Smart Money Is Betting Big In FSLR Options

Smart Money Is Betting Big In FSLR Options

Financial giants have made a conspicuous bullish move on First Solar. Our analysis of options history for First Solar (NASDAQ:FSLR) revealed 43 unusual trades.

金融巨头对第一太阳能采取了明显的看好态度。我们对第一太阳能(纳斯达克:FSLR)期权历史记录的分析显示,出现了43次不寻常的交易。

Delving into the details, we found 41% of traders were bullish, while 39% showed bearish tendencies. Out of all the trades we spotted, 17 were puts, with a value of $895,593, and 26 were calls, valued at $2,262,393.

具体看,有41%的交易员看涨,而39%的交易员看淡。我们发现,在所有发现的交易中,有17次看跌,价值895,593美元,26次看涨,价值2,262,393美元。

What's The Price Target?

价格目标是什么?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $360.0 for First Solar over the recent three months.

根据交易活动,似乎重要投资者的目标是第一太阳能在最近三个月内的价格区间,从75.0美元到360.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

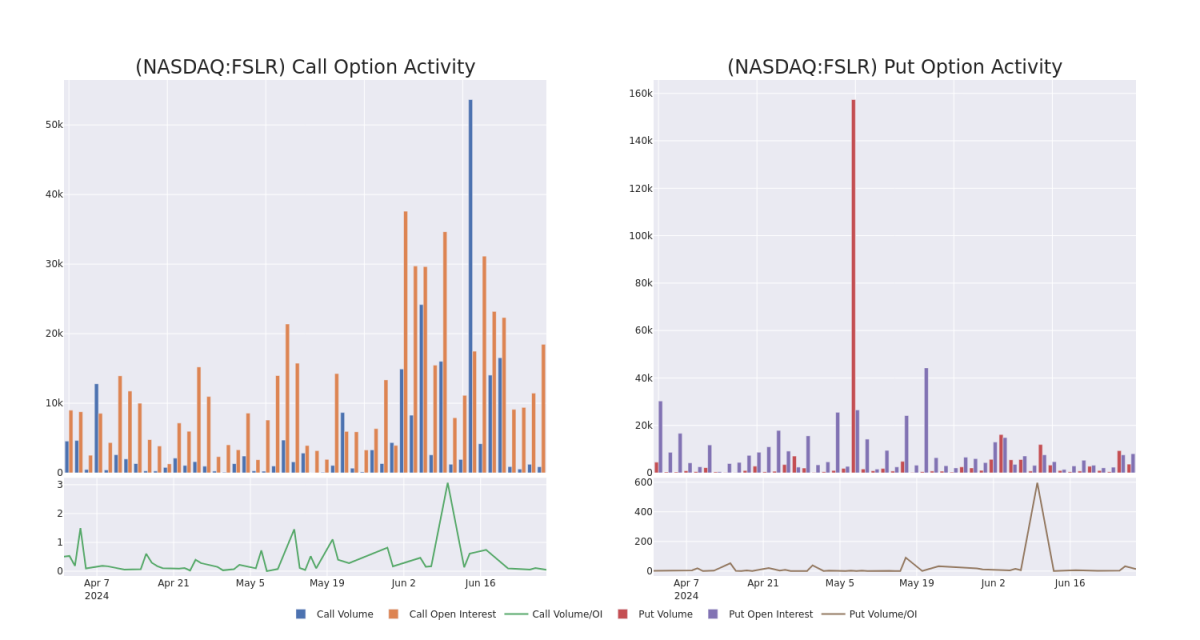

In terms of liquidity and interest, the mean open interest for First Solar options trades today is 1060.52 with a total volume of 4,337.00.

就流动性和兴趣而言,今天第一太阳能期权交易的平均持仓量为1060.52,总成交量为4,337.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for First Solar's big money trades within a strike price range of $75.0 to $360.0 over the last 30 days.

在下图中,我们可以追踪第一太阳能大宗交易看涨和看跌期权在75.0美元到360.0美元执行价格范围内的成交量和持仓量的发展情况,时间跨度为30天。

First Solar Option Volume And Open Interest Over Last 30 Days

第一太阳能期权在过去30天内的成交量和持仓量

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FSLR | CALL | TRADE | BULLISH | 01/16/26 | $26.5 | $24.85 | $26.0 | $360.00 | $782.6K | 11.8K | 2 |

| FSLR | CALL | TRADE | BULLISH | 07/19/24 | $5.8 | $5.55 | $5.9 | $250.00 | $383.5K | 549 | 31 |

| FSLR | CALL | TRADE | BEARISH | 01/16/26 | $174.5 | $170.0 | $171.4 | $75.00 | $205.6K | 95 | 0 |

| FSLR | PUT | TRADE | NEUTRAL | 07/19/24 | $41.4 | $39.35 | $40.38 | $280.00 | $100.9K | 1.2K | 0 |

| FSLR | CALL | TRADE | BULLISH | 12/20/24 | $96.0 | $93.3 | $95.46 | $150.00 | $95.4K | 28 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 第一太阳能 | 看涨 | 交易 | 看好 | 01/16/26 | $26.5 | $24.85 | $26.0 | $360.00 | $782.6K | 11.8千 | 2 |

| 第一太阳能 | 看涨 | 交易 | 看好 | 07/19/24 | $5.8 | $5.55 | $5.9 | $250.00 | $383.5K | 549 | 31 |

| 第一太阳能 | 看涨 | 交易 | 看淡 | 01/16/26 | $174.5 | $170.0 | $171.4 | $75.00 | $205.6K | 95 | 0 |

| 第一太阳能 | 看跌 | 交易 | 中立 | 07/19/24 | $41.4 | $39.35 | $40.38 | $280.00 | $100.9K | 1.2K | 0 |

| 第一太阳能 | 看涨 | 交易 | 看好 | 12/20/24 | $96.0 | $93.3美元 | $95.46 | $150.00 | $95.4K | 28 | 0 |

About First Solar

关于第一太阳能

First Solar designs and manufactures solar photovoltaic panels, modules, and systems for use in utility-scale development projects. The company's solar modules use cadmium telluride to convert sunlight into electricity. This is commonly called thin-film technology. First Solar is the world's largest thin-film solar module manufacturer. It has production lines in Vietnam, Malaysia, the United States, and India.

第一太阳能设计并制造用于大型电力开发项目的太阳能光伏板、模块和系统。该公司的太阳能模块采用镉镉硒将阳光转换为电力,这通常被称为薄膜技术。第一太阳能是世界上最大的薄膜太阳能模块制造商,在越南、马来西亚、美国和印度设有生产线。

Having examined the options trading patterns of First Solar, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了第一太阳能的期权交易模式之后,我们现在把注意力直接转向了这家公司,这个转变允许我们深入研究其当前的市场地位和表现

Where Is First Solar Standing Right Now?

第一太阳能现在处于什么位置?

- With a volume of 2,552,835, the price of FSLR is down -7.41% at $231.41.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 27 days.

- 第一太阳能的成交量为2,552,835,价格下跌7.41%,为231.41美元。

- RSI指标暗示基础股票可能接近超卖。

- 预计下次财报发布还有27天。

What Analysts Are Saying About First Solar

分析师对第一太阳能的评价

In the last month, 5 experts released ratings on this stock with an average target price of $306.8.

上个月,5位专家发布了对该股票的评级,平均目标价为306.8美元。

- Maintaining their stance, an analyst from Deutsche Bank continues to hold a Buy rating for First Solar, targeting a price of $280.

- Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on First Solar with a target price of $344.

- Reflecting concerns, an analyst from Mizuho lowers its rating to Neutral with a new price target of $274.

- Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on First Solar with a target price of $311.

- Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for First Solar, targeting a price of $325.

- 德意志银行的一位分析师继续维持对第一太阳能的买入评级,目标价为280美元。

- 贝尔德银行的一位分析师一直保持看好第一太阳能的评级,目标价为344美元。

- 考虑到一些担忧,瑞穗证券的一位分析师将其评级下调至中立,并设定了新的目标价274美元。

- BMO资本的分析师对第一太阳能保持一致的评价,维持推荐评级,目标价311美元。

- Oppenheimer的分析师维持对第一太阳能的持有评级,目标价325美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for First Solar with Benzinga Pro for real-time alerts.

交易期权存在更大的风险,但也提供了更高利润的潜力。精明的交易员通过持续的教育、战略性的交易调整、利用各种因子并保持对市场动态的敏锐把握来减轻这些风险。通过Benzinga Pro关注第一太阳能的最新期权交易,获得实时警报。