Top 3 Consumer Stocks That Could Blast Off In July

Top 3 Consumer Stocks That Could Blast Off In July

七月可能会暴涨的前三家消费股

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

消费不可或缺板块中最被低估的公司股票出现了买入机会。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指标是一种动量指标,它比较了股票在价格上涨时的强度与在价格下跌时的强度。与股票的价格走势进行比较,可以给交易者更好的了解股票短期内表现的良好程度。当RSI低于30时,资产通常被认为是超卖的,根据Benzinga Pro的数据。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行业板块最近的主要超卖股票列表,RSI接近或低于30。

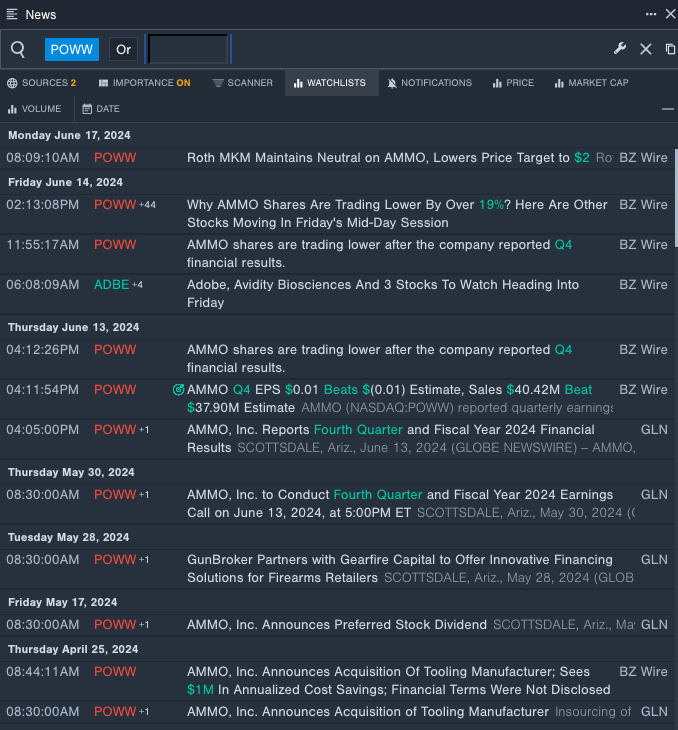

Ammo Inc (NASDAQ:POWW)

Ammo公司(纳斯达克:POWW)

- On June 13, AMMO posted a profit for the first quarter. Jared Smith, AMMO's CEO, commented "Sales increased sequentially despite a slower market environment. We continued to make progress this quarter and ended the fiscal year with a strong pipeline of rifle ammunition and casing sales while accelerating our buildout of GunBroker's capabilities. This is most evident as we start to deliver on our ZRO Delta contract, while continuing the advancement in financing, cross selling, and carting of accessories that will take place with GunBroker in Fiscal 2025." The company's stock fell around 38% over the past month and has a 52-week low of $1.60.

- RSI Value: 29.16

- POWW Price Action: Shares of Ammo gained 1.8% to close at $1.68 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest POWW's news.

- 6月13日,AMMO发布了第一季度的营业利润。AMMO的CEO杰瑞德·史密斯评论道:“尽管市场环境放缓,但销售额逐步增长。本季度我们继续取得进展,并以构建GunBroker平台的能力结束财年,形成了强大的步枪弹药和弹壳销售渠道。随着我们开始履行ZRO Delta合同,GunBroker在2025财年将在融资、交叉销售以及配件销售方面取得持续发展。”该公司股价在过去一个月左右下跌了约38%,52周最低价为1.60美元。

- RSI值:29.16

- POWW价格走势:上周五,Ammo股票上涨1.8%,收于1.68美元。

- Benzinga Pro的实时新闻提醒最新的POWW新闻。

Helen of Troy Limited (NASDAQ:HELE)

海伦特洛伊家电有限公司(纳斯达克:HELE)

- Helen of Troy is scheduled to release its first quarter fiscal 2025 results before the opening bell on Tuesday, July 9. The company's stock fell around 13% over the past month. It has a 52-week low of $87.50.

- RSI Value: 28.92

- HELE Price Action: Shares of Helen of Troy fell 1.7% to close at $92.74 on Friday.

- Benzinga Pro's charting tool helped identify the trend in HELE's stock.

- 海伦特洛伊家电将于7月9日星期二盘前公布其2025财年第一季度的业绩。该公司股价在过去一个月左右下跌了约13%,52周最低价为87.50美元。

- RSI值:28.92

- HELE价格走势:上周五,海伦特洛伊家电的股票下跌了1.7%,收于92.74美元。

- Benzinga Pro的图表工具有助于识别HELE股票的趋势。

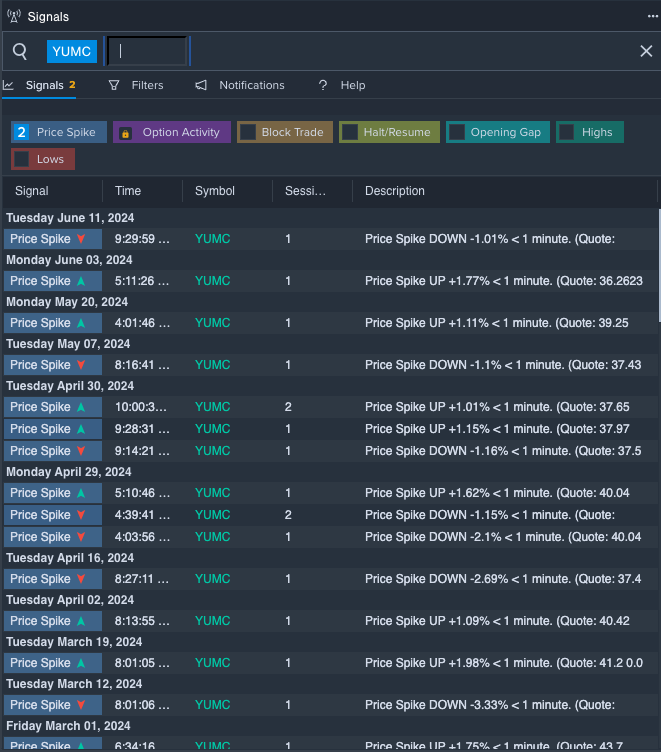

Yum China Holdings Inc (NYSE:YUMC)

百胜中国控股有限公司(纽交所:YUMC)

- On April 29, Yum China reported mixed first-quarter financial results. Joey Wat, CEO of Yum China, commented, "We achieved solid sales growth in the first quarter with total revenues hitting an all-time high. Our core operating profit grew modestly from last year's high base and EPS was up double digits excluding foreign currency." The company's stock fell around 18% over the past month and has a 52-week low of $30.76.

- RSI Value: 22.38

- YUMC Price Action: Shares of Yum China fell 1.5% to close at $30.84 on Friday.

- Benzinga Pro's signals feature notified of a potential breakout in Yum China's shares.

- 4月29日,百胜中国发布了首季度的财务业绩。百胜中国的CEO Joey Wat评论道:“首季度我们实现了稳定的销售增长,总收入达到了历史最高水平。我们的核心营业利润较去年高基数增长了适度,每股收益不包括外汇波动时增长了两位数。”该公司股价在过去一个月左右下跌了约18%,52周最低价为30.76美元。

- RSI值:22.38

- YUMC价格走势:上周五,百胜中国股票下跌了1.5%,收于30.84美元。

- Benzinga Pro的信号功能提示了百胜中国股票潜在的突破。