Procter & Gamble Unusual Options Activity For July 01

Procter & Gamble Unusual Options Activity For July 01

High-rolling investors have positioned themselves bullish on Procter & Gamble (NYSE:PG), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in PG often signals that someone has privileged information.

高飞的投资者看好宝洁公司(纽交所:PG),这对零售交易者非常重要。\通过Benzinga的公开期权数据追踪,我们今天注意到了这种活动。这些投资者的身份不确定,但是PG的如此重大举动通常意味着有人掌握了特权信息。

Today, Benzinga's options scanner spotted 11 options trades for Procter & Gamble. This is not a typical pattern.

今天,Benzinga的期权扫描程序发现了11份宝洁公司的期权交易。这不是典型的模式。

The sentiment among these major traders is split, with 45% bullish and 45% bearish. Among all the options we identified, there was one put, amounting to $34,428, and 10 calls, totaling $412,495.

这些主要交易者的情绪有分歧,45%看好和45%看淡。在我们确定的所有期权中,有一个看跌,金额为34428美元,还有10个看涨,总计412495美元。

Expected Price Movements

预期价格波动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $155.0 to $195.0 for Procter & Gamble during the past quarter.

分析这些合同的成交量和未平仓量,似乎大型交易者在过去的季度一直关注宝洁公司在155.0到195.0美元价位之间的价格区间。

Volume & Open Interest Development

成交量和持仓量的评估是期权交易中的一个关键步骤。这些指标揭示了阿里巴巴集团(Alibaba Gr Hldgs)特定执行价格期权的流动性和投资者兴趣。下面的数据可视化了在过去30天内,阿里巴巴集团(Alibaba Gr Hldgs)在执行价格在74.0美元到120.0美元区间内的看涨看跌期权中,成交量和持仓量的波动情况。

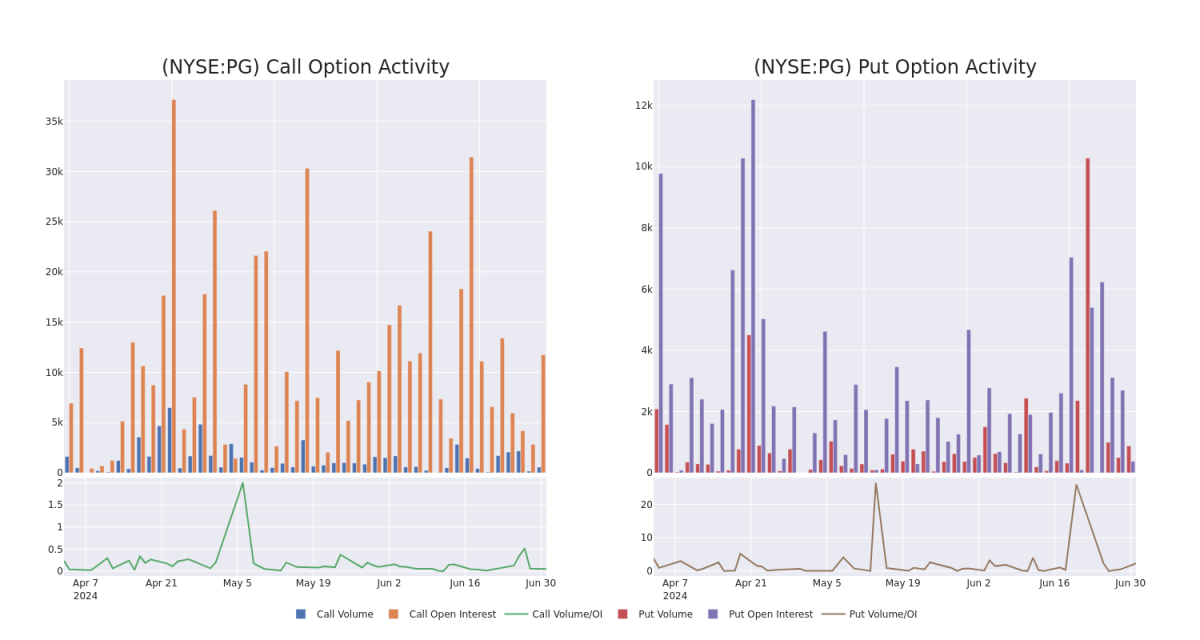

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Procter & Gamble's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Procter & Gamble's significant trades, within a strike price range of $155.0 to $195.0, over the past month.

检查成交量和未平仓量可以为股票研究提供重要见解。这些信息对于衡量宝洁公司特定执行价格的期权的流动性和利益水平至关重要。以下是我们针对在155.0到195.0美元的执行价格范围内的宝洁公司的重要交易看涨和看跌期权成交量和未平仓量的趋势快照。

Procter & Gamble 30-Day Option Volume & Interest Snapshot

宝洁公司30天期权成交量和未平仓量快照

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | CALL | SWEEP | BULLISH | 01/17/25 | $13.5 | $12.9 | $13.5 | $155.00 | $74.2K | 2.3K | 56 |

| PG | CALL | SWEEP | BULLISH | 01/17/25 | $13.45 | $13.0 | $13.45 | $155.00 | $73.9K | 2.3K | 111 |

| PG | CALL | TRADE | BULLISH | 01/17/25 | $14.0 | $13.65 | $14.0 | $155.00 | $53.2K | 2.3K | 17 |

| PG | CALL | TRADE | BULLISH | 01/17/25 | $5.95 | $5.85 | $5.95 | $170.00 | $38.0K | 4.9K | 11 |

| PG | CALL | TRADE | BULLISH | 01/17/25 | $5.65 | $5.6 | $5.65 | $170.00 | $36.1K | 4.9K | 75 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | 看涨 | SWEEP | 看好 | 01/17/25 | $13.5 | $12.9 | $13.5 | $155.00 | 74.2K | 2.3K | 56 |

| PG | 看涨 | SWEEP | 看好 | 01/17/25 | $13.45 | $13.0 | $13.45 | $155.00 | $73.9K | 2.3K | 111 |

| PG | 看涨 | 交易 | 看好 | 01/17/25 | $14.0 | $13.65 | $14.0 | $155.00 | $53.2K | 2.3K | 17 |

| PG | 看涨 | 交易 | 看好 | 01/17/25 | $5.95 | $5.85 | $5.95 | $170.00 | $38.0K | 4.9K | 11 |

| PG | 看涨 | 交易 | 看好 | 01/17/25 | $5.65 | $5.6 | $5.65 | $170.00 | $36.1K | 4.9K | 75 |

About Procter & Gamble

关于宝洁公司

Since its founding in 1837, Procter & Gamble has become one of the world's largest consumer product manufacturers, generating more than $80 billion in annual sales. It operates with a lineup of leading brands, including more than 20 that generate north of $1 billion each in annual global sales, such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. P&G sold its last remaining food brand, Pringles, to Kellogg in calendar 2012. Sales outside its home turf represent around 53% of the firm's consolidated total.

自1837年创立以来,宝洁公司已成为全球最大的消费品制造商之一,年销售额超过800亿美元。它拥有一系列领先品牌,其中20多个品牌的年全球销售额超过10亿美元,例如Tide洗衣液、Charmin厕纸、Pantene洗发水和Pampers尿不湿。在日历2012年,宝洁公司将其最后剩余的食品品牌Pringles卖给了Kellogg公司。其海外销售额占公司整体销售额的约53%。

Having examined the options trading patterns of Procter & Gamble, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在审查了宝洁公司的期权交易模式后,我们现在的关注点直接转向公司本身。这种转变使我们能够深入探讨其目前的市场地位和表现。

Procter & Gamble's Current Market Status

宝洁公司的当前市场状态。

- Currently trading with a volume of 7,619,194, the PG's price is down by -1.33%, now at $162.72.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 25 days.

- 目前成交量为7619194美元,PG的价格下跌了-1.33%,现为162.72美元。

- RSI读数表明该股票目前可能接近超卖状态。

- 预计收益发布还有25天。

Professional Analyst Ratings for Procter & Gamble

Procter&Gamble的专业分析师评级

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $187.0.

在过去30天中,共有1位专业分析师对该股票发表看法,设定平均目标价格为187.0美元。

- In a cautious move, an analyst from Exane BNP Paribas downgraded its rating to Outperform, setting a price target of $187.

- 谨慎起见,来自Exane BNP Paribas的分析师将评级下调为跑赢市场,目标价为187美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Procter & Gamble with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高的利润潜力。精明的交易者通过持续教育、战略性交易调整、利用各种因子并保持对市场动态的敏感来减轻这些风险。使用Benzinga Pro进行实时警报以跟踪最新的宝洁公司期权交易。