Unpacking the Latest Options Trading Trends in Analog Devices

Unpacking the Latest Options Trading Trends in Analog Devices

Deep-pocketed investors have adopted a bearish approach towards Analog Devices (NASDAQ:ADI), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ADI usually suggests something big is about to happen.

富裕的投资者采取了看淡亚德诺(纳斯达克:ADI)的策略,这是市场参与者不应忽视的事情。我们在Benzinga跟踪的公开期权记录中发现了这一重要的举动。这些投资者的身份尚不清楚,但在ADI中如此巨大的行动通常意味着即将发生重大变化。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Analog Devices. This level of activity is out of the ordinary.

我们从今天观察到的情况中得出了这个信息,当Benzinga的期权扫描仪突出显示了Analog Devices的14个非凡期权活动时。这种活动水平是不同寻常的。

The general mood among these heavyweight investors is divided, with 28% leaning bullish and 57% bearish. Among these notable options, 5 are puts, totaling $1,334,929, and 9 are calls, amounting to $471,699.

这些重量级投资者中的普遍情绪是分散的,其中28%看好,57%看淡。在这些显着期权中,有5个看跌期权,总额为1,334,929美元,有9个看涨期权,总额为471,699美元。

What's The Price Target?

价格目标是什么?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $260.0 for Analog Devices over the recent three months.

基于交易活动,看起来这些重要的投资者正瞄准亚德诺在近三个月内的价格区间从200.0美元到260.0美元。

Insights into Volume & Open Interest

成交量和持仓量分析

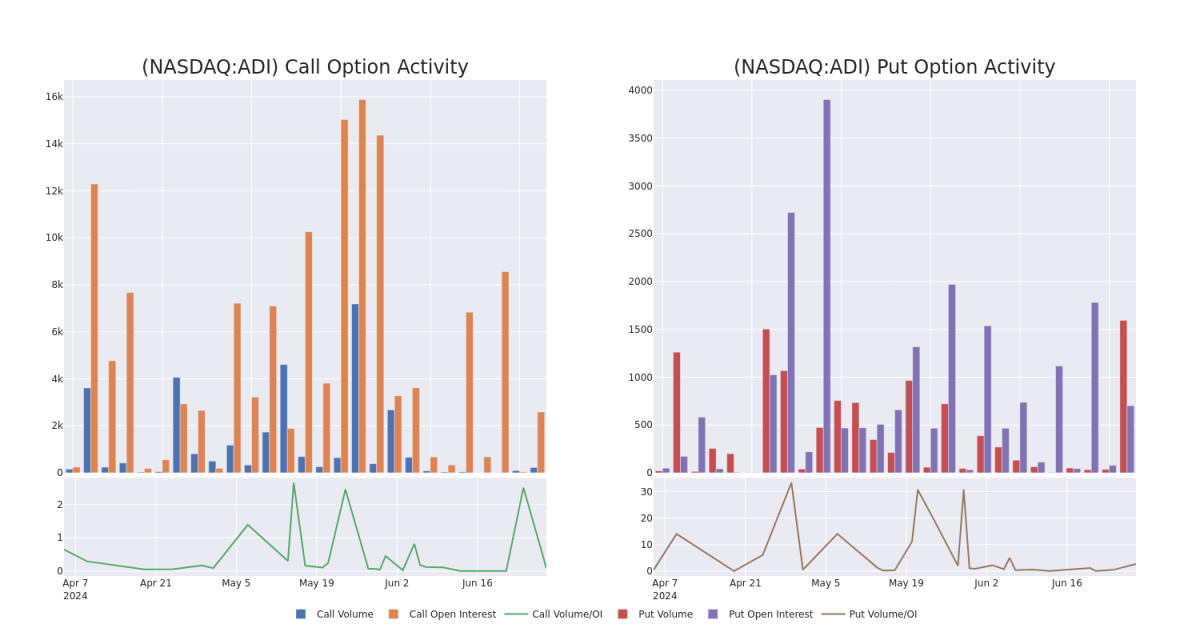

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Analog Devices's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Analog Devices's substantial trades, within a strike price spectrum from $200.0 to $260.0 over the preceding 30 days.

评估成交量和未平仓合约是选项交易中的战略步骤。这些指标揭示了在指定行权价格上关于亚德诺期权的流动性和投资者兴趣。即将到来的数据可视化展示了在30天内,从200.0美元到260.0美元的行权价格范围内,涉及亚德诺重要交易的看跌和看涨期权的成交量和未平仓合约的波动。

Analog Devices Option Activity Analysis: Last 30 Days

亚德诺期权活动分析:最近30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADI | PUT | SWEEP | BEARISH | 08/16/24 | $6.9 | $6.7 | $6.9 | $230.00 | $517.5K | 611408 | |

| ADI | PUT | SWEEP | BEARISH | 08/16/24 | $7.5 | $7.2 | $7.5 | $230.00 | $374.1K | 6111.1K | |

| ADI | PUT | SWEEP | BEARISH | 08/16/24 | $6.8 | $6.6 | $6.8 | $230.00 | $270.6K | 61110 | |

| ADI | PUT | SWEEP | BEARISH | 08/16/24 | $7.5 | $7.4 | $7.5 | $230.00 | $139.3K | 6111.1K | |

| ADI | CALL | SWEEP | BEARISH | 08/16/24 | $2.3 | $2.2 | $2.2 | $250.00 | $106.4K | 4524 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADI | 看跌 | SWEEP | 看淡 | 08/16/24 | $6.9 | $6.7 | $6.9 | $230.00 | $517.5K | 611408 | |

| ADI | 看跌 | SWEEP | 看淡 | 08/16/24 | $7.5 | $7.2 | $7.5 | $230.00 | $374.1K | 6111.1K | |

| ADI | 看跌 | SWEEP | 看淡 | 08/16/24 | $6.8 | 6.6 | $6.8 | $230.00 | $270.6K | 61110 | |

| ADI | 看跌 | SWEEP | 看淡 | 08/16/24 | $7.5 | $7.4 | $7.5 | $230.00 | $139.3K | 6111.1K | |

| ADI | 看涨 | SWEEP | 看淡 | 08/16/24 | $2.3 | $2.2 | $2.2 | $250.00 | $106.4K | 4524 |

About Analog Devices

关于亚德诺

Analog Devices is a leading analog, mixed signal, and digital signal processing chipmaker. The firm has a significant market share lead in converter chips, which are used to translate analog signals to digital and vice versa. The company serves tens of thousands of customers, and more than half of its chip sales are made to industrial and automotive end markets. Analog Devices' chips are also incorporated into wireless infrastructure equipment.

亚德诺是领先的模拟、混合信号和数字信号处理芯片制造商。该公司在转换器芯片领域拥有重要的市场份额领先地位,转换器芯片用于将模拟信号转换为数字信号,反之亦然。该公司为数以万计的客户提供服务,超过一半的芯片销售额来自于工业和汽车结束市场。亚德诺的芯片还被纳入无线基础设施设备中。

Present Market Standing of Analog Devices

亚德诺当前市场排名

- Currently trading with a volume of 1,283,699, the ADI's price is up by 0.68%, now at $228.23.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 54 days.

- 目前的交易总量为1,283,699,ADI的价格上涨了0.68%,现在为228.23美元。

- RSI读数表明该股票目前处于中立状态,处于超买和超卖之间。

- 预计盈利发布还有54天。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。