What the Options Market Tells Us About Deere

What the Options Market Tells Us About Deere

Whales with a lot of money to spend have taken a noticeably bearish stance on Deere.

那些富有的鲸鱼已明显看淡迪尔股份。

Looking at options history for Deere (NYSE:DE) we detected 12 trades.

观察迪尔股份(NYSE:DE)的期权历史记录,我们检测到12次交易。

If we consider the specifics of each trade, it is accurate to state that 8% of the investors opened trades with bullish expectations and 50% with bearish.

如果我们考虑每个交易的具体情况,可以准确地说有8%的投资者持看好期望,而50%是看淡。

From the overall spotted trades, 5 are puts, for a total amount of $195,770 and 7, calls, for a total amount of $217,158.

从整体交易中,有5个是看跌期权,总金额为195,770美元;有7个是看涨期权,总金额为217,158美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $370.0 and $480.0 for Deere, spanning the last three months.

在评估交易量和未平仓合约后,明显的市场主力目前集中在370.0美元至480.0美元的价格区间内,涵盖了过去三个月的迪尔股份。

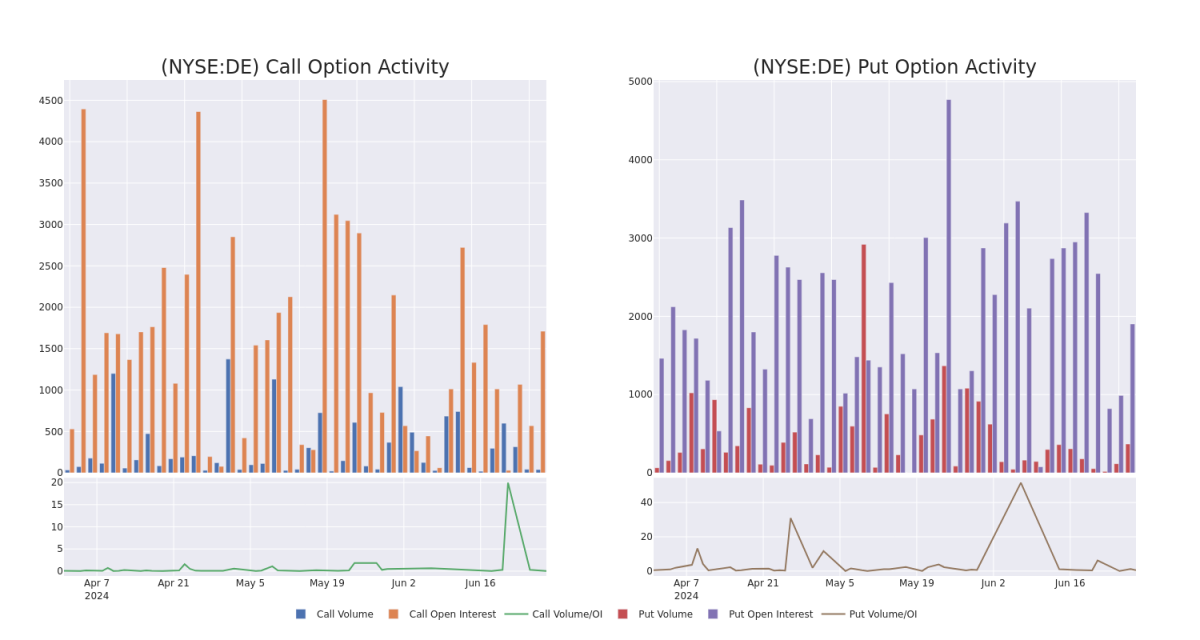

Volume & Open Interest Trends

成交量和未平仓量趋势

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Deere's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Deere's significant trades, within a strike price range of $370.0 to $480.0, over the past month.

检查成交量和未平仓合约可为股票研究提供关键见解,这些信息对于衡量特定行权价等方面的迪尔股份期权的流动性和兴趣水平非常重要。下面,我们提供了过去一个月内,迪尔股份区间为370.0美元至480.0美元的看跌和看涨期权的成交量和未平仓量趋势的快照。

Deere Call and Put Volume: 30-Day Overview

迪尔看涨期权和看跌期权:30天概况

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | PUT | SWEEP | BEARISH | 07/19/24 | $4.0 | $3.75 | $4.0 | $370.00 | $68.0K | 1.3K | 15 |

| DE | CALL | SWEEP | BULLISH | 03/21/25 | $16.0 | $15.3 | $16.0 | $430.00 | $46.4K | 347 | 0 |

| DE | PUT | TRADE | BEARISH | 07/19/24 | $4.25 | $3.75 | $4.05 | $370.00 | $40.5K | 1.3K | 348 |

| DE | CALL | SWEEP | BEARISH | 06/20/25 | $24.9 | $23.85 | $23.85 | $420.00 | $35.9K | 96 | 4 |

| DE | PUT | TRADE | NEUTRAL | 01/16/26 | $68.85 | $61.0 | $64.3 | $430.00 | $32.1K | 27 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | 看跌 | SWEEP | 看淡 | 07/19/24 | $4.0 | $3.75 | $4.0 | $370.00 | $68.0K | 1.3K | 15 |

| DE | 看涨 | SWEEP | 看好 | 03/21/25 | $16.0 | $15.3 | $16.0 | $430.00 | $46.4K | 347 | 0 |

| DE | 看跌 | 交易 | 看淡 | 07/19/24 | $4.25 | $3.75 | $4.05 | $370.00 | $40.5K | 1.3K | 348 |

| DE | 看涨 | SWEEP | 看淡 | 06/20/25 | $24.9 | $23.85 | $23.85 | $420.00 | $35.9K | 96 | 4 |

| DE | 看跌 | 交易 | 中立 | 01/16/26 | $68.85 | $61.0 | $64.3 | $430.00 | 32,100美元 | 27 | 0 |

About Deere

关于迪尔股份

Deere is the world's leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry in their green and yellow livery. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

Deere是全球领先的农业设备制造商,在他们的绿色和黄色车身上生产一些最具代表性的重型机械。该公司分为四个可报告部门:生产和精密农业、小型农业和草坪、建筑和林业以及约翰·迪尔资本。其产品通过广泛的经销商网络提供,包括北美地区的2,000多个经销商位置和全球约3,700个位置。约翰·迪尔资本为其客户提供机械零售融资,此外还为经销商提供批发融资,从而增加了Deere产品销售的可能性。

Following our analysis of the options activities associated with Deere, we pivot to a closer look at the company's own performance.

在对迪尔的期权活动进行分析后,我们将更加关注该公司自身的表现。

Current Position of Deere

迪尔的现状

- Currently trading with a volume of 1,239,225, the DE's price is up by 0.87%, now at $378.6.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 49 days.

- 目前交易量为1,239,225,DE的价格上涨0.87%,达到378.6美元。

- RSI读数表明该股票目前处于中立状态,处于超买和超卖之间。

- 预计还有49天就要发布收益报告了。

Professional Analyst Ratings for Deere

迪尔股份的专业分析师评级

In the last month, 2 experts released ratings on this stock with an average target price of $407.5.

上个月,有2位专家发布了这支股票的评级,平均目标价为407.5美元。

- In a cautious move, an analyst from Raymond James downgraded its rating to Outperform, setting a price target of $420.

- In a cautious move, an analyst from Citigroup downgraded its rating to Neutral, setting a price target of $395.

- Raymond James的一位分析师谨慎行动,下调了其评级至强于市场表现,设定了420美元的目标价。

- Citigroup的一位分析师谨慎行动,下调了其评级至中立,设定了395美元的目标价。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Deere options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在收益。精明的交易者通过不断自我教育、调整策略、监控多个因子并密切关注市场动向来管理这些风险。通过Benzinga Pro的实时提醒,了解最新的迪尔期权交易。