Smart Money Is Betting Big In ORCL Options

Smart Money Is Betting Big In ORCL Options

High-rolling investors have positioned themselves bearish on Oracle (NYSE:ORCL), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ORCL often signals that someone has privileged information.

高投资者看淡甲骨文(纽交所:ORCL),散户交易者要注意。这一活动是通过Benzinga追踪公开可用期权数据来得知的。这些投资者的身份不确定,但ORCL的如此重大举措往往意味着有人掌握了内幕信息。

Today, Benzinga's options scanner spotted 12 options trades for Oracle. This is not a typical pattern.

今日,Benzinga的期权扫描器发现了甲骨文的12个期权交易。 这不是一个典型的模式。

The sentiment among these major traders is split, with 41% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $54,000, and 11 calls, totaling $551,192.

这些主要交易者的情绪分为41%的看好和50%的看淡。在我们确定的所有期权中,有一次看跌,金额为54,000美元,以及11次看涨,总计551,192美元。

What's The Price Target?

价格目标是什么?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $115.0 to $165.0 for Oracle during the past quarter.

分析这些合同的成交量和持仓量,似乎大户已经在过去的季度里觊觎甲骨文的价格区间为$115.0至$165.0的入市机会。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

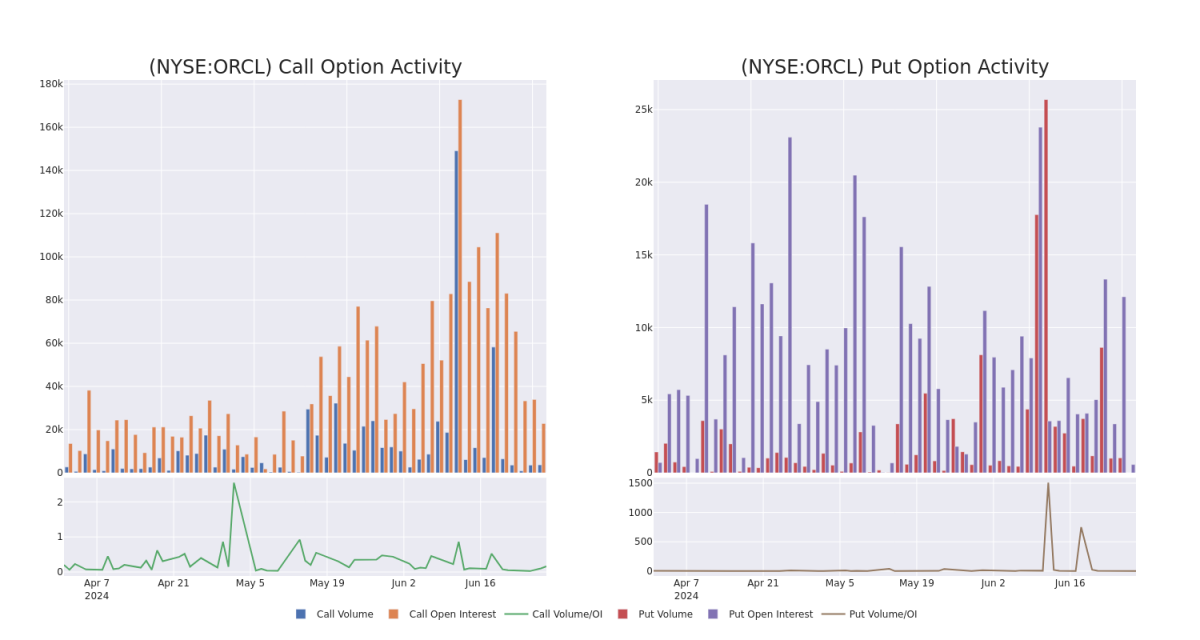

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Oracle's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Oracle's substantial trades, within a strike price spectrum from $115.0 to $165.0 over the preceding 30 days.

评估成交量和持仓量是期权交易的战略步骤。 这些指标阐明了特定行权价格下甲骨文期权的流动性和投资者兴趣。 下面的数据可视化了过去30天内由于甲骨文实质性交易引发的看跌和看涨的成交量和持仓量的波动,涉及行权价格区间为$115.0至$165.0。

Oracle 30-Day Option Volume & Interest Snapshot

甲骨文30天期权成交量和利息快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | CALL | SWEEP | BEARISH | 09/20/24 | $3.4 | $3.3 | $3.31 | $155.00 | $140.9K | 1.7K | 557 |

| ORCL | CALL | SWEEP | BEARISH | 09/20/24 | $3.55 | $3.45 | $3.45 | $155.00 | $85.9K | 1.7K | 113 |

| ORCL | CALL | SWEEP | BULLISH | 07/19/24 | $0.5 | $0.46 | $0.5 | $150.00 | $59.6K | 5.0K | 168 |

| ORCL | PUT | TRADE | BULLISH | 09/20/24 | $11.35 | $11.2 | $11.25 | $150.00 | $54.0K | 569 | 4 |

| ORCL | CALL | SWEEP | BEARISH | 09/20/24 | $3.45 | $3.35 | $3.35 | $155.00 | $44.2K | 1.7K | 410 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | 看涨 | SWEEP | 看淡 | 09/20/24 | $3.4 | $3.3 | $3.31 | $155.00 | $140.9K | 1.7K | 557 |

| ORCL | 看涨 | SWEEP | 看淡 | 09/20/24 | $3.55 | $3.45 | $3.45 | $155.00 | $85.9K | 1.7K | 113 |

| ORCL | 看涨 | SWEEP | 看好 | 07/19/24 | $0.5 | $0.46 | $0.5 | $150.00 | $59.6K | 5.0K | 168 |

| ORCL | 看跌 | 交易 | 看好 | 09/20/24 | $11.35 | $11.2 | $11.25 | $150.00 | $54.0K | 569 | 4 |

| ORCL | 看涨 | SWEEP | 看淡 | 09/20/24 | $3.45 | $3.35 | $3.35 | $155.00 | $44.2K | 1.7K | 410 |

About Oracle

关于甲骨文

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

甲骨文向全球企业提供数据库技术和企业资源规划(ERP)软件。成立于1977年的甲骨文开创了第一个商业SQL基础的关系数据库管理系统。今天,甲骨文在175个国家拥有430,000个客户,由136,000名员工支持。

After a thorough review of the options trading surrounding Oracle, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对围绕甲骨文公司的期权交易进行全面审查后,我们进一步审查了该公司的情况,包括对其当前市场状态和表现的评估。

Oracle's Current Market Status

甲骨文当前市场状态

- Currently trading with a volume of 2,126,888, the ORCL's price is up by 1.57%, now at $142.38.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 73 days.

- 目前成交量为2,126,888,ORCL的价格上涨了1.57%,现价为142.38美元。

- RSI读数表明股票目前可能超买。

- 预计发布收益还有73天。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Oracle options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在的回报。机智的交易者通过不断学习,调整策略,监视多个因子以及密切关注市场运动来管理这些风险。通过Benzinga Pro实时警报及时了解最新的甲骨文期权交易。