Decoding ASML Holding's Options Activity: What's the Big Picture?

Decoding ASML Holding's Options Activity: What's the Big Picture?

Deep-pocketed investors have adopted a bullish approach towards ASML Holding (NASDAQ:ASML), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ASML usually suggests something big is about to happen.

资金雄厚的投资者对阿斯麦采取了看好的态度,这是市场参与者不该忽视的。我们在Benzinga的公开期权记录中发现了这个重大动向。尽管这些投资者的身份仍然是未知的,但阿斯麦出现如此巨大的波动通常意味着即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 37 extraordinary options activities for ASML Holding. This level of activity is out of the ordinary.

我们从观察到的情况中了解到,Benzinga的期权扫描器突出了ASML Holding的37次非凡期权活动。这种活动水平超出了寻常。

The general mood among these heavyweight investors is divided, with 56% leaning bullish and 32% bearish. Among these notable options, 20 are puts, totaling $1,205,170, and 17 are calls, amounting to $1,123,761.

这些重量级投资者的普遍情绪是分歧的,其中56%看好,32%看淡。在这些显著的期权中,20个是看跌期权,总数为$1,205,170,17个是看涨期权,总额为$1,123,761。

Expected Price Movements

预期价格波动

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $580.0 to $1200.0 for ASML Holding over the last 3 months.

考虑到这些合约的成交量和持有量,从过去3个月的情况来看,鲸鱼们一直在以$580.0到$1200.0的价格区间内瞄准ASML Holding。

Insights into Volume & Open Interest

成交量和持仓量分析

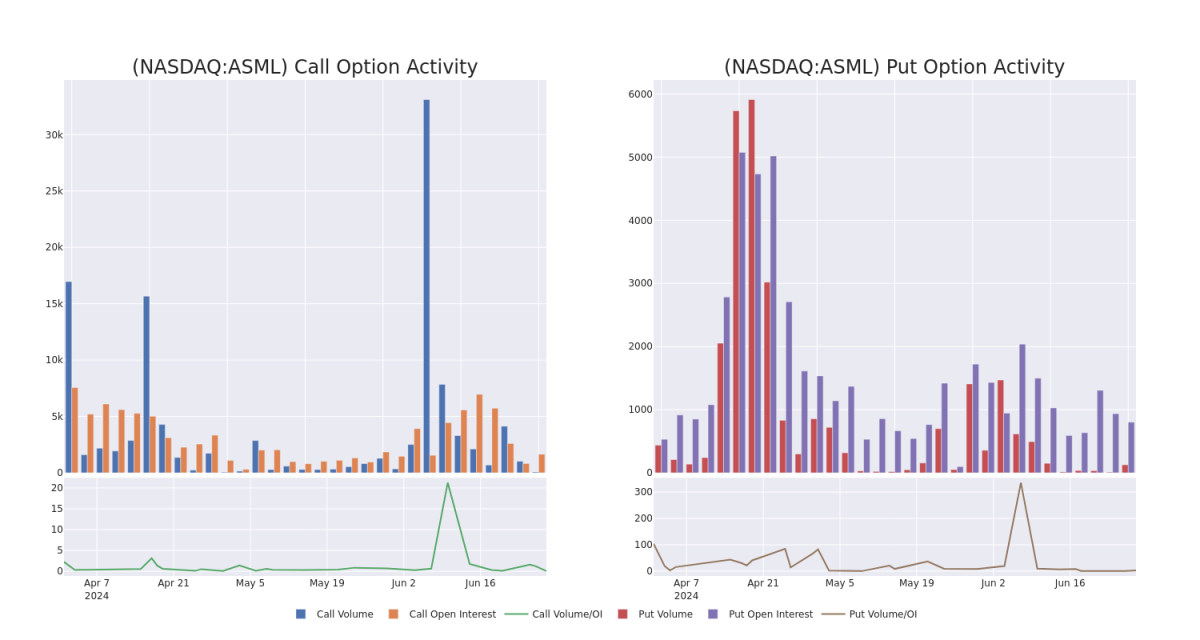

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for ASML Holding's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across ASML Holding's significant trades, within a strike price range of $580.0 to $1200.0, over the past month.

审视成交量和持有量可以为股票研究提供重要的见解。这些信息对于评估ASML Holding的期权在某些行权价格上的流动性和关注程度至关重要。下面,我们呈现ASML Holding显著交易中看涨和看跌期权在$580.0到$1200.0行权价格区间内成交量和持有量趋势的快照,覆盖了过去一个月。

ASML Holding 30-Day Option Volume & Interest Snapshot

ASML Holding 30天期权成交量和持有量快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASML | CALL | TRADE | BEARISH | 01/16/26 | $207.0 | $193.2 | $198.09 | $1060.00 | $198.0K | 47 | 0 |

| ASML | PUT | TRADE | NEUTRAL | 07/12/24 | $114.6 | $108.6 | $111.88 | $1150.00 | $190.1K | 2 | 1 |

| ASML | CALL | TRADE | BULLISH | 06/20/25 | $142.1 | $137.9 | $142.1 | $1100.00 | $184.7K | 25 | 0 |

| ASML | CALL | TRADE | BULLISH | 01/17/25 | $92.3 | $91.3 | $92.3 | $1100.00 | $184.6K | 444 | 2 |

| ASML | PUT | TRADE | BEARISH | 09/20/24 | $101.6 | $100.6 | $101.6 | $1100.00 | $121.9K | 98 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 阿斯麦 | 看涨 | 交易 | 看淡 | 01/16/26 | $207.0 | $193.2 | $198.09 | $1060.00 | $198.0K | 47 | 0 |

| 阿斯麦 | 看跌 | 交易 | 中立 | 07/12/24 | $114.6 | $108.6 | $111.88 | $1150.00 | $190.1K | 2 | 1 |

| 阿斯麦 | 看涨 | 交易 | 看好 | 06/20/25 | $142.1 | $137.9 | $142.1 | $1100.00 | $184.7K | 25 | 0 |

| 阿斯麦 | 看涨 | 交易 | 看好 | 01/17/25 | $92.3 | $91.3 | $92.3 | $1100.00 | $184.6千美元 | 444 | 2 |

| 阿斯麦 | 看跌 | 交易 | 看淡 | 09/20/24 | $101.6 | $100.6 | $101.6 | $1100.00 | $121.9千美元 | 98 | 0 |

About ASML Holding

关于阿斯麦控股

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML's main clients are TSMC, Samsung, and Intel.

ASML是半导体制造中使用的光刻系统领先者。光刻是一种利用光源将掩膜版上的电路图案显影到半导体晶片上的过程。该领域的最新技术进步使芯片厂商能够不断增加相同面积硅片上的晶体管数量,而光刻历史上占了制造前沿芯片成本的很高比例。ASML将大部分零件制造外包,充当装配工的角色。ASML的主要客户是TSMC,三星和英特尔。

Having examined the options trading patterns of ASML Holding, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

我们已经研究了阿斯麦控股的期权交易模式,现在我们将直接关注该公司。这种转变使我们可以深入了解它目前的市场地位和表现

ASML Holding's Current Market Status

ASML Holding的当前市场状态

- Currently trading with a volume of 485,390, the ASML's price is up by 0.15%, now at $1029.54.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 19 days.

- 目前成交量为485,390,阿斯麦的价格上涨0.15%,现在为1029.54美元。

- RSI读数表明该股目前可能接近超买水平。

- 预期收益发布还有19天。

What Analysts Are Saying About ASML Holding

关于阿斯麦控股,分析师们都有什么说法

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $1185.0.

在过去的一个月中,有1位行业分析师分享了他们对该股票的见解,提出了一个平均目标价1185.0美元。

- An analyst from Wells Fargo has decided to maintain their Overweight rating on ASML Holding, which currently sits at a price target of $1185.

- 富国银行的一位分析师决定维持其对阿斯麦控股的超配评级,目前的价格目标为1185美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ASML Holding with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也有更高利润的潜力。精明的交易者通过持续的教育、策略性的交易调整、利用各种因子以及关注市场动态来减轻这些风险。使用Benzinga Pro即时警报,及时了解阿斯麦控股的最新期权交易。