Decoding CrowdStrike Holdings's Options Activity: What's the Big Picture?

Decoding CrowdStrike Holdings's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on CrowdStrike Holdings. Our analysis of options history for CrowdStrike Holdings (NASDAQ:CRWD) revealed 45 unusual trades.

金融巨头在CrowdStrike Holdings上做出了明显的看好动作。我们对CrowdStrike Holdings(NASDAQ:CRWD)期权历史的分析显示,有45笔非同寻常的交易。

Delving into the details, we found 44% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $680,562, and 32 were calls, valued at $3,084,494.

具体分析,我们发现44%的交易者看涨,40%的交易者看淡。我们发现,所有交易中,有13个看跌期权,价值680,562美元,有32个看涨期权,价值3,084,494美元。

Predicted Price Range

预测价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $250.0 and $500.0 for CrowdStrike Holdings, spanning the last three months.

在评估成交量和未平仓合约后,显然主要市场参与者的关注点是CrowdStrike Holdings的价格区间,该区间位于250.0到500.0美元之间,跨越了最近三个月。

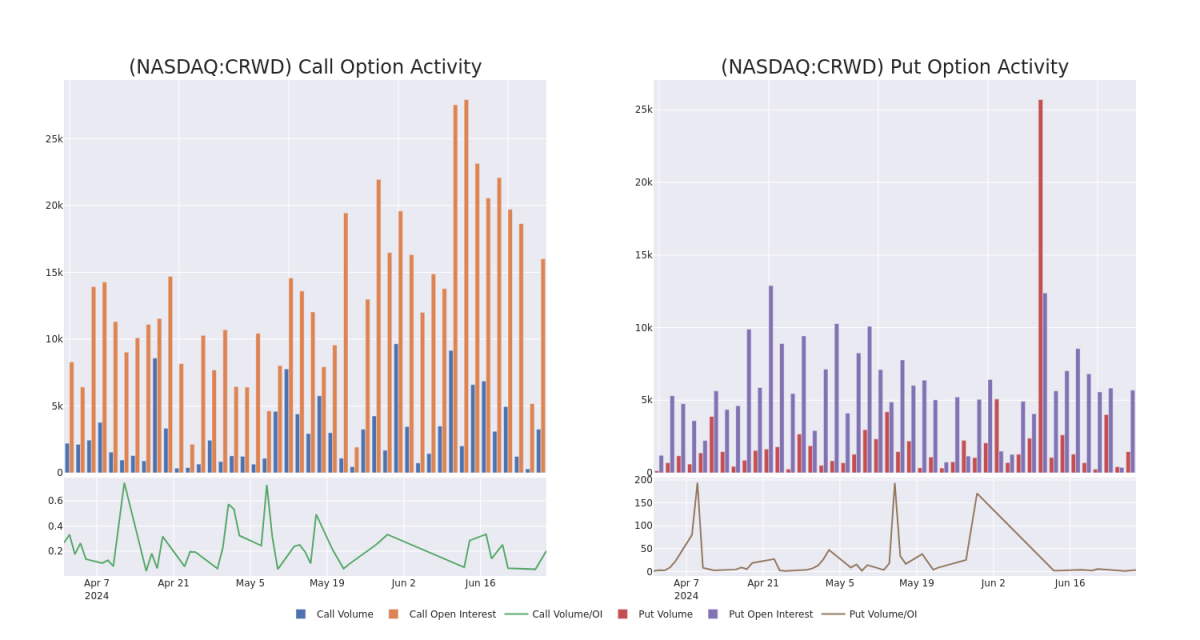

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

In today's trading context, the average open interest for options of CrowdStrike Holdings stands at 603.0, with a total volume reaching 4,605.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in CrowdStrike Holdings, situated within the strike price corridor from $250.0 to $500.0, throughout the last 30 days.

在今天的交易背景下,CrowdStrike Holdings期权的平均未平仓合约为603.0,总成交量达到4,605.00。随附的图表描述了在过去30天中,位于250.0到500.0美元行权价走廊内的CrowdStrike Holdings高价值交易的看涨和看跌期权成交量和未平仓合约的进展情况。

CrowdStrike Holdings 30-Day Option Volume & Interest Snapshot

CrowdStrike Holdings 30天期权成交量和未平仓合约快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | CALL | TRADE | BEARISH | 06/28/24 | $56.8 | $53.8 | $54.5 | $335.00 | $534.1K | 411 | 300 |

| CRWD | CALL | TRADE | NEUTRAL | 07/19/24 | $106.75 | $103.1 | $105.14 | $280.00 | $525.7K | 1.2K | 0 |

| CRWD | CALL | TRADE | BULLISH | 09/20/24 | $120.0 | $116.9 | $119.0 | $270.00 | $249.9K | 158 | 0 |

| CRWD | PUT | SWEEP | BEARISH | 06/20/25 | $60.3 | $58.6 | $60.3 | $390.00 | $168.8K | 1.0K | 0 |

| CRWD | CALL | TRADE | NEUTRAL | 08/16/24 | $28.45 | $26.85 | $27.68 | $380.00 | $166.0K | 604 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | 看涨 | 交易 | 看淡 | 06/28/24 | $56.8 | $53.8 | $54.5 | 335.00美元 | $534.1K | 411 | 300 |

| CRWD | 看涨 | 交易 | 中立 | 07/19/24 | $106.75 | $103.1 | $105.14 | $280.00 | $525.7K | 1.2K | 0 |

| CRWD | 看涨 | 交易 | 看好 | 09/20/24 | $120.0 | $116.9 | $119.0 | $270.00 | $249.9K | 158 | 0 |

| CRWD | 看跌 | SWEEP | 看淡 | 06/20/25 | $60.3 | 58.6美元 | $60.3 | $390.00 | $168.8K | 1.0K | 0 |

| CRWD | 看涨 | 交易 | 中立 | 08/16/24 | $28.45 | $26.85 | $27.68 | $380.00 | $166.0K | 604 | 0 |

About CrowdStrike Holdings

关于CrowdStrike控股公司

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike's primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

市净率P/B

Following our analysis of the options activities associated with CrowdStrike Holdings, we pivot to a closer look at the company's own performance.

在我们分析与CrowdStrike Holdings相关的期权业务之后,我们转而更加关注公司自身的表现。

CrowdStrike Holdings's Current Market Status

CrowdStrike Holdings的当前市场状态

- With a volume of 2,309,043, the price of CRWD is up 0.47% at $389.1.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 61 days.

- CRWD的成交量为2,309,043,价格上涨0.47%,为389.1美元。

- RSI因子暗示底层股票可能被超买。

- 下次盈利预期将在 61 天内发布。

What The Experts Say On CrowdStrike Holdings

市场专家对CrowdStrike Holdings的看法:

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $399.0.

过去30天里,共有5名专业分析师对该股票发表了自己的看法,设置了平均目标价399.0美元。

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $400.

- An analyst from Mizuho persists with their Buy rating on CrowdStrike Holdings, maintaining a target price of $370.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $400.

- Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on CrowdStrike Holdings with a target price of $405.

- An analyst from Rosenblatt has decided to maintain their Buy rating on CrowdStrike Holdings, which currently sits at a price target of $420.

- 出于担忧,Cantor Fitzgerald的一名分析师将其评级下调为超配,并设置了新的目标价400美元。

- Mizuho的一位分析师坚持推荐CrowdStrike Holdings的买入评级,维持目标价为$370。

- Cantor Fitzgerald 的一名分析师将其评级下调为超配,并设置了价格目标为400美元。

- Canaccord Genuity的一名分析师保持对CrowdStrike Holdings的买入评级,目标价为405美元。

- Rosenblatt的一名分析师决定维持其对Crowdstrike Holdings的买入评级,目前的目标价为420美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest CrowdStrike Holdings options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。精明的交易员通过持续教育自己,调整策略,监控多种因子,并密切关注市场走势来管理这些风险。通过Benzinga Pro即时提醒了解最新的CrowdStrike Holdings期权交易动态。