Unpacking the Latest Options Trading Trends in Vertiv Hldgs

Unpacking the Latest Options Trading Trends in Vertiv Hldgs

Deep-pocketed investors have adopted a bearish approach towards Vertiv Hldgs (NYSE:VRT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in VRT usually suggests something big is about to happen.

资金雄厚的投资者对纬创资讯股份有限公司(NYSE:VRT)采取了看淡的态度,这是市场参与者不应忽视的事情。本站在追踪Benzinga公开期权记录时,发现今天有这一重大的举措。这些投资者的身份尚不清楚,但VRT的如此大的变动通常意味着会发生一些重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Vertiv Hldgs. This level of activity is out of the ordinary.

我们从今天的观察中获得了这些信息,当Benzinga的期权扫描器突出显示Vertiv Hldgs的12项非凡期权活动时。这种活动水平是不寻常的。

The general mood among these heavyweight investors is divided, with 25% leaning bullish and 66% bearish. Among these notable options, 3 are puts, totaling $157,150, and 9 are calls, amounting to $882,225.

这些重量级投资者的整体情绪是分歧的,25%看好,66%看淡。在这些值得注意的期权中,有3项认购合约,总计157,150美元,9项认沽合约,总计882,225美元。

What's The Price Target?

价格目标是什么?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $30.0 to $90.0 for Vertiv Hldgs during the past quarter.

分析这些合约的成交量和持仓量,看来大户已经在过去的一个季度里觊觎Vertiv Hldgs在30.0至90.0美元的价位窗口。

Insights into Volume & Open Interest

成交量和持仓量分析

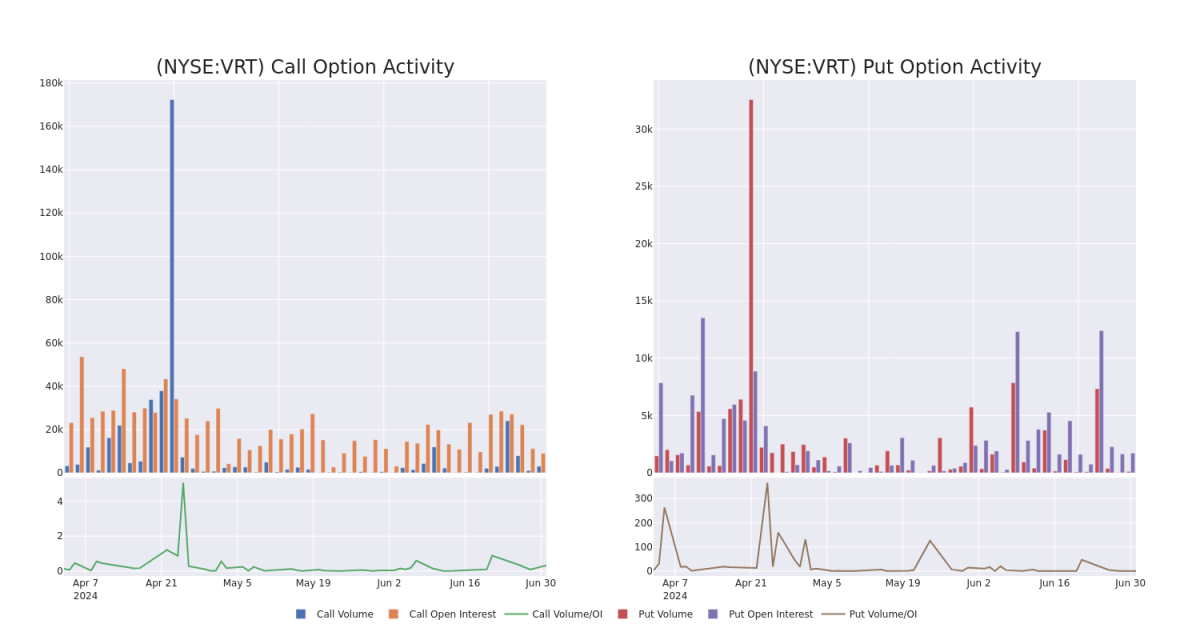

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Vertiv Hldgs's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Vertiv Hldgs's whale trades within a strike price range from $30.0 to $90.0 in the last 30 days.

在期权交易中,观察成交量和持仓量是一种强有力的举措。这些数据可以帮助您追踪给定行权价格的Vertiv Hldgs期权的流动性和利率。下面,我们可以观察到过去30天内,所有在30.0至90.0美元行权价格范围内的Vertiv Hldgs鲸鱼交易的认购和认沽的成交量和持仓量的演变。

Vertiv Hldgs Option Volume And Open Interest Over Last 30 Days

纬创资讯股份有限公司期权成交量和持仓量过去30天内的情况

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | CALL | TRADE | BEARISH | 07/26/24 | $4.9 | $4.8 | $4.8 | $85.00 | $240.0K | 49 | 10 |

| VRT | CALL | SWEEP | BULLISH | 07/05/24 | $2.0 | $1.7 | $1.9 | $85.00 | $189.9K | 150 | 107 |

| VRT | CALL | TRADE | BEARISH | 08/16/24 | $8.3 | $8.0 | $8.0 | $85.00 | $160.0K | 187 | 0 |

| VRT | PUT | SWEEP | BEARISH | 12/20/24 | $9.6 | $9.5 | $9.6 | $77.50 | $96.0K | 9 | 0 |

| VRT | CALL | TRADE | BEARISH | 07/12/24 | $1.75 | $1.5 | $1.5 | $90.00 | $75.0K | 8.5K | 92 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | 看涨 | 交易 | 看淡 | 07/26/24 | $4.9 | $4.8 | $4.8 | $85.00 | $240.0K | 49 | 10 |

| VRT | 看涨 | SWEEP | 看好 | 07/05/24 | $2.0 | $1.7 | $1.9 | $85.00 | $189.9K | 150 | 107 |

| VRT | 看涨 | 交易 | 看淡 | 08/16/24 | $8.3 | $8.0 | $8.0 | $85.00 | $160.0K | 187 | 0 |

| VRT | 看跌 | SWEEP | 看淡 | 12/20/24 | 9.6 | $9.5 | 9.6 | $77.50 | $96.0K | 9 | 0 |

| VRT | 看涨 | 交易 | 看淡 | 07/12/24 | $1.75 | $1.5 | $1.5 | $90.00 | $75.0K | 8.5千 | 92 |

About Vertiv Hldgs

关于Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

Vertiv Holdings Co整合了硬体、软件、分析以及持续服务,确保其客户的重要应用程序连续运行、执行最佳,并随其业务需求增长。公司通过一系列在云端到网络边缘的电力、冷却和IT基础设施解决数据中心、通信网络及商业和工业设施面临的重大挑战。其服务包括关键电源、热管理、机柜和机箱、监控和管理以及其他服务。其三个业务领域分别为美洲、亚太地区和欧洲、中东和非洲。

After a thorough review of the options trading surrounding Vertiv Hldgs, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对围绕Vertiv Hldgs的期权交易的彻底审查后,我们转而更详细地研究该公司。这包括对它当前的市场状态和业绩的评估。

Current Position of Vertiv Hldgs

Vertiv Hldgs的当前持仓量

- Trading volume stands at 1,719,258, with VRT's price down by -2.32%, positioned at $84.56.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 30 days.

- 成交量达到1,719,258,VRT的价格下跌了-2.32%,位于84.56美元。

- RSI指标显示该股票目前处于超买和超卖之间的中立状态。

- 预计30天内公布收益公告。

Expert Opinions on Vertiv Hldgs

关于Vertiv Hldgs的专家意见

In the last month, 1 experts released ratings on this stock with an average target price of $105.0.

在过去的一个月中,有1位专家就该股发表了评级,平均目标价为105.0美元。

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Vertiv Hldgs, targeting a price of $105.

- 维持其观点,Evercore ISI Group的一位分析师继续为Vertiv Hldgs持有超买评级,目标价为105美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vertiv Hldgs with Benzinga Pro for real-time alerts.

交易期权涉及更高的风险,但也提供了更高的利润潜力。明智的交易者通过持续的教育、战略性的交易调整、使用各种指标以及保持敏锐地关注市场动态来减轻这些风险。通过Benzinga Pro的实时警报,及时了解纬创资讯股份有限公司的最新期权交易。