Insights Into Eli Lilly and Co's Performance Versus Peers In Pharmaceuticals Sector

Insights Into Eli Lilly and Co's Performance Versus Peers In Pharmaceuticals Sector

In the fast-paced and highly competitive business world of today, conducting thorough company analysis is essential for investors and industry observers. In this article, we will conduct an extensive industry comparison, evaluating Eli Lilly and Co (NYSE:LLY) in relation to its major competitors in the Pharmaceuticals industry. Through a detailed examination of key financial metrics, market standing, and growth prospects, our objective is to provide valuable insights and illuminate company's performance in the industry.

在今天快节奏且高度竞争的商业世界中,进行彻底的公司分析对于投资者和行业观察者来说至关重要。在本文中,我们将进行广泛的行业比较,评估纽交所(MRK)在药品行业的主要竞争对手。通过对关键的财务指标、市场地位和增长前景进行详细的考察,我们的目标是提供有价值的见解,阐明该公司在行业中的表现。礼来公司(纽交所:LLY)默沙东生产多种药品,治疗多种领域的疾病,包括心代谢症、癌症和感染。在癌症领域,该公司的免疫肿瘤学平台正在成为总销售额的主要贡献者。该公司还具有实质性的疫苗业务,包括预防儿童疾病以及人类乳头瘤病毒(HPV)治疗。此外,默沙东出售与动物健康相关的药品。从地理角度来看,公司销售额的近一半来自于美国境内。

Eli Lilly and Co Background

礼来公司背景

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly's key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for diabetes; and Taltz and Olumiant for immunology.

礼来是一家专注于神经科学、心脏代谢、癌症和免疫学的制药公司。礼来的主要产品包括用于癌症的维津尼奥;马天尼罗、泽普邦、贾达信、特鲁利康、胰岛素诺和人用胰岛素用于糖尿病;以及用于免疫学的塔吉特和优泰乐。

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Eli Lilly and Co | 133.88 | 63.88 | 22.86 | 19.02% | $3.12 | $7.09 | 25.98% |

| Novo Nordisk A/S | 50.55 | 45.32 | 18.48 | 24.73% | $36.91 | $55.43 | 22.45% |

| Johnson & Johnson | 21.66 | 5.01 | 4.28 | 4.69% | $5.68 | $14.87 | 2.34% |

| Merck & Co Inc | 144.24 | 8.15 | 5.38 | 12.22% | $6.96 | $12.23 | 8.89% |

| AstraZeneca PLC | 38.61 | 6.47 | 5.13 | 5.69% | $4.47 | $10.46 | 16.55% |

| Novartis AG | 24.22 | 5.48 | 4.63 | 6.23% | $4.66 | $9.02 | 9.71% |

| Zoetis Inc | 34 | 15.92 | 9.31 | 11.91% | $0.93 | $1.55 | 9.5% |

| GSK PLC | 14 | 4.49 | 2.04 | 7.69% | $2.07 | $5.39 | 5.93% |

| Takeda Pharmaceutical Co Ltd | 45.23 | 0.89 | 1.53 | -0.04% | $86.09 | $668.37 | 9.91% |

| Dr Reddy's Laboratories Ltd | 18.83 | 3.73 | 3.76 | 4.77% | $20.32 | $41.48 | 12.49% |

| Jazz Pharmaceuticals PLC | 22.17 | 1.83 | 1.93 | -0.39% | $0.23 | $0.81 | 1.03% |

| Prestige Consumer Healthcare Inc | 16.70 | 2.10 | 3.10 | 3.04% | $0.09 | $0.15 | -3.11% |

| Corcept Therapeutics Inc | 30.53 | 6.09 | 6.76 | 5.22% | $0.03 | $0.14 | 38.95% |

| Average | 38.4 | 8.79 | 5.53 | 7.15% | $14.04 | $68.33 | 11.22% |

| 公司 | 市销率P/S | 净资产收益率ROE | 息税前收入EBITDA (以十亿计) | 毛利润 (以十亿计) | 营收增长 | CrowdStrike Holdings Inc (847.84) | 营业收入增长 |

|---|---|---|---|---|---|---|---|

| 礼来公司 | 133.88 | 63.88 | 22.86 | 19.02% | $3.12 | $7.09 | 25.98% |

| 诺和诺德 | 50.55 | 45.32 | 18.48 | 24.73% | $36.91 | $55.43 | 22.45% |

| 强生公司 | 21.66 | 5.01 | 4.28 | 4.69% | $5.68 | $14.87 | 2.34% |

| 默沙东(MRK)公司名称 | 144.24 | 8.15 | 5.38 | 12.22% | $6.96 | $12.23 | 8.89% |

| 阿斯利康有限公司 | 38.61 | 6.47 | 5.13 | 5.69% | $4.47 | $10.46 | 16.55% |

| 诺华制药 | 24.22 | 5.48 | 4.63 | 6.23% | $4.66 | $9.02 | 9.71% |

| Zoetis公司 | 34 | 15.92 | 9.31 | 11.91% | $0.93 | $1.55 | 9.5% |

| 葛兰素史克制药 | 14 | 4.49 | 2.04 | 7.69% | $2.07 | $5.39 | 5.93% |

| 武田制药股份有限公司 | 45.23 | 0.89 | 1.53 | -0.04% | $86.09 | $668.37 | 9.91% |

| 如瑞迪博士(Dr Reddy's Laboratories Ltd) | 18.83 | 3.73 | 3.76 | 4.77% | $20.32 | $41.48 | 12.49% |

| 雅培制药有限公司 | 22.17 | 1.83 | 1.93 | -0.39% | $0.23 | $0.81 | 1.03% |

| 普雷斯蒂奇消费保健公司 | 16.70 | 2.10 | 3.10 | 3.04% | $0.09 | 0.15美元 | -3.11% |

| 科汇生物 | 30.53 | 6.09 | 6.76 | 5.22% | 0.03美元 | 0.14美元 | 38.95% |

| 平均值 | 38.4 | 8.79 | 5.53 | 7.15% | $14.04 | $68.33 | 11.22% |

By closely examining Eli Lilly and Co, we can identify the following trends:

通过仔细研究礼来,我们可以确定以下趋势:

The current Price to Earnings ratio of 133.88 is 3.49x higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

The elevated Price to Book ratio of 63.88 relative to the industry average by 7.27x suggests company might be overvalued based on its book value.

With a relatively high Price to Sales ratio of 22.86, which is 4.13x the industry average, the stock might be considered overvalued based on sales performance.

The Return on Equity (ROE) of 19.02% is 11.87% above the industry average, highlighting efficient use of equity to generate profits.

With lower Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $3.12 Billion, which is 0.22x below the industry average, the company may face lower profitability or financial challenges.

With lower gross profit of $7.09 Billion, which indicates 0.1x below the industry average, the company may experience lower revenue after accounting for production costs.

With a revenue growth of 25.98%, which surpasses the industry average of 11.22%, the company is demonstrating robust sales expansion and gaining market share.

当前市盈率为133.88。3.49x高于行业平均水平,表明该股票在市场情绪下被定价为溢价水平。

市净率为40.11,相对于行业板块水平高出5.78x,表明公司可能被高估,基于其账面价值。63.88相对于行业板块水平高出5.78x7.27x表明公司可能被高估,基于其账面价值。

由于市销率达到6.88x,高于行业平均水平,因此从销售业绩的角度来看,该股票可能被认为被高估了。22.86,该值是4.13x由于盈利之前的利息、税、折旧和摊销(EBITDA)低于行业平均水平的0.01x,该公司可能面临较低的盈利能力或财务挑战。

该公司的roe19.02%。11.87%高于行业平均水平,突显出资产、权益的高效利用带来的盈利。

由于其更低的息税折旧及摊销前利润(EBITDA)为$3.12十亿美元,该值是0.22倍这表示公司具有更低的毛利润水平,低于行业平均水平。

由于较低的毛利润$7.09十亿美元,表明0.1倍低于行业平均水平,该公司可能在考虑生产成本后,经历较低的营业收入。

营业收入增长为25.98%,超过了行业平均水平的11.22%,说明公司展示了强劲的销售扩张并获得了市场份额。

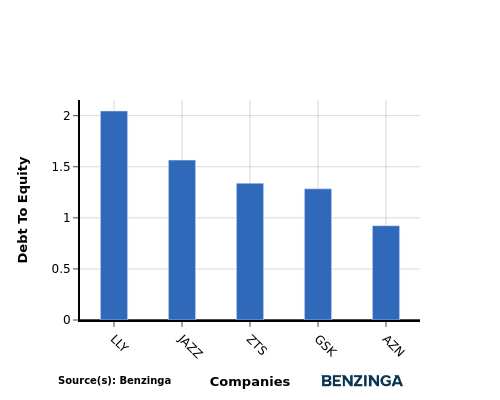

Debt To Equity Ratio

债务权益比率

The debt-to-equity (D/E) ratio is a financial metric that helps determine the level of financial risk associated with a company's capital structure.

当比较Fiserv和其前四家同行公司的负债与股本比率时,会得出以下对比情况:

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

在行业比较中考虑债务权益比率可以简明地评估公司的财务状况和风险特征,有助于投资者做出明智的决策。

When evaluating Eli Lilly and Co alongside its top 4 peers in terms of the Debt-to-Equity ratio, the following insights arise:

将礼来与其前四大同行按负债权益比进行比较后,我们可以获得以下见解:

Eli Lilly and Co has a higher debt-to-equity ratio of 2.05 compared to its top 4 peers.

This indicates a higher level of financial risk as the company relies more heavily on borrowed funds. Investors may perceive this as a potential concern.

礼来的负债权益比较高,为2.05,高于其前四大同行公司。

这表明公司存在更高的财务风险,因为其更加依赖于借入资金。投资者可能认为这是一个潜在的问题。

Key Takeaways

要点

For Eli Lilly and Co in the Pharmaceuticals industry, the PE, PB, and PS ratios are all high compared to its peers, indicating potentially overvalued stock. On the other hand, the high ROE and revenue growth suggest strong profitability and future prospects. However, the low EBITDA and gross profit may raise concerns about operational efficiency and sustainability.

对于药品行业的礼来而言,PE、PB和PS比率都比同行业高,可能表明其股票被高估。另一方面,高ROE和收入增长表明其盈利能力和未来前景强劲。然而,低EBITDA和毛利率可能引起人们对其经营效率和可持续性的担忧。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自动化内容引擎生成并由编辑审查。