What the Options Market Tells Us About Valero Energy

What the Options Market Tells Us About Valero Energy

Whales with a lot of money to spend have taken a noticeably bullish stance on Valero Energy.

有大量资金可支配的鲸鱼已对瓦莱罗能源持有明显的看好态度。

Looking at options history for Valero Energy (NYSE:VLO) we detected 8 trades.

查看瓦莱罗能源(NYSE:VLO)的期权历史,我们发现了8次交易。

If we consider the specifics of each trade, it is accurate to state that 75% of the investors opened trades with bullish expectations and 25% with bearish.

如果我们考虑每项交易的具体细节,可以准确地说75%的投资者持看涨预期,25%的投资者持看淡预期。

From the overall spotted trades, 2 are puts, for a total amount of $54,400 and 6, calls, for a total amount of $292,950.

从所有交易中可以看出,2次是看跌,总额为$54,400,6次是看涨,总额为$292,950。

What's The Price Target?

价格目标是什么?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $110.0 to $165.0 for Valero Energy during the past quarter.

分析这些合约中的成交量和持仓量,似乎大玩家们在过去的一个季度里一直在关注瓦莱罗能源在$110.0到$165.0之间的价格范围。

Volume & Open Interest Trends

成交量和未平仓量趋势

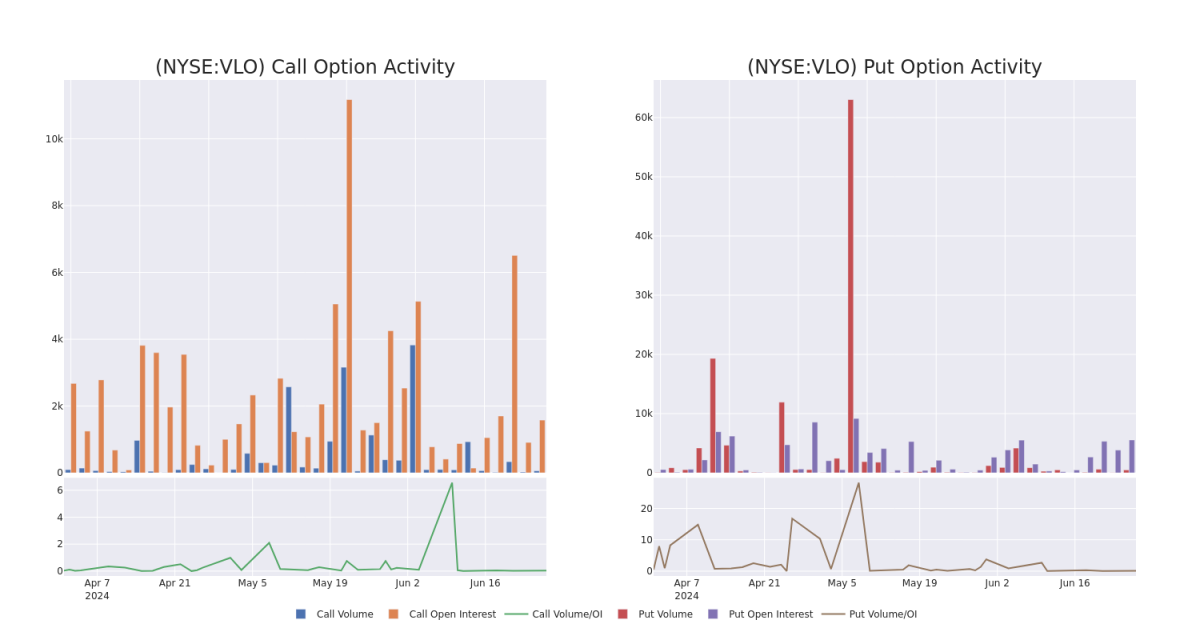

In today's trading context, the average open interest for options of Valero Energy stands at 823.0, with a total volume reaching 798.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Valero Energy, situated within the strike price corridor from $110.0 to $165.0, throughout the last 30 days.

在今天的交易情境中,瓦莱罗能源期权的平均持仓量为823.0,总成交量达到798.00。下图描述了过去30天内,瓦莱罗能源$110.0到$165.0的行权价格区间内,高价值交易的看涨和看跌期权成交量和持仓量的变化情况。

Valero Energy Option Volume And Open Interest Over Last 30 Days

瓦莱罗能源期权交易成交量和持仓量过去30天的情况

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VLO | CALL | TRADE | BULLISH | 08/16/24 | $3.4 | $3.35 | $3.4 | $165.00 | $85.0K | 2.0K | 87 |

| VLO | CALL | TRADE | BULLISH | 12/19/25 | $27.75 | $27.75 | $27.75 | $150.00 | $55.5K | 65 | 0 |

| VLO | CALL | SWEEP | BEARISH | 08/16/24 | $5.1 | $5.0 | $5.02 | $160.00 | $50.1K | 1.9K | 656 |

| VLO | CALL | SWEEP | BULLISH | 07/26/24 | $10.6 | $9.1 | $9.1 | $150.00 | $40.9K | 36 | 0 |

| VLO | CALL | SWEEP | BULLISH | 01/17/25 | $11.9 | $11.75 | $11.9 | $165.00 | $30.9K | 605 | 16 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VLO | 看涨 | 交易 | 看好 | 08/16/24 | $3.4 | $3.35 | $3.4 | 165.00美元 | $85.0K | 2.0K | 87 |

| VLO | 看涨 | 交易 | 看好 | 2025年12月19日 | $27.75 | $27.75 | $27.75 | $150.00 | $55.5K | 65 | 0 |

| VLO | 看涨 | SWEEP | 看淡 | 08/16/24 | $5.1 | $5.0 | $5.02 | $160.00 | $50.1K | 1.9K | 656 |

| VLO | 看涨 | SWEEP | 看好 | 07/26/24 | $10.6 | $9.1 | $9.1 | $150.00 | $40.9千 | 36 | 0 |

| VLO | 看涨 | SWEEP | 看好 | 01/17/25 | $11.9 | 11.75美元 | $11.9 | 165.00美元 | $30.9K | 605 | 16 |

About Valero Energy

关于瓦莱罗能源

Valero Energy is one of the largest independent refiners in the United States. It operates 15 refineries, with a total throughput capacity of 3.2 million barrels a day in the US, Canada, and the United Kingdom. Valero also owns 12 ethanol plants with capacity of 1.6 billion gallons a year and holds a 50% stake in Diamond Green Diesel, which has the capacity to produce 1.2 billion gallons per year of renewable diesel.

瓦莱罗能源是美国最大的独立精炼公司之一。在美国、加拿大和英国经营15个炼油厂,总通过能力达到320万桶/日。瓦莱罗还拥有12个乙醇工厂,年产能达16亿加仑,并持有Diamond Green Diesel的50%股权,Diamond Green Diesel的可再生柴油产能为12亿加仑/年。

Following our analysis of the options activities associated with Valero Energy, we pivot to a closer look at the company's own performance.

在分析与瓦莱罗能源相关的期权交易活动之后,我们转而更仔细地观察这家公司的业绩。

Valero Energy's Current Market Status

瓦莱罗能源的当前市场状态

- With a volume of 3,609,831, the price of VLO is up 1.77% at $156.76.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 27 days.

- 瓦莱罗能源的成交量为3,609,831,在$156.76上涨了1.77%。

- RSI指标暗示该股票可能要超买了。

- 预计下次财报发布还有27天。

What Analysts Are Saying About Valero Energy

分析师对于瓦莱罗能源的观点

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $173.0.

在过去的30天中,共有3名专业分析师发表了自己的看法,设定了一个平均目标价为$173.0。

- An analyst from Piper Sandler persists with their Overweight rating on Valero Energy, maintaining a target price of $169.

- Consistent in their evaluation, an analyst from Mizuho keeps a Neutral rating on Valero Energy with a target price of $171.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on Valero Energy with a target price of $179.

- 派杰投资的分析师坚持对瓦莱罗能源的超配评级,目标价维持在$169。

- Mizuho的分析师在评估方面一致认为瓦莱罗能源应该为中立,目标价为$171。

- Wells Fargo的分析师在评估方面一致认为瓦莱罗能源应该为等重评级,目标价为$179。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Valero Energy with Benzinga Pro for real-time alerts.

交易期权会涉及更大的风险,但也提供了更高的盈利潜力。聪明的交易者通过持续的教育,战略性交易调整,利用各种因子,并保持对市场动态的关注来减轻这些风险。使用Benzinga Pro获取瓦莱罗能源的最新期权交易,以获得实时警报。