而降低看跌期权到期时处于内在价值(in-the-money)的概率。该方法有助于客户理解相关风险:旨在获得20%期权溢价的策略固有地承担更多的风险,而旨在获得5%溢价的策略则固有地承担更少的风险。尽管收入目标没有任何保证,但它们以应对风险的方式引导投资者进行期权考虑。目标是明确传达风险,而不是促进“收入”。请注意,行业法规禁止针对特定回报的定位。

Add an On/Off Switch

添加一个开关

Based on our experience with put selling strategies during periods of high volatility (such as those in 2008 and 2020), we have observed that some clients prefer to move to cash which has significant implications for reentry. Consequently, it may be beneficial to devise a signal within your strategy that either diminishes exposure or deactivates the strategy entirely during times of increased volatility. While it is recognized that some of the richest premiums can be found during these tumultuous periods, such volatility may not be suitable for all investors. Implementing an on/off switch could effectively alleviate their concerns.

根据我们对看跌策略在高波动性期间(例如2008年和2020年)的经验,我们观察到,某些客户更喜欢转移到现金,这会对重新进入市场产生重大影响。因此,在增加波动性时,在你的策略中设计一个信号,要么减少敞口,要么完全停用该策略,可能会有利。虽然我们认识到在这些动荡时期可以找到一些最丰厚的保费,但这些波动可能不适合所有投资者。实施on/off开关可以有效缓解他们的担忧。

Staggered Strikes and Tenor

错开的行权价和期限

Staggering the strikes when selling put options can diminish the probability of those options expiring in the money. For instance, instead of selling the entire strategy's options 2% out of the money, one could distribute the strikes more diversely—1%, 2%, and 3% out of the money—allocating approximately 33% of the capital evenly across these strikes. This approach might be more appealing to certain investors who are prone to fixating on a single strike price each month, and it could also alleviate client anxiety at the time of option expiration. Moreover, the integration of staggered expirations may contribute to a reduction in client stress and aid in moderating volatility. For example, clients might opt for an assortment of expiration periods, such as 2, 3, and 4 weeks, or 30, 60, and 90 days, as opposed to adhering to the conventional "30-day standard." However, the trade-off for employing staggered strikes and expirations may make it more challenging to understand for both clients and advisors.

错开看跌期权的行权价可以降低这些期权到期时变为内在价值的概率。例如,与其将整个策略的选项从钱外2%卖出,不妨更加分散地分配这些行权价,向钱外1%、2%和3%分散分配,以大约均匀地将33%的资本分配到这些行权价上。这种方法对某些倾向于每个月盯住一个单一行权价的投资者更有吸引力,它还可以在期权到期时减轻客户的焦虑。此外,错开的到期期限可能有助于降低客户的压力,并有助于调节波动性。例如,客户可以选择不同的到期周期,例如2、3和4周,或30、60和90天,而不是坚持常规的“30天标准”。然而,采用错版行权价和到期期限的权衡可能会使客户和顾问都更难理解。

Add a "Grace Period"

添加一个“宽限期”

Allow a few trading days for expiration before a new option is required to be placed. For instance, the Cboe PutWrite Index typically writes puts the next immediate trading session after expiry. This can be problematic when there is a binary event with the potential to significantly move the markets. For example, it may be preferable to wait until after a non-farm payroll report, the outcome of a Federal Reserve meeting, or an election, rather than unnecessarily exposing the client to a significant event with an unpredictable outcome akin to a coin toss.

在到期前几个交易日,需要进行新期权投资。比如,Cboe PutWrite指数通常会在到期后的下一个交易日写空认购期权。当市场存在一个可能会显著影响市场的二元事件时,这可能会成为问题。例如,如果非农就业报告、联邦储备会议或选举的结果需要等待,那么最好等到这些事件结束后再进行交易,而不是让客户暴露在像抛硬币一样不可预测的重大风险中。

Use of "Smart" Leverage

使用“聪明的”杠杆

When an investor uses options to leverage their position, they amplify the potential returns on their investment. However, leverage is a double-edged sword. While it can magnify gains, it can magnify losses, using put spreads allows for the "dialing-in" of risk to the exact levels suitable for the investor. Smart Leverage in options is using option spreads to exactly define maximum loss and NEVER exceeding those levels.

当投资者使用期权加杠杆时,他们可以放大其投资的潜在回报。然而,杠杆是一把双刃剑。虽然它可以放大收益,但它也可以放大亏损。使用看跌期权套利可以将风险精确地调到适合投资者的水平。期权中的“聪明杠杆”是指使用期权套利来准确定义最大亏损并永远不超过这些级别。

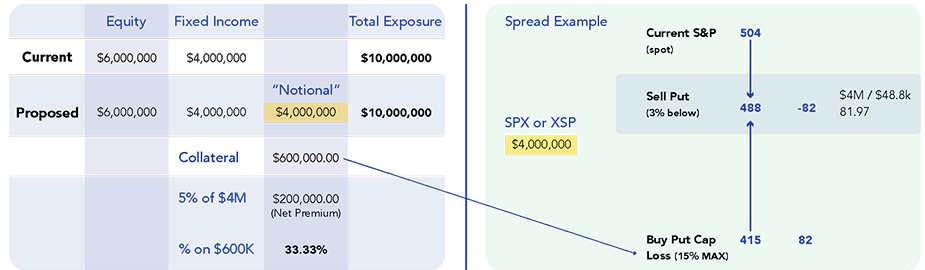

Let's walk through an example of using leverage with defined risk: (see chart 3)

让我们通过一个杠杆使用的定义风险的例子来理解:(见图3)

The advisor has determined suitability and decided to implement a put-spread strategy to potentially increase risk-adjusted returns. The investor has a $10 million portfolio, with $6 million allocated to equities and $4 million to bonds. The advisor aims to generate approximately $200,000 in annual income (risk premia), which is equivalent to 5% of the $4 million. Therefore, she allocates a notional value of $4 million to the 30-day put spread strategy and opts to cap the maximum loss of the put-spread strategy at 6% of the total portfolio value; 6% of $10 million equals $600,000. Consequently, the maximum loss on the spread amounts to 15% of the $4 million, which will occur only if the S&P 500 falls by 15% or more. The investor uses the bonds in the portfolio as "collateral" for the $600,000.

顾问已确定适宜性并决定实施看跌期权套利策略以潜在地增加风险调整后的回报。投资者有1000万美元的投资组合,其中600万美元用于股票,400万美元用于债券。顾问旨在产生约20万美元的年收入(风险溢价),相当于400万美元的5%。因此,她将400万美元的名义价值分配给30天期的看跌期权套利策略,并决定将看跌期权套利策略的最大亏损限制在总投资组合价值的6%以下;1000万美元的6%等于600000美元。因此,她的套利策略的最大亏损只占400万美元的15%,这只会在标普500指数下跌15%或以上的情况下出现。投资者使用投资组合中的债券作为交纳600,000美元的担保。

At present, XSP (1/10 of SPX) is trading at 504. The advisor determines that selling the 488 strike in 30 days (premiums omitted for simplicity) will satisfy the 5% income target she has set. She divides $4 million (notional value to layer on the portfolio) by $48,800 (488 x 100) to arrive at 82 contracts. To cap the downside at 15%, she selects 415 as the other "leg" of her trade (415 is 15% below 488). The spread, selling 82 XSP Put 488 and buying 82 XSP Put 415, is sold for a "credit" with the options expiring in 30 days. XSP options are European style, meaning they can only be exercised at expiration (although they can be sold in the secondary market at any time). If the XSP is trading above the sold strike of 488, the proceeds from the spread will be booked as profit (income). If XSP trades below 488 at expiration, resulting in a loss, the investor can choose to:

目前,XSP( 1/10 of SPX)交易价格为504。顾问确定在30天内卖出488行权价格的期权(简化起见,不考虑保费)可满足她设定的5%收入目标。她将400万美元(投资组合的名义价值)除以48,800美元(488 x 100)得出82个合同。为了将下行风险限制在15%以下,她选择另一个腿为415(比488低15%)。担保使用放空认购期权,即卖出82份 XSP Put 488,买入82份 XSP Put 415,以期权价值的“信贷”出售期权,并在30天后到期。XSP期权是欧式期权,意味着只有在到期时才可以行权(尽管它们可以在二级市场上随时出售)。如果XSP行权价格高于488,则收益将被列为利润(收入)。如果在到期日时XSP交易价格低于488,导致亏损,投资者可以选择:

Use margin to cover loss with hopes to pay off margin with future gains

Sell the collateral

Use funds from another source

使用保证金承担损失,希望用未来的收益抵消保证金

出售担保物

使用其他资金

Chart 3

图表3

Tax Advantages

税务优势

The benefits of 1256 contracts are not well-known in the retail advisory space by either advisors or clients. Our recommendation is for advisors to educate themselves on both options, 1256 contracts, and the potential tax advantages afforded to their clients. Index options that qualify as Section 1256 contracts benefit from the 60/40 rule. * According to IRS Publication 550 "Under the marked-to -market system 60% of your capital gain or loss will be treated as a long-term capital gain or loss and 40% will be treated as a short-term capital gain or loss. This is true regardless of how long you actually held the property."

1256合同的好处在零售顾问领域内很少为顾问或客户所知。我们建议顾问了解这两种期权,了解160合同所带来的潜在税务优势。可以作为1256合同的参考标准的指数期权可从60/40法则中受益。 * 根据IRS550号出版物“根据市场标记制度,你的资本收益或损失的60%将被视为长期资本收益或损失,40%将被视为短期资本收益或损失。这适用于无论你实际持有财产多长时间。”

As previously mentioned, there is one potential tax benefit of 1256 contracts that is rarely discussed. *The loss carryback election afforded to 1256 contracts is, in my opinion, a game-changer. From IRS Publication 550: "An individual having a net section 1256 contracts loss can generally elect to carry this loss back three years instead of over to the next year the laws carried back to any year under this election cannot be more than the net section 1256 contracts gained in that year."

正如先前提到的,1256合同有一个潜在的少有人谈及的税收优惠。 *我们认为1256合同拥有的亏损结转权是一个改变游戏规则的因素。根据IRS 550号出版物:“持有净1256合同亏损的个人通常可以选择将此损失往前推三年,而不是将此损失延迟到下一年。借助此选项往前移的任何年度的1256合同净收益总和不能超过该年度所获得的1256合同净收益总和。

In our experience, advisors with knowledge of this domain tend to experience enhanced client retention and benefit from increased referral rates from CPAs. These referrals are based on merit rather than the anticipation of reciprocal actions, indicating that CPAs recognize and trust the advisor's expertise to provide superior counsel to their clients.

根据我们的经验,了解这一领域的顾问往往会提高客户保留率,并从注册会计师那里获得增加的推荐率。这些引荐是基于卓越表现而非预期的相互行动,表明会计师认识和信任顾问在为客户提供超级咨询方面的专业知识。

Cboe Global Markets offers an impressive array of resources that can significantly enhance your ability to serve your clients effectively. By leveraging these tools, you may even enhance client outcomes. I firmly believe that the most effective advisors are those who consistently push beyond their comfort zones, committing to continuous learning for the ultimate benefit of their clients.

芝加哥期权交易所提供了一系列令人印象深刻的资源,可以显著增强您有效服务客户的能力。通过利用这些工具,您甚至可以提高客户的业绩。我坚信,最有效的顾问是那些始终超越自己的舒适区,致力于持续学习,以实现客户的最终效益。

*Please consult a tax attorney or CPA, as I am not a tax expert or CPA

*请咨询税务律师或会计师,因为我不是税务专家或会计师

About the Author

关于作者

Rob Emrich has over 20 years of investment experience. Rob began his financial services career in 2000 as a financial advisor with Morgan Stanley. He has since worked in the fields of consulting services and money management, including his work as Vice President with Alliance Bernstein and Director with Janus Capital, where he raised over $1 billion for these investment managers.

罗布·艾默里奇具有20年的投资经验。2000年,罗布以摩根士丹利的财务顾问身份开始了他的金融服务生涯。此后,他曾在咨询服务和资产管理领域工作,包括担任Alliance Bernstein的副总裁和Janus Capital的董事,为这些投资管理公司筹集了10亿美元以上的资金。

In 2010, he developed an algorithmic commodity trading system and ran a portfolio for four years, trading over $4 billion in notional value of oil and gas, interest rate and foreign currency futures. Rob is currently involved in developing and managing investment strategies, including the use of index options for hedging market risk and volatility. Rob has been quoted extensively on his market insight by Forbes, CNN Business, Business Insider, Wharton Business Radio and Yahoo Finance.

2010年,他开发了一种算法商品交易系统,并为四年统计了交易量超过40亿美元的油气、利率和外汇期货。罗布目前正在开发和管理投资策略,包括使用指数期权来对冲市场风险和波动性。罗布的市场见解被《福布斯》、CNN商业、商业内幕、沃顿商业广播和雅虎金融广泛引用。

This article is part of Cboe's Guest Author Series, where firms and individuals share their insights, strategies and ideas with the broader Cboe community. Interested in contributing? Email [email protected] or contact your Cboe representative to learn more.

本文是芝加哥期权交易所客座作者系列的一部分,其中公司和个人与更广泛的芝加哥期权交易所社区分享他们的见解、策略和思想。有兴趣贡献文章吗?请电子邮件联系 [email protected] 或联系您的芝加哥期权交易所代表,以了解更多信息。

Disclaimer: There are important risks associated with transacting in any of the Cboe Company products or any digital assets discussed here. Before engaging in any transactions in those products or digital assets, it is important for market participants to carefully review the disclosures and disclaimers contained at: . These products and digital assets are complex and are suitable only for sophisticated market participants. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle. The views of any third-party speakers or third-party materials are their own and do not necessarily represent the views of any Cboe Company. That content should not be construed as an endorsement or an indication by Cboe of the value of any non-Cboe financial product or service described.

免责声明:交易Cboe公司的产品或数字资产存在重要风险,对此进行任何交易之前,市场参与者应仔细查阅以下网站中包含的披露和免责声明:。这些产品和数字资产非常复杂,仅适合复杂的市场参与者。这些产品涉及损失风险,该风险可能很大,具体取决于产品类型,可能超过建立头寸时存入的金额。市场参与者只应将他们能够承受的不会影响其生活方式的资金放在风险中。任何第三方的发言或第三方材料的观点皆归其所有人所有,不代表Cboe公司的观点。这些内容不应被视为Cboe对所描述的任何非Cboe金融产品或服务价值的认可或指示。