Check Out What Whales Are Doing With CEG

Check Out What Whales Are Doing With CEG

High-rolling investors have positioned themselves bullish on Constellation Energy (NASDAQ:CEG), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CEG often signals that someone has privileged information.

赌徒投资者对星座能源 (纳斯达克: CEG) 看涨,这对零售交易者来说非常重要。我们今天通过贝芝加公开的期权数据跟踪发现了这一活动。这些投资者的身份尚不确定,但这种对 CEG 的重大举动通常意味着有人拥有特权信息。

Today, Benzinga's options scanner spotted 10 options trades for Constellation Energy. This is not a typical pattern.

今天,贝芝加的期权扫描器发现了10个星座能源的期权交易。这不是一个典型的交易模式。

The sentiment among these major traders is split, with 50% bullish and 40% bearish. Among all the options we identified, there was one put, amounting to $202,500, and 9 calls, totaling $711,660.

这些大型交易者的情绪分为两派,50% 的人看涨,40% 的人看淡。我们在识别出的所有期权中,有一份看跌,金额为202,500美元,和9份看涨,金额合计711,660美元。

Predicted Price Range

预测价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $190.0 and $240.0 for Constellation Energy, spanning the last three months.

在评估交易量和持仓量后,明显的是,主要市场动因在于星座能源的价格带,该价格带为190.0至240.0美元之间,跨越了过去三个月。

Volume & Open Interest Trends

成交量和未平仓量趋势

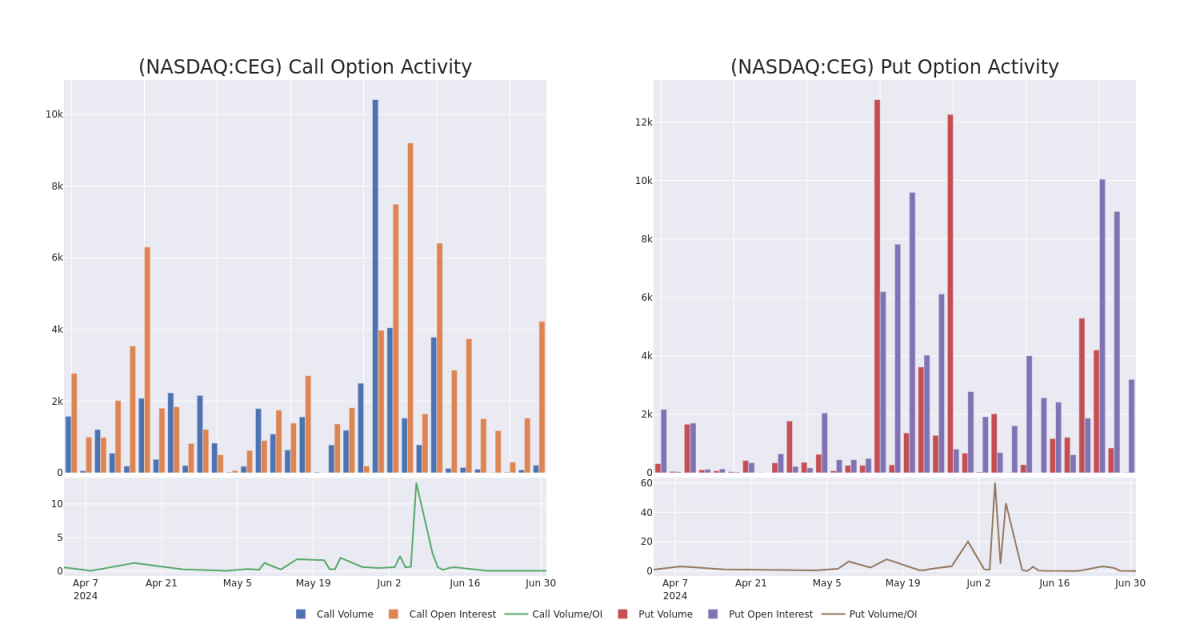

In terms of liquidity and interest, the mean open interest for Constellation Energy options trades today is 1059.57 with a total volume of 223.00.

在流动性和兴趣方面,星座能源期权交易的平均持仓量为1059.57,总成交量为223.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Constellation Energy's big money trades within a strike price range of $190.0 to $240.0 over the last 30 days.

在下面的图表中,我们可以跟踪过去30天星座能源的大额期权交易的看涨和看跌期权成交量和持仓量的发展情况,该范围位于190.0美元至240.0美元的执行价格范围内。

Constellation Energy Call and Put Volume: 30-Day Overview

康斯泰瑞能源看涨和看跌期权成交量:30天概览

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | CALL | TRADE | BEARISH | 01/17/25 | $18.3 | $16.2 | $16.6 | $240.00 | $332.0K | 1.1K | 0 |

| CEG | PUT | TRADE | BULLISH | 07/19/24 | $2.1 | $1.3 | $1.35 | $190.00 | $202.5K | 3.1K | 12 |

| CEG | CALL | SWEEP | BULLISH | 11/15/24 | $37.1 | $35.1 | $36.56 | $190.00 | $72.9K | 65 | 0 |

| CEG | CALL | SWEEP | BULLISH | 08/16/24 | $11.5 | $10.6 | $11.5 | $220.00 | $57.5K | 937 | 5 |

| CEG | CALL | SWEEP | BULLISH | 11/15/24 | $22.0 | $21.9 | $22.0 | $220.00 | $55.0K | 384 | 20 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | 看涨 | 交易 | 看淡 | 01/17/25 | $18.3 | $16.2 | $16.6 | $240.00 | $332.0K | 1.1千 | 0 |

| CEG | 看跌 | 交易 | 看好 | 07/19/24 | $2.1 | $1.3 | $1.35 | $190.00 | $202.5K | 3.1K | 12 |

| CEG | 看涨 | SWEEP | 看好 | 11/15/24 | $37.1 | $35.1 | $36.56 | $190.00 | $72.9K | 65 | 0 |

| CEG | 看涨 | SWEEP | 看好 | 08/16/24 | $11.5 | $10.6 | $11.5 | $220.00 | $57.5K | 937 | 5 |

| CEG | 看涨 | SWEEP | 看好 | 11/15/24 | $22.0 | $21.9 | $22.0 | $220.00 | $55.0K | 384 | 20 |

About Constellation Energy

关于星座能源

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

星座能源公司提供能源解决方案。它为家庭、企业、公共部门、社区聚合和一系列批发客户(如市政机构、合作社和其他战略客户)提供清洁能源和可持续解决方案。该公司为企业提供全面的能源解决方案和电力、天然气和可再生能源产品的各种定价选择。

After a thorough review of the options trading surrounding Constellation Energy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在仔细审查星座能源周围的期权交易后,我们转而更详细地考察该公司。这包括对其当前市场状态和表现的评估。

Current Position of Constellation Energy

星座能源的当前位置

- With a trading volume of 594,109, the price of CEG is up by 5.24%, reaching $210.76.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 31 days from now.

- 交易量为594,109,CEG价格上涨5.24%,达210.76美元。

- 当前RSI值表明该股票可能接近超买状态。

- 下一个财报发布日期距离现在31天。

Professional Analyst Ratings for Constellation Energy

星座能源专业分析师评级

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $236.0.

在过去的一个月里,3位行业分析师分享了他们对该股的观点,提出了一个平均目标价236.0美元。

- Reflecting concerns, an analyst from RBC Capital lowers its rating to Sector Perform with a new price target of $218.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Constellation Energy, targeting a price of $241.

- An analyst from UBS persists with their Buy rating on Constellation Energy, maintaining a target price of $249.

- 反映出关注事项,RBC资本的分析师将其评级降至板块表现,并设立了新的价格目标218美元。

- 大摩资源lof的分析师继续持有星座能源的超配评级,目标价为241美元。

- UBS的分析师坚持对星座能源评为买入,并维持目标价249美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。